I have noted in earlier blogs that new research that I have been involved in, with colleagues, has shown that at least 20% of FTSE 350 companies in the decade 2009 — 2019 may have over distributed their profits to their members, and that another 20% of those companies may have been close to doing so. At the same time, those same companies showed the weakest levels of sales growth, growth in value added, investment per employee and other key ratios that indicate the strength of underlying economic performance. The companies that showed more restraint in their distribution policy also, broadly speaking, delivered better underlying economic performance.

There is an obvious issue in this. Most people involved in accounting and finance presume that the purpose of a company is to make profit even if s172 of the Companies Act 2006[1] makes it quite clear that this is not its sole purpose. They do then presume that the presentation of consolidated financial statements provides indication to the shareholders of the directors' fulfilment (or otherwise) of their duty to undertake this task on behalf of those members. There are, however, good reasons for thinking that this assumption is not true but that accounting does not make that at all clear.

It can be entirely reasonably argued that a company is not owned by its shareholders. What the shareholders do instead own is the equity share capital issued by the corporation. They enjoy the privileges of ownership implicit in those shares[2] but what is very clear in law is that they have no claim on the underlying assets of the firm. That is the quid pro quo of their limited liability: in exchange for limiting their debt liability with regard to the corporation shareholders relinquish any direct claim that they might have upon the assets of that corporation, excepting when the directors may wish to grant that to them by way of payment of dividends or buy back of their shares, and in the event of liquidation if, perchance, there are excess funds available for that purpose[3].

The essential nature of the peripherality of the shareholders' claim on a company is implicit within that explanation: it is only when or if others consent that the shareholder has a claim upon a company. In that case there is very good reason for thinking that the consolidated group accounts of a public interest entity (PIE) are of relatively limited consequence to the shareholder, and the fact that this is known by some at least is acknowledged in UK company law by the requirement that the balance sheet of the parent company entity of the PIE be published within the group consolidated financial statements.

Although few seem aware of it, by far the most important statement of concern to any shareholder of a PIE is this parent company balance sheet because it alone determines the extent of the profits available for distribution by the PIE to its equity membership. This is the case because for the purposes of equity share distributions it is the retained reserves of the group parent company and not those of the group as shown by its consolidated financial statements that determine the extent of realised reserves available for this purpose.

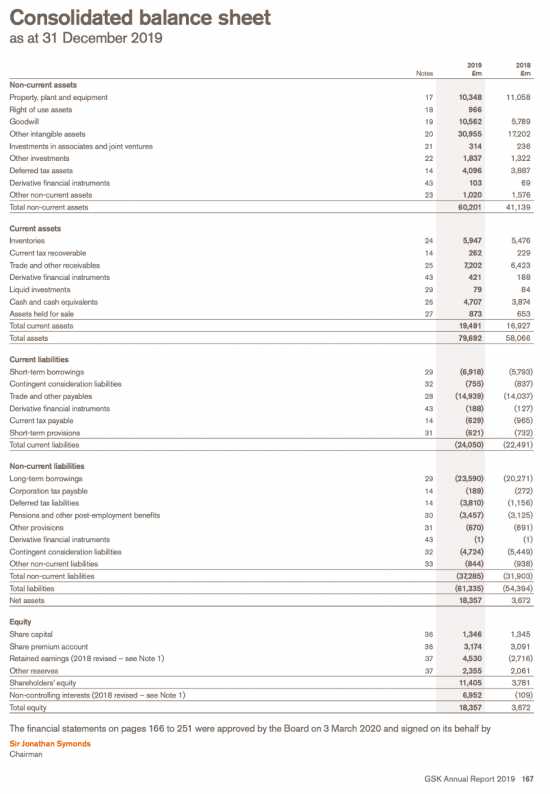

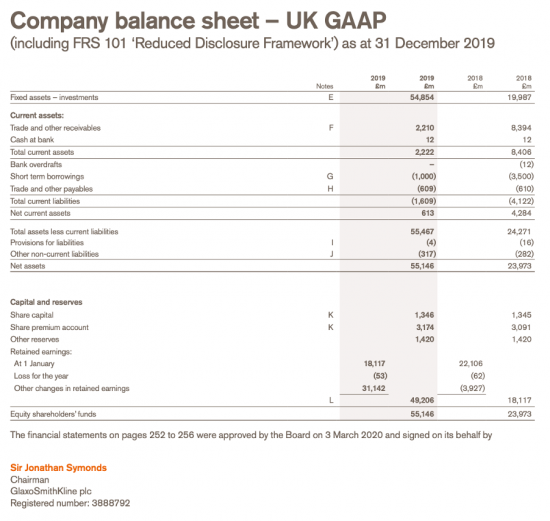

There are those who might have good reason to be pleased by this. For example, these are the consolidated and parent company balance sheets of GlaxoSmithKline plc[4] as at 31 December 2019, with the group being shown first:

