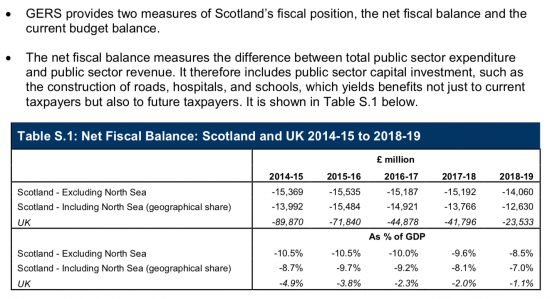

I have had the GERS data for fifteen minutes when starting to write this. Don't expect miracles as yet. But Table 1 told me most of what you need to know. It shows the net fiscal balances of Scotland and the UK as a whole since 1999. As GERS defines it:

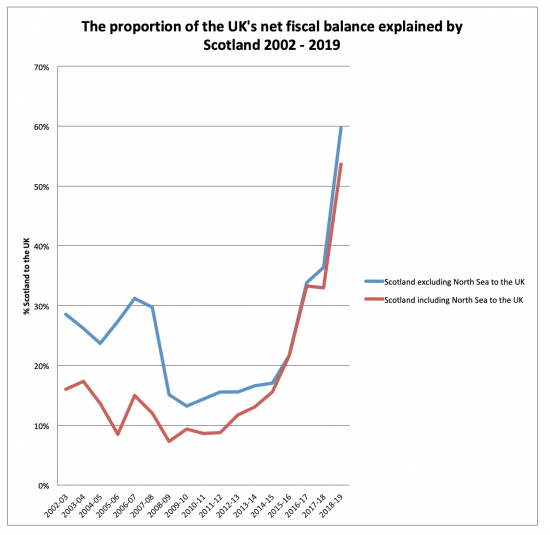

Let me plot this, using the more extended time series data in the supporting files that the GERS web site provides. I have simply compared the two figures for Scotland with the UK as a whole net fiscal balance for each year:

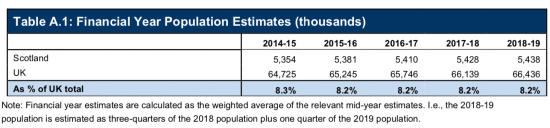

I'll be candid: that makes not one iota of sense. For the record this is the proportion of population of the UK as a whole living in Scotland according to official estimates:

What GERS is asking us to believe is that with 8.2% of the UK population Scotland created between 54% and 60% of the UK deficit last year, depending on the basis used.

And my answer is very simple: no it did not.

How do I know that?

Because Scotland would not have chosen to spend some of the cost charged to it by the UK government.

And because the GERS methodology is wrong when comparing income and expenditure, as I have already noted today.

But most of all it is because what this ignores is three issues. The first is that there is a massive bias in financial services in the UK that the Tax Justice Network has recently pointed out. This means value is extracted from Scotland and recorded in London.

Second, there is massive wealth inequality in the UK:

Of course, there is wealth inequality too, and both represent this looting of the rest of the UK by the financial services industry in the south east of England.

And third, to suggest as the GERS notes suggest that profits are appropriately allocated to Scotland on a case by case basis is just nonsense. I have worked on issues of profit allocation for years and developed country-by-country reporting to address this issue. It is now used around the world, but there is no data in Scotland to appraise it. To then suggest that profits and so corporation tax are correctly apportioned is nonsense.

This data is, then, not just wrong. It is absurdly wrong. From the methodology, to the lack of data, to the inherent biases and the failure to correct for obviously identifiable factors, the result is intended to produce an outcome. As has been noted:

In a leaked memo the then Secretary of State for Scotland Ian Lang wrote "I judge that [GERS] is just what is needed at present in our campaign to maintain the initiative and undermine the other parties. This initiative could score against all of them.”

I acknowledge that things have moved on since then. But let;'s still be clear what GERS is about. Its aim, as is the aim of almost all UK government-produced data, remains to prove that a financial services elite produce most of the value in the UK and that as such the interest of those with wealth, based in the City of London and largely living in the south-east of England, must have priority in all matters, including tax, fiscal policy, regulation and more besides. The rest of the country must behave as supplicants to ask for their mercy and goodwill for the handouts that they are offered. And GERS in this form really suits their purposes very well.

But does it suit Scotlands's purposes? No, not at all.

And is it any real reflection of the true situation that Scotland would face if tax was paid where value really arises? Again, I suggest not. But that the question of where value arises is a question never asked within the UK, although it is on the international tax agenda.

