Polly Toynbee wrote this in The Guardian yesterday, referring to the need for funding to beat our economic crisis:

But what if, with one bound, we could be free? Extraordinary times need astonishing remedies. In this very rich country, private wealth has soared to six times the value of annual GDP. So take a deep breath and jump in. A once-in-a-lifetime windfall tax of 10% on all wealth would yield £1 trillion — enough to pay for all the things we regard as essential for civilisation.

Polly was referring to the proposal for a wealth tax from Arun Advani and Andy Summer that I mentioned here last week. But it's simply wrong to think that there is the potential fir £1 trillion of tax in any such proposal and the sooner the left realise this the better.

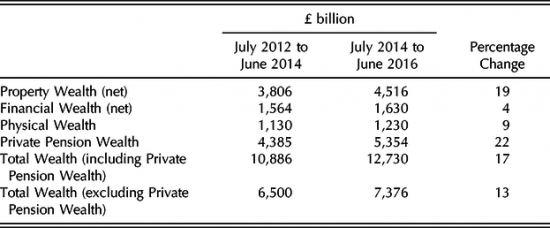

I repeat here the data I posted last week on UK wealth:

The source is ONS wealth surveys.

The key point is a simple one. As I have noted before, most property wealth is homes. That which is not is largely lived in. And it is unlikely that we want people evicted to pay a wealth tax.

Pensions are tax incentivised and so will be hard to tax.

£700 billion of net financial wealth is ISAs and so tax incentivised, and so again, hard to tax.

Physical wealth is as much cars and furniture as anything else - and is very hard to value as a tax base.

So, we are down to £900bn of tax base. That does not permit a £1 trillion tax charge.

There are other reasons why we also do not need a tax of that scale.

First, if £1 trillion of money is required by the economy the government can create it. Polly Toynbee refers to the inflation risk of this, but there is none. We are going to have millions of unemployed. Stagflation is no longer a risk. And QE and central bank reserve balances now let governments control rates in ways that were never possible before.

Second, bizarrely, taking £1 trillion of cash from the economy that the government does not need will reduce UK M4 money supply by that amount, from about £2.6 trillion where it is now, to about £1.6 trillion. And there is, of course, no guarantee that the money will recycle back into the economy: indeed, there would be no capacity for it to do so for some considerable time. So we would simply create a credit crisis by demanding a wealth tax of this level. That would be disastrous.

And at the same time we would create another crisis, because not everyone who had to pay would have cash so they would have to sell to pay. That would force an asset price crisis and probably a banking crisis as well.

And third, so what? The so-called national debt is costing historically low sums that do not threaten our well being but does make spending possible. There simply is no issue with rising national debt right now. All that it represents is the savings glut that is growing.

Do we need to tax wealth more? Yes, of course we do. But let's do what's logical, which is to increase the tax on the income and gains from wealth first. I suggest how here. But let's not talk about crashing the economy to repay the national debt when we simply don't need to do that. Of all the crises that we face, this is one we can avoid, so let's do so.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

An excellent technical point and I hope that Polly pops by and has a read.

Incidentally, I had a review of Stephanie Kelton’s book ‘The Deficit Myth’ refused by Amazon the other day and instead of telling me exactly why all I got was chapter and verse of their ‘policy’. Other than extolling people of the virtues of buying the book for as many other people as you can, I wrote politely and referenced this blog too.

Needless to say, I will resubmit.

Weird….

Don’t include links, email addresses or any html formatting. Amazon don’t like that, certainly when we are listing any of our products or dealing with customers through the Amazon system. You have to be really creative if you are trying to give somebody your email address, for example. Basically anything that might send somebody outside Amazon or allow contact without going through Amazon is not allowed.

Toynbee has no understanding of how the national economy works at all. I have sent her various materials on MMT by eg. Stephanie Kelton and seemingly no result. She seems insulated against learning anything about the subject. Even though doing so would make her column a more effective critique. She seems to be a hopeless case.

I agree, Richard! The trillion was just a “what if” and will not, of course, be among the options that this project will come up with by December. But it just illustrates the magnitude of wealth available. Gus O’Donnell is strongly backing a wealth tax, and I imagine it will be along the lines you propose.

