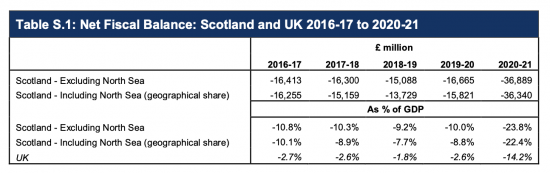

The Government Expenditure and Revenue Scotland statement for 2021 is out. I suspect that it is no surprise to anyone that the tale is of gloom and woe for Scotland. This chart summarises the headline:

The claim will be that Scotland has done much worse than the rest of the UK. This chart supports that claim:

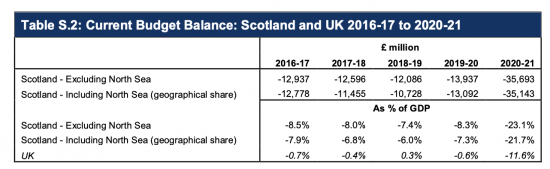

The gap between the Scottish position and the UK position has been running at around 7%. Now it is over 10%. So relatively it will be claimed Scotland has done much worse than the rest of the UK in the current crisis.

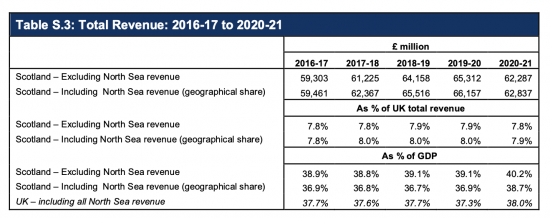

But is that true? Revenues as a proportion of those of the UK have been remarkably consistent:

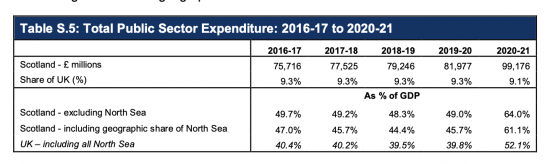

The proportion of revenue raised in Scotland is almost constant. So the claim has to be on the spending side:

And just look - the gap there has increased from spend being 5.% of GDP to 10% of GDP.

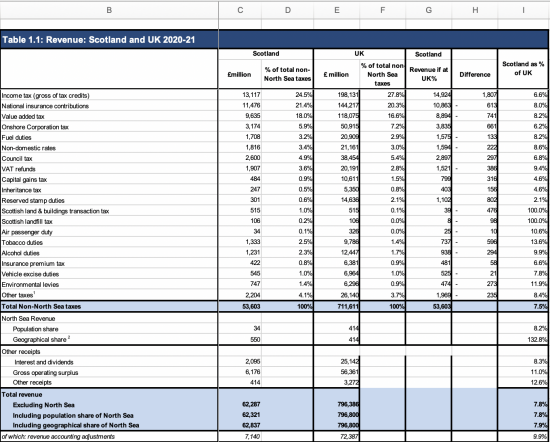

That is interesting. Because what I have spotted is something that supports my hypothesis that all this is manipulated by GDP being wrong. This is my modification of a table in the GERS document:

I have shown column headers to make it clear I added columns F, G and H.

What I show is that income tax is underpaid in Scotland, as is corporation tax pro rate to the UK. On the other hand, apparently Scotland overpays all the taxes on consumption compared to the UK, such as VAT and the various duties on tobacco and so on.

This could, of course, be true. But actually data on VAT and the duties is not known in Scotland, and the claim that even income tax data is known cannot actually really be said to be true: these are estimates. On the consumption taxes the estimate is based on people in Scotland having higher spending in proportion to income, and so paying more consumption taxes. This claim would be supported by the suggestion that incomes and profits in Scotland must be lower than in England because proportionately income and corporation taxes are lower.

But, suppose that is not true? No one actually knows how much profit is made in Scotland and no one will until there is a national account for it.

And no one also knows how much Scottish rent and interest paid is subject to tax in England when it should be taxed in Scotland.

