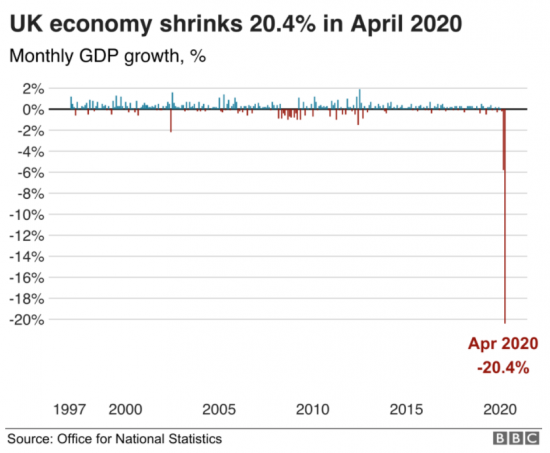

The scale of this crisis is unprecedented. The downturn in economic activity in April was 20.4% according to the Office for National Statistics:

Of course this is likely to be temporary. As a matter of fact, pandemics do always end, if not well. There will, then, be an eventual recovery from this position. But, to pretend that this will be any time soon is naive, in the extreme. As I have said since mid-March, and long before the government did, the economic costs of this pandemic are going to be substantial, and long-term.

That is because the above noted chart does not show the loss of capital in vast numbers of small businesses, in particular, in the UK. Their chances of successfully reopening at their previous scale when the pandemic is over are, in many cases exceptionally limited. That is firstly because of the haemorrhaging of cash that has happened within them during the course of the pandemic despite government assistance. And secondly it is because of the additional costs imposed upon them when they do try to reopen as a result of social distancing and other measures.

In that case we are not going to get a V-shaped recovery, with a quick bounceback. We are, instead, going to see a fundamental change in the level of economic activity for some time to come. That is precisely why I do think radical thinking, including a Green New Deal and the processes of change implicit within it, is necessary now. It is why I also think we need to radically rethink our relationship with what is supposedly called government debt, which is why I have issued a myth buster on that issue this morning.

And yet many on the left seem to have no understanding on this. For them affordability is constrained. And debt repayment remains paramount. One of the reasons why I felt down in the last week was the consequence of exchanges with supposed progressive economists a week or so ago.

They were vehemently anti-MMT. This now appears to be a necessary sign of virility or acceptability in the left of centre think tank world. John Weeks appeared quite without shame in calling MMT a cult on Twitter yesterday.

The economists in question suggested that the public were right to be worried about debt, and that the goal should be to constrain it. There were issues of ‘sound finance' involved, one said. Another described the ‘moral dimension‘ to debt and suggested it a sign of failure. These narratives play straight into the hands of the right. It is as if they wished for austerity.

My belief that their comprehension of what debt really is, what it does, what its benefits are, and what it can do to deliver the economic transformation we require are exceptionally limited. But, I stress, these are people from the left, and I see the same attitudes in just about every left of centre think tank right now.

For example, the chief economist of one argued with me for some time very recently that 'we must repay the debt'. Nothing I could say persuaded them otherwise.

I noted the chief economist of another left of centre think tank liking the deeply anti-MMT comments by Jo Michell and John Weeks in my profoundly worrying Twitter exchanges with them yesterday, where their interest in Keynesian point scoring clearly outweighed any interest in addressing issues. Their anti-MMT comments were also liked by James Meadway, so recently of Labour, and supposedly deeply embedded in left of centre thinking at Novara Media.

Not to put too fine a point on it, we're in the biggest economic crisis of a lifetime, and maybe even centuries, and what the economists on the left want to do right now is talk about how we repay debt, or how they've always known tax does not fund all government spending but that makes no difference to policy, or to argue whether money is endogenous or exogenous, rather than discuss how the ability of government to create money without also creating inflation might solve the crisis we're in and save millions of jobs.

I frequently portray the right as our problem, and there is good reason for that. But candidly, the impoverished, and debt obsessed thinking of much of the supposed left is at least as problematic now.

