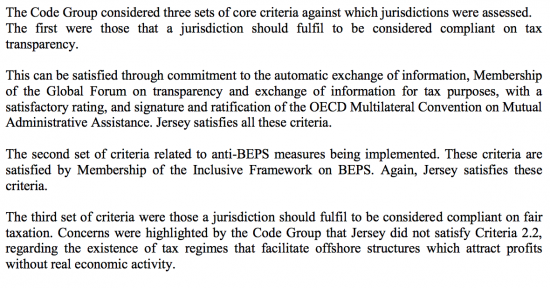

The EU's new tax haven black list published last week, had, as I've noted before, an interesting ' grey list' attached to it. Included in the grey list were the UK's Crown Dependencies and some of its Overseas Territories as a result of this comment:

I have already offered some detailed commentary on the consequences, but this blog elaborates those concerns, with evidential support. That evidence comes from Jersey as a consequence of questions asked of the Chief Minister of Island by States of Jersey Deputy Geoff Southern, quite coincidentally, in September and December this year.

This blog is in four parts. The first assembles the data from the questions Geoff Southern asked. The second assesses that data and suggests its consequences. In the third part I lay out some of the challenges this gives rise to. Fourthly, I suggest the questions that Jersey needs to address now. Finally I suggest what this might mean for the Island.

It is my belief that very similar questions could be asked of all the other jurisdictions noted in the grey list. I would add that because that is my belief I will be sharing this blog post with the Director General for Taxation and the Customs Union in the European Union.

Because the issue I am discussing is of such significance I make no apology for the length of this post. The challenge that the EU has put to the Crown Dependencies and Overseas Territories is significant: an evidence based approach to addressing it is required and this blog starts to set out a way in which this might be done.

The facts

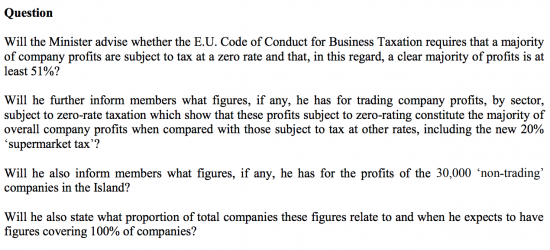

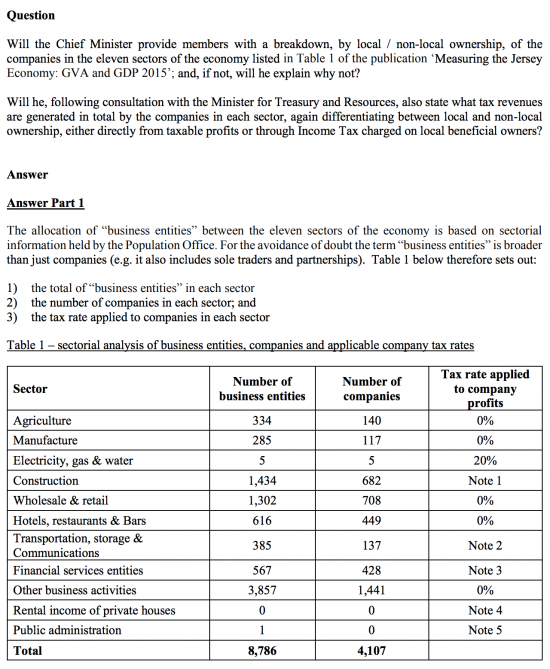

Geoff Southern's main question of interest was raised in December 2017 (number 632), after the release of the EU black list, and asked:

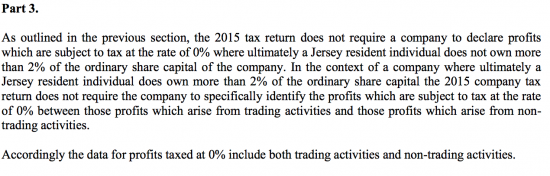

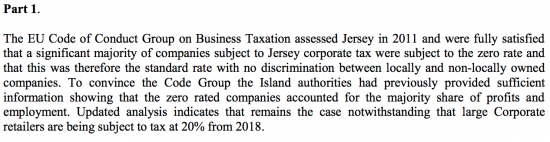

The purpose of his question was, I think, to discover whether the conditions that had eventually led to Jersey having its tax system approved by the EU Code of Conduct Group on Business Taxation still persist. This is implicit in the first part of the question. The answer was about as vague as could be:

