Marco Fante has drawn my attention to a new report, published for Davos and promoted on the FT website by the Zurich Insurance Group. He linked it in response to my comment on bankers refusing to address climate risk in their decision making. It would seem that Zurich takes a very different view. The report is available here with a summary here.

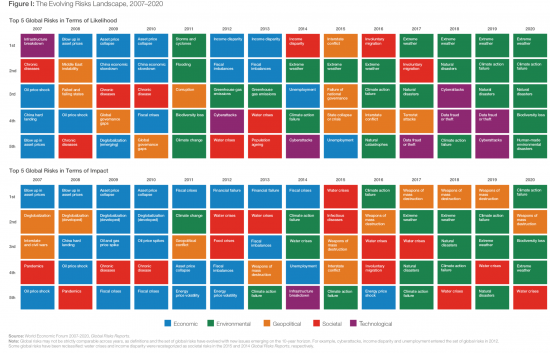

I will highlight two charts from that summary. The first is of the changing priority given to the major risks by both impact and likelihood as appraised by Zurich over a period of more than a decade:

Click on the report links or on the image (and then click on the image again) to get a larger version.

The fascinating fact can be discerned from the colour coding. In 2007 the big risks were economic, geopolitical and technological. Society just crept in. Enviro9nment as nowhere. Now it dominates all likely risks and the impact ranking as well. That right-hand column looks like this:

If you think a water crisis is also down to the environment then nice out of ten of the risks are environmental.

This is reflected in the second majo0r chart in the report:

Economic risks are apparently now the least of our concerns, although I think they're understated, albeit that asset and so debt bubbles) are correctly tranked highest amongst them.

I am surprised data issues are so high.

I would make inequality a bigger risk.

But the mapping shows why the environment gets its ranking.

And still the world of finance thinks it's just a tack on extra that needs no real hard accounting.

I'd suggest Zurich have this one right. Of course their methodology can be questioned. And of course this is not right: it is a snapshot. But as a measure of changing perception this is powerful.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The headline directly contradicts the text

Error

Being corrected!

It should have been nine, not none

Doubtless Zurich will be increasing their premiums in line with the almost exponential increase in environmental (euphemism for climate heating) risks of the coming years. This will prompt other insurance companies to do the same, putting another kybosh on the future and stability of the capitalist system as we know it.

I guess what it shows is that insurance companies think much further ahead than elevenses.

Given that Terry Jones passed away yesterday, we might be reminded of the Monty Python Crimson Permanent Assurance short film.

I am sure you are keeping an eye on the World Economic Forum Annual meeting that’s going on at the moment Richard – I have just had a scroll through the various presentations they are having, some look interesting, but then you come across the likes of this:

https://www.weforum.org/events/world-economic-forum-annual-meeting-2020/sessions/the-centrality-of-central-banks

the blurb says:

“The Centrality of Central Banks:

Lacklustre growth and stubbornly low inflation are diminishing confidence in the ability of central banks to help economies weather the next downturn. How can central banks lead economies more effectively through future boom-and-bust cycles?

On the Forum Agenda:

– The communications game of moving markets

– Global interconnectedness

– Reshaping government relations”

And think – have they really got their fundamental principles right here for affecting change in global economies?

The above is to be presented on: January 24, 2020 10:30 – 11:15 CET.

I will be discussing a paper on this issue tomorrow – I have run out of time today (and have an enormous pile of work to do)