I gave a talk in Vienna last night. These were the slides: I hope the logic flows. I will do more posts on tax spillover very soon:

- Austria has a problem with tax

- That Austria has a problem with tax is not a surprise to anyone

- But in this talk I'll show that the problem may not be the one that you think it is

- And that the solution may be much closer to home than you expect

-

What 15 years of tax justice have taught us

- It's more than fifteen years ago that I co-founded the Tax Justice Network

- Since then the message has been

- Multinational companies are not paying their taxes

- Tax havens are a major cause of this problem

- And so is transfer pricing abuse

- Whilst the accountants and lawyers who support these places are the creators of much of the problem

- And that was all true

- And its what many in tax justice are still saying

-

But things have moved on

- We've made massive wins

- Country-by-country reporting - the idea I had in 2003 - is now the law for tax reporting in 70 countries around the world. No one is more surprised than me

- Automatic information exchange from tax havens is happening and I think it's having an effect

- Some advance on beneficial ownership data is being made

- And we expect to win more

- Country-by-country is going to be a public accounting standard - it's just a matter of when

- The tax havens will be ground down to deliver yet more transparency

- And one day EU countries might catch up with them

-

We are winning

- For example

- The IMF thinks that corporate tax abuse costs the world $600bn and tax justice academics Alex Cobham and Petr Jasky think it's $500bn

- The IMF estimate is that this costs Austria US$0.8bn, 1.19% of GDP

- The Cobham / Jansky estimate is $0.54bn or 0.13% of Austrian GDP.

- And I have just estimated the cost of banks shifting profits in the EU - this is unpublished as yet

- I make the total tax cost to the EU from bank profit shifting just €3.2bn in total a year

- And for Austria just €46 million

- I suspect these estimates broadly reconcile

-

In other words

- We're beating corporate tax abuse

- Country-by-country reporting is working

- Pressure is yielding results

- And full public country-by-country reporting should have a massive impact on solving this issue — because no one wants to be the next Google, Amazon or Starbucks

- Real reform of digital tax would help

- So too would unitary corporation tax — but I think that will happen

- We have things to celebrate then, but we have to keep the pressure up to make sure they're all really delivered

-

But don't get carried away

- This is corporate tax avoidance

- Individuals do tax avoidance as well

- And tax evasion is a vastly bigger problem than tax avoidance - and that has always been true

- What is more the problem is not fundamentally one of tax havens now - important as ending their abuse for good is

- The real issue in Europe now is domestic tax evasion

- But don't forget that the corporate tax abuse of developing countries is continuing too — and the SDGs mean was have to still tackle this as well

- To put this in context

- Earlier this year I presented a report to the S&D Group in the EU Parliament on the cost of tax abuse in Europe.

- The key findings were:

- EU wide tax evasion is not less than €825bn a year

- Tax avoidance is between €50bn and €190bn a year

- Total losses could exceed €1 trillion a year then

- Of this sum Austria is likely to be losing at least €13 billion to evasion a year

- This is much higher than the cost of corporate tax avoidance already noted

- How do we know Austria is losing?

- Austria has a substantial shadow economy

- The EU estimate it at about €31 billion a year

- Two peer-reviewed estimates by economists - one for the IMF - strongly supported that estimate - the average of all three was €31bn as well

- And Austria has an average tax rate across all taxes of 43.2%

- This suggests tax evasion costs more than €13 billion a year

-

Austrians are very law-abiding

- Shadow economy estimates for Austria average 8.25% of GDP

- Only Luxembourg (7.98%) Sweden (8.07%) and The Netherlands (8.29%) do better in the EU

- The worst are Romania (29.51%) Greece (26.11%) and Malta (25.42%).

- The average is 16.53%

- Germany is 10.10% and Italy 23.28%

-

Is €13bn worth ignoring?

- I suggest not

- You have a problem with tax

- But not the one you thought you'd got, I suspect

- So what can be done?