I know they'll say they're Keynesians. But so deep is their paranoia about debt that their language alone will constrain possibility, whilst their desire to limit debt will result in a demand for deeply destructive tax increases that will suck the life out of a recovering economy.

Many who comment on this site despair of Labour. The people I talk to are the people Labour listen to on economics. And they almost all think debt is the big issue to worry about. I am struggling to think of a UK left of centre think tank where the anti-MMT view is not strong right now, and where the desire for debt curtailment / repayment is not an issue for their economics team. And that may be an even bigger problem than the right at present.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Having read John Weeks’s book The Debt Delusion earlier in the year I am surprised to hear that he is attacking MMT. He talks about the difference between a household/business and a government “living within its means” by focussing on the different means they have open to them. So how does he get from there to become anti MMT? Am I missing something?

Look at this https://twitter.com/johnweeks41

It’s pretty hideous and just wrong in most of the claims made

MMT is apparently a cult

I think his attitude to Stephanie Kelton misogynistic, to be honest

I am extremely disappointed in Mr Weeks.

I still like his book, it makes many excellent points and gets you thinking but I suspect upon reflection it accepts the Neo-liberal framing too much.

But even then it makes some some valid points in terms of how taxation works (if you accept that framing) that I have not heard of before , points that contradict Neo-liberal theory and makes a nonsense of low taxation and tax cuts beloved of the Tories/Republicans, especially in the context of austerity.

The progressive stance will get nowhere if it cannot agree and have common ground. This is where the Neo-libs win – by sticking together. That is what makes me sad reading this post.

But these anti-MMT attitudes are widespread.

These lies, these deceits have been around for years. They will not go silently or quickly I’m afraid. And what is worse, many middle class, well educated and successful people hold them as true. It is not just an issue for the working class. The ignorance we are dealing with is universal, classless, without boundaries. Embedded. Ossified.

I have Ms Kelton’s book (your recommendation is on the back cover Professor) and it is looking at me as I type.

However, I also have the second part of Ian Sixsmith’s series on Stanier 8F locomotives with loads of beautifully reproduced B&W photographs and captions to read taken when this country was in many ways a better place to work (if not live). I think I might lose myself in that for a bit before getting into economics again.

I would do just that

It’s Friday

Mind you, I am reading on Keynes

Twitter is not a good platform for a discussion of ideas. Weeks however uses it to propose a very unsatisfactory one: “For me & most heterodox economists theory is abstracting from the complexities of the real world to focus on essential relationships.” (from the last few days).

I have no idea whether Professor Weeks is heterodox or orthodox, but for me he has just provided and excellent summary of why economics is currently in such a deeply unsatisfactory and unhappy state. Economics does indeed use a great deal of abstraction from the complexities of the world; and it uses econometrics to create ever more abstract and complex models. When he writes that it focuses on “essential relationships” it is certainly true that it focuses on abstracted relationships, but I have no idea what he means by “essential relationships”, because here is the problem: economics lacks a robust methodology to examine the fundamental phenomena of the real (economi)c world, and its use of statistics is neither robust or sophisticated enough to make up for the fact that economics is almost all theory, and has virtually no experimental fix on reality. It does not study reality. It creates extremely abstract models only tenuously and remotely related to reality.

The discipline of Economics uses models, in short, because it cannot test. It cannot test because it lacks, and has never discovered, a sound and precise empirical methodology. That is just a fact. It is a discipline replete with abstraction but it possesses weak empirical foundations. I would call it a social quasi-science. It has value in the world, but what it can do is, in consequence of its lack of experimentation – and compared with the ‘hard sciences’, and even other social sciences – essentially modest. Prediction is beyond it. It forecasts; and neoliberalism forecasts badly.

The problem is too many economists succumb to hubris.

Agreed

He claims heterodox

Actually, just an old school SOAS Marxist

I noticed he acknowledged the influence of Marx on Twitter. I have long felt that if you took large excerpts from “Capital” and asked Marxists to read them ‘blind’ (because ‘Capital’ is one of the great unread books, not least I suspect not read by Marxists); they would not believe Marx was a Marxist. Much of ‘Capital’ provides valuable analysis, but is not really ‘Marxist’, nor does it reveal a peculiarly Marxist methodology.

