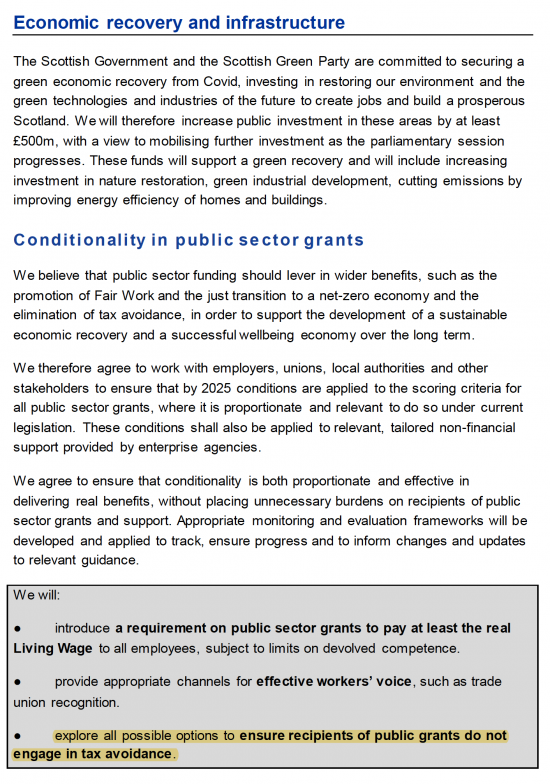

I noted this in the new deal between the SNP and Greens in Scotland:

I highlighted the last paragraph for a reason. Defining tax avoidance in this context is nigh on impossible. What you can do instead is define what is good practice that must be followed if tax avoidance is to be unlikely.

No one has tried to do this better than the Fair Tax Mark, run by the Fair Tax Foundation. Now, I am biased. I founded the FTM and still advise it, but am no longer a director. Those involved in this process will need to look at what it does.

Importantly though, grants, of course, do not all go to large companies. Critically, if the Scottish government is serious it has to:

- Demand that all companies with public grants publish their full accounts on public record;

- If they are a group full country-by-country reporting must be available on public record;

- Ownership should be on public record;

- There must be a tax governance policy in place;

- It must be monitored and audited, annually;

- That policy must require an explanation of the tax rate with workings supplied;

- All cards must be face-up on the table;

- No tax haven involvement should be permitted.

That is deliverable.

But if the SNP / Greens really wanted a level playing field they would demand this of all companies trading in Scotland.

And why not? Why is it only public procurement that matters? Can't people be fleeced in any sector at cost to society at large? Why shouldn't everyone get the protection the government is seeking?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Let me guess.

The demand that there be an explanation of tax paid on grants received with “an explanation of the tax rate with workings supplied” and that “All cards must be face-up on the table” wouldn’t apply to members of LLPs which receive grants.

It does

I pay tac on all grants recurved at my highest marginal income tax rate – usually 40%

There you go; done

Rather than answer the question, you seem to be making an attack on Richard’s LLP status, which he’s answered.

Perhaps you’d like to address the question properly?

On a separate note, nice to see that in Scotland, the Greens actually have some political power, courtesy of the Additional Member Voting system, which combines the traditional First Past the Post system (FPP) and Proportional Representation (PR). And the fact that Nicola Sturgeon is prepared to make deals and share power with other parties.

So where you have s voting system with some element of PR, and a political leaders that can rise above tribalism ,Greens can actually get somewhere.

So unlike our own wonderful ‘Mother of Parliaments’. Are you listening, Labour?

Richard, A timely and useful post on these fair tax considerations.You might want to change the “fill” for “full” typo in the first of your bullet points. That might help if others want to quote from it.

Thanks

Done

From a laymans perspective, it seems to me that its a pretty reasonable starting point, especially as it is a document written by non experts for non experts