I have already shown that there is nothing exceptional, odd or worrying about UK public debt now, and will not be even if it increases significantly.

But it's not the debt people say that they worry about: they say that we should worry about the cost.

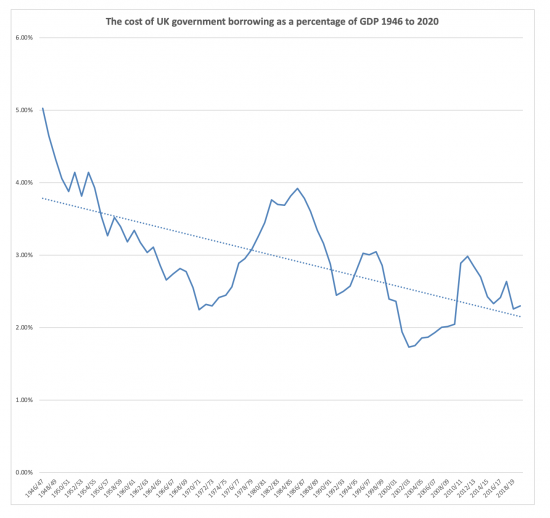

Well, that's not an issue either:

The data is from the House of Commons Library GDP data is from the Office for Budget Responsibility.

I added the persistent downward dotted trend line just in case anyone missed the point.

In cash terms, we have the highest government debt we have ever had.

But the cost is exceptionally low, and even if we increase what is described as borrowing as a consequence of coronavirus the impact will still be very small given current, exceptionally low interest rates, which look like they will persist for a very long time.

Please do always recall, that every penny the government spends on interest becomes someone's income - and most of it in the UK.

And there is good reason for that: UK national debt is just a savings mechanism. There is nothing more menacing or threatening about it to our wellbeing than the amount saved in banks and building societies.

My advice to those worried about this can be summarised in the words of Frankie Goes to Hollywood: relax, don't do it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Indeed, and why exactly are we borrowing at 8% from China to finance Hinkley Point over 30 years when we could have done it at 2% or less or indeed 0% if we had used the post EU referendum QE money? As a result it had a capital cost (estimate, since gone through the roof of course) of £18 billion and a finance cost of £22 billion interest. Note: I am not saying I favour nuclear as I don’t, but if you are going to do something you might at least be sensible. Same with the new Hitachi trains for East Coast and Great Western. Of course we should have electrified all the necessary lines instead of coming up with a bastard (and much more expensive) hybrid diesel / electric train, but we should also not have asked Hitachi to arrange a 30 year loan at again around 8% interest. Then you have all the PFI madness where the interest charges can be anything up to 10 times the capital cost over 25 or 30 years, just to pretend we weren’t borrowing. Even the supposed ‘transfer of risk to the private sector’ was a fiction as at the first sign of trouble they walk away and just hand it back.

As I understand it, on the day that Cameron became PM in 2910, the Japanese PM phoned to congratulate him, then spent the rest of the time making sure that Hitachi’s train deal would be honoured.

Modern Railways ran at least one article explaining how it was a vastly too expensive deal for us. When Benson got the East Coast mainline he was forbidden to use Pendolinos.

Sorry, folks, Benson should be Branson.

Frankie Says – Money is created out of thin air and national debt is not a problem!

I had that t-shirt 😀

… and this will decline further as old debt (issued with higher coupons) matures and is refinanced at current, even lower rates. The average maturity of gilts in issue is now over 15 years ( or 18 years if you weight by market value) which is the longest ever….. and this will get longer as the Debt Management Office continues to accommodate the demand of extremely long maturities.

It means that your chart of borrowing costs will not turn upwards for at least another 8 or 10 years… more or less whatever happens to interest rates.

So, when I am asked “What happens when rates eventually go up?” my reply is “Nothing…. for about 10 years. In fact, rising rates would be a good thing as it would indicate some life in our economy!”.

I may well be borrowing that line….

If rates rose significantly then the price of the bonds would fall below par which would allow the Treasury to buy them back before maturity at less than face value. E.g. they could pay back £80 on a £100 face value bond. The old 2.5% or whatever consols (perpetual) used to trade at around £30-50 per £100 face value.

Indeed….

Need to be a bit careful with this argument….yes, if rates rise bonds will trade below par and yes the government could repurchase them….. but what with? Presumably they would have to borrow more money at the prevailing higher rate. I am afraid there is no free lunch.

On the other hand, if the Bank of England bought them as part of their QE programme there would be a ‘profit’ as the BoE collected interest and capital gain on the bond…. and the BoE is owned by the Government…. but this is only true because the BoE pays no interest on the money it creates by QE. Indeed, QE has been a very profitable activity for all Central Banks around the world.

Personally, I like to think of the BoE, the DMO and the government as one…. and then all activity (issuing bonds, QE and traditional open market operations) can be seen as adding or draining liquidity from the system and makes you see gilts for what they really are – a liquidity management tool (rather than “debt”).

Spot on….

I do not understand why central banks talk about balance sheets and profit and loss. They seem like irrelevant concepts to me, when what is actually relevant is simply inflow and outflow.

I have elsewhere used the example of Hilbert’s Hotel. It is always full, but new guests can be accommodated by getting all guests to move up from room number n to room number n+1. Then the new guest moves into Room 1. Similarly for a guest who leaves, all move down one room, and the Hotel being still full has suffered no loss.

But the flow is indeed relevant for the non-Hotel sector.

Regarding securities, those that earn interest are predominantly the rich. This

is welfare for those that are already well-off.

Even if it is providing an income for pension funds, is it to the public

good to provide private pension savings interest in this way?

I’d be grateful to understand why a sovereign government pays any

interest at all on securities.

I can see the public benefit of offering risk-free savings, but not of

paying interest. This seems like a hold-over from the gold standard when

the public lent real stuff (well, OK, gold) to the state.

It is usually stated that the BofE issues securities in order to hit an interest

rate target, without any clarity as to why such a target is of importance. This

seems like a hold-over from monetarism, which many argue has been discredited.

What do you think of Mosler’s proposal that central bank interest should be set

at zero and kept there?

Thanks

JC

They’re at about 0.2% now

And why is this important? Because banking requires the security of government deposit facilities

It is I agree a social cost – but it so happens that it’s now one where the borrower subsidies the government when inflation is taken into account in many cases