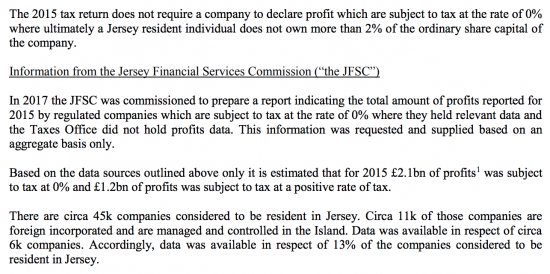

Much of the answer to the second part of the question appeared to be obfuscation until this was said:

Part three to the answer also provided little in the way of clarity :

Whilst in conclusion the answer said:

Whilst in conclusion the answer said:

Which is tantamount to an admission that nothing at all is known about the 11,000 foreign companies managed in the Island right now.

It is fair to say that the information provided is not a model of clarity. Written question 504 from September 2017 adds some elaboration:

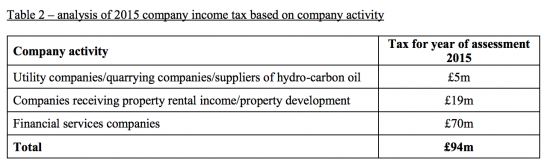

These companies apparently paid this tax:

And it was reported that:

Assessment of the available data

It is important to note that the EU Code of Conduct relates to business taxation, which is interpreted as meaning tax on company profits. That is why company data is critical to the issues being addressed to.

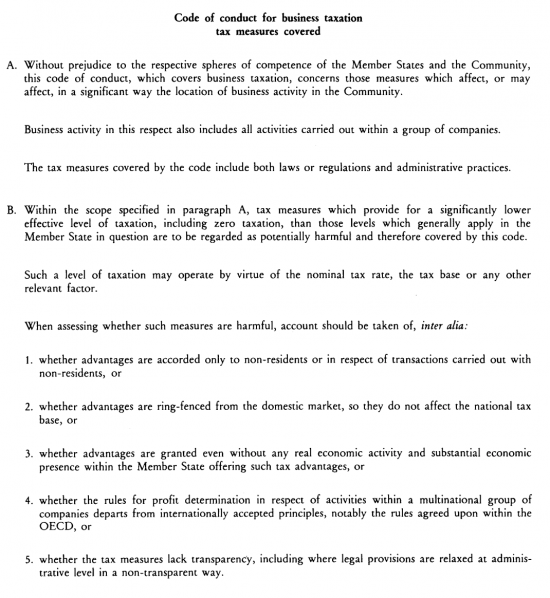

What the Code said in 1997 was that:

That I am aware of this still remains true. As assessment criteria go they're useful.

The information provided in December suggests that:

- There are, apparently, 45,000 companies that are resident in Jersey;

- Of these companies appeoximately 34,000 are incorporated in the Island and 11,000 are resident but incorporated elsewhere;

- The States of Jersey only hold data on the trading of 6,000 of these companies. That is 13.4% of the total.

- No information is requested on foreign owned companies with permanent establishments in the Island and so the nature of their activities is for all practical purposes unknown to the Island.

The September data adds the following perspectives:

- Of these companies just 4,100 may be trading. This is 9.2% of the total. 90.8% of companies do therefore fall outside the tax system it seems, although evidence to prove that this is correct is not available in 86.6% of cases: the Island takes it on trust that this is true.

- Tax paid is settled by a maximum of 1,250 companies, and it may be very much less than this as that total includes all companies in the construction sector, many of which are likely to be untaxed in practice under Jersey law.