It should be. Until it is GERS remains CRAp - a completely rubbish approximation to the truth. GERS unquestioningly takes data at face value and regurgitates it. We need something a lot better than that.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Why are these figures not rubbished by the Scottish government?

I wish I could answer that

Maybe we’ll hear soon enough, Nicola Sturgeon didn’t bother wasting her time with it this year

Good

Here is one possibility; only a surmise but worth consideration.

The first SNP Government inherited GERS as the standatd model. The highest objective that first SNP government had was to establish its credentials to a small ‘c’ Scottish electorate that the SNP were a) responsible, b) managerially competent, c) that it could deal efficiently and smoothly with Westminster. Genrally speaking (in terms of the only real test that matters – the votes of the Scottish electorate in subsequent elections; forget the media, they are bought and sold) – this strategy has worked very well. They are in power in Scotland, have most of the MPs in Westminster, and a solid representation of MEPs. It did not serve these short to middle-term objectives to challenge the basis of the conventional beaureaucratic system which was inherited. More than a decade of focusing on short term politics, it is now very difficult to challenge the principles that have been accepted, unchallenged for a decade.

Fair

But they have to show they can innovate in the right ways now

They don’t have to use my terminology for GERS

They do have to say they are moving on from it

I was trying to explain it; not justify it.

I know…

Apologies if not apparent

May I add a further element in my surmised explanation of the SNP’s over-ready commitment to GERS that now has them in such a fankle? This is a ‘mea culpa’ written today in a piece titled ‘GERS Time Again’ in Bella Caledonia:

“Now a mea culpa. Prior to the collapse in oil prices in 2014, the annual GERS calculations regularly showed a significant (notional) budget surplus for Scotland. As a result, pro-indy economists such as myself gave little regard to GERS other than to note it gave ammunition to our contention Scotland was a normal, rich European industrial economy that could stand on its own two feet.”

It appears some in the SNP thought things never change in economic affairs.

QED?

I am not sure if I omitted the name of the writer of the Bella Caledonia piece this morning, a very basic error; if not, my apologies to him and everyone here: it is by George Kerevan.

Ironically, I have my own ‘mea culpa’! Justice of a kind.

Earlier this year I wrote to the Finance Secretary of the Scottish Government as follows:

A few years ago I became bemused by the heat generated by the contradictory arguments which arise annually when the GERS figures are released. I did a great deal of research into the sources of information and, with my “auditor’s nose” twitching, was astonished by

– how few of the numbers derive from real, probative, Scotland-specific data and

– the complex, arcane methodology involved in disaggregating UK stats to arrive at “supposed” figures for Scotland.

Given that

– there is no probative audit trail for over 90% of all the numbers in GERS, no auditor worth his/her salt could ever give GERS a clean audit certificate and that

– the Scottish Government will be held accountable for the GERS’ results even though GERS contains huge values relating to matters reserved to Westminster,

– and that GERS results will be used to embarrass the Scottish Government regardless of which party is in power,

why not get Audit Scotland to audit and certificate GERS? AS couldn’t possibly endorse the results without adverse comment about their inaccuracy and unsuitabality as a measure of the Scottish economy and the Scottish Government’s stewardship of it.

Here’s the reply I got:

As an economist in the Office of the Chief Economic Adviser, I have been asked to reply on his behalf. The aim of the GERS publication is to enhance public understanding of fiscal issues in Scotland. GERS is an accredited National Statistic Publication. This means that it has been independently assessed by the Office for Statistics Regulation, and found to be methodologically sound, explained well, and produced free of political interference. Further information is available at: https://www.statisticsauthority.gov.uk/osr/

As GERS focuses on public sector accounts it is not intended to be a measure of the Scottish economy. The Scottish Government’s main measure of the economy is GDP, and information is published on this at the link below. https://www2.gov.scot/gdp

However, we recognise that users have indicated that they would like more statistics on devolved finances in Scotland, and as a result the Scottish Government is considering introducing a new statistical publication, which would have a wider scope and report on all devolved revenue and expenditures. Unlike GERS, it would focus solely on the finances of the Scottish Government, local government in Scotland, and their associated agencies and bodies. It would not report on services provided by other UK Government departments either operating in Scotland or providing wider services on behalf of Scotland. Further information is available at the link below. https://www2.gov.scot/Topics/Statistics/Browse/Economy/GERS/DevPFSCons18

You’ll notice the classic bureaucratic response, much beloved by Ombudsmen, stressing that the report follows approved methodologies and therefore passes all the tests, but ignores the fact that it fails to consider the accuracy of the data involved or whether the results make any rational sense. In truth I didn’t expect anything more concrete than that, but took some comfort from the recognition that users might actually want fact-based and relevant data and that steps might be taken to improve data collection.