And since wages only represent half of GDP the obvious fact that GDP may be shifted out of Scotland to present distortions is high, with tax being understated as a result.

I am willing to buy the story that the Scots overpay direct taxes and so are penalised by the lack of progressivity in the UK tax system. But I also think that income and corporation taxes, as well as capital gains taxes and inheritance taxes, are all seriously underpaid in Scotland - because the owners of that income and that wealth in Scotland pay their taxes on it in England.

How much would the adjustment be? It looks like to would be at least £3,000 milliu0n based on this data, although that is just a very rough estimate. That's around 5% of Scottish revenues though - and enough to cut the deficit by a significant amount as a result. In other words - even the apparently consistent income side looks wrong - because maybe it always has been.

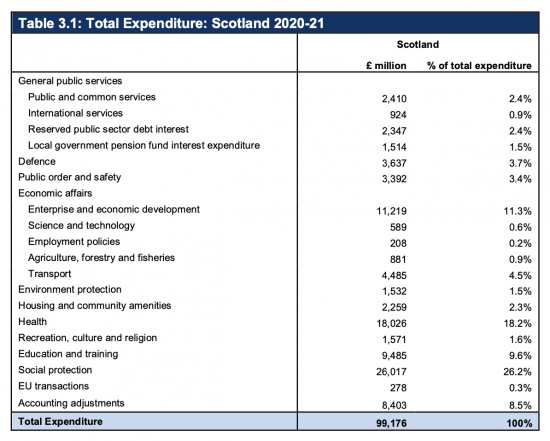

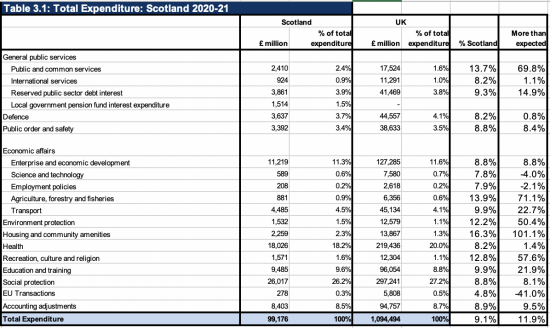

But let's look at the spend. Here, very oddly, GERS makes no direct comparison with the UK:

So, let me add the UK data and interpret it a bit:

The four columns on the right are my workings.

First, notice that Scottish data is inflated compared to the UK by including local pension fund costs, which are not in the UK data, which you might say is odd.

Then note how different the weightings of total spend are.

But the really interesting columns are the last two. The penultimate column shows the percentage of the total UK spend allocated to Scotland. Scotland had an 8.1% population share in 2020.

In the final column I compare the allocated share to Scotland with the anticipated 8.1% share and state the difference as a percentage of that 8.1% share. And then some really odd facts come out. For example, why has Scotland got a disproportionately large share of interest payments, picking up almost 15% too much?

And why are common services so heavily, apparently, biased to Scotland?

Even accounting adjustments are over-apportioned to Scotland.

If these areas - which are likely to be simple apportionments - are overstated how reliable is the rest of the UK spend apportionment? I would suggest that the chance is very low. The evidence that costs are being piled onto Scotland looks to be very high to me based on this data.

I am trained as an auditor. The first thing I do when looking at any data is to make sure that it looks credible. Bluntly, and as ever, the data for 2021 within GERS looks to be wrong on both income (understated) and expenditure (heavily overstated).

But let's also look at what the auditor also asks, which is does this data first the need of the user? Here the GERS document says:

What Questions Does GERS Address?

GERS addresses three questions about Scotland's public sector accounts for a given year:

- What revenues were raised in Scotland?

- How much did the country pay for the public services that were consumed?

- To what extent did the revenues raised cover the costs of these public services?

So, are the questions answered is what I have to ask?

With regard to question 1, the answer is we simply do not know: we do not know that Scotland's taxable income is fairly stated and we have no clue of what proportion of some tax were paid in Scotland. So the data on revenues is likely to be wrong.

