Much of what I am noting in this blog comes from a recent submission that John Christensen and Nick Shaxson of the Tax Justice Network have made to Parliament on wealth inequality in the UK. Their argument is, in essence, that London does as a result of the excessive financialisation of the UK economy drag money out of all parts of the country and record it in the City and the surrounding area. They use an example that TJN has not highlighted on its website but which I think well worth promoting. As they put it:

In July 2002 HRH Prince Charles opened the Strathclyde Police Training and Recruitment Centre in East Kilbride in Scotland. Now renamed the Police Scotland College at Jackton, the project was part of the Private Finance Initiative.

Latest official data record the project as having a capital value of £17 million (though news reports said the project cost was £27.5 million.) However, the same official data show a stream of payments to the company delivering the project of £111 million over the 26-year financing life of the project.7 This fourfold to sixfold disparity between project capital cost and total repayments is only partly explained by standard discounted financing costs: it would have cost the government roughly £35-50 million had it financed the capital value of this project by issuing a bond paying five per cent interest, and used the proceeds to pay private contractors directly.

Such discrepancies are common for PFI, which is widely reported to be delivering poor value for money: “one hospital for the price of two,” as one expert has put it, with “grotesquely high returns on equity”. It is also well known that excessive financing costs go a long way towards explaining the high costs of PFI projects. However, a more forensic exploration of the corporate structure and financial flows involved provides useful new regional perspectives.

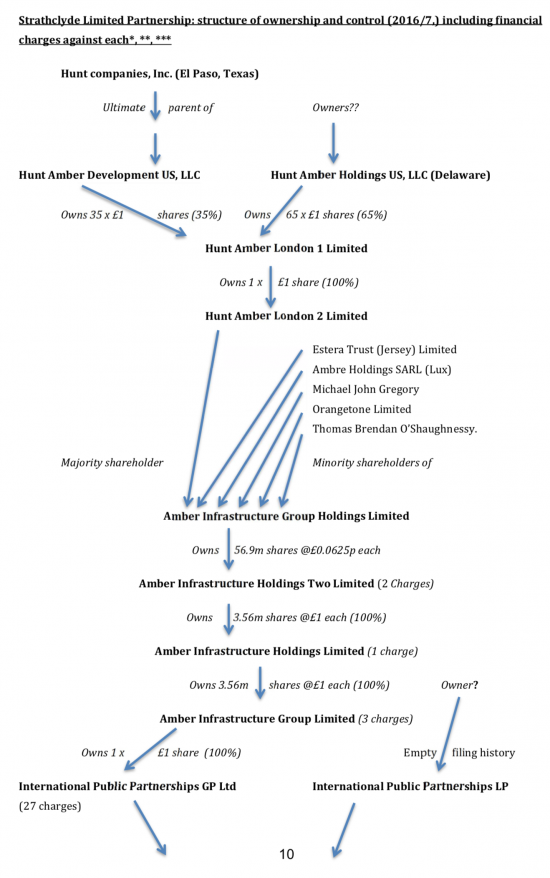

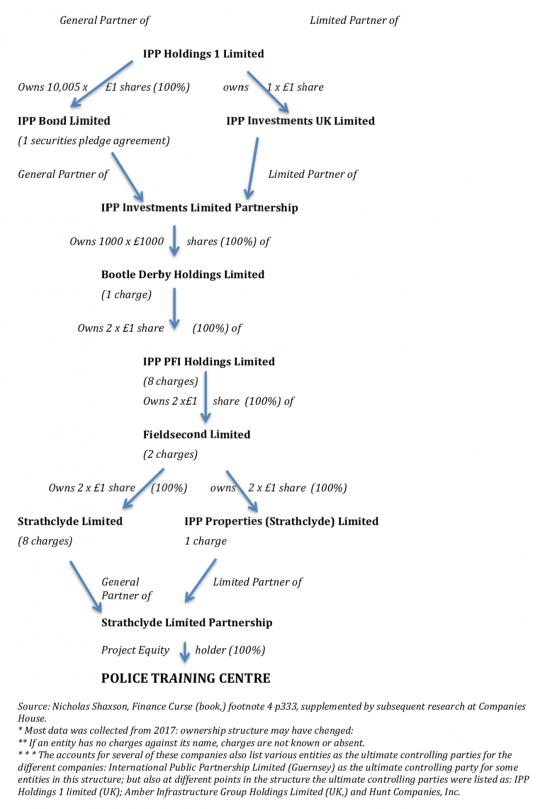

The equity holder for this particular PFI project was officially recorded in the government's 2016 database as “Strathclyde Limited Partnership,” whose corporate structure — and this is a simplified version of the full ownership structure – went as follows (it is not necessary to do more than a skim-read in order to get a sense of it).