Thanks Ken

Good work

“You’ll notice the classic bureaucratic response, much beloved by Ombudsmen, stressing that the report follows approved methodologies and therefore passes all the tests, but ignores the fact that it fails to consider the accuracy of the data involved or whether the results make any rational sense.”

Broadly that appears to be the position adopted by the spokesperson for the Fraser of Allander Institute (BBC Scotland news today). I ask anyone interested simply to read, and reflect carefully on the formal ‘Detailed Revenue Methodology’ used in GERS.

I despair of them….

And thanks for the links from me as well. I found them most interesting and enlightening.

I have previously suggested that the reason the Scottish Government doesn’t rubbish these figures is that they are the only ones available and some of them are useful – as in favourable to the Scottish Government. I confess to never being wholly persuaded by this myself. And I am growing less convinced with every passing GERS.

The only other explanation I can come up with is the SNP’s near-pathological aversion to assertiveness, confrontation and negative campaigning. And that is something they’re going to have to get over pretty damn quick.

True

Very quick

Derek Mackay, Cabinet Finance Secretary, commented on these figures today. By doing so he has given credence to these lies.

He should have said that they are nonsense, that the Scottish Government doesn’t have access to the necessary data to give details of our country’s financial situation and tell the UK Government to stuff their data if they are not able/willing to provide us with actual figures. Other than that no comment should have been made.

Scotland shouldn’t have to put up with this CRAp every year.

I wish he would say Scotland can do better – and he is going to invest in doing so

That would have been my answer if I was him

But I’m not….

The reason these figures are not “rubbished by the Scottish government” is because they are produced by the Scottish government.

In the pre-referendum White Paper, Alex Salmond stated “GERS is the authoritative publication on Scotland’s public finances”. At that time Scotland and the UK as a whole were both running unsustainable deficits of around 8%.

Since then there has been massive divergence largely due to North Sea tax revenues falling off the cliff. North Sea tax revenue in last fiscal year equated to £263 per Scottish citizen – the White Paper forecast a range between £1,300 and £1,500.

And it needs to improve them

This year Norway’s revenue for roughly similar recovery was almost £30B. Something very odd going on.

What are the Scottish Government’s sources for ‘their’ figures?

You need to read the methodology note

I have analysed it in previous years

I have not time to do it again

Alex Salmond stated “GERS is the authoritative publication on Scotland’s public finances”

As you get older you learn not to take everything politicians say at face value. I got there more than fifty years ago.

A long time ago in these terms

Maybe it was then

It has passed its sell-by date now

Well Richard you have well blown a hole in the whole concept of Gers, how it is applied.

Who benefits from it and who does not. Scotland must say, enough is enough. Over to you Nicola.

Your work on this Richard IS well appreciated.

Thanks

Unfortunately Derek Mackay bothered!

Derek sometimes needs to take a deep breath…..

Did Cardiff University not recently publish a report on the equivalent figures for Wales (GERW) which had Wales on a £13.7bn deficit with only 4.7% of the population.

Between Scotland and Wales we seem to have more than 100% of the UK deficit. Utter nonsense.

Yes….

See this too https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/articles/countryandregionalpublicsectorfinances/financialyearending2018

And, what about the equivalent figures for Northern Ireland?

If these were added to Scotland’s and Wales’ figures, the figure would be close to 150%.

If I were a resident of England, I would be saying that England should get rid of these encumbrances – unless, of course, the data are nonsense and that with oil, gas, renewables, water, food, higher education, etc and more than 50% of UK territorial waters (and, hence, the fishery), where the absurdity of Trident plays its games, maybe these parts of the UK are, in fact, net contributors.

Fantastic blog. Thank you.

GERs is clearly flawed for number of well documented reasons.

FWIW : I have 2 major complaints.

1) Scotland doesn’t have full fiscal autonomy. Spending strictly set by Barnett forumla. Tax raising powers limited by design. Holyrood has no control over its supposed deficit (even if there was an obligation to balance books).

