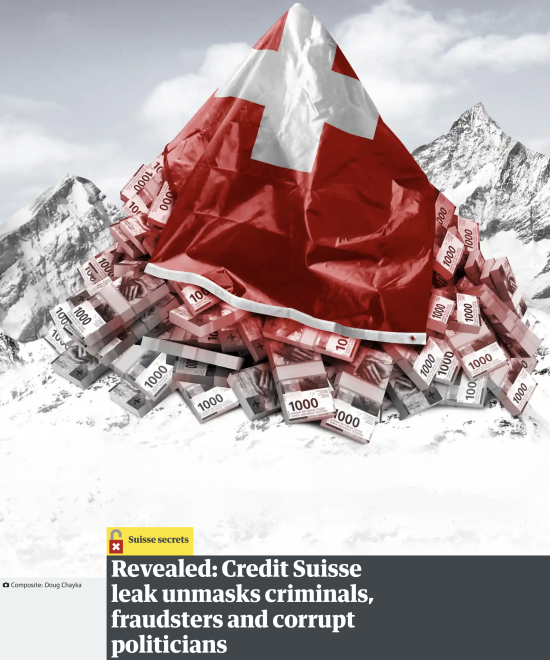

The Guardian and other newspapers around the world are going to town this m morning on the fact that they have another leak from banks that suggest nefarious and tax haven activity. This is the Guardian headline:

This time the target is Credit Suisse. The pattern is familiar, as if there is a routine to these things now. The leak was made to SudDeutsche Zeitung. The data was shared amongst news organisations. A planned release of news followed, starting last night.

Let me be clear that all attempts to clean up banking are welcome to me. As I said only yesterday, if Ukraine teaches us anything this is where our focus of attention needs to be. Cleaning up banking is a vital part of the war on corruption.

I have one word of warning though, and it comes from this paragraph:

While some accounts in the data were open as far back as the 1940s, more than two-thirds were opened since 2000. Many of those were still open well into the last decade, and a portion remain open today.

I have warned, quite often, that tax justice organisations and those who feed off them are now very good examples of the Shirky Principle - which suggests that organisations can perpetuate the problem to which they suggest that they are the solution.

What we know is that there is a real problem in the relationship between corrupt practices and banking, as there remain real problems in accounting and the legal profession. But what we need to do when appraising data is work out what is the problem that needs to be addressed now. My suggestion is that looking at old account opening practices and arrangements long closed down is of little benefit in the case of Credit Suisse. It might let us say that this was a bank with a problem. What we actually need to know is whether this is a bank with a problem now.

In other words, I seriously hope those looking at this data are not going to extrapolate past dirt into present accusations. That will help no one. That the Swiss had a problem with managing tax abuse and corruption is not news to anyone. What we require from this analysis is a solution focus that asks three questions:

- What is the problem now?

- How big is it?

- What can be done to eliminate it?

The last option has to include closing the bank if necessary. The indication that serious action will be taken if problems exist has to now be on the cards. There has been ample enough time for banks to clean up their acts. The only relevance of looking at past data is to prove that they have.

It is now time to deal with current events. We need a world free of corruption to eliminate the risk that it creates for us all, from the threat of war in Ukraine to the threat to democracy in the UK. But let's not muckrake for the sake of it. Let's look for real analysis and real solutions. I hope the newspapers involved in this process understand that this the need.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The Shirky Principle sounds plausible to me no doubt about that. Look at this Government convincing everyone that levelling up was the answer…………….to their own austerity measures.

As for Credit Suisse – it’s not the first time they’ve been implicated in dodgy stuff like this bit I suspect all they will get is a fine and nothing else.

As long as Switzerland maintains its “secrecy” laws concealing information about individual bank accounts, the corruption and money laundering at Credit Suisse and all the other Swiss banks will continue. The Swiss government will hold on as long as possible until international pressure forces them to change their banking regulations.

Swiss banking “secrecy” is not what is was, given that they exchange information automatically under FATCA and CRS. But I’m sure there are lapses in anti money laundering / know your customer checks.

I agree with you – hence my focus on what the issue is now

Agreed, Bill. I had my eyes opened a couple of decades ago when I was contracted to carry out a corporate turnaround in a newly-acquired Swiss subsidiary of a UK-based group and was located in Switzerland for the better part of a year. At that time bribery was not illegal under Swiss law and, although I understand that the law was later altered, I have no confidence that it will be rigorously applied by the banks or businesses, so deeply was corruption ingrained in their business culture. I raised the issue with one of the Swiss directors who dismissed it as nonsense until I pointed out that they had very nearly got away with the “Holocaust Banking Scandal” where the Swiss banks denied the existence of accounts opened by people from across Europe who later perished in the Holocaust. This was nearly 60 years after the end of WW2 and the relatives who sought access to the accounts were themselves in old age; another 20 years and they’d be gone and the next generation would not have had the same close connection with the original account holders.

Part of my duties involved a monthly meeting with the company’s bankers to review monthly accounts and progress of the turnaround. I’ve been a German speaker since childhood, so these meetings were conducted in Hochdeutsch, but the bank officials would frequently discuss matters among themselves in Schwytzertütsch, which is so impenetrable that German TV programmes resort to subtitles when it’s spoken. I had to insist that they speak German or English so that I wasn’t kept in the dark, but it was a regular, if small, reminder of the ultra-secretive nature of Swiss banking. Professional prudence prevents me from going into detail, but I found corruption in almost every aspect of business practice there and concluded that the whole system and culture was corrupt. Given that, I suspect that laws may have changed but the absence of enforcement hasn’t.

Thanks. To echo what David Allen Green has been saying in a different context (that the details of the precise constitutional arrangements are less important than an attitude of constitutionalism, rather than doing whatever is politically expedient), what matters more in society is not the precise rules and laws, but an attitude of lawfulness and respect for legality, rather that people doing whatever they think they can get away with.

The alternative is (for most people) nasty, brutish, and short.

Agreed