But there is a risk in delay: now is the time it might be most politically acceptable, when people can see the extra emergency spending needed, on this “burning platform”. . Also delays gives time to the mega-rich to scuttle their wealth away. It would have to be announced and legislation passed, taking time, but should cover all wealth backdated to the day of the announcement. VAT is an unjust tax, and ever more shifting to taxing work not wealth is unfair, and generationally, it’s mainly the old who hold wealth. All these are good reasons to announce it now – even if implementation is after the peak of this recession.

Polly

Rumour reaches me from reliable sources that GOD may not have been quite as keen as reported

I agree taxes on wealth are good

But if we need to tackle inequality – which we do0, and which is the reason for this tax – we can do it better by:

– aligning income tax and cut rates

– introducing an investment income surcharge

– giving all tax reliefs at basic rate only

– applying NIC across all income brackets

Etc etc

These would also be symbolic and so much more effective

That is why I have real doubts

And we also have to get the reasoning right – to tackle inequality and not to raise revenue. Overall we Do not need tax increases now – because they will simply add to the number unemployed

Best

Richard

If addressing inequality is a key part of changes to the tax system then I’d have thought that inheritance tax would be the place to start. Passing wealth down through the generations largely untouched, at least for the mega wealthy, is surely the most unequal issue regarding inequality. Maybe in the next life?

Polly

It is very nice of you to stop by, but do you think that you could have a word with Ms Viner and get a couple of big articles raising the issue of MMT – a couple of centre-page spread perhaps – thanks.

A Guardian Reader.

Richard your logic is spot on, Polly your thoughts are irrational dogma..

Regarding property wealth, what about just a principal private residence relief against wealth taxes on property that owners live in, with a wealth tax on the rest?

Even a 1% a year wealth tax say on a total property portfolio valued at over £1M for example, a landlord would have to own 100 properties before needing to sell 1 to cover the taxes. This should mean almost no one would be getting evicted due to the wealth tax plus investment properties can be sold without a tenant even needing to move anyway.

But 1% of what?

As I point out, once pensions and private property plus ISAs are removed and personal prop-try is nigh on impossible to value what’s left?

1% might yield £10bn or so

Removing that tax relief on higher rate tax payers for pensions might yield as much

So? Why not do pension reform?

I have no problem with pension reform.

I think a wealth tax on investment properties would bring other societal benefits rather than just the tax yield. Like reducing the incentive for ownership of properties slightly by commercial landlords while a de minimus would mean smaller landlords don’t have to be affected. And it would help to reduce house prices slightly.

I am really quite surprised to see Richard arguing so vehemently arguing against taxation of pensions, ISAs and real estate.

Is that simply pragmatic, because it would be controversial and difficult to implement, and because there are a quicker, easier things to do first? Or do you have a more fundamental objection to getting there in due course?

Plucking ideas out of the air: for pensions and ISAs, you could add a levy (say 1%, or 0.5%, or whatever) to the annual management charge. Get the fund providers to do the valuation and collect it for you. 1% of £5 trillion is £50 billion per year. Not as much as income tax or VAT, but about the same as corporation tax.

For real estate, we need to reform council tax and business rates anyway. There will be winners and losers, but it needs to be done. A 1% land tax might be about right, self-assessed based on indexation of a valuation no more than 5 years old, so a boom to surveyors and valuers. Another £50 billion or so.

Why not?

I am being pragmatic but for good reason

First I want to reduce inequality quickly – and that suggests taxing income from wealth

Secondly, this will also gave greatest impact because lots of evidence suggests the wealthy are desperate to preserve their wealth – it is how they define themselves

So cut their income and force tighter budgets and they don’t dis-save. Instead they cut spending in the end and the harmful social manifestations of wealth are also cut quickest that way

There are two things I don’t bother to read in the Guardian – one is sport in which I have little interest since being excluded from the primary school break time football team at about the age of seven, the second is Polly Toynbee. I did accidentally read a piece by her once or twice, but now manage to avoid them.

Yes, I am bitter and twisted!

I am however enjoying The Deficit Myth and describe the book as sexy to anyone who will listen…. I have found it highly readable and comprehensible.

I absolutely get the ‘Job Guarantee’ idea as an elegant solution – also, it is something that can appeal to both left and right (but don’t tell either side that the others might like it..)

Regarding higher property taxes, scrapping IHT and enacting a roll up and deferment acts as a voluntary IHT to those that don’t want to move/downsize.

Banking crashes come from people not being able to service their debts, not lower asset prices per se. It does not therefore follow that all things that cause lower HP’s also cause a banking crash. IMHO.

