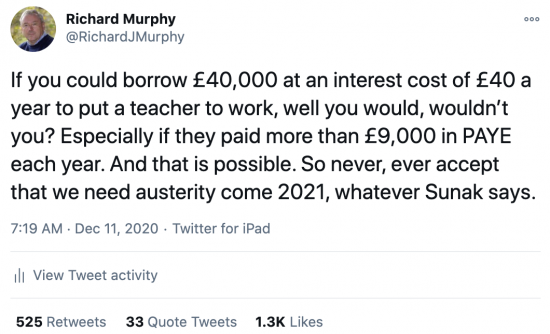

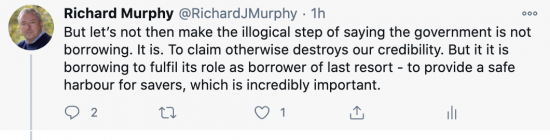

I wrote this tweet this morning:

It's been property popular. I suspect it will get many more likes as yet.

I got this in reply from the Gower Initiative for Modern Money Studies:

It has to be said that I am aware that GIMMS do not much like me. I was an adviser when it started but I criticised Bill Mitchell, for good reason. Now they say I am not an MMT economist and advise anyone who will listen not to read this blog as I do not promote MMT. MMT needs friends like that.

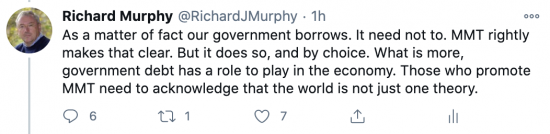

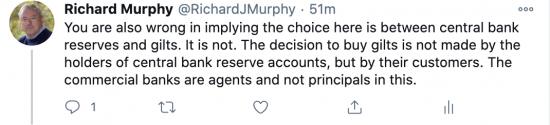

I replied saying this:

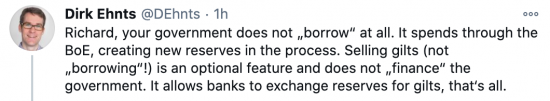

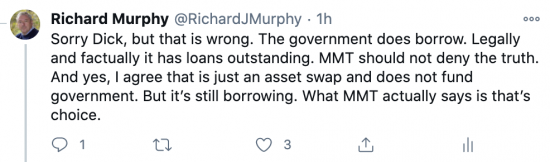

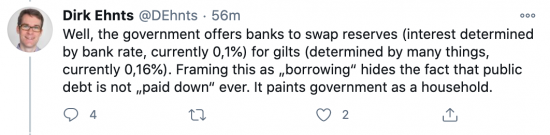

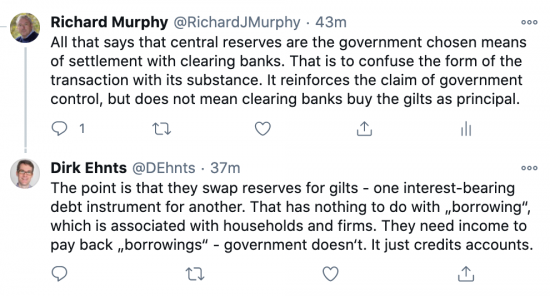

In response Dirk Ehnts, a German professor who teaches MMT sad:

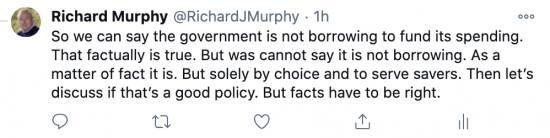

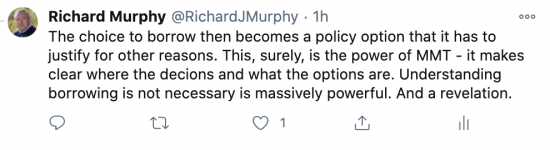

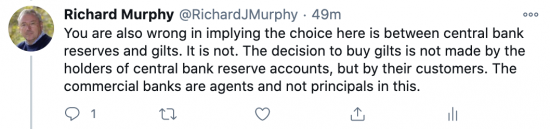

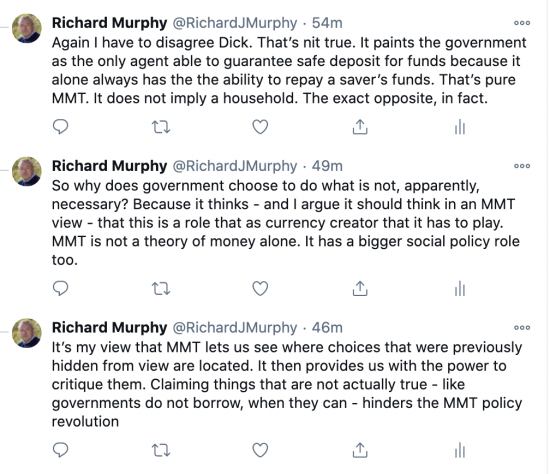

To which I replied in an exchange that went as follows:

I did, subsequently, apologise for calling Dirk Dick, which was autocorrect in play.