With regard to 2, the data is just wrong. That's not just because the data estimates look wrong but also because of something else that is very important. In 2020/21 about £300 billion of the costs of public services in the UK as a whole were not paid for out of taxes. They were paid for by quantitative easing. There is not a single mention of this in the GERS document. But what that means is that actually total spending out of taxes was not £1,094,000 milli0n as the above data implies. They were actually about £800,000 million, or £800 billion. That QE is never going to be cancelled whatever the Bank of England says. In that case, the question asked is the wrong one: the UK did not pay with taxes for all the spend incurred so why should it be claimed that Scotland must?

And as a result the equation supposedly implicit in the third question is a false one.

The data in GERS is unfit for purpose. It is very likely wrong. And it does not answer any fair question that can be posed about the actions of any government of Scotland. All we need to do is keep pointing that out in that case.

And keep asking that the Scottish government do better. I remain baffled as to why they do not want to do so.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Hmmmm – very interesting.

So, Scotland is the Englishman’s burden. How quaint. How convenient.

Maybe the Scottish ‘government’ does not want to rattle the cage of its powerful jailor?

Or maybe these things just aren’t important to the SNP who maybe are a bit one eyed and just want power.

They need to be careful of what they ask for.

Excellent analysis, Richard and much to think about. As ever, with real, probative data for key topics unknown, GERS comes down to dubious estimates and allocations.

You wrote: “What I show is that income tax is underpaid in Scotland, as is corporation tax pro rate to the UK. On the other hand, apparently Scotland overpays all the taxes on consumption compared to the UK, such as VAT and the various duties on tobacco and so on.”

The IT underpayment probably arises out of 2 factors:

(1) IT on unearned income in Scotland (i.e. investments etc) is still reserved to Westminster and the Scottish element in the UK total simply hasn’t been calculated and re-allocated, or it has been very inaccurately guessed and re-allocated.

(2) IT on earned income of individuals with residencies in both Scotland and rUK may have been paid and recorded in rUK to avoid Scotland’s slightly higher tax rates.

The Corporation Tax underpayment surely reflects the fact that huge numbers of Scottish businesses, as well as all the high street chains, are owned outwith Scotland and probably reflects the same problem of poor/lazy estimates of Scotland’s contribution and dodgy allocations. I suspect exactly the same issues affect VAT and sundry duties. These inaccuracies inevitably lead to retrospective adjustments, themselves estimates since real data isn’t collected, which distort trends and make sensible budgeting more difficult.

Why on earth does the Scot Gov give its authorisation to these highly misleading figures? I have no doubt that the compilers followed best practice in producing GERS, but if so little of it reflects real, actual, probative data, what is the point other than for Westminster to gloat over Scotland’s financial “weakness” and the “impossibility” of independence? That begs the question: what would the Tories say and do if, heaven forbid, the Scottish Tories were the governing party in Scotland and had to produce GERS figures which made them look utterly financially incompetent?

We agree Ken

According to the House of Commons library, for the UK as a whole: “The current budget deficit was £247 billion in 2020/21, equivalent to 11.8% of GDP.”

Taking that as the available baseline for comparison, Scotland’s GERS deficit is 14.6% of the UK deficit, for 8.1% of the UK population; almost double, per capita. Is this actually convincing? I would require a great deal of accurately sourced, open-to-public-scrutiny, auditable, verifiable, detailed data supporting that contention, in order to believe it; and would certainly not be prepared to do so, simply ‘out-of-hand’; nor would I expect any well-informed citizen to accept it on such a basis: still less as a puported statement of the finances of an independent Scotland, since GERS is neither conceived nor constructed to replicate such a basis. It looks rather more like a ‘model’ of Governemtn income and expenditure that is increasingly finding it difficult to disguise its underlying conceptual flaws, perhaps exacerbated under the pressures flowing from the consequences of the various crises in which the UK is currently embroiled (inter alia, Brexit and Covid).

