The OECD has published new data on corporation tax, acknowledging, as much of my recent research has found, that a great deal of that available to researchers is extremely poor. I welcome the move, but have not had a chance to test this data as yet.

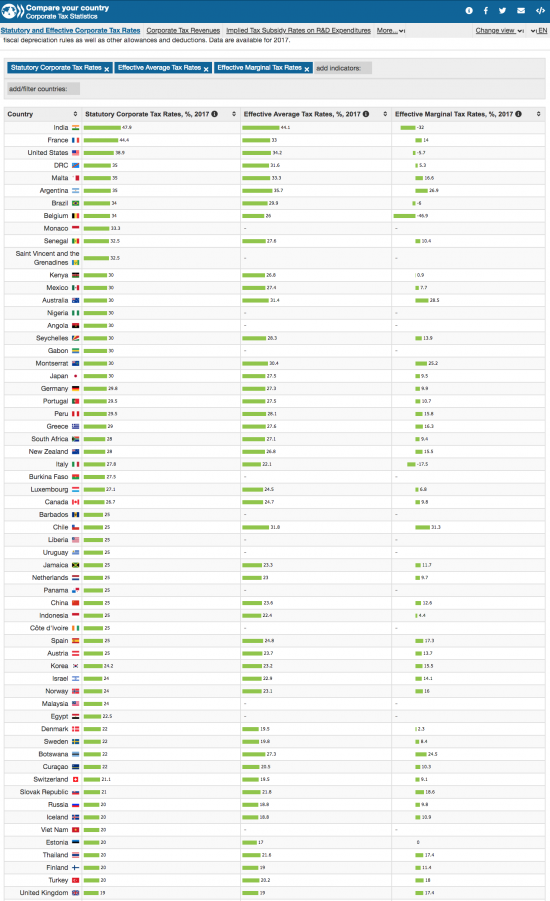

One thing I can show is this table on headline and effective tax rates in 2017:

I have not done correlations or anything so sophisticated as yet on this data. What is, however, clear is that headline and effective tax rates in many countries are quite similar. I cut the chart off at the UK, by the way: it was already getting to be quite small. There are, of course, places with lower rates.

It also happens that I am also finding this outcome right now in the research I am doing.

I would stress, that this probably relates to large companies, in the main. Data is harder to find on smaller companies as accounts are hard to locate.

And I would also stress that this does not preclude profit shifting. Tax avoidance can exist despite this suggestion.

But if it is true what it does suggest is that many countries are recovering most of the tax they expect from their tax rate. And that is a claim that does need further consideration. I leave it on the table.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

There is a basic but very complicated problem. If you have a global economy with a communications digital internet base then it is very difficult to have a national corporation tax that is wholly effective. In some instances it is almost impossible. Add to that the levels of corruption etc. in many states the grim, very grim, conclusion is that the taxes will have to come from somewhere else.

I entirely disagree

We cannot have the corporation tax we have

Demetrius!!

You’ve given up too easily!

Come on now! Tighten yer belt and straighten your back.

“And I would also stress that this does not preclude profit shifting”

Most corporates have been doing this for decades. In the 1980s Sony (who I worked for) had a TV factory in Bridgend. There were a significant number of Japanese engineers – with varying levels of competence (whether they were needed was another matter). They were all charged out at consultancy rates (I know this because I could see the rates on my budget). Thus did Sony recycle profits back to Japan. Fact: on a UK turnover of circa £400 million/yr in the 1980s – Sony paid no UK tax. I am not picking on Sony – I have no doubt other Japanese and American companies and German ones etc did exactly the same.