So let's deal with the real issues here.

First calling something an asset swap does not stop it being a loan. All loans involve asset swaps. In fact, all transactions involve asset swaps. We just so happen to call putting money into a bond on which interest is paid with a maturity date normally being noted a loan. That can't be changed by saying it is an asset swap.

Nor can it be claimed, as Dirk did, that because central bank reserves are used then this cannot be a loan. Central bank reserves are simply means of settlement (call them money if you like, which is what they actually are: the Bank of England said so in 2014). So there is nothing special about that, except to imply that the government has special power when demanding that payment be made this way which indicates its special role in such relationships.

Having addressed these points there is nothing left to the argument. In summary the claim made is that a loan is subscribed for in cash. That is it. That does not mean it is not a loan.

So I go to my main point. This is that MMT cannot say governments do not borrow. As a matter of legal fact they do. As a matter of economic fact they do as well. The asset swap that MMT describes borrowing to be (swapping non-interest-bearing money for interest-bearing gilts) is an act of borrowing, by definition. It does not fund spending, of course. But it is borrowing, nonetheless. So to say that governments do not borrow and that only the private sector does is factually wrong.

What, instead, modern monetary theory actually says is that governments need not borrow. Any government with its own currency and central bank can create all the money it needs to fund its activities without borrowing. Of course, it needs to tax to control inflation. That's a fact. And it says borrowing is not a necessity. In fact, it is an activity entirely undertaken by government choice. As MMT makes clear, a government can always borrow from its own central bank, with no net interest cost if it so wishes instead of paying interest, assuming the conditions that I note apply.

What I would say is that it is in creating this understanding that MMT is important. MMT makes clear that choices are available when very few understand that options exist. That is what good theory does. It does not change reality. It helps us understand reality better. And that's massively important. It offers choice when previously it was thought there was none. In the process it also permits criticism about choices made. It allows those of us not in power to more ably critique those who are in power. And that matters, enormously.

But it's a straightforward mistake to move from the insights MMT provides to saying it prescribes anything. For example, despite knowing that governments do not need to borrow I still suggest that they should. But now I know it is a choice. And I know that I am choosing to say the government should play a very special role as borrower of last resort. That's because I think it important that it fulfil that role. I also think that interest rates should be kept very low so that it does so at minimum cost. But that does not mean I am contravening what MMT says. I am consciously suggesting a policy that is wholly MMT consistent that is chosen as an option, and not a necessity. And I think that awareness is what is critical.

If anyone wants to throw me out of the MMT community for saying that an obsession with the form of transactions is inappropriate when what is important about MMT is the policy substance of what it makes us think possible, so be it. I can live with that. But right now I am quite happy to say that GIMMS and Dirk Ehnts and both straightforwardly wrong, and making claims like this do not help MMT at all when it actually has so much to offer.

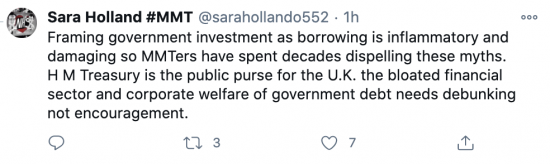

In fairness, the GIMMS response was:

With respect to GIMMS there are so many errors in that it's hard to know where to start.

The investment is the spend. But all spending is a debit in accounting terms and has to have credit, and GIMMS appears to be suggesting single entry. That makes no sense, at all.

And sure The Treasury is the UK public purse. But nothing I said suggested that the bloated financial sector and corporate welfare need gain. I said the government borrows. Most of that is from foreign governments and pension funds and life assurances companies right now. Maybe GIMMS does not want them to save in gilts. That's fine. That's a choice. But it is not what MMT says.

MMT is not a left wing campaigning tool. It is about economic theory. And that requires that facts be stated properly. I did that. Governments borrow. Now let's discuss why and whether that is wise. But let's not have MMT deny reality because that does not help it, at all.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Oh dear, I am sorry but I can’t get the scene from Life of Brian out of my head.

Brian: Are you the Judean People’s Front?

Reg: **** off!

Brian: What?

