Myth

We can't afford the interest on all the money the government it is borrowing. We'll never afford anything else if we borrow at this rate.

The replies

Reply 1

We can afford the interest on the national debt. The nominal interest rate is falling. The real, inflation adjusted, interest rate is close to zero. And as a proportion of our national income the cost has also been falling. It's simply not true that we can't afford the interest paid on the national debt.

Reply 2

Remember that about one-third of the national debt is now owned by the government, and it doesn't pay interest on that because that would mean that the government would be paying itself. Of course we can afford the national debt when there's no cost to a lot of it.

Reply 3

New government borrowing has been at negative rates of interest in recent weeks. That means people are paying the government to hold their money now. We can Most definitely afford that.

Reply 4

You do know that this money does not disappear into a black pit, don't you? Most of it is paid to people in the UK, supporting savers and pensioners in this country. Do you have a problem with that?

The explanation

Interest paid on the UK national debt has, of course, varied over time. That reflects changing levels of debt and varying interest rates.

Since the 2008 global financial crisis one of the quite remarkable features of the economy of the UK, and of that of many other countries around the world, has been both the decline in interest rates (which is part of a very long-term trend) and the ability of government to now control those interest rates through both short term and long term monetary measures available to it, including quantitative easing. The result is that the average interest rate paid on UK national debt has been falling steadily.

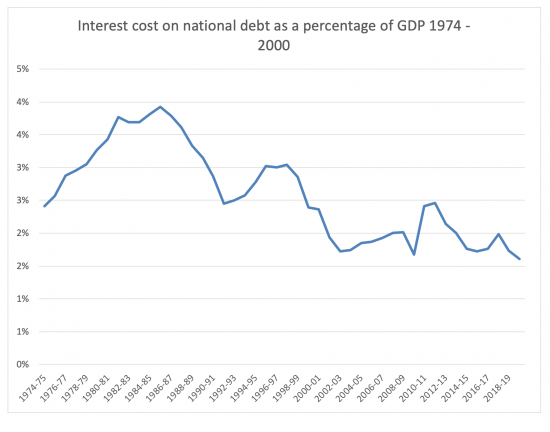

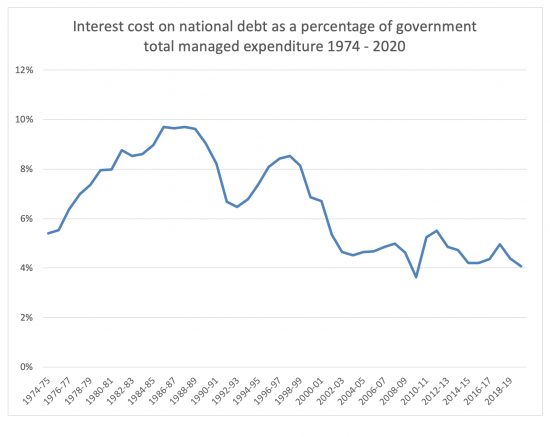

So too has the cost of the interest on that debt ben falling as a part of GDP and of total government spending. Just 4p in every pound the government now spends goes on interest payments. And two-thirds of that goes to people in the UK.

In that case the idea that interest payments on the national debt will be a massive burden makes no sense at all.

Nor will it prevent us affording any other programmes that the government thinks it appropriate to pursue.

The UK national debt is wholly affordable, and given that much of the increase due to the coronavirus crisis will, in any event, be covered by quantitative easing on which no interest is paid, it is entirely affordable.

The data

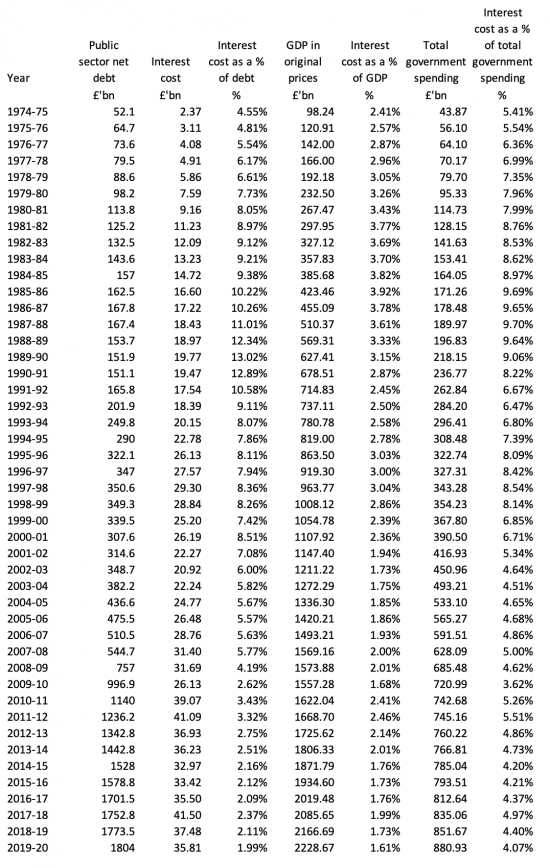

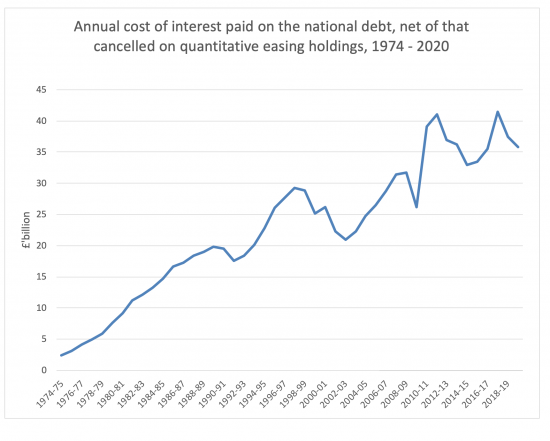

The annual cost of interest to the UK government from 1974 (when the available time series from the Office for Budget Responsibility begins) to 2020 was as follows. The data is shown at original cost, as a percentage of total government spending for the year, as a percentage of GDP and of the outstanding national debt, with supporting data also being shown:

