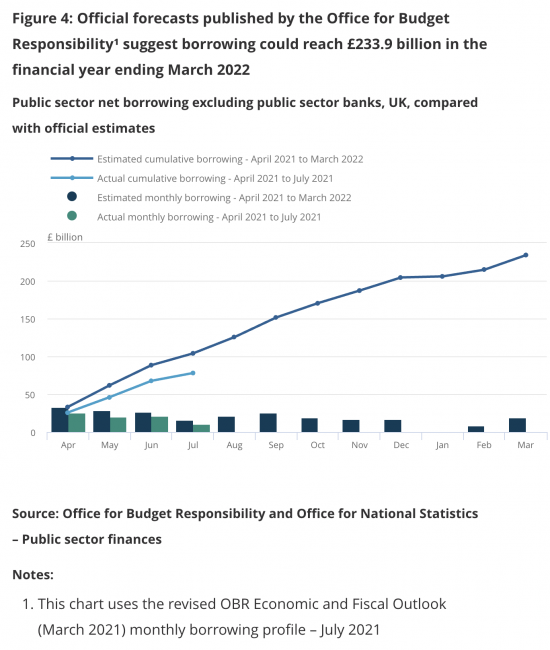

Government 'borrowing' (or money creation as I would prefer to think of it) from April to July this year amounted to £78 billion against an estimate published in March 0f £104 billion, as this chart from the Office for National Statistics shows:

Thye planned £104 billion was apparently sustainable. That's hardly surprising: the deficit was covered by the Bank of England quantitative easing programme and did not really increase national debt at all in that case.

The actual borrowing is £26 billion less than that.

But we apparently require £10 billion if the NHS is going to have the funding it needs.

As is readily apparent, there is no need for that £10 billion tax increase. It is simply, not required. The cost of the NHS funding can be absorbed within existing budgets without detriment arising.

So what is this all about?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

What is this all about?

To perpetuate the myth that “you pay in” and then “you take out” (and that the two are and should be linked). This myth allows the narrative that “the rich pay more than their share” to take root to the greater benefit of…. errrr….. the rich!

Maybe they are spooked by something?

Might it be the issues created by their BREXIT policy?

Might it be profit margins for the new providers they voted to bring into the NHS?

I mean Richard – who really knows how this lot really works or thinks?

Who are they??

Who credits this government with the ability to think?

I was being kind.

It is all presentation. Boris is putting himself forward as the saviour of the NHS. Just generating more money would not be seen as “dynamic” leadership.

Does not of course solve any of the underlying problems, either in the NHS, or heaven forbid, social care.

I reach for the brandy bottle….

Might « they » be the « deep state » or the « continuing state »?

Elections may change the government but its systems, structures etc do not seem to be so affected.

I am sure Johnson’s and Sunak’s comments that raising money through borrowing would be “irresponsible” has left Richard irritated and composing his next blog!

But more broadly, isn’t this a case of cart before horse? There has only been the sketchiest suggestion of how they plan to improve social care, though to be fair expenditure on the NHS should be a straightforward cash injection. Surely the right way is to plan what you want to do, cost it fully, and only then work out how much of it needs to be counterbalanced by new taxation to avoid causing problems with the wider economy.

See my Twitter feed this afternoon….I have been busy

No-one seems to have noticed that the government is claiming that the £37 billion NHS/Social Care plan needs to be ‘paid for’ yet it didn’t see the need to explain how the £37 billion Track and Trace fiasco or the £106 billion HS2 project are to be paid for. Why not?

But at least it exposes the nonsense of the government’s claims about ‘affordability’. It’s high time the reality of government spending was explained to the British public.

The media have consistently turned a blind eye to this crucial issue, even though eminent economists, including Richard and Stephanie Kelton, have demonstrated beyond any question that the conventional wisdom – that government spending must be paid for out of its income like a household budget – is nonsense. The very fact that their views have never received the attention they deserve should ring alarm bells – but it doesn’t. The myth is that the government must tax before it can spend. A moment’s thought should tell us that this isn’t so since tax can only be paid with money that the Treasury has already put into the economy. Spending comes first, tax second. The scandal is that the Treasury knows this full well – hence the free and easy Track and Trace and HS2 spending. So why does the government so selectively introduce the notion of affordability? The answer of course is that it wants to resist spending to which it is ideologically opposed – and when it has to spend, loading the bill onto the sector it has least concern for – whilst frittering money right left and centre on ideologically approved projects which benefit the sector it has most concern for.

The false household budget analogy also allows the government to attack opposition spending plans with such lies as ‘they will ruin the economy’ and ‘leave a legacy of debt to our children’. The truth is that the only limits to government spending are rampant inflation and full employment. There is no risk of the latter and inflation is easily dealt with, not by interest rate rises – a weak and unpredictable tool – but by targeted taxation.

Perhaps the biggest question, however, is why the media – sadly including the Guardian – have not even started a debate on this issue, even if they aren’t brave enough to come out and expose the myth of affordability as politically driven nonsense

Good questions

If the government is the same as a household I want the right to print pound coins and notes like the government does.

🙂

To me, this is just Johnson trying to make the breaking of pledges/promises an official, acceptable tory government practice rather than just his own personal habit.

It’s probably a distraction, today they were supposed to be debating the Integrated Care system bill, only it isn’t about integrating care, but integrating private American corporations onto the new NHS boards along with the likes of Virgin.

Whilst the nation talks to itself, the Tories plod on dismantling the state.

It struck me that it’d be far simpler to raise the money by closing tax/tax haven loopholes than by guddling around with N.I. and the likes. It also struck me that that might inconvenience wealth accumulation by the likes of the Rees-Moggs and the Sunaks.

Could they be related?