2) Comparing supposed deficit of devolved-Scotland with UK doesn’t makes sense. The two sets of figures are compiled using entirely different rules and metrics. Conveniently no GERs figures are ever produced for England for comparison 😉

Agree with both

Thanks

But do try this to see the justification for my comments re financial services https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/articles/countryandregionalpublicsectorfinances/financialyearending2018

Is it perhaps the case that the SNPs reluctance to (sufficiently) distance themselves from GERS stems from Andrew Wilson’s personal fear of attracting the sort of criticism that the White Paper generated, viz, over-optimistic calculations and conclusions.

From the GCR summary – 3.111 regarding the use of GERS – “This should ensure that the initial assessment of the ‘starting point’ is non-controversial”

Except it is not….

Thank you so much Richard. This annual spurt of Scotland is too poor and too much in debt by the Westminster government and others has really gone far beyond the pale. I can not believe that allegedly knowledgeable economics educated people still spurt out a load of nonsense. We even have the BBC Scotland’s own Maestro of Economics Douglas Fraser on Radio Scotland effectively saying in response to the question why was it that approx. 8% of the UK population could be possibly responsible for approx. 54% of the UK deficit he answered in effect because the reported figures state this. I mean really? This guy is allegedly knowledgeable about economics, although those who have been fighting for Scottish independence know him to be nothing more than a charlatan.

It is so refreshing to know that despite the total onslaught of lies we will now face for days from the anti independence brigade and news reporters, people who really should know better but clearly do not, we have at least one oasis of truth to fall back on.

‘Because the figures say so’ is crass

I have prepared vast amounts of data in my lifetime and always ask ‘what does that mean?’ and never accept the answer ‘because that’s how it worked out’

Maybe someone might offer to buy Scotland from us?

Perhaps the people of Scotland might like to buy it?

We already own it, but we do need to evict the squatters and the noyecanny crowd.

Auditors, analysts, and dog food salesmen can look at the detail and convince themselves that there are no mistakes in the figures. A good accountant is always taught to do a sense check, or a proof-in-total, rather than just focus on each individual figure. This is exactly what you have done.

There is absolutely no point discussing the detail when it is patently blindly obvious – to anyone with half an ounce of sense who takes a step back to see the bigger picture – that there are fundamentally serious issues with the data in the GERS report.

It’s a joke. But it’s not funny.

I did what an auditor calls an analytical review

An accountant makes sure the books balance in accordance with the rules

A good FD and a good auditor sniffs them to see if they make sense

I was not a very good accountant by this definition (it is mighty tedious being that sort of accountant, IMHO)

I am a pretty good auditor / FD

Why were the GERS figures highlighted by the Scottish government in the run up to the 2014 independence referendum but are brushed under the carpet now ?

Look at what the Rev Stu has to say here

https://wingsoverscotland.com/the-inverse-miracle/

Yes, I know all about Stuart

But just answer his point

Thanks for the analysis Richard!

As far as I am aware, GERS is produced, allegedly, independent of political interference. So the ScotGov ministers have no input. ONS, Civil Servants (UkGov) responsible.

Am I mistaken ?

It is not ministerially led

in response to the previous comment-the Scottish Government claimed only three or four months ago that vat could not be estimated accurately and we now have a vat figure published within gers… so it is recognised by virtually everyone that gers cannot be used in actual budgeting decisions? i also think hmrc income tax had a lot of errors and had to be changed too

Both true

We need to go back a step and ask a much more fundamental question about what the correct balance of state spending should be. We should not just accept the neo-liberal orthodoxy that Surplus = Great!, Balanced Budget = OK, Deficit = Disaster. This is a double entry accounting system so any State Sector Surplus automatically means a Private Sector deficit. If you realise that the National Debt = the National Savings (and if you don’t accept that then there is helpfully a large government agency in East Kilbride called National Savings) maybe you start to realise it is not that scary. Running a government surplus would simply mean a permanent private deficit, and that would push all of use into debt (instead of the state), so think huge student loans, mortgages, cards etc that could never be paid off (in aggregate). Private debt like that simply strips wealth from the ordinary person and passes it up the chain to those that own all the debt, i.e. the very wealthy. So you could say that having your policy aim as a government surplus is either because you don’t have a clue as to what you are doing economically, or because you know exactly what you are doing which is to enrich the few.

So the conclusion of that is that most states should run a deficit most of the time. What that deficit should be depends on the state of the economy, and that is influenced by the private desire to save. That saving must be balanced by the deficit to avoid a shortfall in demand and thus unemployment.

Having established that a deficit of the Scottish Government is not a bad thing then you can start to sensibly address how big it should be at any given time. One economist suggested it should be 8-9% simply to accommodate what seems to be a high desire to save of our aging population.

