This Tweet from MMT professor Dirk Ehnts is well worth sharing:

I have been playing with the sectoral financial balances today, with data prepared by the @stlouisfed. The result is a very nice figure, which is accessible to all. Just click on the link below. h/t to @CZimm_economist https://t.co/eryR0Otm2A pic.twitter.com/gR47VaD49g

— Dirk Ehnts (@DEhnts) January 13, 2021

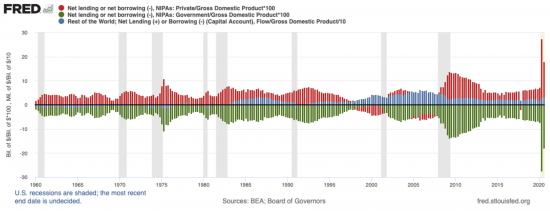

The chart looks like this:

Click on the image to enlarge it.

In effect the sectoral balances simply say that all cash is debt, and so if someone owes, someone must be owed. Put this in the context of deficits and the logic is that if the government is in deficit someone must be in surplus.

The above chart is for the US. The government is in deficit. Households are massively in surplus, the overseas sector, a bit.

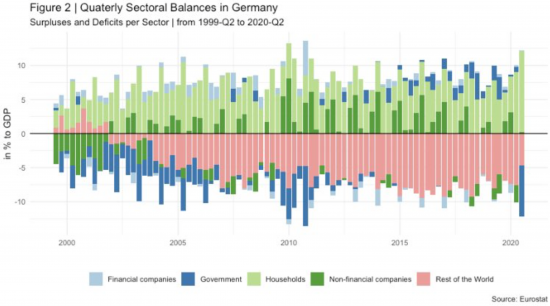

Karl Just added this for Germany:

There. the government is in deficit, but the rest of the world also runs a deficit with Germany (which is what Germany thinks is normal, but is not) and households run massive surpluses right now.

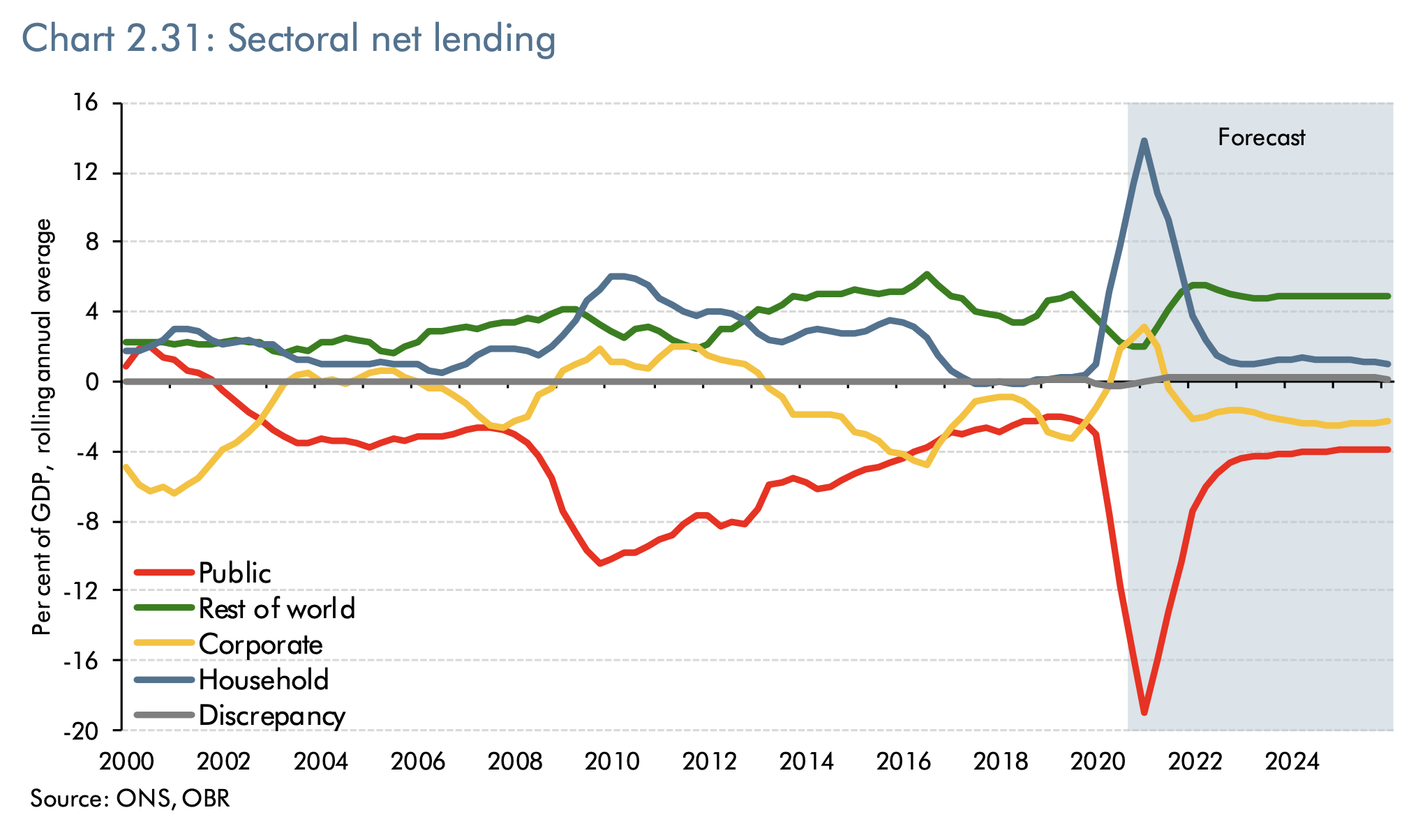

In the UK it is different again, taken from the OBR review last November:

We are more dependent on the rest of the world than the other two countries.

