I read with interest an article by Prof Adam Leaver of Sheffield University published by Open Democracy yesterday. I should, stress, Adam and I do know each other: we are in fact bidding for two grants together right now (which does not mean we will get them).

Adam has done a lot of work looking at outsourcing. In the article he looks at how Interserve, which has now failed, paid management bonuses on the basis of re-stating profits in ways wholly inconsistent with the accounts of that company, triggering liability for massive payments to directors when the company was facing insolvency. The whole article is worth reading, but I highlight this comment from Adam's conclusion:

Interserve is an allegory for late capitalism's dysfunctions, where capturing gatekeeper positions inside a firm rather than generating real value drives economic outcomes and inequality.

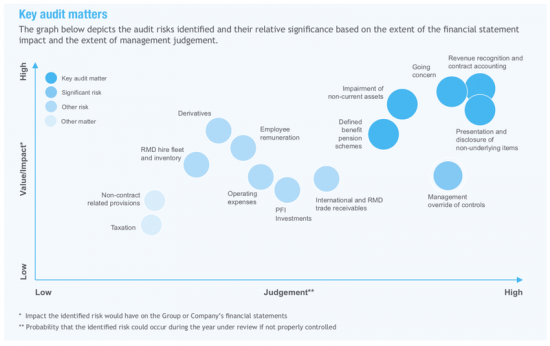

And I also pick up one of his diagrams, which was in this instance appropriately offered by Interserve auditors KPMG on where the audit risk they faced was located, in their opinion. It shows this:

Note what is in the top right-hand corner, where risk is greatest. It is all the areas where discounting can most readily influence income recognition. In the light of my recent comments on this blog on the dangers arising from the use of this technique in accounting I am amused by this confirmation from an unexpected source of what I have been saying. The faux science of discounting is not science when it comes to financial reporting. It is instead in far too many cases bogus cover for management judgement used to smooth earnings to suit management purposes, with that judgement used to reward a few at cost to the many involved in any company.

Note what is in the top right-hand corner, where risk is greatest. It is all the areas where discounting can most readily influence income recognition. In the light of my recent comments on this blog on the dangers arising from the use of this technique in accounting I am amused by this confirmation from an unexpected source of what I have been saying. The faux science of discounting is not science when it comes to financial reporting. It is instead in far too many cases bogus cover for management judgement used to smooth earnings to suit management purposes, with that judgement used to reward a few at cost to the many involved in any company.

I do not dispute the value of discounting at the right time and in the right place. For investment appraisal if you wish; for internal contract accounting if you desire; for estimating cost when making funding decisions, and so on. It has a role. But the wrong tool used in the wrong place creates the opportunity for abuse and alternatives to discounting are available in financial reporting, and those alternatives that offer greater degrees of certainty with no less accuracy (and all financial reporting involves trade-offs between these qualities). In that case the alternatives should be used, precisely to thwart management who might otherwise be tempted to abuse, which no one can afford.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Ok, so what are these better alternatives to discounting?

Discounting itself is not what makes those audit matters in the chart above risky. One of the nice things about discounting is that you know exactly how it is done, and at what rates, so it adds zero uncertainty to an audit. So no added risk.

I get the feeling this post is just you trying to “win” the argument after being made to look like a bit of a fool on the last thread.

In most cases the alternative to discounting is historic cost at the lower of cost and net realisable value

That we do know, and it’s prudent,which protects creditors, which is the requirement of accounting.

Now I accept it may not always be the answer – but let’s start there for now

And if I might say so, your suggestion on discounting is absurd. Discounting nonsense does not create risk free audits: it creates massively risky audits, as even KPMG adimitted

And let me also add that of course I was the person trying to win. Society does not need failed audits, and dire accouting, which is what it is getting. I am seeking better accounting. I can’t lose when what we have is so bad. The question is why are you supporting failure? Maybe you’d like to explain? I hardly think I look the fool by saying so. The problem is all yours – and your tone makes it clear.

You seem at best very confused.

Discounting is only applicable to future cash flows. Historic cashflow are realised and therefore do not need any form of discounting.

So please tell me how you would account for known future cash flows, not some nonsense about historic ones which are rather easy to deal with.

Discounting adds no risk to an audit. By definition. Any discounting of future cash flows must be declared, including the method and rates used. This makes it easy for someone else to replicate the calculation. There is literally no difference in the risk between the discounted present value and the non-discounted future value.

KPMG don’t at any point say discounting creates audit risk. Certainly not in the chart above. You are being disingenuous to suggest it does. Perhaps you could point out EXACTLY where they it creates “massively risky audits.”

Society may well need better audits, but that is nothing to do with the simple, mathematical process of discounting.

That said, I think the real reason you have to win an argument is nothing to do with this at all, and much more to do with what is typical behaviour of a narcissist. You are unable to admit that you don’t really understand what you are talking about whilst claiming to be an expert on all things. The last thread made very obvious that you don’t really have a clue.