This data implies that:

- A maximum of 2.8% of companies linked to Jersey pay tax, and the true figure may be lower than that;

- Jersey has little or no idea what 86.6% of the companies that have links to the Island might do. That is because questions aren't asked of them as a matter of choice.

- Of total personal income taxes paid in Jersey more than 44% arise from the distribution of profits from Jersey companies implying that profit deferral for tax purposes by the use of local companies may be widespread;

This last point is significant in the context of total Jersey tax revenues:

The issues this data gives rise to

There are significant implications arising from this data.

First, it implies Jersey has no real idea what its real GDP might be because it has no idea what the vast majority of the economic activity linked to the Island is. This is why it, admittedly, focuses its own attention on estimating its Gross Value Added because the truth is it simply cannot estimate GDP as it has not got the data to do so. The difference may be colossal. In Ireland GNI may be 26% less than GDP because of flows that do not actually relate to Irish activity: in Jersey it may be much higher.

Second, this implies that Jersey has no real idea what proportion of profits recorded in Jersey by companies have any real relationship to the Island.

Third, what this then means that Jersey cannot really know whether the profits it thinks are appropriately declared as arising in Jersey are the right ones or not because it permits Jersey related companies to make no declaration at all, at their own discretion, and some are bound to abuse this.

Fourth, that then means Jersey can have no real clue as to whether the correct tax is collected in the Island, or not, because it simply does not know what the true potential tax abuse of the Island might be.

Fifth, this has serious ramifications for Jersey's international obligations with regard to tax because it clearly implies that the Jersey tax authorities do not know where else in the world Jersey companies should be declaring tax because it does not make enquiry of them to find out.

Sixth, that then means that Jersey does not have the information to share with those places might have the legal right to tax those profits, which means that it is failing in all the commitments it has made to effective tax information exchange.

Seventh, and of greatest relevance of all at this moment, taken together these facts mean that Jersey simply cannot answer allegations that profits might be artificially relocated to the Island without associated economic substance because it just does not have the data to know the answer to that question.

The challenges this data gives rise to

These conclusions appear indisputable. It is hard to see how the data Jersey has provided lets any other conclusions be reached. And because Jersey has never made enquiry of most of the companies associated with the Island it cannot provide alternative data to refute them. But this now presents Jersey (and any of the other places grey listed for similar reason that hold no more data than Jersey does) with a near insoluble problem. The EU has demanded that they prove that they do not facilitate the recording of profits to which no local economic substance can be attached but Jersey has no clue what profits are associated with the Island and so it has no starting point to answer the question. And that is because:

- Contrary to all international standards no enquiries are made of most companies;

- There is a policy that deliberately ignores companies incorporated outside the Island trading within it;

- The tax administration clearly lacks transparency because it has been decided that it will not collect the data to provide it.

The results is that:

- Internationally incorporated companies (at least) are being offered an effective level of taxation which is significantly lower than the general level of taxation in the country concerned;

- tax benefits are reserved for these non-resident owned companies, at least;

- tax incentives are provided for activities which are isolated from the domestic economy and therefore have no impact on the national tax base, and the fact that Jersey chooses not to collect data on the scale of this does not change the fact;

- there is granting of tax advantage even in the absence of any real economic activity;

- the basis of profit determination for companies in multinational groups may well depart from internationally accepted rules because their permanent establishments in the Island are ignored;

- there is a lack of transparency.

Or to put it another way, all the criteria for tax abuse within the EU Code of Conduct on Business Taxation are being met.

What Jersey needs to do now

Jersey, and quite probably the other locations involved, now need to address the issues that this data gives rise to. I would suggest that first it would seem that Jersey has to agree that it does not have the data that the EU will require that it supply to address the challenge it has to address.

Second, Jersey has to suggest how it will secure the data it now requires and what it will do if it is unable to secure it, as would seem entirely possible.

Third, it has to, for the sake of all companies that use the Island and all those who are dependent upon them doing so within its economy (which is approximately 50% dependent upon the financial services industry) say what plan it has to resolve this issue in 2018.

