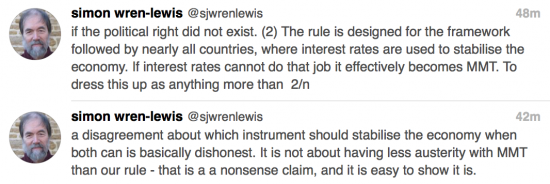

Simon Wren-Lewis made an interesting claim yesterday in three tweets:

This is, of course, a response to the debate on MMT and the Labour Party fiscal rule which has so far been discussed in the context of Jonathan Portes' claims with regard to it and MMT, which latter idea Portes has described as 'nonsense'.

Simon's claim is very different. He does, if I might interpret his comments, say:

a) He and Portes have offered a standard neoclassical (which many might reasonably call neoliberal, given its political economic framing) model of a fiscal rule within the framework of the existence of an independent central bank, which for political economic reasons (such as a lack of democratic co0ntrol of key economic policy) I fundamentally oppose;

b) He and Portes recognise that such models cannot work now, given that the problem of low or no net interest rates exist (the zero bound he refers to), but they did anyway frame their plan on the presumption that monetary policy can work even though they recognise it will not;

c) This apparently makes it a good rule, although why that is the case is very hard to understand when there is little or no chance that the conditions in which it might operate will be seen in the foreseeable future;

d) This is apparently so because other countries also make the mistake of using such rules;

e) But if, by chance, the real world experience of the past decade continues to prevail and low or no net interest rates continue then in practice the Portes / Wren-Lewis rule actually delivers MMT, even though Jonathan Portes thinks that 'nonsense' and no explanation as to how this claim can be justified is provided; it is just stated that it is easy to show.

So my question is, I suppose, inevitable. What I would like Simon to do is show how he and Jonathan Portes have written, as he claims, a rule that delivers a real-world political economic solution (because that is what Labour's rule is, because it is not an academic paper) that is the same as modern monetary theory. And I want him to show this even though:

i) The rule he has written works subject to financial constraints, and not the constraints of the physical economy, and

ii) It does so even though it requires a balanced current expenditure budget and modern monetary theory quite specifically does not;

iii) MMT does not set time limits for actions to resolve funding issues and the Portes / Wren-Lewis rule does.

What I would also like to see is Simon's own explanation of why MMT does work, since he accepts it does, and his explanation as to why Jonathan Portes is wrong in that case.

Of course, the explanation can be theoretical, but I should add that this is really about the political economy. This would not matter nearly so much if Labour had not adopted the Portes / Wren-Lewis rule. So the explanation has to work at that political economic level as well: i.e. the power relationships inherent in the two approaches also have to be the same for the challenge to be achieved as that is what political economy is concerned with.

I have enough respect for Simon to be sure he has made a claim in good faith that the outcomes are the same. I await to see how that is the case because I admit I cannot see how that might be true.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Interesting.

I’ve followed the MMT threads from a position of little knowledge of MMT (as someone in another thread said ‘ therefore not entitled to an opinion’) and seen the responses to contributors who say this is not helping the ‘selling’ of the MMT proposal to the general public (who have also been described as ‘stupid’ by others).

I accept that this seems to be an academic debate, however do you not think that as soon as the MMT principles are published to the general pubic for support the the differences between yourselves will be magnified as each faction will defend their position and it could soon descend into the Monty Python ‘Peoples Front of Judea vs Judea Peoples Front’ farce level?

The differences with Jonathan Portes are pretty fundamental, I’d suggest

The Portes / Wren – Lewis model is designed for a world that, in my opinion, no longer exists and endorses an idea (independent central banks) which I cannot reconcile with democratic control of economic policy, let alone co-ordinated policy

“Democratic control of economic policy”.. the problem with more state intervention & political control is that the electorate do t trust politicians on bit and want power dispersed not centralised. They are right as well.