Elliot

I thought you’d come out as a troll: and you have. Rather strongly.

But let’s note for a moment that what you say is also really rather odd. There are, of course, assets that have a historical cost based on cash flow that are not valued on that basis in accounting because other models, often involving discounting, are used. I sought to resolve that issue. But you chose not to notice. I suspect that’s because you do not understand.

With respect, I think that I have shown time and again that the problems of comprehension here are all yours.

I think you need to withdraw before you embarrass yourself still further, and I’m going to be happy to assist that process.

Richard

Discounting to present value ONLY applies to future cash flows, asset or liability. By definition. There is nothing historical about it.

Any historical or realized cash flow or asset (should the need to modify it exist) would be dealt with by means of write down, depreciation or amortization.

If anything, dealing with writing down or depreciating assets is more open to abuse than discounting, which is purely a mathematical process and requires no judgement call on value.

This is basic accounting. So what you are saying above is simply incorrect. You are flailing around trying to try and prove your point. I would suggest you stop digging your hole.

I challenge you to find a single example of a future cash flow on a balance sheet which is not dealt with by discounting, what model is used and how historical cash flows are somehow involved when dealing with future cash flows.

I think the only person embarrassing themselves here is you, by spouting gibberish whilst claiming to be an accounting expert.

Oh dear Elliot

Do you really think current trade debts are discounted? But they are all about future cash flows

And you really think discounting has less judgement to it than depreciation?

I think you need to crawl away now

This correspondence is very definitely closed. You really are being very silly.

Nice try but no cigar.

Current trade debts (classified as between 10 and 90 days) for goods already recieved are not discounted because….they are current! Clue is once again in the name.

You could claim this is a special case and maybe it is, but because they are treated as current there is no need to discount.

As for depreciation: yes judgement often has to be used. Have you depreciated that asset on a linear basis, or is there some other amortization schedule? This is far more open to manipulation than discounting, which given a present value cash flow and the discount rates will always get you to the same future value.

So try again. I assume though that you are likely to simply claim victory (despite once again getting things wrong) and maybe as a last resort use the cowards route and block me?

Put it this way. It is probably a good thing that you aren’t a practicing accountant any more.

You made a claim

I proved you wrong

No go away and play with those jets you claim to have lots of

I hope their fly by wire is better than your accounting with discounting

Where did you prove me wrong?

You still haven’t been able to say how you would treat a cashflow 2 years in the future – other than simply not including it in the accounts.

How can discounting a cashflow at a known rate ever be manipulated? Are you saying that mathematics somehow changes? Because given a present value cash flow and the discount rate used to generate it there can literally be only one answer for the future value in my experience. Yet you say that this is open to abuse. How exactly?

You didn’t even understand current trades debts properly. They are called receivables and accounted at present value for goods and services already rendered. Not for goods and services rendered in the future.

I’m afraid you might have convinced yourself that you are right, but very few others are likely to agree with you, outside the bubble of your blog. I think it says a lot about you though, that despite not being able to properly answer any of the questions you are still claiming you are correct. You have made errors of basic accounting – and I do mean basic – yet are claiming to be an expert. As I said before. Typical narcissist behaviour. You are the kind of person who thinks the world has made a mistake in not recognising and rewarding their self perceived greatness.

I am looking forward to your campaign to ban discounting in accounting and replace it with guesswork. You will probably be given a Nobel prize, or at very least a peerage for it.

Or maybe just laughed at.

Actually trade debts are debts in my book

What you reveal is that you are regurgitating, unthinkingly, prevailing thought

And yet you know exactly what I mean

So yet again, the problem is all of your making

And what you still don’t get is GIGO: that processing garbage, however well, produces garbage

So spurious accuracy may well (not always, but may well) be worse than a heuristic that people understand

Like calling debts, debts

And saying that the sum due in two years is what is owing, and that interest will be accounted for in the meantime

Of course, in the case of leasing and other transactions that do not state an interest rate then one may need to be computed, but that apart the requirement for discounting is very small indeed

And we even used to do that via a sum of the digits method and no-one batted an eyelid and anyone could understand it – which is more than most can do of discounted values where the assumptions are too often pulled from thin air

But I very strongly suspect that comprehension is the last thing you want

ow, very politely – stop maligning another FCA. It’s unprofessional conduct. Maybe you weren’t aware of that fact.

Trade debts are debts….ok.

So it should be easy enough for you to tell me if your company is owed a trade debt receivable, which column of the balance sheet it goes into: assets or liabilities?

A sum owing in two years time won’t have interest accruing. That’s the whole point. You don’t owe anything now but you do in two years time. Yet another basic mistake on your part.

Sum of digits might have been fine for small amounts in short timescales, but it is not adequate for large amounts over longer horizons. Not least because it is not accurate.

