I am struggling with this morning's Bank of England (BoE) Monetary Policy Committee (MPC) report. There are a number of reasons.

One is that I find it intensely annoying when a report presents all its key findings in percentage terms. Hw is someone meant to know what 7.5% unemployment means when nowhere is data provided to give it a meaning? Economists who resort to such reporting are, in my opinion, always trying to hide something.

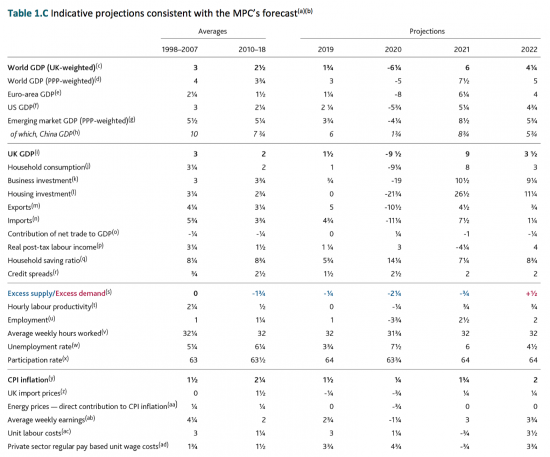

And then there is this table of assumptions, few of such strike me as plausible:

Click the image for a larger version or go to the original report (sorry).

The essence of the MPC's assumptions is;

- UK GDP will recover quickly, and quite strongly in 2022;

- So too will consumption;

- And in 2021 and 2022 business will invest heavily, and at much above normal rates;

- This will be despite heavy falls in post-tax wage income in 2021 which will recover, in part in 2022;

- Unemployment will rise this year, but be back to historically low rates by 2022 and participation rate in the economy will, if anything grow, meaning there will be a real rate of job growth over the next two years;

- There will be labour shortages, or an excess demand for labour by 2022;

- This will fuel above-average wage income growth.

Let me be honest: I am sure that this land of milk and honey must exist somewhere. But it is not a description of what I think likely to happen in the UK in the next two years or so. And the reasons are very easy to find.

First, the MPC assumes that Covid 19 is under control. Oh, happy days! If only that was true, of course.

Second, and as significantly, it would seem that the MPC thinks that credit is flowing easily to small businesses, and that the risk of corporate failure is low as a result. It would also seem that they think the current credit arrangements for small business will last forever. But that is not true. As I noted very recently, on 30 July the FT reported that:

[T]he OBR assumes that up to 40 per cent of bounce back loans could default. Banking executives warn that the loss rates could be even higher. Thousands of companies face being pursued by their lenders for debts they cannot afford to repay.

And as I noted in response, the companies that this implies might fail might employ between them 6 million people in all, because smaller companies employ disproportionately large numbers of people on lower than average wages with lower than average productivity. As I said at the time:

Not all [those jobs] will be lost, thankfully. I am hopeful that will not be the case. But to pretend that many hundreds of thousands of small employers will fail and somehow the jobless total will hardly increase at all - which is the view presented by this FT article - is absurd.

In effect the MPC is now making the same claim on unemployment as the FT article. The FT said that despite all the evidence it found on the stress within the economy only 3 million people might become unemployed. The MPC 7.5% unemployment rate implies a figure of around 2.7 million as I extrapolate it. And both suggestions are, unfortunately, unsupported by the evidence.

Businesses that fail create unemployed people.

And they are not replaced immediately.

And I should add that the figures noted do not include those becoming unemployed who were previously self-employed.

The BoE has focussed its work on the wrong issues and has ignored an issue about which most of its members will, I suspect, have very little awareness, which is small business cash flow, which is what will kill the companies that will fail over the coming months and year. The consequence is a forecast that strikes me as utterly implausible in economic terms, and that's before we even take into account the suppressed 'animal spirits'. The BoE found evidence of such suppressed spirits, for example in investment plans, and yet assume that investment will happen anyway.

So why does this mistaken forecasting happen?

One reason is the lack of experience of the real world in places like the BoE.

The second is, of course, political control: the Bank is delivering the 'boosterish' forecast its masters in Number 10 want.

But third, there is something worse. This is that the BoE is staffed by economists for whom maths is king, and they program all their forecasts to predict a return to the mean - because that is what they think mathematically always happens. So what we see here are forecasts which track the quickest possible return to the mean that the Bank's forecasting models permit. And rather than observe conflicts with reality and then adjust for them they continue to publish their model's results.

In fairness, they do say that the downside risks in their forecasts are considerable, and exceed upside risks. That's the one thing they got right.

I fear that things will be much worse than the Bank forecast. But I would be happy to be wrong.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“This is that the BoE is staffed by economists for whom maths is king, and they program all their forecasts to predict a return to the mean – because that is what they think mathematically always happens” Says it all.