It will be noted that in 2018 the GSK group had cumulative negative retained reserves and yet at the same time the company reported positive retained reserves exceeding £18 billion at that time. In 2019 the disparity is even larger: the group has succeeded in returning to positive cumulative retained reserves, increasing them by £7.2 billion in the year, but the company has done even better, increasing its reserves by £31.1 billion in the year, with total company equity at that date now reaching £55 billion, compared to £18 billion for the group as a whole.

Neither movement, it should be noted, has much to do with the trading performance of the year. The total comprehensive income for 2019 according to the same financial statements was £2.9 billion, out of which almost £4 billion of dividends were paid, meaning that it would be logical for reserves to have declined by £1.1 billion, and yet the funds available to the shareholders in the parent company and in the group appeared to have increased by a much greater sum. In the group that is because of an accounting decision to recognise value in a joint venture which had previously been excluded from account, totalling £8.1 billion, whilst the massive increase in reserves in the company related almost entirely to a distribution from a subsidiary company that clearly did not relate solely to the activities of the year in question.

The relevance of this should be apparent. If the shareholders can only benefit from the distribution of reserves, and these are seemingly calculated within the accounts of the group parent company, and not the group itself, then very obviously the shareholders only need the consolidated data to indicate the capacity of the PIE as a whole to raise loan funding to make dividend distributions in excess of retained income, as has been the recurring pattern within Glaxo Smith Kline, as it has been (as our research shows) in many FTSE companies. It is the parent company balance sheet alone that determines whether they can expect dividends, and in the case of many companies, of which Glaxo Smith Kline is just an example and nothing more, it is that parent company balance sheet that most often permits dividend payments when the group balance sheet would suggest reserves are not available for this purpose.

The significance of understanding this is that it shows that the ability of a PIE to pay dividends is not dependent upon its ability to generate profits but is instead dependent upon its ability to generate distributable reserves within the group parent company and to provide cash resources to make distribution of dividends possible, with borrowing being at least as likely to provide the latter as profit generation.

There are two basic ways where this situation can arise. One is where profitable subsidiary companies pay all their dividends up to a group parent company, which parent company is allowed to ignore the losses made in other subsidiaries because it does not, for itself, prepare consolidated accounts and losses cannot be paid up to a parent by way of dividend. There is as a result inherent bias towards over-recognition of profit in the parent company. Careful group structuring can, admittedly, help this process. The outcome may not be completely neutral in that case, but it is wholly legitimate.

Alternatively, the ability to generate profit available for distribution within a group in excess of that made from trading is easy to demonstrate. It is stressed that the example that follows has nothing to do with Glaxo Smith Kline, whose accounts were used in the earlier example. There is no evidence that GSK is using the methods noted in the next example.

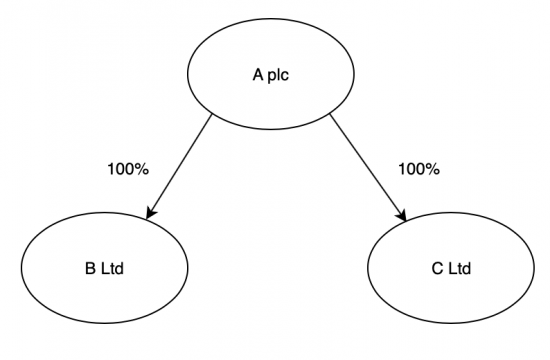

Presume that there is a group parent company of a PIE, called A plc. A plc has two subsidiaries. B Ltd sells the products that the group creates, and C Limited makes them. This is the group structure:

A plc does not trade. It is a holding, and if necessary, borrowing company.

A plc does not trade. It is a holding, and if necessary, borrowing company.