Fourth, it has to spell out the future of the zero / ten tax policy, which the EU Code of Conduct Group on Business Taxation now appears to be signalling is unacceptable to them.

Fifth, it has to say what reforms it is proposing in that case. Since businesses always say that two of the great attraction of the Island are its stability and certainty it has to suggest what these reforms might be at the first possible opportunity or those qualities are lost.

What is clear is that the EU is insisting on change, and based on past precedent it will secure it from Jersey. But in that case the information Jersey must demand from companies associated with it is bound to alter fundamentally and that might, in turn, fundamentally change the way it is expected to tax them.

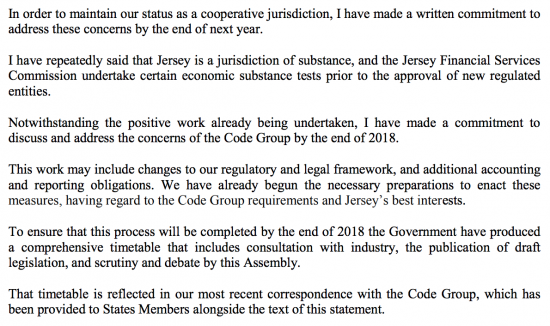

In fairness, it is appropriate to note that the Chief Minister (Senator Ian Gorst) did make a statement on these issues last week. He said all the usual puff about Jersey being fully compliant with all standards asked of it and then added:

The last is the key issue of course, and relates to the Code Group's 1997 standards. This is where Jersey failed. In response he said:

The last is the key issue of course, and relates to the Code Group's 1997 standards. This is where Jersey failed. In response he said:

I am sure that the Chief Minister has his own opinion on what is required but my suggestions are that Jersey (and the other places impacted on the grey list) will now, at a minimum, be expected to:

a) Require that all companies incorporated in or associated with the Island by way of a permanent establishment file a set of accounts and tax return with its tax authority annually;

b) That those companies will be presumed to be taxable in Jersey in all cases unless they can evidence that they have declared their profits to another tax authority and have either been or will be assessed to tax in another place on the resulting income;

c) That Jersey will have to revise its GDP calculations to show the full scale of profits recorded in it by companies associated with the Island so that the full scale of the difference between GNI and GDP as a result of the relocation of profits to the Island for which no locally associated economic activity can be identified.

The implications for Jersey

The changes that these three suggestions will make to Jersey are dramatic. First of all, Jersey will no longer be able to ignore the activities of companies incorporated by it which claim to trade in other locations as a result of which Jersey asked the no information from them. Instead it will have to:

1). Collect accounts and tax returns from them;

2). Determine whether or not they are really tax resident elsewhere;

3). Exchange the resulting data with the places where they claim to be resident, whether that is true or not;

4). Assist those other places in recovering the tax owing to them if they cannot secure it directly;

and, maybe:

5). Have to tax those companies locally.

In other words, Jersey will cease to be a location where 87% of companies can trade anonymously, and without account for their actions to any tax authority, anywhere. Not to be too unsubtle about it, this will shatter forever Jersey as a corporate tax haven. And remember, this process has to be under way by the end of 2018.

What we will also learn, at least during a transitional period, is just how much profit has been relocated in this way. No doubt, and in due course, this practice will be stopped by the changes that will take place.

I should also stress that I believe that these changes will also be required of Guernsey, the Isle of Man, the Cayman Islands, the Bahamas, Bermuda, the British Virgin Islands, and maybe some other locations in the British Caribbean. I have long argued that the European Union has been one of the most effective organisations for the delivery of anti-tax haven measures: I believe that this latest move will prove that this is the case.

And if in any doubt read between the lines in what the Chief Minister has said. His reference to 'our regulatory and legal framework and additional accounting and reporting obligations' does, I think mean something very close to, if not exactly, along the lines that I am suggesting. He may be trying to put an optimistic spin on this, but the reality is that Jersey, and many of the other UK tax havens may now realise that their days of selling abuse are numbered. Whatever the weaknesses within the EU Code of Conduct Group on Business Taxation, and they exist, we should thank them for this.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

If there is a hard Brexit will all this still apply? Because if not, this may be the reason why certain politicians would prefer no agreement with the EU, do you think?