Reg: Judean People’s Front. We’re the People’s Front of Judea! Judean People’s Front. Cawk.

On balance, I think I am with you, Richard – on technical and tactical grounds.

Technically, Commercial Bank’s and GEMMS (Gilt-edged market makers) may be the only institutions that deal with the BOE or DMO but they act as agents rather than principal most of the time. Nothing you say contradicts MMT as I see it (which is as a description of the way the world I work in IS – not an academic exercise).

Tactically, we need to address people “where they are” not where we wish they where. Your concise first tweet challenges people to think… and that is good.

Thanks

And yes – you are spot on re LoB

That was exactly my thought – PFLJ vs JPLF all over again. Promoting MMT as the silver bullet answer to all known problems is a sure fire way of ensuring it stays in the margins. It’s as bad as the monetarist thinking that interest rates were the only tool you need – one club golfing I think Edward Heath called it. This kind of argument makes it easier for its critics to say that is just endless money printing that will lead to another Weimar.

I see it as a very useful lens on how the economy really works, which opens up some new options and exposes some fallacies in the prevailing theories and practices. It does not invalidate all current practices – borrowing still has a place and interest rates will have a role.

I am becoming surprised at the number of slight variations on MMT that there are on the web, each claiming the crown.

I am approaching this on the basis that, “if it looks too good to be true, it probably is,” and for this reason I have been settled on the creation of money, both from the banks’ point of view and the government.

I have a worry about our current situation and our ability to create money to escape from it. I understand that Richard is relaxed about not increasing taxation and happy to continue to create money to fund any deficit.

But, what if there is a limit to how much money we can create before inflation kicks in? What then? What if the limit is triggered by human behaviour, human fears?

In 2021, when we leave the EU with no deal there will be chaos without doubt and UK GDP will begin to plummet and the deficit will rise further. If the MMT heads at the treasury create money there will be eminent economists, including at least one Nobel prize winner – to my knowledge – who will speak out against ignoring budgets deficits, and what if the foreign exchange traders then become spooked by the whole Brexit thing and start to mark sterling down and keep marking it down. An inflationary spike looks inevitable and at that point MMT is hoist on its own petard.

I am really interested to hear the MMT argument as to why this will not happen.

Patrick, as I have explained many times, and as does all MMT, the limit to money creation. is full resource utilisation within sustainable limits – and so in effect full employment.

Foreign exchange and deficits are very indirectly linked – the ability to pay and productivity is what mattes there – don’t confuse the issues – and traders trying to mark it down where it does not want to go does not happen

And so where does inflation come from? How when demand and employment is collapsing do prices rise? Please tell?

Thank you, Richard, I have taken on board your messages about the limits of money creation. I was, however, trying to describe a scenario which is more akin to a price shock of the type that caused the 1970s stagflation.

If events turn out how I describe above then labour cost inflation would not arise, but import prices, including gas and oil would rise, perhaps dramatically. Exchange rates are not relevant until they are.

But we will see.

But why will exchange rates fall?

You do know how exceptional those are in the float era?

And Brexit is already priced in?

Always in human use of a currency, a medium of exchange, is a search for security to help maintain the value of your holding of a currency for as long as possible both in the short and long term. The reason for this is political, governments come and go sometimes violently and not necessarily for better governance, for the well-being of all!

A study of the evolution of English currency reveals this search for security and the creation of a central bank was a device chosen by the wealthy to help them feel secure about their currency holding.

The Romans managed for a 1000 years to hold together a republic and empire and have a currency without a central bank using military force to maintain the hegemony of their currency. Mao said power grows from the barrel of a gun. He failed to link in it also grows from a being able to create a barrel or rather barrels of money!

I think this is one of those occasions where a twitter debate is not helpful. It seems to me better that those involved in the argument are best left to debate with each other, until they understand the other point of view. From that can come statements that are clear, coherent and capable of public acceptance.

In our work, we have a rule that says if you e.g. answer an emailed question and then get another question or contrary response, you pick up the phone to discuss it. Most times you are looking at the same thing in a very similar way, but coming up with a differing explanation.

One answer (ours of course!) will be technically correct, but until it is understood by the other, it is of no use. We make a point of using technically correct terminology alongside how it is commonly understood or may apply in that particular circumstance.

Dirk and I have now engaged off public view…..

Excellent – thank you.

I think I should also add that in this debate one of the issues that shouldn’t be lost sight of is whether a central bank operates as a “flummery institution” something that disguises who is really operating the levers of power. Re-watching the 2003 BBC series “Charles II: The Power and the Passion” helps understand flummery. The creation of the Bank of England in 1694 can be regarded as a means of restraining the powers of the monarchy by establishing another or rather quasi one.