As Shaxson and Christensen add:

Nothing remotely illegal is being alleged here. Yet it raises an important question: what is the purpose of this astonishingly complex corporate tower sitting atop a police training centre in Scotland?

The shortest answer is that this is a classic example of the financialisation of apparently mundane parts of Britain's economy. As explained below, this is not an outlier: it is increasingly the way business is done.

Such structures serve several purposes. Some may involve genuine wealth creation, such as the generation of economies of scale, the provision of investment finance, and the efficient pooling of resources. However, alongside these gains, many other, more extractive activities are evident.

Overall, the general purpose of such complexity is for the owners higher up in the corporate tower to obtain maximum possible rewards from a particular arrangement, while shifting maximum risks onto others' shoulders.

I agree: that is precisely it.

And imagine just how much more efficient our economy could be if a police training centre did not have to bear the burden of all that financial admin, the burden of which all does fall onto the state?

I know PFI is ceasing to be used. But the message is clear: these structures have got to go. I have long argued that QE could be used to fund this at fair value, and stand by that argument now.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Great summary Richard.

And I just published something else on this, here, with a couple of extra Boris bits.

https://financecurse.net/uncategorized/how-financialisation-worsens-britains-regional-divide/

Tweeted Nick

Great example of an invidious practice. Add to that the growing use of contactless cards whereby value is similarly extracted and redirected for even the most mundane of everyday transactions. Why should your small local corner shop lose 3.5% to 5% of its turnover (depending on the size of its business) when you buy a newspaper or a bottle of milk? In a simple example say the shop operates on a 20% gross margin. If the owner loses 5% to bank charges for a card transaction it might only be a 5p hit for a £1 purchase but it’s a 20% hit to his gross margin and therefore a substantial threat to his business. It doesn’t affect the purchaser, who is often unaware of the implications, but it sure affects the trader, so why the stampede to a cashless society?

Agreed

Does anyone know the rates usually charged?

Richard, yes I do since we have a card machine. Before we start it is worth pointing out the horror from the finance industry over the idea of the ‘Tobin Tax’ on financial transactions where the rate was, I think, suggested as something like 0.01 %. Anyway, on a debit card you will pay around 0.35%. When debit cards first came in it was a fixed fee of around 15 per transaction, so e.g. paying £20,000 for a new card with a debit card (as I did in 2005) was very economical for the garage. Anyway, the banks changed it to a percentage a few years ago. On a credit card it varies a lot depending on what type of card and whether it is a personal card or a ‘business’ card. For a personal card they typically charge 1.5% while on a corporate card it is usually 2-2.5%. Amex and Diners Club cost the most at more like 4-5%. UK charges are apparently quite low compared to North America where our Canadian partners say they get charged more like 5% across the board. Apparently the whole US payment system is actually very primitive despite their reliance on cards. Very poor security, for example, and lots of issues cross-state or inter-bank.

Anyway, the banks are very happy to put a tax ranging from 0.35% to 5% on every transaction we make, but of course all their own financial transactions in the markets should be totally exempt.

Thanks Tim

@ Ken Mathieson Agreed re card charges – added to which rumour has it the Tesco were originally actually paid for accepting American Express as they had always refused till then! But now they are a bank themselves I suspect they actually pay almost nothing.

But small traders card charges should not be as much as the percentages quoted – nearer 2% for credit cards I’d suggest and about 15-20p for a debit card (still a lot for a low value sale).

But these charges have to satisfy two lots of rent seekers: the ‘acquiring’ bank and Visa/Mastercard.

