As I outlined last December, the European Union's decision to put Jersey, Guernsey and the Isle of Man on what was, in effect, their tax haven grey list was very bad news for these places. As I noted then, the EU reasoning was as follows:

The explanatory note to this listing said:

The EU Code of Conduct Group has given itself the right to decide whether, on a broader construction which no doubt considers both outcomes as well as legislation, these places are putting into place regimes that do encourage artificial relocation of profits.

I confirm that they do just that. ... Corporate profits make up 67% of the GDP of the Isle of Man. For comparison, they make up 21% of the profit of the United Kingdom, which might reasonably be used as a benchmark. Jersey and Guernsey are similarly abusive, and no doubt Cayman and Bermuda are likewise. Therefore, as a matter of fact, the EU Code of Conduct Group test is failed by each of them: they do provide facilities that do encourage the artificial relocation of profits without the economic substance of the related transactions that give rise to that profit being located in the islands.

The Code of Conduct Group has, then, set up a test which these islands do, as a matter of fact, fail. And the reason why they fail is inherent in the tax system that they put in place by 2012 to get round the original requirements that the Code of Conduct Group expected them to comply with in 1997. Way back then that Group made clear that differential tax rates to encourage the artificial relocation of profits were not acceptable. What they presumed would happen was that there would be a levelling up of rates: they did not expect the levelling down that actually took place. But what they are now clearly indicating is that the continuing abuse justifies further action.

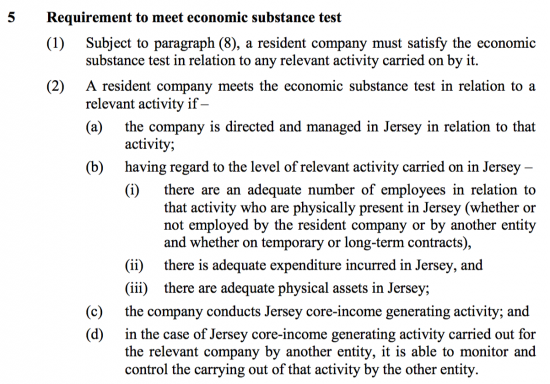

Now Jersey has published its proposal as to how this will be dealt with. This is, in my opinion the key clause:

I have bad news for Jersey. This is really not going to work. There are two fundamental reasons for thinking so.

The first clue is in the first line of paragraph 5(1). This provision only applies to Jersey resident companies. As I noted in December that is about 13% of Jersey companies. The rest are non-resident. Jersey asks nothing about those companies and so has no data to share on them under automatic information sharing regimes. And that is precisely what the EU is worried about. The supposedly resident companies do, of course, create tax problems and artificiality has been rife amongst that population. But the big tax haven problem is that there are very large numbers of Jersey companies about which nothing is known at all. The EU wants to know about them. Jersey is doing nothing at all to address that issue with this proposal. The result is that as I noted last December:

The EU has demanded that they prove that they do not facilitate the recording of profits to which no local economic substance can be attached but Jersey has no clue what profits are associated with the Island and so it has no starting point to answer the question. And that is because:

- Contrary to all international standards no enquiries are made of most companies;

- There is a policy that deliberately ignores companies incorporated outside the Island trading within it;

- The tax administration clearly lacks transparency because it has been decided that it will not collect the data to provide it.

The results is that:

- Internationally incorporated companies (at least) are being offered an effective level of taxation which is significantly lower than the general level of taxation in the country concerned;

- tax benefits are reserved for these non-resident owned companies, at least;

- tax incentives are provided for activities which are isolated from the domestic economy and therefore have no impact on the national tax base, and the fact that Jersey chooses not to collect data on the scale of this does not change the fact;

- there is granting of tax advantage even in the absence of any real economic activity;

the basis of profit determination for companies in multinational groups may well depart from internationally accepted rules because their permanent establishments in the Island are ignored;- there is a lack of transparency.

Or to put it another way, all the criteria for tax abuse within the EU Code of Conduct on Business Taxation are being met.

Secondly, as I also predicted last December, even with regard to resident companies I suggest the measures will fail. This is because I think Jersey has completely missed the point of the EU requirement. The test is not just that there is economic substance in what happens in Jersey, although that is important. It is also that this does not artificially induce the relocation of profit. So proving you do something, which is what Jersey is seekingbthat it's suppisedky resident companies do, is not enough. They must not also make disproportionate profit in an apparent attempt to secure a tax advantage. I said last December that this would require much more radical reform than Je set is apparently considering:

I would suggest that a total reform of the corporation tax systems has to be on the cards. Firstly, they will be expected to have a corporation tax. Second, this tax will be expected to be set at a rate that does not encourage the relocation of profits. Third, as a benchmark for what that rate might be I strongly suspect that the Code of Conduct Group will look at comparable income tax rates on the island, which are 20% in each case. Anything significantly different from this will, I suspect, require some tortuous explanation.

As a result I predict that this latest attempt will not in anyway satisfy the EU. I predict that Jersey is still in deep trouble. And if it is not, then the EU initiative is coming to nothing. But Jersey should take note: they are well aware that I have form in this area and have always tended to call these things right when they get them wrong.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It could just be some conspiracy theory but I vaguely remember someone saying that the reason May triggered article 50 when she did was specifically so that this rule from the EU could be ducked.

This rule will apply to Jersey whether we ae in or out

Or course, we may not have to apply it to Jersey but I would not count on that yet.

The struggle to comply while not doing so has long been the fate of the slave and peasant too. Resistance to change components are used across the board. Can the EU “send the boys round”?

large numbers of Jersey companies about which nothing is known at all.

I’d like the names of a few of these companies that declare they are not resident in Jersey, but which the EU and yourself believes is a problem for Jersey to resolve in addressing their own tax-haven ‘greyness’. It would make it easier for non-accountants to understand the difference and why it matters. Thank you in advance.

I have provided the evidence that Jersey admits that 87% of all Jersey companies are in this position

No one knows where these companies might trade, inclduing Jersey, and it refuses to ask

That’s the whole issue

“I have provided the evidence”

There is currently a cloud hanging over your evidence. When will you blow this cloud away by answering the criticisms levelled at you by the parliamentary report into your tax gap figures?

A good way would be to find an independent expert to review and confirm your figures. Can you find someone to do this? Anyone?

I am having a paper peer reviewed right now

Well you can forget these Public Registers for BO.

https://jerseyeveningpost.com/news/2018/10/30/former-bailiff-hits-back-at-mps-finance-register-claim/

As you well know, we can legislate and you cannot stop us doing so

That’s why UK Politicians are coming over to plead with us to.

It is always nice to ask