Even my wife, who is generally not interested in these things (mostly because she has to put up with me!) saw straight through it.

We agreed that we used to laugh at the Soviet Union in the 1970s etc. with all of the great pronouncements; whereas ordinary Russians had their very wry sense of humour. We figured we are in the same politspeak as back then on the good old USSR (CCCP)

Just wondering, but do you think your forecasts and predictions are more accurate than the Bank of Englands, and what work and analysis do you use to get to those numbers?

Do I think my logic makes more sense then theirs by considering a broader evidence base?

Yes

The sources are all explained

I do that

Logic is nice, but what you are doing is guessing. You don’t have any real data, and the only source you do point towards is a newspaper article.

Don’t you think that the BoE, who have hundreds of people working on these models and collecting data for them, might have a better understanding of what is really happening than you?

You haven’t collected any data, haven’t done any research and as far as I can see all you have done is criticise the BoE without actually having any numbers of your own.

Then you are arrogant enough to claim that what you have done is superior to their work.

Why don’t you do a comparable piece of work containing your own estimates for some of the data they provide (just the important ones like GDP, unemployment rate and CPI maybe) and show us the workings of how you got to them. Then we can compare the two and see who is more accurate over time.

It’s easy to take a swipe at someone, but much harder to actually do the work yourself – which you haven’t done.

However much work you do, if you make the wrong assumptions you will get it wrong

And I am suggesting that’s what they’re doing

If you don’t understand that about economics then your suggestions really do count for nothing

Right. If your assumptions are wrong you will get the wrong answer – and nobody expects that every assumption will turn out exactly as predicted.

But that’s not really the point, is it?

They have gone to huge amount of trouble to get the best understanding of the underlying data available. They then use this as their base case set of assumptions.

Yet you say they are going to be wildly wrong, and you could do better. So what are your assumptions, what data have you gathered, and couldn’t those also be wrong to an even greater extent?

It’s easy to throw stones from the sidelines, especially when it comes to forecasting, but unless you are willing to provide your own predictions then throwing stones is all you are doing. You don’t have any value to add or really any sort of leg to stand on.

So go on – give us a set of your own predictions and show us how you got to them. Then we can compare them side by side, in a transparent and fair manner.

Oh dear

You don’t realise assumptions come before data

If you don’t get your assumptions right you never collect the right data

And as for your request for my workings – it appears you have not noticed I have already provided them, with all assumptions stated

You are wasting my time

And then there’s #Brexit. (Sigh!(

This seems to me that this BoE report is about containing panic and nothing else.

Well if you believe economies easily self-equilibrate (even if you can’t prove why) you’re always going to have a rosy delusional view of the world aren’t you and I haven’t even got to Hyman Minsky!

I stood in Oxford Street last week. Where were the people? Not a very scientific analysis, but. Collected a friend from Edinburgh airport at the weekend. Where were the people? Not a very scientific analysis, but.

I keep asking the same thing

I caught the Victoria line from oxford street to Euston, Monday morning – no people. That’s when it hit me. This situation has never occurred in my 48 years before. To sit on the tube at 10:30 on a Monday morning alone in central London. If one freak day occurred like that in a whole year I’d think to myself, that’s an awful lot of lost revenue – that continued for 12 weeks. Now their is a slow trickle. We’ve never seen anything like this. Not even during WW2. Surely ‘back to the old ways’ just won’t be possible.

I refrain from my predictions of a new dark ages because I know it upsets Richard 😉

Btw, are you really 62? You don’t look it!

I think we are in for a different age

And this is one of many reasons why I do not believe the BoE forecasts

And yes, I am 62.

I live in the North West and there is a lot of people going around, kids outside playing. Neighbours visiting each other and lots of traffic on the road. Compared to the lockdown it is like a normal. Ther is supposed to be a lockdown, looks like people are ignoring it.

The OBR exists solely to assert the economic status quo, and no matter what happens, the ‘new normal’ will in fact always be the old normal. Any data which conflicts with this view is disregarded, suppressed, or otherwise ignored.

The OBR is an organ, which plays economic mood music, to soothe the anxiety of those who have not only never had it so good, but always had it so good. The thought that this state of affairs is no longer sustainable, is to those so well treated by the prevailing political and economic order, akin to the end of civilisation itself.

Didn’t you predict that Covid-19 deaths would be running at over 10,000 a day a couple of months back?

What does that say about your forcasting skills?

I have already replied to this point

I remember one prediction you made..

“deaths of more than 10,000 a day are likely in little more than a week”

That was off the mark

Lockdown then happened

Unemployment need not be as high as I forecast if action is taken

Context matters

“Lockdown then happened”

The UK lockdown was imposed on 23rd March.