Now suppose C Limited makes product that costs £100 million which it sells to B Limited for £80 million, which B Limited then sells to third party customers for £110 million. These are the only transactions for the year.

B Limited has retained reserves of £30 billion at the end of the year. A plc has retained reserves of £10 million in its consolidated accounts, and C Limited has retained losses of £20 million, all stated before dividends are taken into account. Tax is ignored in this example. No company had reserves brought forward.

Then assume that A plc borrows £20 million which it in turn lends to C Limited, leaving B Limited with funds to match its supposed retained reserves having settled the price charged by C Limited. The £30 million of funds in B Limited are then paid as a dividend to A plc as the group parent company, and it in turn then pays a dividend to the shareholders, which it can because this dividend received will then constitute its sole distributable reserves in its capacity as a parent company, and not as a group entity.

As a consequence B Limited and A plc (as a parent company) have no reserves, and the group has negative reserves of £20 billion, as does C limited, whilst a dividend has legally been paid, much of which never represented a real profit arising, but which were nonetheless recognised as realised and distributable within the group structure that has been created. This is despite the fact that most of the retained reserves used to manufacture that dividend arose as a result of the use of transfer pricing mechanisms, which might have to be adjusted for tax purposes but which do not require alteration for corporate reporting purposes. The creditors have now funded a legal dividend to shareholders which has not, in large part, been earned. This is the consequence of financial engineering. The world has been used to transfer mispricing being used for the artificial reallocation of profit for tax purposes. What this example shows is that it may have other, quite different, uses for the generation of profits available for distribution in excess of those available to a group as a whole as well. There is, it is stressed, nothing illegal about this, or the adoption of the group structures that make this possible.

The point being made here is that current UK accounting rules in use also permit this outcome without adequately explaining how it has arisen, albeit that the figures used may be exaggerated.

The point of this example is, then, threefold. First it shows how peripheral to the interests of the shareholders the group consolidated accounts of a PIE really are.

Second, it demonstrates how easy it is to manipulate the reported capacity of a group of companies to pay dividends within the existing framework for both determining those dividends and reporting the activities of the group in question, both of which lay themselves open to enormous risk of being arbitraged.

Third, the point is made that if the creditors of the entity being audited are to be protected from exploitation by shareholders, which this example demonstrates to be completely possible, then it is essential that risks of this type not only be made apparent, but be audited and reported upon. However, existing frameworks of accounting and related disclosure requirements, do not require this. As such the inherent risk of audit failure within existing accounting frameworks is significantly increased. That is an issue which the current review of auditing should be addressing. It is not clear that it is. And that should be a matter of concern to all who are worried about the credibility of UK financial reporting, the credibility of stock market investment, and the risks that investing without this data has implicit within it.

Notes

[1] https://www.legislation.gov.uk/ukpga/2006/46/section/172

[2] Robé, J.-P., 2011. The Legal Structure of the Firm. Accounting, Economics, and Law: A Convivium 1.

[3] We are aware that there are a few occasions in standard Articles which might suggest shareholders do have power over the directors, but we consider this inconsequential in the case of PIEs because there is little evidence of such powers being capable of use.

[4] https://www.gsk.com/en-gb/investors/corporate-reporting/

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This needs a bit more thought, but three initial observations.

1) Company C being required to sell assets to its sister Company B at an undervalue (particularly below cost) involves a distribution. How long will Company C have sufficient reserves to permit the undervalue sales with their implicit distribution to be made lawfully?

2) Might Company A have to recognise an impairment in the value of its investment in Company C, if Company C continues to make losses year on year by in effect transferring value to Company B?

3) You could do this once or twice, but eventually the lender to Company A is going to ask where the money has gone and how it is going to be repaid. A sensible lender would already have built covenants around the financial strength of the borrower, and security over its and its subsidiaries’ assets, into the lending agreement. The shareholders will not be very happy at getting healthy dividends for a few years, and then making a huge loss on their capital investment if the group ends up in default.

Re your points

If C was created with £1 capital to do this there can be no impairment

C can trade with a guarantee from A – it is incredibly commonplace in groups

And yes creditors should ask questions but the evidence is that they clearly are not. Why is that? Probably because there is sufficient security, leaving third parties at real risk, plus pensioners, of course

OK, so Company C has £1 of share capital, but it also appears to have fewer assets that liabilities, as it keeps making losses and has debts to repay but no assets. What value do you put on the £20m intercompany receivable in the books of A? How can it ever be repaid?