Discounting uses no assumptions. Zero. None. Do you understand this? When you discount a future cashflow you have to use the most suitable interest rates available – typically that of the government bond market – and they are observable. Nothing is pulled from thin air, as you wholly incorrectly claim.

As for accuracy, you keep avoiding that part . You are claiming that your guesswork method, or on the last thread simply leaving out future transactions because they are not yet realized is somehow more accurate than full disclosure at present value.

What you are saying is pure nonsense. Don’t you think people would want to know if a company has made contractual obligations which would affect its balance sheet, and how much they are worth? By your logic this is not important.

I do want comprehension. Though I doubt I will get any from you. Nor am I maligning you. From what you have written above and on the last thread it is clear you don’t understand basic accounting. I do not think you are competent given what you have said.

Not that you seem to have a problem maligning other accountants yourself (you hypocrite) – you do so all the time attacking the big four.

I come to a conclusion Elliot: you are really very worried that I might expose all you believe in as being a charade that maintains your economic and social status but which is bogus. Hence the fear that underpins your anger.

But let me ask you some questions about the aircraft you’re buying. Tell me:

A) How do you know their life?

B) How do you know how regulation will change during their lives, impacting cost?

C) How do you know that demand will remain for your planes?

D) How do you know what costs will be charged for externalities during their lives? When will they be introduced? On what basis?

E) How do these factors impact your projected cash flows?

F) How do you know?

G) So what is your plane worth?

H) How do you depreciate it?

I) How do you know?

J) Wouldn’t a heuristic be better?

I could ask more.

K) What are interest rates going to b over these planes lives?

L) Now tell me how discounting is wholly objective?

Oh dear. Here we go again – lots of questions (which I will answer for you) which show you have once again not understood the accounting.

I notice you are trying to drift away from the initial point – which was about discounting for known future cash flows – and have now moved on to questions asking how things can be accurately accounted for when we can’t predict the future. Well, nobody can, so we have a set of rules which try and mitigate and control in a standardized way how things are treated.

Whereas you seem to just want to guess or ignore. How would that work exactly?

A) You don’t know an individual aicraft’s exact useful life. This is not a problem though in practice. Useful life estimates are pretty good, as are estimates for all the underlying components. Then there are accounting rules (IATA) specific for aircraft which tie in to IAS37.

B) We don’t but again IAS37 means accounting provisions can be made. I’m not really sure what your point is here.

C) Again, we don’t, but this is not a balance sheet issue. It is a revenue/profit issue, which sits on the income statement – not the balance sheet – as any accountant should understand.

D) We don’t. But again, dealt with under IAS37.

E) I assume you mean when you ask this question, how this relates to revenues, given the aircraft purchase prices are (essentially) fixed, even if for a future delivery date. So again, if is revenues, the this is nothing to do with balance sheets.

F) How do I know what? What a stupid question. Nobody can predict the future precisely. Are you suggesting we can???

G) Initial purchase price less depreciation, or market value. The former is accounting based, using IATA/IAS rules, the latter is market based. You know exactly how much an asset is worth if you sell it.

H) IATA rules. IAS16 for components (which have to be treated separately)

I) Again, a stupid question. The future? How do you know? You haven’t actually said how your guesswork or ignore version of accounting would be more accurate.

J) I see you have found along word on the internet, and decided to use it. Heuristic methods, otherwise known as rules of thumb or guesswork, are probably not a good way to go about accounting and are judgement based. How could you realisitically make such a system work, standardize it across an industry and then make it more accurate and less open to abuse. The mind truly boggles that you are suggesting this type of thing would be better.

K) Doesn’t matter. Once the asset is realized interest rates have nothing to do with their accounting treatment. Again you don’t seem to understand this. They only matter when discounting the present value of an future, unrealized asset.

L) OK. Let me try and explain this in a way even someone as simple as you can understand.

It is basic maths. Multiplication. Unless you have a different way of doing that, it is wholly objective. You have very little choice in what discount curve you use (and extensive regulation governs that) and the discount rates you use have to be disclosed.

So, if I show a future asset on a balance sheet at a given value, and then (by law) state the rates used to calculate that present value, there can literally only be one future value of that asset. One which anyone with a pocket calculator can work out.

Wholly objective, unless multiplication is somehow “not objective”.

I honestly can’t believe I had to answer that last one, but I have answered all your questions. So why don’t you return the favor and answer the question from my last post. I’ll repeat it for clarity:

“So it should be easy enough for you to tell me if your company is owed a trade debt receivable, which column of the balance sheet it goes into: assets or liabilities?”

Debts are debts, as you say, so which side of a balance sheet does it sit on? Should be easy for the Professor of economics and accounting expert? Right?

So you’re agreeing that discounting applies what you describe as objective science to unknown data and that the result is certain

I despair

I really am wasting my time

This debate really is over

I feel sorry for your employers