It remains quasi

Hello Richard.

People familiar with your blog will be familiar with some of the points you make here. However, it still must be said that you are breaking new ground for MMT, often, not just in this blog. It’s strange that, in order for MMT to exist, people had to look at how things work in reality, and question orthodox economic explanation of this, but now some within MMT don’t want to look at how things work in reality, and don’t want to question how this fits with MMT and/or any other economic theory.

I agree with the Life of Brian reference.

I like the term ‘borrower of last resort’ for the government and I feel that this should be added or mentioned often, by anyone, when talking of government borrowing. I think it automatically separates government from other borrowers, and induces the question of ‘what do you mean by borrower of last resort?’ which allows an opportunity to explain that it’s a government choice to borrow. I don’t see how this can be a problem for anyone who wishes to promote MMT. It’s part of that promotion surely?

I also think that a lot of MMT stuff is about holding elected representatives to account, rather than letting them claim that they can’t do anything because of the ‘who will pay for it?’ line or BoE independence. Borrower of last resort puts political choice firmly at the centre of this whole area and that means voters can demand answers. That’s surely a good thing?

This blog could spawn further blogs, if you we’re to choose to do so. I think there’s quite a lot in it.

Your tweet with the time stamp of 43m and beginning “all that says that central reserves…” is something I feel I understand but that there’s more to it that I definitely don’t know. A blog on this would be good or equally I’d appreciate some links…. I’m actually thinking Helen would be the perfect person to provide these in the comments…. no pressure, Helen 🙂

Ok, I’ve written more than enough.

Thanks.

Gordon

I refuse to be constrained…but living or long-dead economists

So I am willing to push forward

I will do central reserves, soon. Maybe quite soon

Thanks

Richard

The key issue in this debate is whether having a central bank obscures the sovereignty of government to create currency, a medium of exchange. The old MMT stalwarts like Randall Wray believe it does. See his conclusion in this 2014 paper:-

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2407707

If you don’t accept his argument then you need to list out why a country needs a central bank as opposed to just an exchequer or treasury. The history of the creation of the Bank of England, initially a private institution for many years till nationalised in 1946, strongly suggests a quasi-independent institution helps give confidence to the private sector if government has A) failed to understand how currencies work and B) because of that failure behaved in ways that undermine markets.

Having said this the private sector according to Christine Desan fails to recognise that a sovereign government through its constitutional powers is able to create the “safest” medium of exchange through its currency “retirement” powers and this enables the existence of markets and markets foster capitalism. (You only have to read up the Libertarian Hayek’s proposals for private sector currency creation to understand this!)

This would all strongly suggest that having a good understanding of currency or medium of exchange creation breeds confidence amongst citizens and this is the real issue in this debate!

I support a central banking function, firmly under democratic control

My counter obviously is how can you have any kind of rational democratic control when there is so much widespread ignorance about currency creation amongst citizens as serious study of the history of currency evolution reveals? The ignorance is the big gorilla in the room!

Mz Schofield,

“This would all strongly suggest that having a good understanding of currency or medium of exchange creation breeds confidence amongst citizens and this is the real issue in this debate!”.

That is a really interesting statement, not least because I suspect it is not true. If it was true virtually nobody would have confidence in the £ Sterling, or in the US, the $ Dollar; because this Blog discusses day and daily how few citizens (subjects here), understand money. The facts contradict the theory. Confidence is entirely a function of trust, and trust is a matter of psychology. In money this is not based on a soundunderstanding the theory of money creation. It never was.

Confidence in money was something sovereign government struggled to achieve over a very long period.

The phrasing of my last comment may appear ambiguous. Allow me to clarify. I should make clear that what I mean is that understanding the creation of money is not a necessary condition to have confidence in it.

I do not mean that understanding the creation of money reduces confidence in it; merely that at a population level, understanding cannot, as a matter of empirical fact, be a necessary condition for widespread confidence in money.

Thanks

One thing that’s of interest in the pro’s and con’s argument of having a central bank as well as a government treasury is the matter of power to create interest bearing financial instruments. On page 325 of her book “Making Money: Coins, Currency and the Coming of Capitalism” Christine Desan talks about the fear amongst some about the creation of the Bank of England. Namely that it was being used to create such financial instruments and the interest rate kept high in order to encourage hoarding of them.

This was seen as reducing the volume of currency in circulation which would deflate prices enabling the wealthy to buy up real assets at low prices then the BoE would lower interest rates on these instruments encouraging less hoarding and the real assets sold off at higher prices.