🙂

Now you have really depressed me as well. How can they be so totally indoctrinated? and unable to open their supposedly intelligent minds?

I wish I knew

But I promise you, it’s scaring me rigid…

I am also willing to take it on

I suspect i will get bruised on the way

That will not be the first time in life

A while back you were extolling the virtues of John Weeks and his book The Debt Delusion. On the strength of your recommendation I bought the book. I did not finish it because to my mind it was full of neoliberal framing of the problem. Now he disappoints you. By the way, if anyone wants a copy of The Debt Delusion they can find it in a charity shop in Dursley who have my permission to claim gift aid when they sell it.

There was sufficient in it to endorse, I felt

We have to find common grounds

Right now his behaviour is not endearing him to me

He knows it

That’s both depressing and shocking. Easy for me to say, I know, but why waste your time & energy arguing and debating with them? The house is ablaze and they’re warning the firemen not to use too much water. Not a perfect analogy but … FFS! How big an existential crisis does there have to be in order to get the requisite changes to prevent the next one? A worse pandemic? A 3rd world war? The collapse of the eco-system? One can understand how Marx reached his conclusion that capitalism will be undone by ‘internal contradictions that would manifest as ever-greater crises’. That was 150 years ago, since when socio-economic crises have increased exponentially.

“You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete.” (Buckminster Fuller)

Wise words John

I agree with you that, in practice, Government Debt does not have to be repaid. However, lenders be they banks or the electorate (tax payers) lending money to themselves need to *believe* that their money is safe, will return interest (preferably, at least above the rate of inflation). It is that *promise* on bank notes to ‘pay the bearer’ that needs to be believed – and that that currency will not be devalued. It is lack of confidence, flight from currencies, withdrawing of funds from rumoured failing banks, slowing or obstruction of cashflow.

Ultimately the voters decide who gets to implement their financial policies (and the Social policies that flow from them). You have to convince the Politicians with arguments they can relay to the electorate with confidence that the electorate will vote for them.

Johnson and Cummings know how to do it – tell the electorate what they want to hear in broad terms, get elected with a large majority, then do what you think best, spinning the detail to fit the broad narrative. Cameron and Osbourne tried and failed to repay debt with the dire consequences of ‘austerity’ on the way. Margaret Thatcher, with the help of North Sea oil, did repay some debt but had highest mortgage rates, highest unemployment and lowest value of the pound on the way – still she managed to spin it so the Cons still love her!

Un-savoury to pander to voters’ simplistic understanding of Economics but a means to a better end – and if you do no real harm and show an improvement in the majority of people’s lives before the next election you should get re-elected.

So, saying you will repay debt is necessary to convince the electorate – whether you really believe it is necessary is another thing. You wont get a chance to prove MMT unless you first get a sympathetic Government elected.

People don’t think this

They hold cash

It’s not repaid

They think this because they’ve been told it

And they don’t want repayment. They want the ability to exit. That is something fundamentally different: it’s a secondary market

And sometime events will evidence that

There are some links to voter attitudes below. Do you have other more specific or up-to-date links?

from 2018 https://www.survation.com/public-divided-on-austerity/ – indicates lack of understanding of Machro Economics.

from 2017 https://www.bsa.natcen.ac.uk/latest-report/british-social-attitudes-34/key-findings/a-backlash-against-austerity.aspx indicates support for tax and spend which the Labour Party were not able to take advantage of in subsequent elections. Why was that? Lack of credibility? Confusion with Brexit (which, in my opinion, comes back to attitudes to and ignorance of Economics).

People did not believe Corbyn could deliver

On the issue of MMT I have come to a simple conclusion: anyone who has a problem with it is actually not very bright. For me it comes down to something like the 1st law of thermodynamics or conservation of energy. It’s just a mathematical statement of how money works in an economy. The real beauty of MMT is that it moves the debate away from money onto what really limits our actions on this planet, I.e. resources. I would prefer to be shipwrecked on a desert island with some MMT economists because with them something would get done. If they were neoliberals half the people would be declared unemployed and forced to sit and do nothing while a few tried to build a live raft and one or two would be planning their luxury accommodation on the life raft.