As is apparent, the cost of interest on the national debt rose over the period did increase:

However, as a proportion of GDP it fell:

And as a proportion of total government spending it also fell:

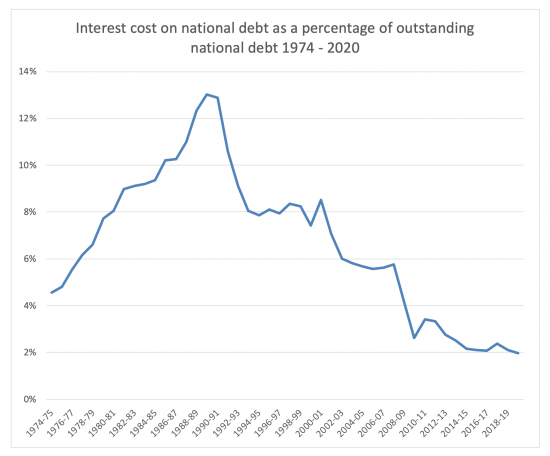

And that is, perhaps, unsurprising as the implicit interest rate paid on the outstanding debt also fell, quite considerably, over this period:

Most people do not now recall the enormous interest rates of the Thatcher years, and immediately thereafter. The rate paid on the national debt is now a nominal 2% on average, and the trend is still downwards.

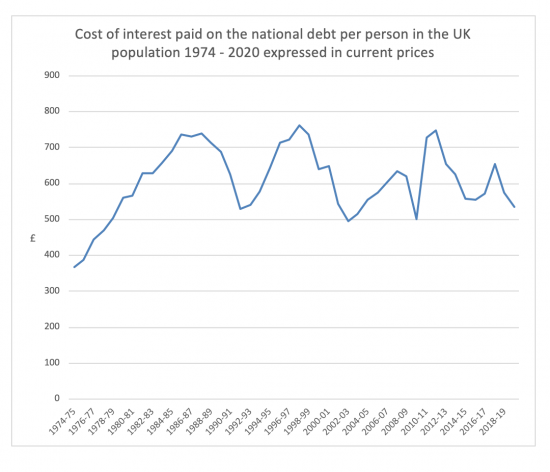

Expressed as a cost per person in the UK, and in constant 2020 prices the trend is as follows:

The cost of debt peaked during the Thatcher and Major years and again, briefly in the years after the crisis of 2008, but is now falling steadily. And it has to be recalled that about two-thirds of the interest paid goes to UK savers. It is not, then, lost to the UK economy.

The cost of the interest on the national debt is, then, no impediment to the government spending now.

There are more Mythbusters here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Where has the ‘share’ button gone?

It should be there!

To me “Reply 1” is a mistake. It invokes the idea that there is a ‘cost’ to government (not true) and that it therefore should take advantage of current low rates. By implication therefore we can’t afford it when interest rates are high.

Steven Hail often says that the interest rate is a policy variable, not a policy goal, so saying “interest rate is falling” undermines that simple statement of truth. In other words the rate isn’t something that happens to government, it is something set by government.

I agree with Steven

So this will it change

Cheers Richard.

This pair of tweets from Stephanie Kelton is really good…

“Q: But what about the interest payments? There will be less money available for everything else.

A: Wrong. The gov makes interest payments the same way it makes all payments. It can always spend more on other things. Inflation is the limit.

Q: So interest on the debt can never be a problem?

A: All spending carries inflation risk when the economy gets to full capacity. If people are receiving/spending too much interest income, the Fed can cut rates. Or Congress can cut spending or raise taxes.”

https://twitter.com/StephanieKelton/status/1093575473853009921

Precisely

Norman Lamont on Today this morning. “You can’t accumulate without limit because you have to repay the principal at some point.”

Are those sums included in the costs of interest as on the graphics, or are they an extra item?

No

Because they’re not interest

And because as I showed yesterday we do not need to repay the national debt

Lamont is wrong

Lamont has always been wrong

probably why he is on the BBC so often.

Thanks for clearing that one up.

Perhaps also worth considering that amount of interest that is paid to holders outside of UK. It’s still paid in £ and will be paid into a £ account. The Sterling area does not exactly match the geographic area of the UK. If those Gilt holders want to spend proceeds outside of Sterling zone/UK they will need to find someone to buy the £, so the money never actually leaves the UK currency area.

Agreed

Hello Richard,

Inspired by your work I have been doing some calculations of my own, using the House of Commons library briefing document SN05745. It lists the same figures for the interest cost as a percentage of GDP as those listed in the OBR document you have used, although only to one decimal place. This allowed me to work out the average interest cost per GDP for each PM term in office from 1974:

Thatcher 3.6%

Callaghan 3.0%

Major 2.8%

Cameron 2.7%

Wilson 2.5%

May 2.4%

Blair 2.2%

Brown 2.0%

I understand that the interest paid by the government simply adds to public wealth, but is there value to be had in exploding the myth that Labour always costs the country more in interest, particularly given that Margaret Thatcher is 20% ahead of her nearest ‘challenger’? Apologies if you’ve already dealt with this elsewhere.

Thanks for your blog, from which I’m learning a lot.

Steve M

Fascinating

Not d0ne in this way before

I like it

Thank you Richard for busting that myth.