Your article in the National today hits the nail quite squarely, but I was particularly entertained by this sentence, “But so too is the devolution settlement on finance, most especially when any attempt that Scotland makes to raise its own revenues results in that money largely being clawed back by Westminster by reducing the block grant, leaving Scotland more highly taxed but no better off, with England getting a Scottish subsidy instead.”, as I believe got some small mention in the media recently although it’s not that easy to find.

Since it was obvious at the time that this would be the case, I’m finding it difficult to decide if the SG’s handling of the GERS figures is also due to financial naivety or just basic incompetence. Given some of their other antics, it is getting harder to dismiss the idea that the current SNP are deliberately trying to make independence look unattractive.

You cynic

And why not?

Hope you don’t mind me asking this, but if the GERS figures are so inaccurate, why does the (SNP) Scottish Government not change the methodology? The figures as currently produced are significantly damaging to the economic case for independence, so it would be in their interest. Perhaps the answer is that, in broad terms, the methodology and the figures it produces are valid?

Alternatively, and is clear from other economic actions and policies, they are really not that bothered by independence.

Ouch!

So what we are faced with then is a yet another bunch of politicians who are caged by their ignorance of how things work (or could work) basically saying that within their world view, independence is not worth going for just yet? The conditions are ‘just not right’ for the sort of independence they seek (one I imagine more closely aligned with the English pound rather than a Scottish Central bank).

Increasingly we seem to have a surfeit of useless politicians everywhere just as we need real leadership for issues like independence, BREXIT, Covid, Afghanistan, the environment.

Think you may be accurate with that comment, Richard.

Richard, great presentation, thank you.

Regarding your comment above to Patrick Edwardson, “Alternatively, and is clear from other economic actions and policies, they (the current SNP leadership) are really not that bothered by independence” surely that would also have been the case in the run-up to the 2014 referendum. The GERS figures released in March 2014 produced similar headlines to those we saw this week. Why did Alex Salmond continue to allow their publication even at that crucial time?

I believe that GERS have been a “problem” for the independence movement for years (though you have done great work in explaining their true significance) but I’m not persuaded that their continued annual appearance is a sign that Nicola Sturgeon is somehow “soft” on independence given that Alex and his governments were happy to publish them too.

I think Alex regrets that now

Mr Edwardson,

I think you have to understand the history. The SNP have been in power for around fourteen years, but typically not in an overall majority because of proportional representation. Minority Government requires compromise, and for most of the SNP’s period in office this is a factor that cannot be ignored. Even more important, from the perspective of Scottish politics and history, the prime objective for the SNP initially (as a Party that had never before been in power), was to establish its credibility as managerailly competent; a highly critical matter in the optics of Scottish politics (not to be ignored), and something on which they had no demonstrable track record, and a weakness which opponents exploited fully. The SNP therefore accepted the whole system of devolved Government, including GERS, from the beginnin;, not least to demonstrate the political maturity and responsibility the cautious Scottish electorate would expect of them, at what was for the SNP a critical time. The success of the SNP strategy thenceforward was thus built largely on “managerialism”, and the power and success of that strategy is demonstrated by the fact that the SNP has been in power continuously ever since: I did say managerial competence was important politically in Scotland. QED. (For those who sneer at the ‘success’ of the SNP Government, I would merely point out that the abject failure of all Scottish opposition parties in election after election show the complete lack of confidence the public has in the basic competence, judgment and talent offered by Conservative, Labour or LibDem: combined. All the SNP need do is show they are more competent than the opposition – principally Scottish Conservative leaders who pass before us like so much chaff, or the very thought of Boris Johnson: I rest my case).

The problem is that “managerialism” is not enough; and the blanket commitment to a devolution settlement that was, at best a ropy piece of constitutional DIY in 1997, was bolted on to an antiquated Union constitution that did not actually bear close rational scrutiny, even when it was written in 1706-7 (and it was written). GERS was created by a Conservative Secretary of State as a calculated political scheme to ‘dish the Nats’, not a serious piece of economic managment. It has subsequently been patched up by statisticians to make something that looks plausible, but constructed out of a botch. If you wanted to create this afresh, you would never, ever start with GERS (It would be interesting to know just how much ‘resource’ is required to produce GERS). The SNP accepted it, worked with it initially and in the closing years of high oil prices the failings of the system were conveniently ignored – and now they are stuck with it, and their continued passive acceptance of it has created its own problem.