There’s a heck of a lot of not very bright economists out there then

I’m coming to the conclusion that is probably true – and Steve Keen, for one, would agree! but some are just silo thinkers or careerists. I’m not at all sure though that learning economics teaches you to think. Mind you economists are not alone in being among those who know more and more about less and less and forget or ignore the big picture…

True

this point exactly. many years ago in my early 20’s i pondered why we couldn’t just……….do things.

back in the days before money, if a tribe discovered a nearby island with abundant food resource, they’d find the materials and labour to build a boat to go there and plunder it.

i’m making this up but you see my point – if the resources are there, they can be used to produce things which may lead to higher utility (in this case food for the tribe).

I was thinking – we have green tech. We have wind turbines. Why can’t we just build them and start harnessing free energy, what is the constraint?! We have people out of work, we have willing and idle labour, what is the problem? Why can’t we just get people to produce wind turbines (obviously after training etc.)

I couldn’t understand it. That was 10 years ago.

I stumbled across Josh Ryan Collins book; Where does money come from – that led me to MMT, and suddenly everything made sense. Bill mitchell frequently uses the term ‘a lens’ through which you can see better, and that’s exactly what MMT is.

To me it’s completely intuitive – credit creation is simply a claim on resources to produce things. The money created is an income for that productive capacity…which in turn generates demand for other goods and services. its as simple as following the money trail. Hell, it’s even laid out there in the national accounts where government spending is a component! Which you learn in 1st year Macro.

i think someone needs to make some kind of animated cartoon that people can follow.

I watched an animation about economic rent and land value. It’s simplistic but takes the viewer through the basic concept of land value from t=0!

https://youtu.be/vyRAhoci5LY

i bought the MMT textbook recently which is a good start, and Mitchell has started an ‘MMTed’ website with Q&A which are on youtube, though his delivery is so damn dry. I think there needs to be some kind of ‘evidence repository’, or an MMT wiki, where *all* of the ‘anti MMTers’ writings are published with comments dealing with the misrepresentations, as well as a section which collates all the evidence built up supporting MMT.

You just need time, and resources

But good ideas

“And yet many on the left seem to have no understanding on this. For them affordability is constrained. And debt repayment remains paramount. ”

So what do these so called left of centre economists think the economy is for then?

So we can all spend our lives in debt bondage?

If that’s the case then either they need changing or the economy does.

If they don’t think that the purpose of the economy is something like ‘to enhance the well-being of everyone enabling them to live full and interesting lives by using resources in common while having regard to climate sustainabilty’ then I suggest they’re not of the left at all.

The beauty of simple MMT is that it shows that the existing economy can much better enhance the well-being of everyone just by changing the way we explain it and think about it. What is not to like?

I wonder what is ‘progressive’ about many of them

Can we not get one of those zero interest balance transfers that came through my mailbox the other day?

Which bit of the debt is it they want to repay? The ~25% held by the BoE? (hasn’t that got something to do with the government?) Or maybe the nearly 60% held by UK companies such as pension funds, insurance funds, banks and building societies?

Or maybe they should pop over to Japan (when allowed) and tell them the bad news about needing to repay their debt of 200+% of gdp because they are clearly defying gravity and as we all know that’s impossible.

As if there isn’t enough to get depressed about without some on the left showing classic symptoms of having succumbed to effects of the second most common substance in the universe after hydrogen: stupidity.

I agree.

My main worry is encapsulated in your last 3 paragraphs. The right have so completely dominated the narrative since 1979 that it has become almost impossible for the centre-left to state an obvious truth about government debt and money. Even John McDonnell did not (was it ‘tactical’ or did he really not get MMT??).

I have made a brief submission to Labour’s forum for policy ideas but I fear that it will fall on stony ground.

I think the problem is that so few people in Labour have any experience of finance that they believe the nonsense that the bankers tell them. It goes all the back to Ramsay McDonald and the defence of the gold standard.

