If the debt fetishists were to be believed the additional supposed borrowing that the government is going to take on to pay for the coronavirus crisis will burden us forever, and leave the government crippled with an unaffordable debt mountain.

That's not true. I have noted the impact of quantitative easing on this issue already, using data from today's Office for Budget Responsibility report, which is manna for those fetishists. And yet, within it are the true stories, which I have already been noting, here, and here.

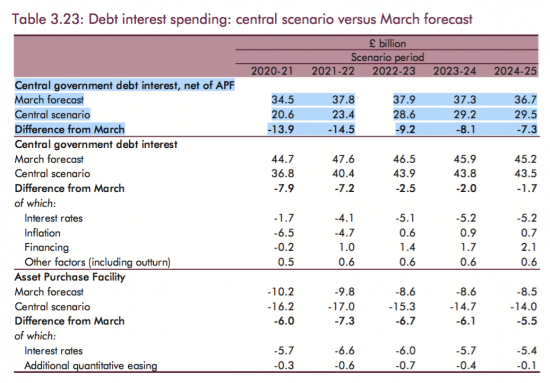

Now let's look at another aspect of this report which the debt fetishists who want to slash government spending will not be highlighting. It's this:

The critical data is highlighted in blue. This is the true cost to the government of borrowing after the cost of debt canceled by QE is taken into consideration.

As is apparent, for every one of the next five years the cost of borrowing has been reduced by the coronavirus crisis despite the fact that in every one of the next five years a deficit of more than £100 billion is forecast.

The rest of the table explains why. Much is due to quantitative easing cancelling debt costs. Some is due to falling rates. But the fact is that interest rate costs to the government over this period despite not less than £800 billion of additional debt being forecast will fall.

In other words, this debt is not imposing any real cost on us at all. In fact, the costs of debt are falling.

So why is anyone obsessing about it? Could it be that the real issue is that the debt fetishists comply don't want the government to spend and that's their real agenda, after all?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“Could it be that the real issue is that the debt fetishists comply don’t want the government to spend and that’s their real agenda, after all?”

Government intentionally underfunding public services means some people are unable to fulfil their potential because the education made available to them is inadequate, life expectancies are reduced because the NHS is starved of resources, affordable, securely tenured housing is unavailable, renewable energy infrastructure is neglected degrading the environment, and people are exploited by inadequately regulated companies.

I think that they just want to starve us of cash so that it can be lent to us or privately invested in order to make a return by the private sector.

If certain services fail, they have simply manufactured consent to privatise.

Also, if you have people funding you who are betting on the economy going under, you don’t want to hand out any cash and lessen the chances of them making a killing on the back of economic disruption.

Mind you – there is the other view that the fetishists genuinely believe that there is a problem. There is frankly no excuse for such ignorance.

Surely MPs get a bloody induction when they enter Parliament? As a student I worked in a petrol filling station in Lewisham when Glenda Jackson (recently joined Labour as an MP) turned up one night and bought some smokeless fuel. I offered to take the sack of fuel and put it in her boot (which I did) and as I did so she moved a wad of induction notes for new MPs.

The biggest endowment we could make in this country at the moment is proper training and awareness of the tools of the State for MPs and voters.

Have we given due consideration to the possibility that the debt fetishists (inc this government) are, put simply and very crassly, monumentally fucking stupid?

Occum’s Razor and all that.

Apparently Dominic Cummings thinks the same PSR. There was a programme on R4 yesterday morning elaborating on the changes he wants to make to the ways MPs are inducted and then to ongoing ‘training’ through the course of their ‘careers’ as MPs. I thought the idea was a good one and then I thought ‘hmm, Dom Cummings leading the charge. What could possibly go wrong with that?!!’

Does the text of the OBR report address/explain the point you’ve raised?

In the area you’ve highlighted in blue, the Central scenario figures are less by a total of £53bn compared to the March forecast over the 5 years, i.e. 29% less. I assume that’s the reduction in interest you refer to.

A bit more than half of that (£31.6bn) is explained by the Differences in the Asset Purchase Facility. Is there an explanation of this, given that the APF is a fraction of the total debt?

I am not sure I follow George – the table shows each year has less interest cost due to lower inflation (and so lower rates) and lower base rates plus a major increase in the APF

Apologies for lack of clarity Richard, I think I’ve got there (very roughly).

I wasn’t up to speed on how big the APF is now. If the APF is £650bn, Government Debt is £1,95tn, then “Debt net of APF” is £1.3tn (ONS latest I think).

Hence the APF is about half the size of the “Debt net of APF”.

So the answer to my query – “Is there an explanation of this, given that the APF is a fraction of the total debt?” – is obvious. That fraction is about 1/2.

So it’s unsurprising that (totalled over the 5 years) the change in APF forecast from March (£31.6bn) is not far off 1/2 the size of the change forecast in “Debt net of APF” (£53bn).

In my last sentence the word *interest* should appear!