A form of arbitrage or rent seeking was institutionalised by the creating a central bank was the essence of the argument.

What safe-guards are in play today to prevent this today even though the BoE is nationalised and treasury bonds issued by the government? Is the MPC, an unaccountable body from a democratic perspective, cast iron objective on interest rate setting?

The reality is that the sheer volume of household debt is now that constraint

I would put it that Government “borrowing” is just the swap of one type of Govt IOU (cash) for another type of Govt IOU (bonds).

Is that really borrowing?

All transactions are just swaps

Calling something a swap does in that case add no value: if I buy a sandwich I swap cash in my bank account for the food

So we have to look to the sun=bstance of te transition to describe it and not the swap mechanism

When is a loan not a loan? The arrangements look and quack like loans so they are loans. There’s a term. A promise to rep[ay. And interest. How is that not a loan?

I seem to remember some previous discussion s suggested debt was not the best word when describing how government financed. Is borrowing the best?

Both are accurate when used in the right context

What is not accurate is calling something a debt when it is not – which ios what the government is very keen to do

That was a fascinating encounter on Twitter. Thank you for sharing. I admire how you stuck to your point.

I am pleased to say that I think I get it about choosing to turn Government investment into debt or not.

I am also intrigued by how your encounter revealed the thinking of these MMT proponents. They seem to think that by narrowing down or philosophically reducing the concept, they are making MMT easier to understand and avoiding the household analogy and other pitfalls.

How many times do we see this over simplification approach fail?

We seem to be unable these days to cope with dialectical paradox or coping with a number of contradictory elements in a situation and trying to resolve them by just not bloody acknowledging that they are there!! And often choosing the easiest route which leads to (for example) shite like ‘tax payer’s money’.

We operate under flags of convenience – not truths. And as a result, politics achieves nothing for most people.

As Varoufakis once said ‘Everything is heavily pregnant with its opposite’.

As you say, whether a Government decides to turn its money creation into debt or not is something that can happen in a given set of circumstances. We should welcome this fact and embrace the complexity.

I applaud your stance with admiration.

Thanks

It makes unpopular….

Oi, PSR!

I *like* my ‘taxpayer’s money’ ! – it makes me feel entitled and important, and is great in arguments for when the government is wasting ‘my’ money on their dodgy deals with their pals. 🙂

And I think therein lies one problem of how to change the way we all think about the way in which the economy works.

Government money is already ‘our’ money because government only exists to serve and represent us, the great unwashed (I’m talking theoretically here, obviously).

Taxes are required for a functioning economy.

So, even though the description ‘tax payer’s money’ at the moment is used to erroneously describe us paying into the treasury’s coffers so the government has the pennies to spend, I think it’s still important to keep that sense of importance and entitlement that comes from paying taxes. ‘Tax payer’s contribution to a functioning economy and society’ doesn’t have quite the same brevity to it, or even cover the whole. Our tax money doesn’t directly pay for anything, but ‘our’ (government) money does, sort of, so can we use the term ‘tax payer’s money’ with a different definition – the real one – but one described in simplistic terms? That is, not change what people say, but change people’s understanding of it?

Taxes are still a contribution to economy, and to the functioning of society as a whole, and people who pay taxes should be allowed to know they are, and feel they are, entitled and important, whether or not actual money goes into any actual coffers. How do we do that?

I hoped I’d get inspiration while writing this, but nope, nothing, so I’ll hand back to PSR for ideas and inspiration 😉

🙂

The following article is one that Randall Wray references in his 2014 I reference above:-

https://www.minneapolisfed.org/article/1977/perspectives-on-federal-reserve-independence-a-changing-structure-for-changing-times

The author Bruce K. MacLaury comes close to calling the United States central bank a “benevolent dictatorship” and if you know the history of the former head of this bank Alan Greenspan’s refusal to intervene in the fraudulent mortgage bond market that led to the GFC despite warnings from a wide variety of people you would query the use of the word “benevolent” whilst retaining the word dictatorship. Democratic control was conspicuously absent and to my knowledge nothing has changed to prevent a reoccurence. What is missing is as I argue rational understanding of the currency creation process amongst the laity in general. Absent a central bank a treasury department can still suffer a “Greenspan” travesty. The only merit of such a civil service department handling currency creation both as input and retirement is that government politicians are used to working closely with civil service heads. Wisely is another matter!

No….

Hello,

You have probably seen this?