John, I wrote to the previous Finance Secretary (McKay) and asked why SG didn’t get Audit Scotland to audit GERS, given that only a small percentage of the numbers in GERS derive from firm, proveable, Scotland-specific data, the rest being estimates and allocations of UK data. Audit Scotland would have to report on its findings and any auditor worth his/her salt would have to draw attention to the fact that most of the data were estimates, not accurate Scotland-specific data. In addition, any Audit Scotland report worth its salt would have to clarify that GERS does not (and has never pretended to) represent the economics of an independent Scotland. Instead it presents an imperfect picture of how Scotland has fared under Westminster control, so the results are hardly a commendation of UK stewardship.

Needless to say, Mr McKay did not respond, but instead a civil servant replied to say that laid-down procedures for compilation of GERS (i.e. the processes of estimates and allocation) had been followed throughout, but neglected to recognise that the underlying data were flawed. We have a general problem with the accuracy/reliability of UK Gov accounting data and statistics: Richard has drawn attention to it on numerous occasions and it will continue to affect the reliability of Scotland’s reporting until such time as Scot Gov gathers its own Scotland-specific data at source. Until then GERS will continue to be a blight on all of us.

Thanks

In the immortal words of Mandy Rice-Davies “they would say that, wouldn’t they?”. Scotland’s political creativity and imagination is becoming smothered to death through a gross over-production of accountants, lawyers and civil servants (the FM is a lawyer, her Deputy an accountant). None of these disciplines typically attract original, cutting-edge or ground-breaking thinkers. Safe and ‘by-the-book’ (and don’t think about what the book means, whatever you do) is the modus operandi; in Scotland, it has come to define the politics, ne plus ultra.

Sorry, Richard; you are an exception.

Thanks for coming round to this once more Richard!

The current Scottish Government have no interest in properly presenting Scotland’s accounts.

Is it possible, in principle, to produce a proper set of accounts for Scotland?

If so –

Does it depend on the assistance of the UK state?

How long would it take?

How much would it cost?

It is entirely possible

Watch the Scotonomics video that I will post soon

You ask the following question:

In the final column I compare the allocated share to Scotland with the anticipated 8.1% share and state the difference as a percentage of that 8.1% share. And then some really odd facts come out. For example, why has Scotland got a disproportionately large share of interest payments, picking up almost 15% too much?

The answer to this question is on pages 7 & 11 of the GERS report (and can be easily audit-trailed using the Supplementary Data Expenditure Database and PESA data).

With respect, I disagree

That says how the numbers arose

Not why

Mr Inches,

You need go no further than the Preface to GERS (p.12) to see how this has been conceived, and how much it is a shape-shifting WIP. Thus:

Revenue:

“In general, the way in which revenue is collected means that separate figures for each country and region of the UK are not available for most revenues, although following increased devolution in recent years, more Scottish data have become available. As a result, Scottish public sector revenue is estimated by considering each revenue stream separately. Where Scottish data are unavailable, GERS estimates revenue using a set of apportionment methodologies, refined over a number of years following consultation with and feedback from users. The methodology note on the GERS website provides a detailed discussion of the methodologies and datasets used.”

Incidentally, the “methodology note” provides a link that does not work. Nor does the feedback link they offer.

Expenditure:

“Public sector expenditure is estimated on the basis of spending incurred for the benefit of residents of Scotland. That is, a particular public sector expenditure is apportioned to a region if the benefit of the expenditure is thought to accrue to residents of that region.