How do we address this?

Do you remember when John McDonnell said at the Dispatch Box that I was good at tax but not economics?

It was MMT he was objecting to

James Meadway was, no doubt the source of the opinion

The corruption starts in the think tanks – who are buying the debt constraint

Perhaps they need to speak to a few Government Bond Traders rather than Think Tanks…. they might be rather surprised at what they hear.

How do I put you in touch?

The dialogue between you and Clive is always worth reading. I look forward to seeing Mr Perry’s comment, and what follows. You should write something together.

Well, somebody needed to say it. Okey, I’ll mind my own business …..

That would be fun…..

I think its probably worse than you describe. I sat through 3.5 hours of this video from the Rebuilding Macroeconomics, (a NIESR funded think tank, no less) a recording of a conference on MMT with several prominent ‘MMT’ers’ (god i hate that term but i guess we have to group people into camps!) and people who either don’t understand the very basics of it, or, want to deflect and talk about how it is bad for policy making (as if the current orthodoxy has been great at it so far!).

Anne Pettifor in particular was full of strawmans, logical fallacy, and hysteria about how MMT is Dangerous, apparently. It was simply unbelievable.

https://www.youtube.com/watch?v=xQFImP5VDrQ&feature=emb_logo

When i did my masters in economics in 2016 (uni of nottingham) i had every intention of doing the phd and getting a job in academia. but when i saw what life was like, how the various academics stuck to their own bubbles of thought, and wrote obscure fringe papers to get in published journals, i couldn’t bring myself to change my career and went back into accounting.

Academia is supposed to be about the search for truth, not defending your own ideas no matter what evidence is presented against it. Or indeed, outright twisting the logic to make your own points valid.

Anne’s comments in particular were outrageous.

Narayana Kocherlakota was like ‘ok maybe MMT is true but what about policy!’ – both him and Rogoff have this issue with allowing governments to spend money, unchecked, because at the moment things are in perfect harmony due to an ‘independent’ central bank. (but clearly no issue with private sector credit creation being totally unchecked……….)

Laurence Kotlikoff was off on another planet – its worth watching the video just for his take.

The intellectual debate around MMT is non existent at the moment – even in a conference full of academic professors, the discourse pivots around either a lack of basic understanding of the concept, or, complete mischaracterisation of MMT in order to frame it in a negative way. Maybe the incentive here is to protect their own careers so they can continue publishing in journals?

@Richard Murphy – why do you think they behave in this way? what’s the incentive?

I am utterly clueless about Ann, for example

Candidly, I have almost no clue what she is talking about these days: it’s fiddling without benefit and completely incoherent, as language in most cases, let alone as economics

Trying to work with her is near nightmarish – largely because most of what she claims MMT is about is simply not true. Her book on the GND was typical of this – and when I confronted her on it and pointed out all the things she claimed I’d said (I was the target for her venom in that book) had never been uttered by me she could not answer

She has simply never read it

I have to say some of the problem is the aggression of Bill Mitchell – which is why I will not go near him – he is a complete liability to MMT

But most of it seems to be their dedication to maintaining all that Keynesian IS/LM and Phillips curve crap they have invested so much energy in

Rogoff? I do not know to which Rogoff you may refer, but if you just type in ‘Rogoff’ and ‘howler’ into Google, the results speak for themselves. I think a period of silence from that Rogoff – if they are the same, of course – may be greatly appreciated by some of us, and perhaps even beneficial for more.

😉

@John S Warren

yup, that Rogoff.

backup to my comment about him can be found here:

https://www.youtube.com/watch?v=s2RcrvetsiA

spends most of the time extolling the virtues of ‘independent’ central banks and how governments shouldn’t be given the power…..

Anti-democrat, in other words

I doubt these people are stupid. They just need to be persuaded and convinced. As I commented on your MMT mythbuster, what are the counter-arguments that need to be engaged with and demolished?

Is this simply a political concern, that it would be too difficult to explain, too easy to mock, and the public just won’t buy it? Did they have an alternative and coherent explanation of how governments create and spend money in the economy?

