I publish this for no better reason than information. It's from the FT:

But some thoughts do follow, of course.

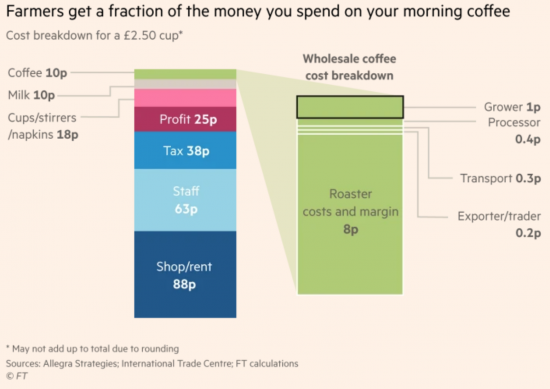

First, how much of the profit is where? Or to put it another way, is it oin the right place? And what is the right place? We need to know. Country-by-country reporting would tell us.

Second, don't grow coffee. Or, alternatively, work out why those who do are still screwed so badly.

Third, when rentiers take the biggest slice our economy really is in deep trouble. Every day, everything we do, is about sending wealth upwards.

Oh, and fourth, the tax is low. If VAT is at 20% that should be about 42p in here. And then tax is due on that profit as well. Something does not add up. Just saying.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I seldom buy coffee from shops and grind my own beans (which I do buy). This seems to be a reminder to keep to doing that.

However you drink your coffee, you cannot get away from the fact that the rich West’s quest for price competition and competition on returns for investors comes at a cost to those who provide the basic ingredients for what we increasingly take for granted. As much as I like good coffee, it still leaves a bad taste in my mouth.

The chosen contemporary narrative for Retail business is that online shopping is destroying the High Street. Both business and media promote this argument. It does not, of course solve the problem for retailers.

What sends retailers ‘to the wall’ is not just the loss of revenue to online, but an unsustainable cost structure; particularly the fixed cost. Compared with online some of these cost comparisons simply cannot be overcome, but at the same time the strengths of good High Streets means some Retail could remain viable; but the cost structure of the High Street as currently established probably isn’t. Service on the High Street is fundamental, so staff costs typically can’t be ‘magicked’ away. They are core features, and probably more important for any viable future in the High Street.

In your £2.50p cup of coffee, 35% of that price was the shop/rent. the coffee accounts for 4%. I wish to focus on the 35%. In the standard media-business narrative the cost selected for attack is tax (local authority tax), but I would hypothesise that close examination of the accounts of retailers should focus more attention on High Street rents and the long fixed-cost leases that often may prevail.

The fact is, in this war retailers are the first casualties.

I draw attention to the UK House of Commons ‘High streets and town centres in 2030’ Report of 21st February, 2019:

[https://publications.parliament.uk/pa/cm201719/cmselect/cmcomloc/1010/report-summary.html#heading-5]

It is striking that the Report chooses to highlight the need for reduction of Business Rates for Retailers, noting business rates account for 1.5% to 6.5% of turnover (for Amazon it is 0.7%). Here the cost of reducing this burden on retailers falls on local authorities, we may surmise with implications for their resources .

On Rents, the House of Commons Report provided only one, limited illustrative list of larger retailers; showing costs of between 6% to 14% of turnover for rents (Sect. 1, para., 24, p.14). Here was a sample of opinion on rents in the UK Government Report (See Sect. 1, para., 23, p.14):

“Rents were also reported to be very high. Clayton Hirst, Group Head of Corporate Affairs at John Lewis Partnership, said that they had “a very large rent bill”, for Debenhams rent was “very burdensome”, and, for Marks and Spencer, it was a “significant cost”. For the hospitality sector, rents were “out of kilter with commercial reality […] leading to exorbitant costs”. We heard that long leases with ‘upward-only rent reviews’ had caused rents to rise to a level that no longer reflected the market; Kevin Frost, Property Director at Cineworld, explained the “trap”: ‘It exists at a number of our cinemas where rents have been set at the very latest record rent in the marketplace, but that is not the marketplace tone. If rents fall away, as they have done over the last two to three years, we are then stuck at an artificially high rent level.’.”

This then is the simple comparison, as best I could establish it from the Report: 1.5% to 6.5% of turnover cost for business rates; 6% to 14% of turnover cost for rents. I could not find mean averages in the report. Which of business rates or rents is going to have the biggest impact on retailers? A simple question.