“The simple fact is that MMT does not, definitively does not, describe the existing reality of the monetary system. Let me explain.”

https://www.pragcap.com/stop-saying-mmt-describes-reality-it-doesnt/

The Fed is consolidated in government

Just as the BoE is here

So he’s utterly wrong then

Thanks Richard for bringing this issue to our attention

it’s clarified something for me

I just couldn’t understand why any sovereign govt. would want to borrow money when it could simply create it instead —— unless of course it was some Govt. sponsored City of London piece of jiggery-pockery

the broad church of MMT has outlined the different interpretations of reality

I at least can cope with this ambiguity — without any need of excommunication

we’re not the bloody Labour Party !

See today’s post as well

The question of whether Govts borrow is largely determined by how we define Govt debt. We all tend to agree that Gilts and other Govt bonds are Govt debt. However, for historical reasons due to the linking of the quantity of Govt issued cash in circulation with reserves of Gold the monetary base wasn’t considered to be debt. At least in theory, there was enough Gold in the reserves to guarantee all the cash.

But now, even though there is no Gold link to the currency, our attitudes haven’t fully caught up. A point often made by MMT proponents. We do, though, consider that the pound is the I.O.U of the British Govt and nothing more. So on this basis it has to be debt too. The sectoral balances, an important part of MMT, don’t balance if we don’t include cash issues.

So therefore it must follow that the issue of cash (a Govt IOU yielding 0% interest) differs only from the issue of a Govt bond (a Govt IOU paying some small interest) only by the extent of that very small interest. At the moment it is ultra small and even negative for some Gilts.

Maybe we can say it’s all borrowing or none of it is borrowing. I’m not sure it matters very much providing we have an understanding of what’s going on in the market operations of a currency issuer.

See today’s post….

Here’s the core of the debate, again it’s a Desan argument.

She argues that the insertion of a central bank turns a sovereign government into an “individual” as far as currency creation is concerns. It “un-democratises” what is a “collectively” not “individually” approved government ability to create a “safe value” medium of exchange through its constitutional or rather legal right to use the fiscal power of taxation.

The lost understanding of the “collective” benefit of this fiscal power led to the arrival of a central bank because public perception had been “persuaded” there needed to be intermediation in the use of this “individual” fiscal power.

In practice Alan Greenspan’s “individual” arbitrary and therefore democratically unaccountable use of central bank power led to the GFC. It had become his “individual” will against that of the “collective” will.

In a nutshell there was no “democratically accountable ” control over a central bank and still isn’t and the reason for this has to be there is no public perception that it’s the collective or constitutional legal fiscal power of a sovereign government to impose taxation that creates a “safe” medium of exchange that enables markets and this in turn capitalism.

More succinctly the argument is the creation of the Bank of England in 1694 led to the 2007/2008 Great Financial Crash!

There is much to that argument

As others have said, it does sound like an argument over what the definitions of words are and how they are used, and what the meanings should be. Semantics rather than an actual disagreement,,, maybe, and a but:

What might be causing the differences in opinion of the detail here seems to be a fundamental difference in attitude to what MMT is, as a theory. I suspect this means that there always will be differences in opinion on the detail – because what MMT is *thought* to represent is fundamentally different between the two parties.

On one side – MMT is seen to be a brand new theory that will revolutionise the *way* economics works and everything must be changed to suit this new theory, including how things are already described. It’s trying to create a completely new framework that, one could argue, already exists, and make it look new and exciting.

On the other side – MMT is seen as a theory that describes how things already work, but describes it in a realistic way, such that this new economic *thinking* can be used to develop useful economic policies within the framework we already have, or to advance frameworks that may better suit how an economy actually works.

Okay, so I’ve used a broad brush there, and kept it vague on purpose and not named which each party is – have I got close to the fundamental views of each side?

Richard, you have complained about the words used in describing macro economical systems, and the difficulties in how people view things based on the word used – the implications of the word ‘deficit’ for instance – but I think the above discussion is about more than what words are used, or definitions. I don’t know if issuing gilts is borrowing or not – and I’m not sure I care 🙂 – but I reckon to productively discuss the detailed ins and outs of MMT, how everyone views ‘what the purpose of MMT should be’ needs to be established first (not for discussion purposes, just to inform each participant of the overarching view that leads to a belief).

I’m not suggesting my descriptions of views on what MMT is, above, are correct, just that consideration of what everyone’s AIM in making these distinctions is, would be a good way to find common ground.

Say: IF Dirk’s aim is to use MMT to describe everything in a prescribed way that only ever refers to an agreed set of terms, THEN he will continue to argue that those are the only set of terms that can be used, regardless of how the process is described as it happens right now.

