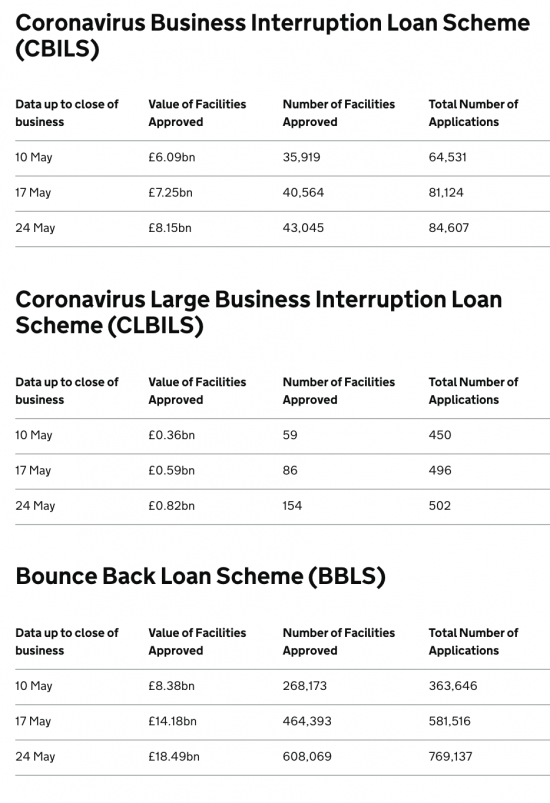

The government has just issued figures for the take up of its business loan schemes:

To put this in context the average CBILS loan has been £189,000.

The average large business loan has been £5.3 million.

And the most popular bounce-back loan scheme has provided £30,407 on average.

Let is never be said that British business is frightened of debt when the alternative is closing.

But, just imagine three things. Just suppose £28 billion had been invested into the UK economy instead of lent to it? think how much more robust the economic recovery would be in that case.

Second, imagine that this was now a National Wealth Fund run by a National Wealth Service - investing for the future of this country. How much easier would that be to explain?

And third, suppose that this money had been used to leverage:

- Commitments to a green transition;

- A commitment to paying a real living wage;

- The better representation of employee interests on boards;

- A commitment to full accounting for tax on public record;

- An end to the use of tax avoidance schemes.

This could have transformed large parts of the economy for the common good.

But none of that happened. £28 billion is apparently not enough to buy that leverage when you're the Treasury.

Which is absurd.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

If George Monbiot is correct some of the larger corporations that may have received loans could well be suing HMG, under the provisions of the “investor state dispute settlement”, for impacting their profits. Biting the hand that feeds, so to speak.

What it also shows, as you predicted back in March, was that the 80% Guarantee schemes would not work and what the charts show is less than £9 billion taken up out of what was supposed to be a £300 billion pot. The 100% guarantee scheme has worked since the banks are happy to hand out the cash, it is simple and quick and up to £50,000 over 6 years at 2% interest with nothing to pay in Year 1 is a financing offer that has simply never been available to any SME in at least the last 40 years. UK banks don’t much like lending to SMEs, and when they do it is expensive. The just pre-2008 loan we had from Bank of Scotland was at something like 6% with an arrangement fee of a couple of thousand and full repayments from the first month. I never understood what the point was of forcing a business into immediate repayments when the investment was in our case for a data project that would take a year to complete. In effect you had to borrow another year’s worth just to cover the first year monthly payments.

So we did get one of the bounce back loans and have used much of it to pay off all other finance and outstanding suppliers. So it has in effect been saved per your other prediction that everyone will be postponing purchases and paying off debts / accumulating savings.

For the record we do since last year now lodge our full accounts at Companies House and not the useless abbreviated version, we don’t use tax havens, etc and we would have been happy to have the bounce back loan as a purchase of 25% of the shares rather than a loan.

One thing to note, though, is that the Treasury has not spent £28 billion. In fact they have not spent anything other than whatever interest or fees the banks have so far charged. The £28 billion was created by the commercial banks. Doing it this way it would have been the banks that bought the 25% shareholdings. If you wanted to do that then the Treasury would have to actually genuinely spend some cash rather than pretending to have done so. Obviously real spending rather than bank debt would be better for the economy, but oh no! The Deficit – we will all be crushed by The Deficit!

Points accepted

But as ever, the banks act as mere agents for the government in money creation…

Lack of conditionality was a missed opportunity but I do have some sympathy with the government. When you show up in a Fire Engine to the burning house you do have huge leverage to extract conditions but in this case, although you and I might have similar demands, there was no broad consensus about what we should expect from our corporations. So, while the debate raged the whole street might have caught on fire. So, in my book – a missed opportunity but not an easy one to grasp (indeed, impossible with the current government driving the bus).

However, the question now is what next? Given the Cummings saga, I fear my idea might be ridiculous……. but I will say it anyway.

Can we get a list of all the large firms that took the money? If not, would a company have to state that they took money in their annual report? Armed with that data can we shame these companies into some action? A tough one but with the rising tide of anger among the public it might have some impact.

I’m interested in them all – not just the large ones…

And I do think this was a case where the conditions would have been very easy to impose

For £28 billion I could have managed that

…. but you have vision*…. and we are stuck with Johnson.

*although you might like to go for a drive to check you still have it!

🙂

CLIVE PARRY suggests…… “…Armed with that data can we shame these companies into some action? ”

Like we did with the banks and finance sector, you mean ? I think I know how that is likely to play out.

I entirely accept your point…… hence prefacing my remarks as being possibly ridiculous…. but I live in hope.

I would also add that the banking industry has changed since 2008…. it is slow going and relies largely on old men retiring/leaving/being fired to be replaced by a new generation. But, as a close observer of the younger generation of bankers, there is a change. Do we need more change? Of course but there is a change of attitude.

But the common good is decided by the commonality, that it, the people, that’s the definition of it. So the commonality can decide not to reward those not providing what the commonality decides is a common good by not purchasing their wares, and they go bust. No heavy hand of the state needed.

Are you really that stupid?

You really think that there is an invisible hand?

“…Are you really that stupid?

You really think that there is an invisible hand?”

Of course people believe in the invisible hand of the market. Exactly the same way as for countless generations they have believed (and many apparently still do) in a sky-daddy. Tell people what they want to hear and they will believe it.

So why doesn’t a majority believe modern monetary theory ?……. It is a very liberating thing to believe and understand, but for some reason the majority is frightened of the knowledge , because knowledge brings responsibility as Adam and Eve discovered……(?)

On a somewhat separate point, the shortfalls in delivery of funds to business by the UK Government may have a deleterious knock-on effect on the Scottish Government.

From what I heard in the Scottish Parliament today, there may be a clawback of promised Barnett consequentials if the UK fails to meet its targets – so Scottish business may suffer because of the inefficiency of the UK Government.