To think about…and I am

I feel a bit depressed after reading that lot. There’s clearly no hope for MMT because I think the economists you are talking about would rather the world ended on their terms than succeeded on anyone else’s. Having read al the major MMT proponents I think it’s a bit unfair to dump the blame on Bill Mitchell. OK , he is a bit long winded but I don’t find him aggressive. I got interested in MMT through an essay by Randall Wray in a book edited by Mazzucato and have learnt from you in The Joy of Tax, Mitchell in Reclaiming the State, Bill’s Blog. I’m now ploughing through Stephanie Kelton’s book. I really can’t see how mainstream economists have problem with this. I don’t know how they would manage with Quantum Electrodynamics or even Classical Electromagnetc Theory. As far as I can see macroeconomics presents no intellectual challenges at all. I wonder who ties their shoelaces.

It seems to me that what John Weeks’ pronouncements represent is more interesting and significant than just a statement of ‘my ideas are better than yours’. The real target audience for his tweets is his economist peers; his intention is to signal that he still thinks correct, approved thoughts (the ones he has been thinking since 1964), and that his mind has not been corrupted by any new-fangled nonsense. In other words, it is an attempt to reinforce established macroeconomic groupthink. Yes, in a way it’s depressing that many people in Mr Weeks’ position are incapable of adapting to changing times and new ideas – thinking outside of their self-constructed boxes. But it’s also heartening, as it shows that macroeconomic groupthink is being seriously challenged by new ideas, and that’s making the old order’s adherents sufficiently uncomfortable and reactive that they feel the need to protect their positions in this way. This lends support to Planck’s postulation that advances in mainstream thinking tend to happen ‘one funeral at a time’. Max Planck was talking about advances in science, but the same is clearly true of non-sciences like economics.

I may have moore on this tomorrow…

Thanks

[…] scale of this crisis is unprecedented: now we need the radical thinking to address it” [Tax Research UK]. “In that case we are not going to get a V-shaped recovery, with a quick bounceback. We are, […]

[…] scale of this crisis is unprecedented: now we need the radical thinking to address it” [Tax Research UK]. “In that case we are not going to get a V-shaped recovery, with a quick bounceback. We are, […]

Strong stuff.

I cringe every time someone on Novara talks about tax payers’ money or asks how something will be paid for.

You have to actually step out of your belief in the basic nature of our reality in order to see the more real reality behind it.

The people who are annoyed at you here are just scared to accept the conclusions of ideas they probably know are correct. Once they accept those ideas the world as they currently appears to them starts to dissolve.

I am an uneducated bozo so it’s very easy for me to accept MMT. In my ignorance it’s always seemed obvious to me that money is just a made up thing that can be changed according to need. And stuff is real. So I’d think about how you could still do stuff with stuff if money didn’t exist, you’d just need to come up with a system to force people to do what you want.

It seems that you are one of the few thinkers that’s solid enough as an individual to accept an idea that challenges the fundamentals of the broadly accepted reality.

I admire your will to challenge the entrenched story.

Your critical word is ‘story’

Stories are what matter

The world’s story is that we tax and spend

That makes us dependent on the private sector

But we don’t tax and spend. We spend and tax

That empowers the government to deliver what the private sector cannot deliver, Or when it can’t deliver

We are ruled by stories.

I believe that the infernal “household budget analogy” is at the root of the problem. Those who oppose MMT either take this terribly flawed premise as axiomatically correct, or they believe that the electorate has to such an extent that anything which contradicts it must be politically unsaleable.

It’s astonishing to me that the sectoral balances analysis hasn’t utterly demolished the notion that “paying down the sovereign debt” is anything but the sheerest folly. Do proponents of such an action really want net private savings as denominated in their own sovereign currency to go to zero? Presumably not — which means that they don’t understand the relationship between the two.

Keep fighting the good fight, Richard, but you must have no illusions that these tired shibboleths will give way anytime soon …

In the long run, though, anything is possible

When you say that you “see the same attitudes in just about every left of centre think tank right now” you might want to add “with the notable exception of Common Weal in Scotland.”

True!

Apologies