MMT teaches us that deficits are not a problem

But the messaging about this is what matters

And it’s wrong at a political level

Then we deal with the economics

This is one of the areas where the SNP’s pacivipty wrt domestic policy it could affect with its powers comes in. It could empower Scottish Statistics office with the powers to compel companies etc to properly report their sales and profits in Scotland or no license to operate here or some such.

It’s almost as though they don’t want to know in advance lest the figures be worse than expected and scare the horses. Or they have a better idea than GERS gives and ditto, they don’t want us to know before a Yes vote.

My worry is they will agree to that report which says we must have austerity and pay our supposed share of the debt to look good to the markets or some such. If we do do that only 8-9% of the debt and only once Trident is gone and the Scottish defence forces occupy Faslane and Coulport. Oh and the rusting nuclear hulks are gone from Faslane and a deal for Westminster to continue to pay to decommission Dounreay and Hunterston etc.

Just saying we should do it without knowing what asset we get in actuality or in kind is silly. We won’t be swimming in money initially even if the SNP immediate post a Yes vote get to reform North Sea operating conditions and the revenues. But I expect WM to milk it as hard as they can pace the fire sale of exploration licenses in the latter stages of IndyRef1.

I have supported Common Weal on the campaign for a Scottish stats office and argued for it in Holyrood

But, it has to be willing to ask the right questions

And that means it has to have enlightened advisers

The world would not have changed its view on profit allocation for tax without some awkward sod inventing a way to do so

That was me

Re funding, read what Common Weal is publishing

The establishment of Statistics Scotland as a proper government agency was one of the motions my SNP branch seconded at the spring conference. It was passed without dissent so this is now SNP policy. Ministers should get on with implementing it!

Agreed…..

[…] such person is Richard Murphy, and in an excellent piece today he posted a version of this graph which did catch our jaded eye. It purports to show the share of […]

On BBC Radio Scotland News at lunchtime the economics/business correspondent of BBC Scotland, Douglas Fraser was asked how it could be that 8% of the UK population is responsible for over 50% of the deficit. If I understand his reply (which managed to be both diffuse and terse) it is because the Scottish expenditure is high and the revenues did not match it; it is just what the figures tell us. This was a little less than illuminating of the underlying facts. He then unexpectedly turned to Wales and research carried out by the University of Cardiff (I think?), in a periphrastic analysis of doubtful direct relevance to the accuracy of GERS (which was the core of the question he rather unsatisfactorily answered); in which he implied the position in Wales is even worse than Scotland – at over £14Bn deficit, if I grasped this sudden appeal to new data, not even in GERS.

I presume if we add Northern Ireland into this analysis we will find that Scotland, Wales and Northern Ireland (together around 15% of the UK population, must be responsible for well over 100% of the deficit.) 120%? 150%? 200%? More? What on earth is this supposed to mean, if it supposed to mean anything at all, or persuade anybody about anything worth serious consideration. In short, how has Britain managed to create such a mess of its finances and economy that such a ludicrously lop-sided result is even speculated, or considered a credible apology for Government; or rely on data that is no defence at all of the management competence of the British State? This is not a definition of “pooling and sharing”; but rather the hapless picture GERS conveys, provides an implicit and demeaning acknowledgement of the abject economic and political failure of British Governments over decades.

I will post some data

In all gubernatorial matters the Scottish Government is too closely bound institutionally to Whitehall and WM. After 312 years I would say that the relationship is pretty incestuous. It might have been labelled a government but in real terms it remains an executive where the power and the purse-strings remain centralized in a unitary state. The rest is cosmetics. Some kind of irreversible polarization needs to arise before we can cut free and start anew. But the task of cleaning up our institutions will, even then, take much longer. The roots of colonialism spread wide and go deep.

I suspect only independence can solve this

And then in the right way

Read Robin McAplnie’s book on this

I am biased: it quotes my work

Unfortunately I find this idea that Scotland is a drag on the Treasury and the UK in general rather widespread this side of the wall. It is deep rooted even in people I respect or whom have a modicum of intelligence. Honestly, its deeply engrained in the English psyche.

See blog just posted PSR

You made me do it… 🙂

Always pleased to be of assistance Richard being the rather limited agitator that I am.

🙂

Actually this must all the spin doctors and canapés Fluffy Mundell has been spending Scotland Office funds on. That would explain the rising deficit spending accorded to Scotland.

The true cost is only now feeding through as he shuffles off his ministerial coil. I wouldn’t back any bets that his replacement will be any more frugal mind.

