I tried to engage with Simon Wren-Lewis and Jonathan Portes on twitter yesterday with regard to the questions I had raised on Simon's tweets to me, made earlier in the day.

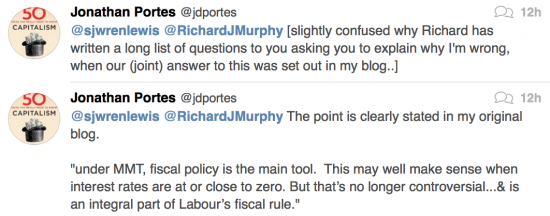

In fairness, Jonathan'scontribution was short:

Before becoming patronising:

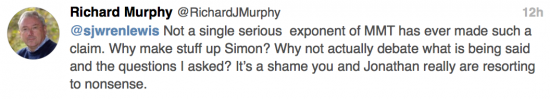

I say that is not true, because this issue really is complicated, whatever Jonathan might like to suggest. In that case Jonathan's intervention, which was in effect to repeat that MMT is nonsense, only a little more loudly, was not helpful. The 'Englishman abroad' approach to argument rarely works.

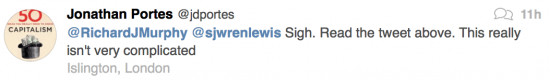

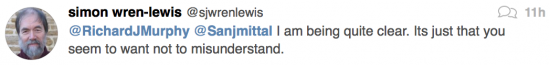

I persevered with Simon, although he too was not above abuse, saying at one point:

And then this:

I found that more than a little perplexing when I had actually gone to the bother of asking some serious questions requiring serious answers. To describe the above as unflattering to Simon is to be kind, I think. He's taught for long enough to know that if someone does not understand you have to try something different.

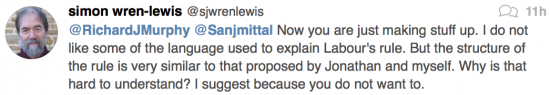

I did not give up. And there were some useful admissions:

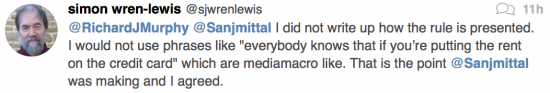

This could be taken at face value, of course. And should be. The framing of the rule is crass, and he knows it.

But it is deeper than that. What this says is that the political economy of this is not the same as the economics. And that matters. But I think Simon and Jonathan dismiss that. They should not.

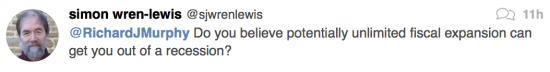

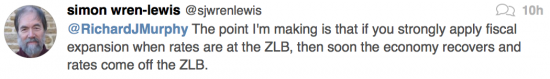

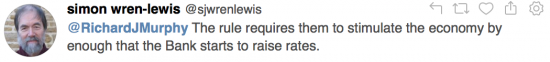

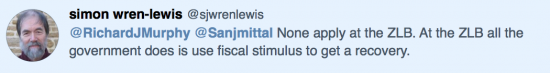

I continued to pose questions. And eventually (I say that, with feeling) I appreciated what Jonathan and Simon do not understand and why therefore they do not understand what I am saying. The critical tweets were these:

To which I replied:

I did so thinking Simon believed he was stating my position.

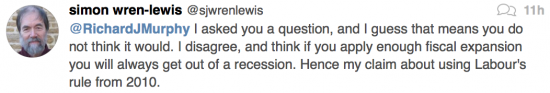

But actually, it was his that he was presenting:

To which can be added this:

And this:

And at last it dawned on me why we were talking at cross purposes. I offer the following explanation, which I hope is fair representation.

I asked these questions, for the record:

What I would like Simon to do is show how he and Jonathan Portes have written, as he claims, a rule that delivers a real-world political economic solution (because that is what Labour's rule is, because it is not an academic paper) that is the same as modern monetary theory. And I want him to show this even though:

i) The rule he has written works subject to financial constraints, and not the constraints of the physical economy, and

ii) It does so even though it requires a balanced current expenditure budget and modern monetary theory quite specifically does not;

iii) MMT does not set time limits for actions to resolve funding issues and the Portes / Wren-Lewis rule does.

What Simon said in direct response was:

Or, in other words, he assumed my question away, saying that for the last decade it did not matter as we should simply have done fiscal policy. Unlimited fiscal policy, in fact. Enough fiscal policy, in fact, to ensure that monetary policy could be restored to use, because that, as Jonathan and he see it, is the right ordering of economics (see the earlier blog on this theme for evidence of that).

But what that means is three things. First, in Simon and Jonathan's view economic policy is being run for the sake of economic policy. Its aim is to restore monetary policy. Second, that means the aim is to put bankers back at the heart of economic policy, and not people. And third, the aim is to restore finance as the constraint on activity instead of that limit being the available resources within the economy i.e. the goal of establishing full employment.

