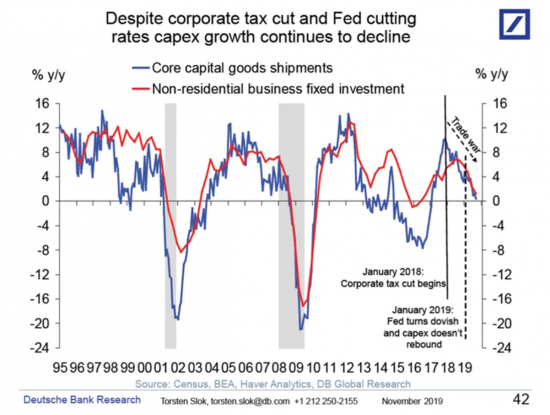

The FT reproduced an extraordinary chart produced by Deutsche Bank yesterday:

The point is very clear: despite the apparent incentives given to US business in the form of tax cuts and low interest rates they are not investing.

The question has to be why? And there are at least four possibilities.

First, they don't trust Trump and his strategies on trade, and many other issues.

Second, regulatory and financial abuse pays much better than conventional investment.

Third, the incentives no longer work: we're in another era now.

Fourth, they've simply run out of ideas on things to invest in.

I happen to think all are true.

Politics is failing business.

It has forgotten how to make profit from honest trading.

Old models of economic incentives are now history.

And capitalism as we have known it is at the end of its life: the era is over.

But if so the UK is in trouble. The Tories are wedded to this failed model of capitalism. They want power to promote it. That will fail. We will fail with it. It's not a pretty prospect.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It’s time to go into survival mode till all this blows over. Assume the machine’s going to stop and prep accordingly.

How do parents ‘prepare’ for not being able to properly feed and clothe their children. How do pensioners ‘prepare’ for not being able to heat their homes?

Whatever the result of this election the same right/left battle will continue. The right won’t walk away so neither can those of us on the left.

Thermals and a woolly hat work for this pensioner. A heavy duvet is worth having too. I got a USB powered heated waistcoat this year as well, don’t know if I’ll need it but it struck me as useful to have. I have no thyroid gland which seems to help though removing it to assist surviving winters isn’t something I’d recommend. I would however recommend that those with children they can’t feed consult history to remind themselves how it came to be the working day was reduced to eight hours and what killed the poll tax.

At bottom the problem is ‘Trickle Down’ mentality isn’t it? That silly notion hasn’t gone away despite it being the obvious failure it was always destined to be. There is no point whatsoever in investing in production of goods and services the bulk of the populus cannot afford to buy. Money only ever flows upwards through the economy that is the ‘natural’ gravitational flow. Money quite simply does not behave like water.

Money behaves much more like electricity. It doesn’t flow out of sockets across the floor of the living room it only flows when an appliance is plugged in and switched on to do some work… to power the vacuum cleaner to clean the floor, or to fire-up the TV set.

The bank bailouts, QE, and top level tax cuts have had the effect of charging up batteries held by the top few percent, but they have nothing useful to put the batteries into to release the energy. They are frightened to use their battery store because there’s not enough power coming through the mains sockets to keep them charged.

Or something like that. In gold standard terms the header tank model of money makes a degree sense if the water pressure under the force of gravity drives water wheels powering the mills of industry. But we don’t live in a gold standard world.

Andy, that is an excellent analogy.

My own crude way of trying to explain the need for redistribution and taxation is to compare money with blood.

If society is a living organism like a body, then all of the blood being hoarded by any given bodily organ is counter productive. If you starve the rest of the body, it all dies.

If you impoverish the populus and hoard their wealth, society will fall apart. There will be no productive growth or societal advancement. The rich will live in fear and (to some extent) shame and denial. And we will all be worse off.

Is it better to have a big piece of a rotten pie, or a smaller piece of a brand new pie that keeps getting bigger?

That’s enough crude analogies for me today. Back to work.

🙂

For me today’s model of capitalism is mostly about ‘wealth’ extraction rather than ‘wealth’ creation. Include natural and societal wealth in that extraction. Wealth creation requires investment be it in R&D, technology, people, plant, infrastructure and the rest, to create wealth in the future. Add decent public services and institutions to that list. How that wealth is shared is another matter – it has consistently trickled up in recent decades.

We are now in an era where the objective is to extract as much as possible, driven especially by the short terms demands of the Financial institutions, and the major owners of current wealth. Existing wealth is squirrelled away off-shore to avoid taxes where possible, and/or applied to short term speculation. The examples are all around us, from Thames Water loading the business with artificial debt whilst paying out unjustifiable dividends, to Apple hoarding their capital off shore So called investment banks and funds long since stopped real ‘investing’.

Anyone who has dealt with City institutions and banks will know that they are deeply ignorant of how real real businesses are run and what their needs are. That includes the accounting firms who are merely the enforcers of City rules and requirements.

Governments now too often behave the same way, failing to invest in infrastructure and public services, thinking only in the short term and trying to ‘balance the books’. Selling off public assets at knock down prices to avoid raising taxes or borrowing.