There is remarkably little evidence of that in the UK

Politicians are despised!!. Even more since this survey

https://www.ipsos.com/ipsos-mori/en-uk/politicians-remain-least-trusted-profession-britain

So?

Does that mean people really want rid of them? Or want better politicians?

Steve,

I am not sure how that comment relates to the power of an unelected yet independent central (yes, central) bank whose power is neither democratic nor “dispersed”.

I think what they are trying to say is that the rule allows its self to be ‘suspended’ in ZLB conditions whereupon fiscal policy (whatever fiscal policy is preferred) takes over.

Personally, I don’t like the idea of it being “suspended”. I would prefer that it was expelled. Monetarism has had its time, it hasn’t worked for ten years , let it go , I say. It seems that Portes and W-L wan’t to keep it in cryogenic storage like the dead Walt Disney just in case favourable conditions return.

I see monetarism (both the earlier Friedman version and the current ‘rate targeting’ variety) as the demand management regime that gave us permanent unemployment for nigh on 40 years. I’m pleased to see it fail and fade into history.

BTW Portes’ Prospect article seems to have created a debate where the discussion about Labour’s fiscal rule and the “discussion” about MMT are blended in as if they were one and the same. Well, they are not the same. They are two separate issues – related (sort of) – but separate.

It might be a good idea if they remained separate. It could avoid some unnecessary confusion.

I think I got into the SWL mind set tonight

I will reflect on it overnight

I do not agree with it

SW-L appears to be saying he’s perfectly happy for fiscal to take over from monetary and do the MMT business at the ZLB (i.e. probably always and for ever more).

JP’s article is trying very hard to rubbish MMT because of his misinterpretation of SK’s article (which could be viewed as a satire on the anti-deficit position of the wealthy, rather than a holistic description of MMT policy).

What are we supposed to think?

What you get if you abandon control of the base rate to stabilise the economy (if it ever did) is not really MMT. Portes and Wren Lewis say that because they want to pretend MMT to simply mean the use of fiscal policy instead – which of course is one part of MMT but not by any means the whole idea. They are simply trying to pretend the difference between their rule and MMT is trivial so we don’t really need to bother with MMT.

The point about MMT is that it completely transforms how you look at the economy and the role and scope of money and government within it. It makes obvious all kinds of possibilities which neoliberalism denies. The full implications are staggering and world changing. So we have to sell people the whole shooting match not just a small part of it. I think giving in to what amounts to a sop from Wren-Lewis at this stage would be a dreadful mistake.

But I do take very seriously the problem of selling the idea of MMT to the public. But I am equally serious that it absolutely must be done. And the Neoliberal ideology spouted by our government ministers is clap-trap which must be shown to be baseless nonsense which is both illogical and without corroborating evidence in the real world.

And I do see the problem of making it sound academic too. The basic ideas are subtle and hard to grasp. And even when you can grasp them it is easy not to see the huge significance. So very careful precise explanation is necessary – but who wants to sit and listen to careful precise explanations?

I think we have enough genuine experts in the subject who do take the time to explain MMT carefully step by step which for people like me is excellent. (And I don’t have the problems with Bill Mitchell and Warren Mosler that Richard does. I do get the impression that their disagreements may not actually be very significant at bottom.) But that sort of thing will not do to convince people who are not interested in economics and don’t trust experts anyway.

I think we need a completely different skill set for that. One approach that I like would be not to expound MMT at all but simply to relentlessly oppose those very successful but incorrect little memes that are trotted out all the time on TV like government budgets are the same as family budgets. Or that government spending must first be ‘funded.’ In fact I long for the time someone on TV will reply to the question ‘How will you fund that?” with the answer “That really is a stupid question” and then explain why. I know the first time it happens the explanation will be met with incredulity. But after the 20th time? Intelligent people at least will think about it. And in my defence can I just remind doubters how successful the relentless Tory propaganda was about blaming the 2008 financial crisis on Labour. For five years no Tory politician would answer any question on any subject without saying first “It was Labour’s fault…” And it worked. All we need to do is be equally relentless telling the truth about their fantasy economics. And using explanations based on MMT without actually mentioning it. Let our opponents bring up the topic of MMT if they want. If they then ask for an explanation give them something practical like an explanation of how austerity doesn’t save the country any money or explain how saying a government with a sovereign currency and a sound economy cannot afford to fund the police properly is always a lie.