The objectives I pursue and those that Portes / Wren-Lewis pursue are then fundamentally different. I am seeking a stable, sustainable economy with full employment. They are seeking the restoration of the model of central bank monetarism that existed from 1999 to 2008 in the UK, with well-known consequences.

In the process, the Portes / Wren-Lewis model would deliberately stoke inflation to the point that interest rates would have to rise, even though there is little doubt whatsoever that this would be harmful to the economy and would precipitate a banking and credit crisis, reduce employment and push many households into bankruptcy and homelessness.

And the consequent monetary policy would also, of course, be used to limit spending and so constrain necessary government action i.e. it would have to be linked to austerity because a deliberate boom and bust cycle is the objective of the Portes / Wren-Lewis model. This is the only way I can read what has been said. This has horrible overtones of all that used to be said about Old Labour.

Worse, though, Portes and Wren-Lewis both imply there is no difference between this and MMT since, I now realise, Portes really does think MMT is just an excuse for the same fiscal policy that he would promote. And that is emphatically not true.

MMT would never seek to push up the inflation rate to the point that interest rates have to rise. It seeks low inflation and low or no interest rates as a matter of policy. And it would avoid the boom and bust the Portes / Wren-Lewis model seeks to stimulate by noticing the real constraints in the economy and preventing over-heating before it happens. That is the MMT goal. But the Portes / Wren-Lewis model wants to overheat, by choice. They could not be more different.

No wonder I did not understand. Because, I confess, I did not. I had no idea someone could be putting forward such a plan as Portes and Wren-Lewis are doing as if it was a serious economic policy for Labour.

For the avoidance of doubt, let me summarise that plan. First, write a plan as if monetary policy works even though it has not for a decade. Second, plan to overheat the economy with unlimited fiscal expansion until there is inflation in the system. Then restore power to bankers to power to prove you needed a plan where they were in charge, after all. Then let them increase interest rates. Let them crush the economy again. And in the process do reignite austerity at untold cost. Whilst doing that ignore the fact that people will suffer badly on the way and a banking crisis may be ignited as debt burdens become unmanageable. Ignore too the environmental impact of this policy.

That's the Portes / Wren-Lewis plan. All wrapped up in the story of the maxed out credit card.

At least I understand now. I admit, I did not beforehand.

Simon concluded with this tweet when I said I was giving up for the night:

There may be remarkably little else.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Bearing in mind that both Wren-Lewis and Portes were Treasury civil servants it suggests that my Treasury letter that said straightforward government spending would lead to inflation http://www.progressivepulse.org/economics/hm-treasury-says-mmt-is-correct can be a conscious policy – and all to put the Bank of England in charge again.

That really is government capture by the City of London. The BoE is then in charge of moderating inflation – and tax doesn’t seem to get a look in.

Until, presumably, we get back to tax and spend….

For the Treasury ( and its former staff Portes and Wren-Lewis ) to acknowledge the reality of MMT is to acknowledge that government does indeed create money when it spends, which it does all the time. In the ivory towers of Islington the very idea that the great unwashed might get to know and understand this is simply beyond the pale.

Don’t I remember you saying you were going to do less blogging in 2019 and take more of a back seat? Doesn’t look like it. But I think we should appreciate the effort.

And is SRL being honest but confused when he equates “unlimited fiscal expansion’ with “enough fiscal expansion” to get out of a recession or was he deliberately setting a trap? I think he is probably being genuine. I think he only really sees the tip of the iceberg when it comes to MMT.

The important thing is whether the Labour Party abandon their “fiscal rule” and genuinely tackle austerity. By sticking to eliminating the deficit in 5 years instead of the Tory 10 years is not going to do this. Have Portes/Wren-Lewis any valid advice rather than singing from the old hymn sheet and being in hock to the bankers and markets? It seems not, they are desperate to retain their reputations and egos ever nervously watching the Daily Mail et al over their shoulders.

My gob has been well and truly smacked. Do they know nothing of history, of how we got to this place, have they not seen the capture of government and central banks, have they not noticed the poor getting poorer while the rich have got richer etc etc?

Perhaps Labour need a new slogan: Socialism in no country.

I could not work out why I could not get what they were saying

I had no idea we were so far apart I had not a hope of doing so

No Graham,

They just would to get things back to business as usual so that put monetary policy can be put back in charge again.

Apologies for appalling typos.

Easily forgiven

My sympathies to you Richard and congratulations on your stamina in continuing a debate with these people. The real tragedy is not that they don’t understand but the fact that McDonnell and Co think they do. Could be a long painful learning curve.

There’s still one obvious thing missing in all of this that needs to be resolved and that is whether Quantitative Easing would still be an option for the BoE (MPC).