This is a different measure from total public expenditure in Scotland. For most expenditure, spending for or in Scotland will be similar. For example, the vast majority of health expenditure by NHS Scotland occurs in Scotland and is for patients resident in Scotland. Therefore, the in and for approaches should yield virtually identical assessments of expenditure. However, for expenditure where the final impact is more widespread, such as defence, an assessment of ‘who benefits’ depends upon the nature of the benefit being assessed. Where there are differences between the for and in approaches, GERS estimates Scottish expenditure using a set of apportionment methodologies, refined over a number of years following consultation with and feedback from users.

The for approach considers the location of the recipients of services or transfers that public sector expenditure finances, irrespective of where the expenditure takes place. For example, with respect to defence expenditure, as the service provided is a national ‘public good’, the for methodology operates on the premise that the entire UK population benefits from the provision of a national defence service. Accordingly, under the for methodology, national defence expenditure is apportioned across the UK on a population basis.”

I simply invite readers to think about the myriad interpretations of expenditure allocation that may be derived from that statement, especially in the hands of politicians with a vested interest to defend. The detailed methodology notes I read in prior years merely compounded the complexity and recondite nature of the problem. Take just one example: HS2 spend has been allocated to Scotland in the past, but suddenly, not for 2020-21; although there has never been any prospect of HS2 reaching Scotland in the lifetime of anyone now living. GERS is a moving, unstable feas, subject above all – to politics.

Thanks for doing that John

I had checked it all before Scotonomics – and it is as poor as ever

One final point. I think HS2 provides a distinct example of the problem of GERS. It appears from GERS 2020-21 that up until and including 2020, Scotland was allocated over 8% of the cost of HS2 (on the basis that it could simply be allocated by identifying it as “spending incurred ‘for'”, rather than “spending ‘in'”), but that was changed in 2021.

There has never been a plan to extend HS2 to Scotland. None of the published plans even reached the border. The timescales left Scotland in the position that it was unlikely ever, in any known or planned timescale, to reach Scotland. The change in treatment is announced for GERS 2021, but noticed by nobody for the preferred comedy of errors that is Scottish politics; squabbles over the crude size of the supposed ‘deficit’.

What debate has there ever been about the approriateness of HS2 for a GERS charge to Scotland? Where was it publicly discussed? What is the argument for the allocation? Who made it? Who changed it? Who justified it? If something on such a scale can happen, and nobody even notices, and the politicians are all making cheap jibes about abstract generalities they do not actually closely scrutinise – what is the point of the whole exercise?

Does anybody, anywhere actually care?

We do

It is becoming clearer by the day that the SNP has become a classic case of capture theory. Thank you for your work, highlighting the clear inconsistencies and laziness of the current administration.

I am now convinced that independence will not be achieved with the SNP, and that Scotland will have to wait for the emergence of something new.

If you need any more evidence of being an occupied country then look no further than the Fraser of Allander Institute. When the GERS figures were being published they immediately appear on the BBC spouting doom & gloom about how much money Scotland owes to the England (for debt we Scots have not incurred) through the most gracious generousity of mother England. The Fraser of Allander Institute should be abolished for crimes of deception perpetuated against the Scottish people. On an another note the SNP do not want independence. If that doesn’t worry you then there is no hope for Scotland.

The Scottish Government are no more now than, in the words of Neil Young, a “kinder, gentler, machine gun hand”!

Read this in depth report that examines the GERS lies that are fabricated by Westminster on the UK / Scottish Economy.

http://www.oilofscotland.org/scottish_politics.html#GERS_REPORT

Oil, when I follow your link and then try to open the link to the 2005 article, it leads to a page on Alba Money’s site about private loans. The 2006 article does open.

Hi Ken – the 2006 report opened for me, and resulted in http://www.oilofscotland.org/The_Great_Obfuscation_GERS_2006.pdf

It’s a long read!

Replying to George S Gordon’s reply at 2:35pm to my post immediately above:

Thanks George: I did get through to the 2006 report and will read it later, but the link to the 2005 GERS report took me to another site. However if it’s as long as the 2006 one, maybe I’ll just pass on it.

Hi Richard, how much would it roughly cost to crowd fund an accountancy firm uk or abroad to do a version of gers with accurate data? Which firm would be globally competent?