I know it will not be easy and I can remember Richard doing a spot on a London radio programme where he did exactly the kind of things I have just said but got a pretty frosty reception. But I am confident that reception will improve in the future. I am also hopeful of a few newcomers to TV discussion programmes. Grace Blakeley and Aaron Bastani seem to me to have a good grasp of MMT and can be effective speakers. And Ann Pettifor and Mariana Mazzucato occasionally appear too. I especially liked Grace’s story on ‘This Week’ about austerity being like a bar which cut more and more of it’s drink menu and closed more often till it lost all its customers and closed down. And I long to see someone quote Randy Wray’s “What does an economy run on? … Sales! And what drives sales?… Spending!”

There is a lot to do I know but I am hopeful. But I am certain that Richard is doing the right thing replying as he has to Portes’ article. And the longer he can keep that debate going the better. But keep the tone respectful and friendly.

Anyway to quote ‘This Week’ again; It’s late, very late and I am going to bed.

Thanks

I suspect there is more to this than meets the eye . Ever since 1951 the Tories have succeeded in portraying Labour as being incompetent in the management of the economy aka ‘ money ‘ . And they have done so successfully. Over these years, and especially since Blair took the party sharply to the right, politicians of both parties have become ever more in thrall to rich men and big business and for any politician on the left , especially Corbyn that presents a real problem : how to convince the electorate that he can advance policies which are not neoliberal whilst at the same time are seen to be

‘ sound ‘ economically. The public cannot be ‘ sold ‘ MMT ; it is just too remote from their everyday lives. And this I think is where Portes and Wren-Lewis come in with their ‘ rule ‘ i.e. it can be used by Labour to say to the public ‘ look you can trust us with the money – why we’ve even gone so far as to create and impose upon ourselves a rule intended to prevent things getting out of hand ‘ . Remember Portes was at the Treasury ; say no more. But their rule potentially gives Labour cover should it ever get elected.

The problem with this position – if indeed I am right – is that it maintains the status quo , politically and economically.

See comments to be made by me this morning

[…] tried to engage with Simon Wren-Lewis and Jonathan Portes on twitter yesterday with regard to the questions I had raised on Simon's tweets to me, made earlier in the […]

What’s not clear to me in the way this debate is panning out is whether the Portes/Wren-Lewis …proposal..position whatever we think of it as ….is founded on a misunderstanding of what MMT says and therefore how money works and a sound economy can be constructed;……….. or whether it is principally a pragmatic exercise in pretending Labour believes one thing while intending to deliver something different if it gets into office.

Is this whole discussion just a PR exercise in pretending economic orthodoxy in the hope of being able to win an election without seeking actual informed consent. ? If this is the case I think its intellectually lazy and I think it will backfire.

There is mention earlier in the thread of the Tory trope, oft reiterated, that 2008 was all down to Labour mismanagement. And they got away with that because the Miliband era leadership never resisted it, nor made an effort to point out that it was the Darling/Brown administration that rescued the economy in the wake of the banking/financial crisis, and Cameron/Osborne who then wrecked it again with Austerity.

If politicians dissemble it leaves the public bamboozled and democratic consent becomes meaningless; it all comes down to buying votes with vacuous (and false) campaign promises of jam tomorrow.

They claim it is not a PR exercise

I suggested it was and was told in no uncertain terms otherwise

But they would say that wouldn’t they, whether it is or not.

[…] I noted very recently, this last point is what I think the Portes / Wren-Lewis rule to be. It is a rule written to […]