But the point is clear in each case: deficits create surpluses. The question now is how they are managed post coronavirus, because that will be essential, because the management of the inequality implicit in them is much more important than any debt issue within the state sector.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard — Thank You !

the penny’s dropped

” all money is just debt ”

I never quite got my head around that

but today

” if someone owes, someone must be owed ”

ties in nicely with double -entry bookkeeping

I’ll just have a quick word with the Labour Party hierarchy –put them right on this one

” Now Sir Keir, I know you,re a lawyer & not an accountant, but ……….. ”

ever the optimist !

Yay!

My day has been worthwhile

@ Rob Gray

There you go you’re now in orbit! Unfold your solar energy panels knowing that the safest collateral for money is “debt upon debt” meaning government created currency. You borrow from your bank with both you and the bank knowing your repayments will have the best stability all be it short term because the government has the coercive ability to retire as much of its “debt”, the currency, as it sees necessary for that stability.

@Rob,

” the penny’s dropped……all money is just debt”

Not so fast! Your next problem might be the argument that currency issuing governments can create money “debt free” because they don’t have to borrow it from anyone!

So it is and yet it isn’t!

They borrow it from their central bank

The twist is they do not have to repay it

It is not debt free

It is just in perpetuity

The central bank is owned by the Govt so they are borrowing from themselves. There is always going to some intellectual difficulty in saying that’s really borrowing. At least in the way everyone understands the term to mean. It’s the same as moving money from the left to the right trouser pocket.

In practice the BoE is buying up bonds in the market at the same time as the Treasury is selling them. There is a taboo on direct sales, so this allows some to say the Govt is still borrowing. But it is just a work around. The net result is just the same as if there were direct purchases.

All money creation is so simple it offends the brain

Government money creation is so easy some think it obscene

I don’t

I say release its power

It is not possible for the government to issue debt free money, and it doesn’t matter if the central bank printed it or it was ‘borrowed’ from the private sector….

The key is the understanding of what the ‘I promise to pay” written on Banknotes means. It is a promise, to repay a debt. Bank Notes are an IOU from the government, the person holding it, and Bank of England reserves are the same in electronic form.

It makes no difference how this money was created. If the government pay you £10, it means the government owe you £10 in value. Same as If I was to write an IOU to you if you fixed my car…. So long as you knew you could get your moneys with with this IOU, you’d accept it.

When you hold the governments £10 IOU , what this means is the government has promised to give you in return, £10 of value. This could be:

– A £10 NHS prescription

– Part payment to a £85 passport

– £10 reduction in a state issued fine against you.

– £10 off your tax bill.

And, since everyone else in the country wants these same things, that £10 is valuable. But, it is still government debt. To get the the original point, what does ‘Debt Free’ money even mean? Maybe it’s another type of money, without this ‘promise to pay’ written on it.

It would mean the government doesn’t owe the holder anything. Sorry, your tax/ fine wont be reduced by surrendering it, and you can forget about a NHS prescription – The government has no obligation to honour it at all. You’re on your own! You wont even be able to exchange that ‘debt free’ £10 at the Bank of england for some smaller denomination… , because this is debt free money and the government owes you *nothing*. But, in this case, can you see that essentially this makes this ‘Debt Free’ money worthless…. Money holds value because the government has an obligation to honour it.

Agreed

Debt free money is meaningless

This is why I disagreed with Positive Money for so long

Richard, your exchange with Mr Gray may provide the form in which to give the issue wider, comprehensible public circulation.

” if someone owes, someone must be owed ”.

This leads on to other questions you would wish to explore in clear and understandable terms; who owes whom? Which will lead inexorably to safe asset theory, I surmise. In any case territory where neoliberalism has difficulty with close scrutiny.

Indeed….I am working on that….for sometime….

Useful thread on govt money creation from Richard Tye here https://threadreaderapp.com/thread/1348277294159290372.html

With regard to Starmer, I thought that lawyers were required to undertake some basic accountancy training as part of their qualifications?

Agree with the message and wholeheatedly agree with your previous critique of the OBR’s forecasts illustrated in their chart. I might quibble very slightly with the title as it suggests a (direction) of causation that might not be as clear as the headline suggest

OK

@ Richard,

Yes this is the standard MMT line.

But, previously, it did seem you had a disagreement with Dirk on this.

https://www.taxresearch.org.uk/Blog/2020/12/11/governments-borrow-thats-a-fact-what-mmt-makes-clear-is-thats-a-choice-the-debate-should-be-on-whether-thats-a-good-choice-and-not-on-whether-it-happens/

You picked up the wrong end of the stick there

It’s difficult to know which is the right end. One says government debt fuels private saving. The other says private saving fuels government debt.

So which is cause and which is effect?

Since government spending creates deposits, just as loans create deposits (ask the BoE) there is only one direction of travel

@Tim

I’m still working things through

if the Govt. doesn’t have to borrow it from anyone

what’s the double – entry for the Govt’s money creation ?

The double entry is the usual one for loan creation

The parties are the BoE and Treasury

It is all new money.

And yes it has been used the wrong way. Hence the savings glut.

Had it been created for the under privileged, it would have been largely spent.

So little or no savings. It also stablises demand.

I wonder how Basel feels today. Full.

New money is hidden in Govt-Bank bond mechanism.

It is a requirement of licensing?

They have to buy the bonds from Gvt.

Gvt then has new money.

More on this to come