A generation of business leaders have emerged who only know how to extract to please their financial masters (and they are mostly masters). You find them moving across different industries and sectors, understanding little about the businesses they lead, their only expertise being how to extract the wealth for which they are richly rewarded. The honourable exceptions are there but they are few and far between. They are as resentful of the City as most of those who read this blog. Paul Polmans of Unilever would be one example.

The government is going to have to take a lead in changing the rules of the game in the City, the goals and purpose of business, and taking a lead role in investment. The Conservatives in their current form are utterly opposed to any change – they really would sell their own grandmas. Having read the manifestos (sad I know), the LibDems get the need to change business but it’s not clear they have the courage to do anything sufficiently radical. On public services they have little to say. Labour certainly get the problem (and it looks like they have been listening to Mazzucato) but have nothing constructive or positive to say about how to build a different kind of wealth creating business. Nationalisation seems to be the only answer they have.

So my Venn diagram of the ideal party seems to involve a mix of Greens, LibDems and Labour! Sadly not available.

It seems you are not alone…..

Robin Stafford says:

“So my Venn diagram of the ideal party seems to involve a mix of Greens, LibDems and Labour! Sadly not available.”

Oooh, I don’t know. Jo Swinson has to hold her seat in East Dunbartonshire for her antipathy to Corbyn to prevail. I don’t think she’s going to be a shoo in. It will depend on what priorities her constituents are swayed by. Admittedly it is very unusual for a party leader to be unseated in a GE, but these are strange times.

What politicians say before an election goes out of the window once they are elected and their out and out declared rejection of Brexit, and long standing pro EU sentiment would surely dissuade them from supporting a Boris-type exit. If the result is as close as we expect (I’m ignoring the opinion polls as pure spin and headline fodder. Especially anything from You Gov.) the post election horse trading will be ….. interesting (?)

I worry that it is not tax cuts or low interest rates that business wants. I think that we may be on the cusp of further retrenchment of social security provision (I hate the word welfare), pension provision and health care globally plus also citizens rights.

Once real citizens have these rights further reduced, then we’ll see a further wealth transfer into the so-called persons that are corporate America and the UK.

So this is what business wants – a capitalism with even less rules, where the already powerful benefit most because they are worth it.

We have to accept that modern capitalists always want more – even though they already have everything.

I like Labour’s selective nationalisation because they have rightly identified certain sectors where it does not really work or where the private management has used the assets to make their service debt ridden and enrich themselves (like those who buy football teams and then load the debt onto Club – not themselves). Only new management will orientate services back to end users and away from those who legally come first when private – the investors.

Michael Moore says that ‘Capitalism is a system of giving and taking…………….mostly taking’. And as Robin points out, that is the problem. The returns become too narrowly redistributed under privatisation.

So, we need market interventions from a courageous state – Varoufakis has argued that only socialism can save capitalism – and he is right.

I’d just be wary of generalising about all ‘business’ – unless one is a full blown anti-capitalist… There’s a very wide range of views and practices in the business world, many of them resentful of free loaders and anti cometitive practices, be it tax dodging, relying on others to do training or stuffing the environment. Smaller businesses can be just as guilty of bad practices as the favourite target of large multinationals. Also having travelled a lot in backwoods Eastern Europe, I’ve seen the grim consequences of unalloyed ‘socialism’ – something JC seems rather to ignore or dismiss.

The right ideas are out there about how to kick the the dysfunctional form of capitalism that has evolved into shape, be they from Marianna Mazzucato, Will Hutton or our esteemed host. People might be surprised to find those ideas getting more support from the business world than you’d expect. Labour would have a much more robust manifesto if they showed some signs that they recognised this. At the moment their messaging is all negative.

Richard, none of the four explanations you give is very convincing – for example if it was local factors that explained lack of investment (such as regulatory uncertainty) capital would simply move elsewhere. The reason it doesn’t is because there is a global crisis across capitalism of where to invest. A fifth (Marxist) explanation which you don’t mention is that the lack of investment is linked to a fall in return on capital or profitability. Profitablity now appears so low that not even tax cuts and ever lower wages can persuade those with capital to invest – hence the very interesting graph – and many prefer to gamble in the financial system.

Nick Kempe says:

” A fifth (Marxist) explanation which you don’t mention is that the lack of investment is linked to a fall in return on capital or profitability. Profitability now appears so low that not even tax cuts and ever lower wages can persuade those with capital to invest —2

Well, it’s hardly surprising is it ?

What are ever lower wages going to do except stifle demand from the people who want and need to be customers but can’t afford to be. I noticed Fortnum’s have just posted good profit growth. That tells you where the money is in the hands of people who don’t need anything but can afford silly prices for food.

If your business is making widgets it’s a bit pricey to suddenly go into the luxury car market and compete head to head with Ferrari. So what is there to invest IN ? Gold plated widgets ?

Rapacious capitalism is systematically destroying its own market. Productive capitalism is knackered. Henry Ford famously paid his production line staff enough that they could afford to buy his product.

Presumably capitalists are too busy counting their money to have time to read history. Or perhaps the only lesson they took from Henry Ford is that ‘History is bunk’ (?)

The graph from Deutsche Bank does seem to rather blow a hole in the IFS argument that the corporation tax increases in the Labour manifesto will lead to lower investment. Rather, there seems to be no obvious relationship between the corp tax rate and the level of investment whatsoever!

Indeed…