It appears to me that the media, business and even academia have followed the business rates narrative far more than rents, especially in headlines*. The questions I would prefer to ask are – first, do current High Street rents charged by landlords represent the current revenue earning capacity of High Streets? Second, are business rates as significant a cost impediment as rents; from the evidence produced in the report, I surmise they are not.

I do not argue that all landlords are inflexible over rents, but I do ask for closer examination of the real cost structure of retailing, the nature of the public narrative and how it is being driven; and clear auditable evidence of where the bottlenecks to progress actually reside.

* First, City University of London, 17th September, 2018 report titled ‘High streets are being strangled by council tax and business rates — here’s how to save them’ (well-publicised at the time). Second, Guardian, 4th July, 2018 ‘High streets must stop relying on retail, says expert review’. The article is relatively balanced, the further you read. Up front it cites the Grimsey Report and chooses in the second paragraph to lead the direction of travel with this emphasis: “The Grimsey Review 2 makes a series of recommendations including an overhaul of the business rates system”. Third, Didobi, 20th August, 2018 ‘Death And Taxes — The Causal Link In UK Retailing?’

I could go on, but perhaps you catch the drift?

I do

You make it well…

Mr Davis,

You make some skilfully executed points; albeit it is special pleading. Everybody has business pressures, including landlords; and I have experience in business (confessedly some time ago), on an ‘other side’ of the business equation; paying High Street rents. My point, however is that your eloquent apologia does not entirely disguise the fact that the landlord takes an exceptionally high proportion of the total income generated by retailers, critically as a retail fixed cost, and enough to impact everybody and everything else associated with the High Street; according to your own case, not just the retailer but the council. I am not in a position to debate the policy of lenders, but I think it would perhaps be a little disingenuous to argue it is only in the interest of lenders to have solely ‘upwards only’ rent reviews. If it couldn’t be made to work for landlords at all it wouldn’t be there. Furthermore I think the existence of the convention is rather a function of the fact that in the High Street (until the dot.com revolution), compared with most business cycles, there has been strong and resilient growth to the point it became a standard expectation that rents will inevitably rise. The precedent was set by experience. At the same time, in periods of market distress other business markets traditionally have to adjust rapidly, including changing their pricing. In the case of High Street rents a kind of glacial inertia seems to prevail. Everybody sinks, until only the landlord remains. Whole High Streets die before our eyes and landlords seem to do little more than sit on their hands. There is a precedence for decay over action; and so far little action to oblige landlords either to counteract even the neglect and ruin of the site, or move on. Perhaps they are waiting for some deus ex machina – a ‘Crossrail moment’ – to transform their values, while doing precisely nothing at all. See London, Crossrail 1 and Crossrail 2.

Thanks John

As a commercial landlord I can see how the rent looks like a larger target than business rates to save the high street. But that is because the calculation for rates at market rent X 0.50 (multiplier) is locked in relation to the rent.

So if you managed to persuade / force landlords to lower rents across the high street you would still reduce business rates and the funds available to local government. Rents are often set every five years so quite often they lose their relation to the actual “market” rent. Fixed uplifts using RPI have been available for years but tenants don’t like them, they prefer to try their luck at rent reviews.

And lastly rent reviews are upwards only mostly due to lender requirements, they are very careful over income cover and Loan to Value. Therefore they don’t like the idea of rents falling after then have lent out money on previous calculations in value and income.

Which all rather proves my point

Meantime Government grants to Local Authorites have ceased in favour of LA’s retaining the business rates they can generate – bankruptcy faces us with even more devastation to services. Cock up or extreme right wing plan?

This is no cock up I am afraid. In 2010 government grants made upwards of 80 per cent of local government expenditure. It is intended to be eliminated in the next couple of years with local authorities having to rely on council tax, business rates and other fees they can raise locally.

It does not follow that the demands on local authorities to carry out those statutory duties required by central government are directly related to their capacity to raise those funds locally.

So as voters become gradually disillusioned with their local authorities capacity to fund those projects and services that they would like to have provided for them even though their council tax increases, then yes, it it is aright wing plot

@ Paul Mayor

I agree re Council Tax. ‘Fraid the only solution is for local authorities is to create their own money.

In order to create your own money all you need is:

1 Something to spend it on

2 A method of requiring its compulsory payment

Both of which they have.

That would be proper local democracy.