Labour’s Fiscal Credibility Rule gives the MPC the authority to ‘suspend’ the fiscal rule when ZLB conditions occur. Now…

If Quantitative Easing is NOT an option

then the MPC’s authority is merely ceremonial – they get to tell everyone what we would already know – that interest rates are zero (and it is then assumed that fiscal policy takes over).

If Quantitative Easing IS still an option

and the MPC has all the authority to decide what happens, then they might resort to old habits and introduce QE again as a response to zero interest rates. In which case they may not suspend the rule (?)

As far as I can tell the fiscal rule (the relevant bits are at the start and end – see link below) is not clear on this. Perhaps I am missing something(?) If I am not then it is something that definitely needs to be cleared up.

http://labour.org.uk/wp-content/uploads/2017/10/Fiscal-Credibility-Rule.pdf

You are right

And SWL made no mention of QE at all

I raised this with them on Twitter this evening. There was no response, at all. The comment was completely ignored, even when repeated

This is big as well as being unavoidable within the context of this discussion

For my part I feel a bit silly that I hadn’t thought of it before.

There is of course the possibility that some sort of understanding exists (a protocol, stated or unstated) whereby the BoE requires the consent and co-operation of the government before introducing or expanding QE. We’ve seen letters between Osborne and the BoE that might infer that(?). It is also likely that, if this is so, then Portes and Wren-Lewis, both of them ex-Treasury, might know something about it.

This possibility however is not sufficient to answer the question about QE as an option (under Labour in ZLB conditions). The fiscal rule nominally accords all of the decision making authority to the MPC, so the question still remains as far as we know.

BTW their non-response is intriguing to the say the least. If there was a readily available answer I suspect that you would have received it by now.

At this stage I think that we may be on to something.

Just one more thought (sorry, but I want to get in ahead of the game with this one).

If my suspicion re. QE is correct. then neither SW-L, Portes or Labour need to react defensively to the question. I know that, from their point of view, they would not want to change the fiscal rule as that may bring unwanted attention. But they wouldn’t have to. They could tie up the loose end with another, separate rule, policy statement or directive about QE (in some other area at some other time).

At this point I’m beginning to wonder if I’m doing someone else’s job for them (and its not yours).

🙂

Seriously . Labour’s Fiscal Credibility Rule is a piece of eyewash. ‘ Anything that contains the statement ‘ Following discussions with world-leading macroeconomists and the Shadow Cabinet we have decided to adopt a Fiscal Credibility Rule which will underpin Labour’s fiscal position . ‘ Translation : we know you think we are a bunch of financial incompetents so guess what we’ve consulted some unknown academic types which we trust you will believe give credence to what we are about to tell you ( even if you don’t know who they are ) and we’ll call it a Rule with a capital ‘ R ‘ and then you will definitely believe us because ‘ rules is rules ‘ right ! And when we describe the rule ………….please stay awake. LOL .

Amen. If there was a chink in the Corbynite revolution. You nailed it.

They should listen.

[…] debate on Twitter between Simon Wren-Lewis, Jonathan Portes and me on Labour's fiscal rule was resumed last night, and continued long after I'd dropped out to go to bed. I'll comment […]

[…] Simon Wren Lewis, the rule’s author’s it would seem. It got a little testy. Anyway, here’s Richard, detoxifying, or not the twitter spat, and making the point that the Fiscal Cre…. because it acknowledges the monetary constraint, and not the real world one. Murphy refers to his […]

Thank you for your persistence Richard and intelligence for uncovering this blind spot in understanding.

There seems to be an issue of power hungriness /invincibility from the Treasury officials in seeking to regain monetary power despite their previous misuse, failure and abuse of that power – e.g. The failure to guide R B S Nat west to behave properly to customers and HMT have recently been caught out in open court seeking to protect Treasury officials who had pushed deliberately or were mislead to bilk Mr Morley vs RBS of his property assets. In that case the judge told the bank to unredact the papers showing HMT officials involvement in the Asset Relief Programe ARP.

10 years of failure at systemically important banks, selling quality assets cheaply to overseas buyers, a bank that only grew because the Treasury allowed RBS to buy the four times bigger safe Nat West then play double or quits in buying ABN Amro. The same with Bank of Scotland and Halifax takeover. All this seems to me to show that the HM Treasury team might have more than a few Corporate Psychopaths (See Prof Clive Boddy) in their midst and flawed decision making processes. HM Treasury also had 18 officials seconded to the Brexit Department the largest from a single department and that has gone . . . . I might be wrong what do you all think?

All that spare time HMT since Gordon Brown handed over interest rate setting task to the MPC has in my view been put to some bad uses. Not least in my view removing/damaging credible opposition to Gordon Brown becoming PM after Blair.