A report by Micahel Kapoor of Bloomberg, published yesterday suggests:

The major U.K. accounting firms could struggle to weather the impact of the pandemic or a big legal claim because they distribute most of their profits to their partners, leaving little money in reserve.

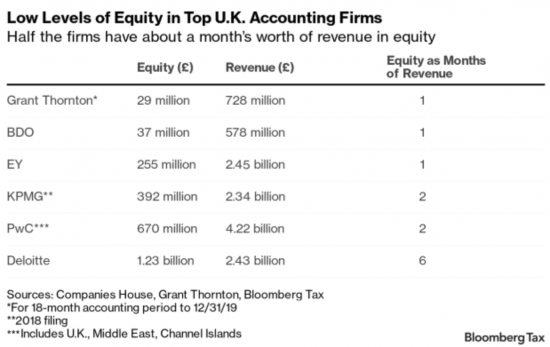

Accounts filed by the U.K. arms of the six biggest firms–the Big Four, BDO LLP and Grant Thornton LLP–show very low levels of equity, in some cases less than a month's revenue.

They published this table:

And as they note:

“These are hollowed-out firms,” Richard Murphy, an economics professor at City University and a co-founder of the international group Tax Justice Network, said.

They also note:

Murphy added that reserves were so low that some of the firms could also struggle to meet expenses from the coronavirus lockdown: EY's U.K. revenue was 2.5 billion pounds in 2019, for example, meaning that its 255 million pounds of equity translates into little more than a month's turnover.

“The Big Four have already announced some cuts and the next stage will be layoffs,” Murphy said. “Look at the challenger firms, and they have very little in reserve to cover this sort of event.”

These firms have stripped themselves of money in the pursuit of the goal of owner wealth maximisation. Can they survive? That's a very good question. But have no doubt that whatever happens they face some considerable stress if they are going to do so and I now know of large accounting firms laying even quite senior people off as they come to terms with a new world where there might be less corporate excess.

Accounting needs reform right now.

So too do the accountants.

And only if both happen will really get the corporate reform that we need.

We live in interesting times, as the saying goes.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I was shocked to read about the behaviour of EY’s leadership in the Rihan case – https://www.bailii.org/ew/cases/EWHC/QB/2020/901.html – involving the audit of UAE client that was smuggling gold bars out of Morocco coated in silver to avoiding export restrictions, and doing US$5.2 billion of cash transactions in 2012 (40 per cent of its transactions by value – including transactions involving Sudan, DRC and Iran) without proper KYC.

Perfectly normal to do multiple-million pound/euro/dollar transactions *in cash* isn’t it. (That amount of cash occupies a substantial volume: suitcases, boxes.)

I will commenting on Wirecard very soon

As an alumni of a couple of the major UK accountancy firms (and one mid-tier listed firm which, sadly, went bust in 2013) , I think they will survive. There is too much work out there which can be done by no-one else. They have a good going oligopoly and even if some short term pain is required, there are insufficient other players with the skills or appetite to step up and audit the FTSE100 (for example). In extremis, a failing Big4 firm would be saved in some form.

The ‘hollowed out’ model is one which has resulted in the insolvency of many legal firms here in Scotland but it tends to be a slow death spiral which finishes them off rather than a catastrophic event. Profits fall; partners’ drawings are reduced; infighting results between the most profitable and the less profitable service lines; best partners leave for better money and/ or a more harmonious partnership; and the remainder struggle on until the ‘whole’ become unsustainable.

The problem of course is the headline figures of average partners’ profit share. When a huge figure for ‘average’ partner earnings is published and staff cuts are announced to maintain that kind of figure, their is little sympathy among the public or in the staff canteen. There is competition for the best talent and some of that talent is not particularly loyal to any particular firm.

Having said that, some of the big firms have already show a willingness to cull partners on a regular basis in order to boost the earnings of remainder. One only needs to see the number of audit reports (outside the listed sector) being signed by a Director rather than a partner as Responsible Individual. I suspect that this is a trend that will continue.