Getting the data would be the issue

Better to put pressure on the SNP

Excellent validated opinion that GERS is only fit for yoon propaganda.

Unfortunately it will continue to be used to bash Scotland until our government produces a real financial statement and a well validated projection both in and out of the union.

Why would the SNP want to make the Gers data look better ? Surely having such terrible figures for Scotland as part of the United Kingdom only strengthens their argument for independence ?

Why has the Scottish Government under both Alex Salmond and Nicola Sturgeon always published the GERS figures in the same way when they are clearly used to give an entirely false impression of Scotland’s economic viability after independence?

I genuinely don’t know! Any insights?

I do not believe that Alex Salmond and Nicola Sturgeon are secret unionists so I simply don’t understand why GERS were not dumped by the SG in 2007. Am I missing something?

I am as baffled as you

We are promised something better, maybe next year

Hi Stewart. I think the only possible justification (in their minds) is TINA. I think TINA is true in the sense that the UK government would have to agree to spend their (hard earned #LOL) cash on providing better data; they would also argue that it would be an additional cost on businesses. We know this is at best exaggerated, at worst a cop out. The reality is that there’s nothing in it for the UK.

However, the SNP government appears to believe –

a) the GERS result really is a deficit;

b) deficits are bad and must be reduced.

So it’s hard to understand why they have not at least included realistic caveats about the data sources and results. In fact they’ve gone out of their way to include “justifications” and confidence limits. To rub salt in the wound, they seem to delight in debunking some of the wilder claims by “cybernats”. They pay little attention to the statistical biases that will inevitably have arisen in the estimates, which would call into question the confidence limits they quote (with no source).

I’m not sure where Alex Salmond would sit on this. The Alba party has an economics “guru” who (I think) believes in a Scottish currency but believes MMT is nonsense, and is very much market oriented; I don’t know what he thinks about deficits.

Who is this Alba “guru”?

My conversations with Alex suggest he gets MMT

GERS 2020-21 (p.9):

“The Scottish Government held a public consultation on a potential new publication on devolved public sector finances in Scotland from June to September 2018. A consultation response was published in November 2018, setting out the intention to produce a new statistical publication in this area. Work on this publication has been delayed due to the coronavirus pandemic. The Scottish Government will provide a further update once a publication date is confirmed.”

The Oracle at Delphi is still with us.

I think Gordon MacIntyre-Kemp falls into that category but so would Andrew Wilson who is sometimes described as the SNP’s economics guru. Perhaps Jim Walker, George?

However, maybe we have too many economics gurus trying to lead us to their promised land and not enough economists who understand the importance of educating us on the basics, outlining Scotland’s fundamental strengths and weaknesses and debunking the bonkers myths.

That’s why I particularly value your own contributions, Richard. I’ve been posting some of your GERS stuff on my SNP branch Facebook pages over the last couple of days (hope you don’t mind) and they’re receiving a great response….though I’m not sure that all our members are ready for “viewing the Scottish post-independence economy through an MMT lens” quite yet!

The final decisions on Scotland’s future, economic or otherwise, can only be taken after independence. Vision and planning are vital, of course, and we must discuss all the likely options but I’m wary of those who would have us dotting the “i”s and crossing the “t”s in 2021.

Thanks

Indeed Stewart, I was referring to Jim Walker who is/was chief economist at Alethia Capital in Hong Kong (not sure if he still has that role), and apologies for delay in answering Richard.

I had a bit of a tussle with him about MMT on Roger Mullin’s blog a while back, where one of his replies to me was –

“So, going back to George’s main point, there is nothing much for economists to “understand” about MMT. It is as old as the hills and the reason it isn’t the prevailing economic wisdom today is because it has failed on every occasion that it has been tested. It creates distortions in the economic system, it undermines the capital structure (which is fragile at the best of times) and it produces unintended consequences that are the reverse of its well-intentioned goals (think Trump with limitless funds for military drones). If, like most sensible people believe, the best future for our planet is the prospect of governments shackled to the concept of ‘balancing the books’, then MMT should be returned to where it deserves to be: in the dustbin of history. Or, to put it more simply still, governments are not run by the good guys.”