If C has negative distributable reserves, why aren’t the undervalue sales to B unlawful distributions? And I’ll add, what regard do Company C’s directors have to their fiduciary duties, and corporate benefit?

So Company A has a final salary pension scheme? Won’t its trustees become worried about the company borrowing year after year to fund the payment of dividends that exceed the group’s net profits?

The inter company loan will be claimed repayable in the basis of a cash flow projection showing that is possible

It will be claimed pricing will change

It will be, but another subsidiary will then repeat the trick

And no, underpricing is not an 7nlawful distribution. It is a loss.

“underpricing is not an [u]nlawful distribution” – notwithstanding the Aveling Barford case?

Who is going to bring the action?

OK, so you agree the undervalue sale might be an unlawful distribution?

Yes, enforcement is another matter. Most company directors (particularly where the company is listed) would rather avoid breaking the law. Typically the person brining an action would be a creditor – perhaps HMRC – arguing that the directors are personally liable to repay the unlawful distribution, and potentially that shareholders knew it was unlawful and should repay. But it would usually only become an issue in insolvency.

But if sale at undervalue is an unlawful sale in the UK the activity will simply shift out of the UK – as is easy in a multinational corporation and beyond any action

There is no reason why not

And who says what is undervalue? I exaggerated here, but as we know transfer pricing is a nightmare and transfer mispricing is commonplace so no one fears this

I do not see how action can be taken to prevent this without disclosure

I’ve been reading your posts about this subject all morning and you are your colleagues are definitely onto something rather crucial.

It certainly throws a potential spanner in the workings of markets – the ‘best knowledge processor’ – my arse.

GIGO – garbage in, garbage out.

If the advocates of free markets don’t get this then damn them all to hell. If they can’t see how this undermines what they apparently believe in – and its precisely this sort of behaviour that enabled 2008 BTW – then how an earth can they expected to thought of as credible?

The other thing that occurs to me is no wonder companies resist paying taxes, meeting their social obligations and doing R&D.

Because they are simply lying about how well they are doing.

Thanks

We think this very significant

I have known banks to lend where there is little chance of the loan ever being repaid. What they rely on is the company continuing to trade for a reasonable period and pay interest and fees over a number of years by managing other creditors, usually HMRC. Many of these companies are technically insolvent but manage to keep trading even where audit reports are qualified. The advantage for the bank is that the fees and interest represent revenue and profit which can be distributed to management and share holders. Eventually the loan may have to be written off but if but if provisions have been made over a number of years the eventual write off will have little impact on the balance sheet and there is always a chance that the company might get lucky and dig itself out of a debt hole.

True

Most banks lending to distressed companies would make a judgment about whether they think the debt will be repaid and what security they need, and expect to make a profit from the whole deal taking account of the risk of losing the principal (and their cost of capital).

Perhaps I misunderstand the accounting treatment, but wouldn’t a provision made by a bank (that is, a financial trader) against its loan book (that is, its stock) usually go straight to P&L? That would defeat the purpose of generating higher fees and interest. Although I suppose there might be benefit in generating profit in period 1 but losses in period 2 and later.

It is still true that the provision can be deferred, even under IFRS 9 – if it can be shown there are grounds to expect recovery. That is one person’s judgement over another

In that case I am not sure that accounting can necessarily prevent this as yet

Back in the inter war period the Great Western Railway was the only one of the UK’s ‘Big Four’ Railway Companies to pay a dividend on its ordinary shares,* mostly at the insistence of the Chair, Viscount Portal and this was the subject of much controversy at the time as even Gods Wonderful Railway was barely if at all profitable.

It now seems to be going on on a much larger scale.

In Portal, and the boards favour there were significant unclaimed Directors Emoluments and Expenses that went to the staff ‘Helping Hand’ fund and when the company was formally wound up in 1948 he declined his contractual pay off to maximise the pay out to the holders of Ordinary Shares.

*Most of the Railway Company capital was in the form of Preference rather than Ordinary shares

That would not happen now

There are two issues here.