You made your “10,000 deaths a day within a week” claim on April 2nd.

Have the grace and humility to admit your were completely and utterly wrong with your prediction.

So, lock down worked better than the epidemioligists I was talking to expected? No one, including the government expected such compliance. I was wrong on that. Thank goodness. That does not make any point of note, except to prove as I am suggesting on unemployment that drastic government intervention is required. I am not apologising for suggesting that

Richard, that isn’t true. Lock down started on March 16th. You then predicted on April 2nd that there would be 10,000 deaths a day. Why not just admit the mistake, reflect on why you made it, learn the lesson, and move on?

Lock down did not start on 16 March

You seem the one with a data problem

People generally suppose that economic variables are smoothly continuous functions (of time.) And they imagine economies in terms of simple images like a piece of elastic, a hibernating animal, a car engine etc

But if simple images are to be invoked, how about a spinning top? When it stops spinning it undergoes an irreversible, discontinuous state change.

The Government have already asked pharmacists and pharmaceutical companies to increase stockpiles of drugs in advance of December 31 to avoid the risk of shortages. An assumption of likely outcomes?

The BoE are basing the report on the assumption there will be a smooth Brexit transition.

They are also assuming no second wave of Covid. I am not sure when the number of multiple local outbreaks can be classified as a second wave. But, if they happen to be London, Birmingham, Manchester, Leeds, Middlesborough etc that effectively would be equivalent to a second wave regardless of the label attached.

To me it all seems to be whistling in the dark. The maxim ‘Fail to plan and you are planning to fail’ seems apt. That is precisely what happened with Covid and resulted in at least 20,000 excess (and often unreported) deaths.

To base a report on selective data and not temper it with an honest assessment of the Government’s misguided assumptions since 2010 seems to render the report as you say optimistic? I would add negligently so.

Unimpressed by pharmacists and pharmaceutical companies, I’m stocking up with meds myself. So, I imagine, will many others, leading to shortages probably well before the end of the transition period. Which reminds me, Losartan…

I am no economist, BUT the idea that we will shortly be back to ‘Business as usual’ seems at best highly optimistic, major job loses are clearly in the offing.

What happened to the holiday……….? Sometimes a complete break is refreshing…….fewer typos (!)…………..? I plan to spend more time on the golf course with what is left of the summer.

I watched the Governor of the BofE last night interviewed on C4 News; spinning technical gobblydegook about primary markets and interest rate control, as if it was more than mere mechanics; anything to avoid reality, and, it appeared to me calculatedly to ‘make smoke’. The expression on his face at the end of the interview was extraordinary, half Restoration comedy, half Jacobean tragey.

I had not recovered from that depressing experience (I actually began to feel that central bank independence is actually a euphemism for a licence to be political, as long as it is neoliberalism). Then I listened to Rishi Sunak takling guff on BBC Radio Scotland GMS in an interview this morning. He tried to misunderstand, with transparent implausibility, what the Scottish Government was asking for (more headroom to borrow, to tackle the economic crisis direct in Scotland), by saying that it was being considered for attention, and may lead to some kind of fruition, next year. Perfect timing for a panademic and economic depression now, then.

This is what passes for Government in Britain today. They have learned nothing from the last eighty years. Nothing. Everywhere you turn in British politics you find that anyone near financial power is part of the generation who learned their banking in the period 1990-2015, from the inside; the generation that destroyed the financial system; the snake-oil salesmen are the ones who are in charge of the system they destroyed. They are experts only in austerity and destroying the lives of almost everyone. They are, fatuously still represented as the ony ‘experts’ who understand financial prudence.

This assumption, this credence is a matter of public self-harm, on a national scale, and, frankly one of jaw-dropping public stupidity. These are the very people who should, as a cohort, be out-of-a-job; and forced to live on their assets; it isn’t as if they do not have any. None of them will ever need a foodbank. This generation of bankers should by by-passed for public office in the interests of the self-preserving, common good. They are the lost generation. We need to lose them now.

I promise you, many miles of walking, and a great deal of very industrial archeology debate, took place yesterday

And I will be taking more time off during the month, having taken none so far this year

As for the rest; you are depressingly right

When I was 20, ‘mathematical modeling’ was, even if it dated from the late 19th Century, rather rare (outside, maybe, of the hopeless weather ‘forecasting’ of the day) but the concept of GIGO did and was quite well established. Weather forecasting is not bad now, but mathematical models for the economy (or Covid) are useless (arguably worse than useless). What still works, at least in some cases (including Richard) is the use of our between ear computing power, although GIGO still applies.

I may do a post on this…. Soon

Well said Mr O’Connell. I couldn’t agree more. I remain perplexed by the fact that so few are prepared to ‘go there’.

And apparently the governor supports the government ending furlough.