We cannot do that…not is we want a controlled macroeconomy

Sorry Peter, but that one does not work

much as I agree with all the observations you make regarding the here and now of our bizarre society I find they pale into insignificance as you look a little further ahead,

just published on the Indie website:

https://www.independent.co.uk/environment/climate-change-global-warming-end-human-civilisation-research-a8943531.html

the actual report, only a few pages,

https://docs.wixstatic.com/ugd/148cb0_a1406e0143ac4c469196d3003bc1e687.pdf

and these aren’t tree hugging hippies smelling of patchouli oil, they’re mature gentlemen who’ve spent their lifetime working at the top echelons of the establishment,

in all respects we seem to be heading in completely the wrong direction,

I rather think I’ve reached the 5th and final stage of grief as laid out in the Kubler Ross model,

https://en.wikipedia.org/wiki/K%C3%BCbler-Ross_model

I recognise the risk that the Green New Deal may not be enough…and we’re making almost no progress on it in reality

I agree with Matt B to be honest, look at what’s happening to the CO2 emmisions, ever upward and it even seems to be accelerating, to say nothing of sea level rise, deforestation, plastic pollution, NOx, etc etc………. The more I learn about climate change and our increasingly disfunctional political system the more I am convinced we are headed to a very unhappy place, probably a large scale die-back, in fact sometimes it looks as though it has started.

As wealth goes upwards surely that disincentivises the movers and shakers to actually do something meaningfull, unless of course they are threatened. Perhaps a major dieback is what we need to jolt us into getting our arses into gear. Brexit and Numpty Trumpty will be seen as a minor irritation if/when the climate goes nuts.

Sorry I’ll go back under my rock now,

Desp

There should be 42p of output VAT charged on the sale of this hot takeaway food (or catering). But that ignores the retailer’s inputs. The shop is likely to recover 15p of VAT on the rent (probably opted to tax by the landlord) so only 27p of VAT would be payable by the retailer. The landlord should be paying VAT too, and so on up the supply chain, so there should be 42p of VAT all told, just not all paid by the retailer.

Add 5p of corporation tax (19% on the retailer’s 25p profit) and some business rates (maybe also employer NICs too, if it is not already included in the staff line) and perhaps you’ll get to 38p of tax all told payable by the retailer on this example.

Presumably the landlord is also liable to tax on the rent, and the employees on their earnings (and everyone else in the supply chain: the grower and the roaster, the transport companies, and the suppliers of cups and so on, on their own profits) so the total tax take will be considerably greater than 38p, just not all paid by the retailer, and not all in the UK.

A similar breakdown leads to a convincing argument to pay just a little more for a much better bottle of wine, as then you are paying more than pennies for the grapes.

No hang on….VAT is a tax on end consumption

That’s what the chain ensures

So the retailer may get a rebate but the customer does not

Sorry, I’m right and you’re wrong here

The 2.50 includes a full VAT charge: the retailer is VAT neutral

Add on the 5p or more on profit and that tax figure is way out

All I would add to Peter May’s comment is that another concern over the ‘democratisation’ of local money is that we have to be aware of the problem of debt. The lifting of the debt cap on borrowing from the housing revenue accounts of local authorities for example is welcome in that I and many other affordable housing developers can build new homes.

However, it is still debt and needs to be paid off. Tory Governments are renowned in objective economic circles for the growth of debt in the economy when they are in power. This is because they like to essentially under-invest real/base money (they don’t like investing/printing hard cash). The affordable housing grant (subsidy) rates per new unit from Homes England are paltry and are a lot of work for very little. Development costs are saddling LA’s with more debt. Even if the HRA can sustain it (and indeed it creates revenue from the loans for the HRA) it does not help LA finances when more debt is being created and budgets in other area are being squeezed.

The other issue is that the Tories in particular these days like to squirm out of their commitments in the NHS and to other services. An emphasis on local cash essentially helps break the policy support from the centre further (LA’s essentially exist to deliver national policy at a local level).

Eventually, LA’s will have no option but to do what the housing association sector did – to go to the major banks for money or increase borrowing and borrowing costs (which is yet another mouth to feed). And what did we say about sending money to the top?

There is no silver lining in my view about the chronic under investment of local services from this bastard of a Government (to put it very bluntly – sorry).

And money is a macro and not a local issue

Yes – most succinctly – money is indeed a macro matter.

All the Tories are doing is using the double devolution apparatus of New Labour (designed I think to enable the fine tuning of policy delivery at a local level) to offload their responsibilities based on the fact that they do not believe in Government or the state any way.

That cup, napkin, stirrer estimate is a gross over estimate what the retailers pay, just saying.