First, shareholders don’t seem to understand the risky nature of their investment. They seem to think that regular dividends are a “right” rather than a “bonus” to be distributed AFTER every other obligation is fulfilled. This was most vividly illustrated when Banks were required to suspend dividends while the Covid pandemic played out. To me, this was an obvious sensible thing to do but the whining from shareholders was astounding. We also see it in this blog; whenever you mention Green Bonds someone always chips in with the fact that buying them is crazy as the rate paid is below inflation and that equities are better…. ie. NO understanding of equity risk.

Given the expectation of shareholders for steady dividends it is not surprising that managers will jump though any number of hoops to maintain the dividend. If they don’t they get replaced.

That brings us to the second, broader issue. We live in a country where skirting around the rules to achieve the personally desired outcome is seen a “clever and good”…. without to regard to “is it right?”. Whether is is COVID rules or paying tax or paying dividends this “extreme individualism” is very damaging….. and at the heart of current government thinking.

Agreed

I see your work on this as really important. Other commentators who point out this sort of company shenanigans are not accountants, and not in a position to dig deep to analyse how it is done and go on to identify how accounting rules could be changed to minimise abuse.

It seems to me that if accounting rules forced there to be transparency about company “profits” coming from borrowing rather than earnings, such companies would find themselves high risk for future loans and possibly a “junk” credit rating. Which should be a deterrent.

The good thing is that if this is routinely done like your example, by choosing how to declare profits and losses between subsidiary companies, the same solution for accountancy transparency would show up the similar behaviour of multinational companies deciding where to declare taxable profits.

Thanks

Does this have any bearing on the real world ftse company in the news?

Can someone explain why £6 billion bid for Morrisons directors to start singing ‘we’re in themoney’ is anywhere near fair price?

‘Morrison owns about 85% of its almost 500 stores, as well as manufacturing sites, making it attractive to private equity bidders. The property portfolio was last valued at about 6 billion pounds, above the company’s market capitalization before news of the CD&R approach was made public.’

https://uk.finance.yahoo.com/news/l-g-pushes-morrison-real-171343759.html

‘Last’ – when? Asset prices have increased substantially under QE – not Morrisons share price. Lets say £9 Billion in their land bank.

Lets say £3 billion for the goodwill.

£12 billion, not six.

I am not quite sure I follow your logic

Nor have a checked the data

Well, there is a PDF with the 31 January 2021 accounts of Morrisons here – https://www.morrisons-corporate.com/investor-centre/annual-report/

The consolidated income statement and consolidated statement of financial position are on pages 86 and 87.

Profit before tax of £201m on sales of £17.6 billion. That is a margin of just 1.1%.

Gross assets of £11.036 billion (mostly non-current assets, including property plant and equipment valued at £7.358 billion) and total liabilities of £6.820 billion (about £4 billion non-current). You’ll need to take the debt off the value of the assets to get to a valuation. Or to put it another way, arguably the goodwill just not worth £3 billion.

As to the land, note 3.3 (page 107) gives the cost of freehold land of £3,848, freehold buildings of £4,201, leasehold improvements of £635, and plant etc of £2,355, depreciated by a total of £3,681 down to a net book value of £7,358 as at 31 January 2021. And then a net book value of £997 for “right-of-use” assets, which is the depreciated cost of mainly freehold land and buildings. (all of these £m)

So that looks like land and buildings of over £8 billion. And that is depreciated cost. I can’t see market valuations or a revaluation reserve anywhere. But then you’re left with about £3 billion of non-land assets, and about £7 billion of liabilities (mostly £2.8 billion of trade liabilities, nearly £2 billion of borrowings, mostly with a maturity over 4 years, and £1.3 billion of lease liabilities, mostly beyond five years).

Very good

And incidentally, the tax makes no sense

A tax charge of £69m on profits of £165m (including exceptionals), or an effective tax rate of 42%!

Mainly due to disallowed depreciation and changes to the provision for deferred tax, it seems.

The large provision for deferred tax liabilities presumably arises from claiming capital allowances (against tax at 19%) ahead of depreciation (in the accounts but disallowed for tax) in the last few years, but they will have more depreciation ahead of capital allowances (at 25%) in future.

There is much more to it than that….I have new research under way

Thankyou very much both.

I look forward to a stand alone article on this and such valuations which are designed to enrich a few at the expense of the majority of long term faithful shareholders – i am one.

Read the report I out out earlier this week