The future is going to be challenging, particularly outside London. However, partners will not be turkeys voting for Christmas. If all of the big firms are facing similar challenges and as a result of economic circumstances (rather than any collusion) require to cut drawings by similar percentages at similar times, then I can’t see the exodus of key talent happening which would precipitate the death spiral.

Thanks

Who’d have thought a global pandemic could have a silver lining.

Was the ‘don’t count on it’ meant to be funny?

Yes

I agree with you,it’s high time accounting reformed for the better.

I think you have used the wrong numbers. Not great journalism. Deloitte’s equity is actually negative -£1.2bn. KPMG’s reserves are actually £51m, GT’s -£35m and BDO £4k. I don’t think you are reading the accounts properly.

I used Bloomberg’s data

I did not do the research

What really need reform is the LLP SORP – the standard under which UK accounts are prepared. Most partners’ equity is currently classified as liabilities rather than capital, based on the legal terms on which it can be withdrawn (at or before retirement).

These are not the real ‘net assets’ figures otherwise Deloitte and GT would be technically insolvent.

They may be

Just had a look at the Deloitte 2019 accounts out of curiosity and I suspect you are right. The negative balance sheet derives from the recognition of £1.5bn of annuities due to current and former partners. These are long term and profit dependent (hence no going concern qualification) but they are liabilities.

I would be interested to know how these would rank in an insolvency scenario against trade creditors or successful litigants.

Strong words. On a balance sheet test, or a cashflow test, or both?

To pick an example, the May 2019 balance sheet of Deloitte LLP (at https://beta.companieshouse.gov.uk/company/OC303675/filing-history ) says

* Non-current assets £392 million

* Current assets £1,578 million

* Total assets £1,970 million

* Current liabilities £1,294 million

* Non-current liabilities £1,908 million

* Total liabilities £3,202 million

* Net liabilities attributable to members (£1,232 million)

That last number appears to be the one that Bloomberg has taken as “equity”, although it seems to leave out about £136m classified in the accounts as “members capital”.

Balance sheet test only of course (hence my use of the work ‘technically’, which may have lacked clarity). The firm will be required to demonstrate an ability to meet their liabilities as they fall due (a cash flow test) to their auditors on annual basis otherwise there would be a very prominent qualification of the audit report.

Looks like the house of cards is starting to tumble & maybe collapse.

Believe I suggested this would occur a little while ago…

Might see the rise of a new government department though as all these highly skilled & well-connected persons couldn’t possibly be thrown into destitution.

All accounts & audits in the future potentially to be conducted by some sort of body similar in nature to the structures of Companies House or the IPO.

Let it be named… HM Accounting & Auditing.

Would share a hot-line with HMRC – Companies House & the Serious Fraud Office (SFO).

Consequently watch fraud, tax evasion & financial irregularities across ALL business sectors plummet.

Watch & be astounded as tax receipts sky-rocket by hundreds of % & Britain becomes the envy of the world for sound financial practices.

If the Government are looking for an easy solution to recoup £…this is the way forward.

Whether or not that will translate into increased spending that benefits ALL the citizenry within the UK EQUALLY is another diatribe entirely!

Prem Sikka has long called for this

I prefer National Auditing & Accounting though…..

I’ve had enough of royal prerogatives

Good point.

I am absolutely certain feudalism ended centuries ago; we wouldn’t want to extend any outdated notions of fiefdoms or serfdom !

National does sound a bit more neutral on reflection.

Also, it might be useful in the present climate for the UK national budget if we start freezing & seizing funds of all suspect entities held in British Overseas Territories.

Anyone who has a leg to stand on can always pay a 25% release fee.

There’s a price for benefiting from Britain protecting their wealth at no charge for all these years.

Might free up a few trillion for the next budget & silence all this nonsense about the ‘national debt’.

Everybody at the future NAA I’m sure would do a sterling job (pun intended) of determining with certainty which were the ‘suspect’ entities.

How much would they pay their senior auditors???

The going rate