>sarcasm.

Two genuine questions. In this thread you say that when Salmond made his “authoritative” statement in the White Paper in 2014 you said “maybe it was then” but presumably you feel that it is not now.

How does that work? How can an accounting system be “authoritative ” in 2014 but be “CRAp” in 2019?

Because we understand it better

Once we thought the sun went around the world

And then we understood it better

Re Oil revenues falling of cliff! They are still substantial, most taxation is now via Corporation tax paid to London HQ’s , it is highly probably that this Corporation Tax is not

Allocated to Scotland’s Corporation Tax total.

[…] have already commented on the Government Expenditure and Revenue Scotland statement, issued […]

From a slightly different perspective and if the GERS figs are to be believed and IF Scotland is perceived to be responsible for 60% then surely the Scot Government should be shouting these from the rooftops especially to the MSMedia. After all Scots do want to be a heavy burden the larger UK economy especially at a time of catastrophic economic collapse from Brexit. I’m sure then English taxpayers will then be mightily relieved to get rid of us and call for a UK wide Indy ref to secure our Independence. Fight fire with fire as they say.

My suspicion is that the SNP have decided, with the huge media bias it faces, that arguing with these figures has the effect of giving them more oxygen.

My response would be a very simple one. “So the union has destroyed Scotland’s economy. Is that what these figures tell us?” or stuff in a similar vein.

I don’t think there is any benefit in getting into a figure by figure argument with them.There is every benefit in steadily undermining the whole basis of them as Richard Murphy is effectively doing here.

Glad you agree

Another great article Richard.

Let’s not forget the most glaring oversight of all which is the UK Governments intentional mismanagement of the oil industry.

£23bn (251bn NOK) in tax revenue raked in by the Norwegian Government from their petroleum industry last year. – https://www.norskpetroleum.no/en/economy/governments-revenues/

Let’s @lso be aware Scotland has to give up oil

The planet demands it

It is interesting to note that almost half of the “deficit” (£5b) comes from expenditure on “accounting adjustments” that Scots unfairly get to benefit from.

Speaking of which, I’m looking forward to see how the position will change when student finance in England is accounted for properly.

James,

Go to pp 49-51 of the GERS publication where you’ll see that Accounting Adjustments on the Revenue side are largely offset by corresponding adjustments to the Expenditure side. There’s even a table (A.9) showing line-by-line adjustments see you can see where they don’t match exactly. Explanations of exactly what these adjustments are for are sadly not available on a line-by-line basis, but we’re in the territory of arcane adjustments for differing methodologies in source data and such like.

Once again, your GERS articles prove to be crucial backing for those of us in Scotland who need proper information to deflect the yearly Unionist tide of “cannae dae it” against independence.

Thank you very much indeed.

I laughed out loud when I saw the graph showing Scotland’s percentage “share” of the UK deficit. That blatant spike at the end really is something else.

It’s impossible to avoid the thought that Westminster is doing its level best to stack the deck against Scotland, and that puts a completely different complexion on the UK Government’s blank refusal to collect proper economic data for each of the UK’s 4 constituent nations.

Neil, your last sentence says it all. Westminster stacking the deck against Scotland is going to be ramped up, with the new UK Hub incurring costs which will be booked in GERS, and the Scottish Gov’t will be held accountable for this even though it has no say in any of it. I’ve pointed out here before that it’s only a matter of time before the UK Hub initiates policies which are entirely contrary to those of Scotland’s elected Gov’t. This will be a wholly intentional double-whammy: it will undermine Holyrood and simultaneously add cost to the GERS figures, so be under no illusions that this is the Westminster Gov’t’s strategy – death of devolution by a hundred cuts.

A vital means of achieving this is the continuance of fuzzy or non-existent record-keeping for the UK’s constituent parts, as it enables the Westminster Gov’t to fabricate pseudo-statistics to support whatever grievance or policy they wish to enact. The Scottish Gov’t’s new Statistics Department is going to take years to become fully effective (and will be a necessity if/when Scotland decides to become independent), but until then we’re stuck with UK’s fuzzy stats.

The common-sense answer to all this is that countries much smaller than Scotland, such as Malta, Latvia (and etc.) have fully viable economies within the EU, even though they have fewer resources.

An independent Scotland would have (as well as oil), whisky, water (a much underestimated and potentially very lucrative resource), hydro and wind (and tidal) electricity generation, fish and a host of smaller products, and would be entirely capable of self financing, to an even greater level that at present under the hobble of UK mendacity.

Precisely