And, IF your aim is to use MMT to describe what happens now, and so will use the description and terms already in use, and apply the theory to describe the process in whatever terms can be understood, THEN you will always argue the terms used are correct, that they fit with MMT, it is the reasoning behind them that needs adjusted.

So, to reach common ground, does Dirk agree it can be borrowing if he doesn’t restrict himself to prescribed terms, and does Richard agree it wouldn’t be borrowing within the purely theoretical terms prescribed by their theory? Then, after that, you can agree to differ on how MMT should be used. Sorted.

Absolutely no idea if I have managed to make any sense at all there, or if I got the wrong end of each stick (I’m not paying attention to any of the meaty technical stuff you are having fun arguing over, and not worrying about it), but I will be very interested to know the outcome of your and Dirk’s (dis)agreement anyway 🙂

I like this

Let’s be clear, I resisted MMT for some time – after doing the Joy of Tax – precisely because it has all the characteristics for some of a religion – that there is only one pure way

I don’t buy that of religion – and I don’t but that opf MMT

I am a pragmatic user and even developer of MMT – but I se it as a tool, nit a belief system. I do not see anything. In it as an absolute. It’s useful so long as it’s a model that describes what is needed.

Like maps, it has merit in describing a terrain but is not that terrain. I think some think it might be. Category error.

And I agree wholeheartedly with your view of MMT being a tool, and that it should be used pragmatically. In fact, that’s the only way I can see it ever being accepted in wider society and by the establishment – it has to have a practical use that causes the least amount of disruption, even if that means having to pick and choose only parts of it. (I’m keeping in mind that it puts paid to many myths used by the already wealthy to create more wealth inequality, so will always have strong resistance).

Interesting what you say about many treating MMT more like a religion – even more reason not to come at any argument from the front, as a head on detailed argument. It’ll need lateral thought to find a good approach (flank ’em!) – and right enough I did find a rather inflexible thinking the easiest way to describe Dirk’s position on the discussion (without knowing his opinion). It is more to do with power playing then, than an actual desire to have MMT used – sadly. Producing a hard and fast rule book on it is never going to be a winner, I’d say.

Heh, I’d just tell them, ‘of course you’re right, but it’s called borrowing (or whatever) in thicko unbeliever terms, so best stick with it’. Always good to throw in a slur of anyone not ‘them’ to boost the sense of entitlement 😉

Or another lateral approach could be: 1. get them to agree that it would be great if MMT could be implemented wholesale. 2. Propose that it can be done in stages. 3. Suggest, to get some stages implemented some compromise will be needed 4. Insist those compromises are an interim measure and will in no way hinder the end goal (1). 5. Tell them you are then right, in the context of applying (3), and if they don’t agree, how do they plan to reach goal (1)? Hmm, maybe that won’t work after all – their answer would just be ‘they need to adopt our whole theory in its entirety for (1), without question, so we can win a Nobel peace prize’ (so nothing after (1) applies as far as they are concerned).

Good luck then 🙂

I think it was when I read some older historical papers and documents while finding out about MMT, that I realised the principles behind it weren’t new, some of the basic ideas had already been formulated, but never gained traction in concious thought. What is new is bringing the concepts together and describing it in modern terms. It’s a modern description, about money. It’s not the money itself that’s modern, and it’s not even a description of fiat money in particular, but perhaps fiat money was introduced because that’s the best thing to run an economy with, as described by MMT. That is, MMT doesn’t come *after* fiat currency, MMT (or equivalent practical thinking) comes *before* it and tells us why fiat currency is now used (without the pretence of gold standard). Those are some idle thoughts I occasionally indulge in, of no consequence!

Thanks

I am a pragmatic user of MMT. I have always been so. It took me some time to embrace it. And I have never been wholly convinced by all of it, as some explain it e.g. Bill Mitchell. So I have been willing to argue when required, and also develop when necessary e.g. on tax.

And my point is, it is a lens. I am not seeing it as a prescription. More a way of thinking. That’s the way to see it, I think.

A sovereign government is “the” base generator of a country’s medium of exchange because it’s able to generate the “safest” version of this. The reason it’s able to do this is because it has the constitutional power granted through the will of the people to use the fiscal power of “retiring” the medium.

It does not, however, have to retire all of the medium it creates to make it the “safest” it has another mandate to satisfy the citizens desire to hoard some of this medium as savings.

The problem with the introduction of a central bank into this government medium generator role is three fold.

Firstly, it suggests the government needs a guardian to watch over its base generating power when in fact fiscal retirement is an intrinsic and vital part of that power not a central bank’s.