- The answer is a tax spillover analysis

-

Tax spillover analysis

- A new idea

- A tax spillover analysis measures the impact, whether favourable or unfavourable, one part of a tax system has on another part of the tax system

- A new methodology to appraise this risk has been developed by Prof Andrew Baker of Sheffield University and myself

- Search our names and journal name Global Policy to find it

- What we propose is a qualitative appraisal of eight high risk parts of the tax system

- The aim is to find the biggest problems that are easiest to put right with the greatest chance of getting more tax

- Doing a spillover appraisal

- The spillover checks risks created by at last four taxes:

- Income tax

- Corporation tax

- Capital gains tax

- Social security

- And four areas of tax administration:

- Tax policy / politics

- Tax administration

- Company and trust law administration

- International tax laws

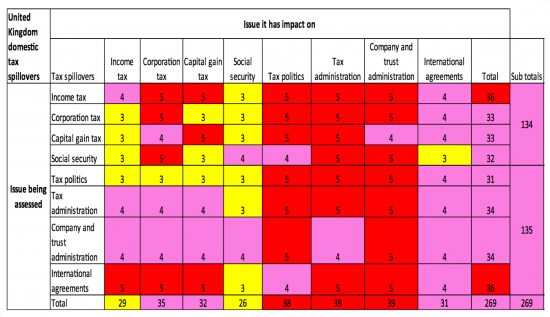

- And fills in a grid with marks on a scale of one to 5 — with 5 being the biggest risk

- This is the UK domestic spillover risk table:

- The UK tax system is in deep trouble

- From politicians who seek to undermine its effectiveness

- For a tax administration that hasn't got the resources to enforce the law

- And a company and trust administration system that lets tax evaders hide their money from tax authorities — and get away with it

- That's why the right hand side of the table is so red and the left hand side not so much so

- It's really not good

- So we lose vastly more tax than you do

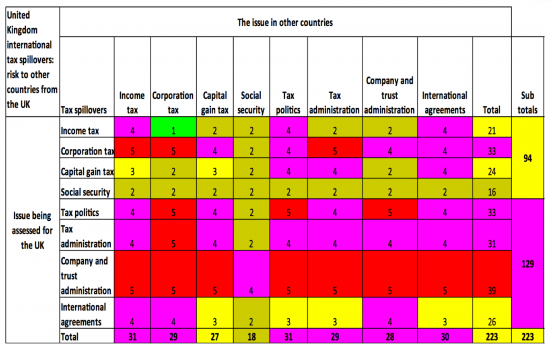

- But internationally, we're not so bad

- The UK's a threat to the world

- The chart is very red — still — especially because we form companies for less than €20 euros with no anti-money laundering questions asked

- But the point is — what this chart shows is we could massively improve our tax spillover situation by taking some simple actions

- And I strongly suspect it's the same in Austria

- You can solve your tax problems

- But you'll need to do a tax spillover analysis to get best value for money from doing so

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Tax Spillover analysis – this is fascinating – can you give us more detail on what the numbers in the tables mean? What criteria do you use to determine the risk value between two catagories?

When you say improvements can be made by some simple actions – what are these? Do we just look at the red boxes and assume those are the areas that need changed? To me it looks like everything needs changed! I think I am just asking for a bit of and explanation on the tables here,,,

Have you read the paper?

I will publish the support notes to this analysis in due course – but due warning, they are 28,000 words….

I will get back to you though

Ohh, yes, now I think about it, you have talked about this analysis before – I was too distracted at the time I think to check it out. Hmmm, 28,000 words. ‘Support Notes’ – longer than the paper itself??

I haven’t read the paper, but I think I can find it…

It’s linked in there

Add in the ‘how to do it’ manual the support notes are 45,000 words….

Anyone want to publish a book on tax spillovers?

Jesus what about the carbon footprint? did the cost justify the benefit? Isn’t this the sort of thing the extinction rebellion was protesting about?

I have already said I will review such trips in future

On this occasion I would say the benefit was worth it

Bout I am, of course, aware of the issue