Economic growth comes from cost reduction/better resource allocation. So the big picture is not how much we tax, but what we choose to tax.

50% of UK wealth is land, which having no human input, merely represents the capitalised transfer of net incomes between groups in society. Typically between the young/poor to the elderly/rich.

This can and should be taxed away entirely which would benefit society and its economy, the growth from which would be the best way to pay down our increasing debt.

Not only does such a tax allow for the reduction in growth shrinking taxes on output, it allows for optimal market allocation of existing stock, negating the need to wastefully build the numbers/type currently projected.

By ending that net transfer, excessive regional, intergenerational, income inequalities are reduced, solving issues like housing affordabilty instantly and permanently.

I concede the politics is hard, but the gains are great. And if not now, when?

50% of UK wealth is not land

Land is much less than that

Buildings are not land

LVT is not an answer to many questions, barring how to replace council tax, and for that limited role alone

https://www.ons.gov.uk/economy/nationalaccounts/uksectoraccounts/bulletins/nationalbalancesheet/2018

“The UK’s land is valued at 51% of net worth in 2016”. Net worth is how I define wealth, perhaps I’ve got this wrong?

Poor tax choices shrink the economy by at least 20% GDP. So whatever questions LVT doesn’t answer, the ability to substantially relieve the economy of deadweight costs is an answer that the UK needs now more than ever.

Different massages….

I am using data net of liabilities

Why not get rid of SDLT (mostly paid by the young) and introduce CGT on main homes? Many people (mostly the older generation) have got rich because their home (now an asset) has gone up in price without them doing anything. Why should people pay SDLT out of their earned income when no tax is payable on unearned profits from asset price rises on homes. CGT is payable on shares and other investment income. It should be introduce on main homes too and would only be paid on the profit.

A good point

And fair

I would have CGT ion cumulative gains on houses on death or last sale

A good point

And fair

I would have CGT on cumulative gains on houses on death or last sale

Yes to wealth tax but it will still leave many with more than their fair share. We need to stop people getting so wealthy in the first place.

Accepted

‘We need to stop people getting so wealthy in the first place.’

Damn right, you knock all the ambition to succeed out of people and if they disagree, off to the gulag.

You really should take some time out of the Maniac echo chamber and speak to real people, the kind of people of course that progressives such as yourself truly despise.

I have been an entrepreneur

I have known many others

I know you are wrong

Why should a measure of success be the amount of wealth that you accrue? Many people work hard even doing two or three jobs, but because of a plethora of ‘schemes’ such as zero hours contracts and a ‘living wage’, have to rely on the regressive benefits system as they are denied an appropriate reward for the work done and thus live in poverty and have little or no chance to better themselves. Meanwhile others, having already amassed enough to live on for the rest of their lives are able to profit from the endeavours and efforts of those, who are paid so little, to have even more.

This is not the politics of envy but, as the current pandemic quite clearly demonstrates, those we rely on so much are paid so little.

I don’t think that stopping people from hoarding billions is going to knock the ambition out of most entrepreneurs…

Agreed

So quite a lot of ideas here!

For me it would be helpful to have some kind of dynamic modelling system to try to work out which of any approaches and combinations of approaches would result in what outcomes.

In the COVID modelling it seems that the main method has been to extrapolate the observed trend and show what happens if nothing changes. Some alternate groups have instead used a dynamic system that incorporates likely behavioural changes into their forecasts. e.g. it was observed that infection rates were falling before the lockdown commenced and some questioned the lockdown. The answer was probably found in people like us getting our vulnerable relatives and friends to isolate a couple of weeks or so before BoJo finally got round to ordering the lockdown. The alternate groups modelled these type of changes and suggested that hospitals may not be overwhelmed. They argue that their methods have been more accurate and useful than the official ones.

In a like manner, if we had a dynamic modelling system it might be easier to identify better the likely outcomes of various economic policies.

Does one exist?

The Treasury has one

It’s fair to say it does not work because it assumes that everything returns to the mean within two years, whatever is planned

GIGO in and out then

Yes, my point entirely, I suppose.

Maybe some numbers and software folk might have an idea of how to build one – it’s well beyond my spreadsheet capability!.

But maybe not as hard as it might seem – as we know that if you e.g. tax X, Y tends to occur and then X follows that, and, given that most people in power don’t understand MMT, the Treasury forecasters are unlikely to factor in the correct outcomes.

Job for the weekend…