Secondly, citizens’ hands-on experience of banks is confined to private sector banks whose “fiscal” power is limited to full retirement of any medium of exchange it creates as a supplement to the governments. This confounds modern day citizens who think the government must do the same even if they acknowledge their government has to be a base generator of the medium of exchange.

Finally, the operation of a reserves based system operated by the government to enhance the “safety” of the country’s supplemental medium of exchange doesn’t have to be called a central bank.

Conceptually therefore the perception amongst modern day citizens of how their country’s medium of exchange is generated is a mess!

Hmmmmm.

It’s an interesting debate.

Having spent most of this year trying to get my head round MMT, I can see it from the layman’s side.

If you use the language of “debt” and “borrowing” to describe government spending then you are coming up against an understanding of debt and borrowing that is very different to most people’s experience.

Government can pay for its debt and borrowing by creating more money. The rest of us can not.

Government and private debt and borrowing are both technically debt and borrowing, but they behave in very different ways.

To describe government finance to private finance with the same terms is a recipe for confusion.

The government doesn’t need to pay off its debt but the rest of us do. Same word for two very different realities.

I have first hand experience of this having tried to explain MMT to a neighbour.

He just can’t get his head round the idea that the government doesn’t need to pay off its debt. When he hears me saying that the government doesn’t need to, he just thinks I’m mad. It’s not his reality/experience of debt.

I can cope with you using such language, as I understand what you are getting at, but it has taken me a long time and a lot of mental capacity to get there. Most people just don’t have the time or the interest.

The goal is to get as many converts as possible. I get Dirk’s position that we need to avoid the language of government debt, if we want to get as many converts as we can.

I find the language I use to be that which resonates

It’s not pure MMT terminology but it is pure MMT practice – and I am interested in what works

The problem with people who argue that books must always balance regardless of “circumstance” don’t actually practice what they preach. If all private bank created money created under government licence to supplement the currency in circulation is repaid then how can money be saved to buy a real asset like a piece of land to build a factory on? If, however, you argue its really advance money that’s repaid through a future income stream but meanwhile allows resources to be brought into use for purposes of human well-being then what’s wrong with government using that same process? If you can find no theoretical argument with government doing this why would you argue government has no money of its own?

When non-economists hear on the news “the government needs to borrow a billion pounds”, they naturally think the government is short of money, which is not true.

It IS borrowing, but it is misleading, so I think it should invent a new word for it. Call it “X” for now, as in “the government wants to X a billion pounds”

When asked what X is we cay say “X is a special of borrowing” and then explain what it is.

Just like trawling is a special kind of fishing. I think Richard (like most economists) is doing the equivalent of insisting on calling trawling “fishing”, which I think is counterproductive if one wants non-economists to understand what is happening and why.

(That was off the top of my head, but why not actually call government borrowing “trawling” as in “The government needs to trawl a billion pounds”.)

I described it as savings

That is what is

It’s a savings account

If I give you a box with £500 in it and you agree to hold that money for me on the condition that you will not open the box and use the contents, have I loaned you £500?

I would posit, no.

Do you owe me £500?

I would posit… yes… sort of.

The accounting for the currency issuer is NOT the accounting for households.

The same rules do not apply.

If you think that an argument worth considering I think you have lost it

I think this is very much the heart of the argument.

Does the government use the funds it is given by depositors?

Yes or No?

The answer is clearly, no.

The government does not use the funds it is given by depositors. All fiat currency governments are money financed.

Therefore, is accepting funds into trust, “borrowing”?

I seriously doubt it. I’ve never heard of Trustees describing funds in Trust as “borrowed money”.

Have you ?

The money is repayable on a loan agreement – so it’s a loan

Why waste time arguing – you are beating your head against a wall to absolutely no gain

And all you are putting into the process is a massive impediment to understanding

I am talking to real decision-makers about this and they say if we try to change the language forget it – it’s not worth their while to try to explain that on Radio 4

“Does the government use the funds it is given by depositors? Yes or No? The answer is clearly, no.”

You might consider looking at this from a different perspective.

The answer is that it clearly does in the sense that the depositors are acting in exactly the same way as taxpayers. ie They are handing money to the government. So just as taxpayers are creating the fiscal space to allow the government to spend without creating inflation so too are savers.

So it is easy enough to see that saving is equivalent to taxation in the short term. It can be considered as a form of temporary and voluntary taxation. In the longer term that may change if saving becomes de-saving. But that’s a problem to be tackled if and when it happens.

The samke3 behavioural consequence does not mean that they are the same