I’ll leave you to form your own opinions of that – but if you want to learn more about his approach, the conversation is here – https://www.independentview.org/post/economics-an-apology

Holyrood Magazine also has an article penned by Jim Walker, discussing the currency issue – https://www.holyrood.com/comment/view,show-me-the-money, in which he attacks what he describes as the Tim Rideout and Richard Murphy approach, which he says “would push for an immediate adoption of a new, separate currency in order that the Scottish Government could then adopt an MMT approach to the fiscal accounts i.e., to print money, via a new Central Bank, to cover the government’s deficits. This would indeed be a bold departure from current policies (in the UK and everywhere else in the world) and has many potential pitfalls, not least a possible crash in the currency’s value in short order unless the new independent Scotland, like China, was willing to impose capital controls on its citizens and businesses.”

To sum up, he believes implicitly in the power of markets, and says we can’t trust governments to do the right thing. However, he is very smart, and as you will see if you read the conversation I linked above – not easy to argue with.

Not easy to argue with?

Anyone who thinks balancing books is more important than the deficits required to fight cl8maye change is simply insane

Sorry, but that has to be said

I would willingly take on this nonsense anyday

Mr Gordon,

“…. governments are not run by the good guys”. What precisely does Mr Walker propose the “good guys” are running? Mr Walker sets a perilous standard if he wishes to venture there, in the non-government, or private, or market sectors. Simply to offer a single example, from a genuinely inexhaustible list of wholesale disasters; remember LIBOR? Then check out the reasons for its demise.

I do not doubt that it is difficult to trust a government (look first at Boris Johnson’s); but in the selections you offer, Mr Walker simply begs the question: let me put it in terms that Adam Smith first articulated; a wisdom that neoliberalism has conveniently, and very deliberately forgotten: “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.” (‘Wealth of Nations’, Book I, Ch.10).

The leopard has not changed its spots since 1776, and it has never thrived better than under neoliberal ideology. As far as I can see, Mr Walker’s idea, as you present his wisdom, offers mere froth as sustenance, which is a classic neoliberal diversion.

Agreed Richard, but he’s hard to argue with in the sense that his answers are very long – as you’ll see if you look at the conversation I had with him.

This started with me commenting on an article posted by Roger Mullin, which he suggested “focuses on the failure of economic theories that promote a blind certainty (I would suggest ranging from so-called neoclassical economics to Modern Monetary Theory).”

Roger didn’t reply, but Jim Walker did, at length.

Part of the standard right wing trolling armoury

@John S Warren

Indeed, Jim Walker has neoliberal tendencies. It can be deduced from his replies to me that his antipathy to the idea of what we might see as good government stems from concerns that his beloved markets might be disturbed. He obviously has not come across those in his field who see that an understanding of MMT can benefit their market analysis.

We are indeed fortunate that he failed to be elected to the Scottish Parliament in May.

He seems to be better at winning horse races, or at least his horse is – https://www.thetimes.co.uk/article/alba-candidate-jim-walker-gets-better-result-at-ascot-3sxp77jdd

@Richard Murphy

I wonder if you’ve been able to ask Alex Salmond about GERS; I sort of get why he used it in the 2014 referendum, but why did he continue to promote it as an accurate reflection of Scotland’s finances, and has he changed his mind more recently.

At the same time, it would be interesting to ask him if he is happy having Jim Walker as the “economic guru” of the Alba party (assuming he still has that position).

When we talk…..

Thumbs up (looks like emojis don’t work here?).

Re the charge for Defence and the argument that everyone in UK benefits from, not everyone in the UK has the “benefit” of living 35 miles downwind of the biggest nuclear target in Western Europe. I think we should demand a rebate in GERS for all Scots as we are forced to live with increased daily danger as a direct result of UK Defence Policy.

Agreed