So more money being hoovered up from the little people by the global corporations. They are in the lead for that stampede to a cashless society.

Apologies for the dodgy arithmetic in my example: the 5p hit extracted from the shopkeeper’s gross receipts travels all the way down to the bottom line where its impact is 5p on a gross margin of 20p i.e. 25% hit to profit, not 20%. Mea culpa – CA stands for can’t add! The rates I used were random choices to “simplify” the arithmetic and were based on figures I’ve come across for card commissions.

It could have been much worse: a B&B owner I talked with recently told me that bookings.com charged her 15% and quoted a charge in their ads which was lower than her standard rates, so she was taking a double hit on such bookings amounting to 17.5%. Given that bookings.com is one of the first sites to come up when searching for accommodation and well before the B&B’s own website, the volume of bookings via her own website was also well down, so her margins further damaged. If her quoted commission of 15% is typical of others like Airbnb, Trivago, Trip Adviser etc, they must be extracting huge sums of money from local economies everywhere

I always try to book direct

I usually get breakfast thrown in when I do for no extra

Financialisation typically entails circumlocution. Transparency is the first casualty of circumlocution. One of the advantages of independence for Scotland is the clean start it would potentially allow in so many sectors; without requiring an over- Herculean effort to clean the Augean stables of over-financialisation.

I have read this and I work out business case appraisals for new social housing developments.

What I have read leaves me totally disgusted.

It was Adam Smith who said businessmen (persons) could not meet, but even for a glass of sherry, but that their conversation would shortly turn to a conspiracy against the public interest.

Yes indeed, and government, Labour in particular, enabled them to turbocharge the conspiracy. https://www.theguardian.com/public-leaders-network/2017/sep/25/private-finance-initiative-lousy-deals-unpicking-contracts-john-mcdonnell

Indeed. To be precise, it was “New Labour.”

In mid-eighteenth century Scotland it was much more likely to be claret than sherry; which was also a much better accompaniment to the main course than an aperitif; the co-ordination of fleecing the public.

Yes claret was common as Scotland always had good connections with France. To be exact the full quote is: “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.”

And I am afraid to say, true

The professions are based on that logic

So are the Masons

And all other such institutions

For those who could afford it in mid 18th century Scotland, I’d guess sherry would have been the aperitif, loads of good claret with the main course, plenty port for afters, before rounding the evening off with some strong ale. It’s a wonder any of the Enlightenment thinking ever got written down!

If I remember correctly the Scottish emergency services are unable to reclaim VAT whilst all others in this union of equals can. An additional cost to the (Scottish) public purse.

The anomaly is not only in Scotland I think

But it is worse in Scotland because of the structure used

This anomaly was corrected in April 2018 after Hammond’s 2017 budget. (The proposal for unified services was, in 2011 supported by Tories and Labour, only for both later to blame the SNP for the “mess”.) Apparently, Mr Hammond had been persuaded by the Scottish Tory MP’s, who despite the Scottish Government and SNP MP’s arguing for several years that the VAT regulations were arbitrary, unfair, inequitable and could be changed if the government had the will, came up with a new and dazzling piece of intellectual dialectic: namely that the Scottish Tories, despite opposing any concession to the SNP, would now be able to claim all the credit for the Chancellor’s magnanimity. The “Roothie” dividend.

Scottish Tories are now blaming the SNP for a “no deal” Brexit.

“Scottish Tories are now blaming the SNP for a “no deal” Brexit.”

Well it’s well established that Nicola was responsible for Brexit. Everybody else was on holiday at the time…..

All this complexity is basically a way of hiding government spending isn’t it. Because government spending is baaaad and we’ve been hoodwinked into a neurotic obsession with government debt.

Gordon Browns ‘Prudence’ was something of a harlot when all’s said and done. And we’re still picking-up her Champagne tab.

Yet another fantastic piece Richard..

This explains, in some mole terms, how the UK public have been ripped off by the rich for the rich …

Delaware?

El Paso?

Wow! Interesting that it starts off with American noses in the trough first.

Delaware – one of the best tax havens for the cognoscenti: https://www.theguardian.com/us-news/2016/apr/06/panama-papers-us-tax-havens-delaware