Yes it would: the list is worldwide and 27 states can still apply it

Merry Christmas :- Jersey, Guernsey, the Isle of Man, the Cayman Islands, the Bahamas, Bermuda, the British Virgin Islands, and other locations in the British Caribbean 😀

You’ll like this……

https://flipchartfairytales.wordpress.com/2017/12/18/the-uks-brexit-options-are-limited/

Thank you

Now blogged

Richard

As mentioned by me on other threads, a Singapore-style or Hong Kong-style territorial tax system will address all of these issues with a 10% or 12.5% tax rate. Yes, accounts will need to be filed with the Jersey tax authorities and tax returns filed, giving them all the info that they need, but minimal Jersey tax will be charged because the vast majority of companies will have no qualifying Jersey-source profits.

All very straightforward and the key challenge is to put in place the local tax administration to deal with it. But Jersey and the other British territories will no doubt deal with it.

But the point is information exchange

It will kill these places

Sorry – I totally disagree. 10 years ago I would have wholeheartedly agreed with you. Clients are already fully accepting of information exchange under CRS/FATCA, which applies just about anywhere.

Once territorial tax systems come in, clients will be fully compliant with information exchange and with tax reporting obligations in their home country, and will not have any tax to pay in Jersey. Their wealth be in a safe and secure jurisdiction.

I can assure you that there is no panicking going on. Things will just be a bit different but the death of Jersey is grossly exaggerated.

No, no, no

You’re ignoring that corporates (and this is only corporates) know Jersey has no data to exchange on them and no way to get it

That’s true, they admit of 87% of Jersey companies

This is going to rock Jersey to its core

And Cayman and the BVI even more

And I have a record of being pretty good on my guesses on this stuff

And Jersey has not

Richard

That’s nonsense. The core of Jersey’s client base is not “corporates” and never has been. It is private clients using structures which happen to include companies, usually underneath a trust. You seem to be missing the point altogether that beneficial ownership information is already being collected by Jersey to be shared with tax authorities around the world. Clients know that and accept it. They have not left in their droves!

You are reading the impact totally incorrectly. Clients aren’t scared of the things that you think they should be. I really don’t think you are up to speed with the client base of the current Jersey fiduciary industry.

With respect, I know that Jersey is a trust haven

Well with Brexit not happening any time soon you’re going to need to register those too

But the reality is that what I have outlined does massively change the Jersey culture for good, and will knock BVI out completely

And no one is weeping

Nor is anyone believing you

Having to file accounts and say where tax is actually paid will devastate the Jersey corporate market – and a lot of money is made from those 40,000 or so companies

Richard

The Crown Dependencies and Overseas Territories are not part of the EU and there is not a cat in hell’s chance of a trusts register being imposed (sic) before the EU leaves in March 2019. In any event, it wouldn’t be public so there’s nothing to be concerned about.

It really won’t materially affect Jersey. I know that will disappoint you – sorry about that. Yes I agree that it will very badly affect the BVI.

Your last paragraph misses the point entirely. Filing accounts is not a problem. Filing tax returns is not a problem. Where you miss the point is that only a minuscule percentage of Jersey’s companies are trading entities. They are nearly all passive asset-holding/investment companies. They are managed and controlled from Jersey, not from anywhere else. They hold their investments in jurisdictions where their income and gains are not taxed there, because they aren’t trading and they don’t have a permanent establishment there. They may suffer foreign withholding tax at source on some income (as indeed they do now – so no change). They won’t be taxable in Jersey (which by then would have a territorial tax system) and they will be exempt from tax elsewhere. That would be correctly disclosed in their tax returns. They wouldn’t be paying tax elsewhere because they wouldn’t be taxable elsewhere. They would no longer be a low-tax jurisdiction – whether the Jersey tax rate is 0%, 10%, 12.5% or 20% is irrelevant – with a territorial tax system the profits would simply not be liable to tax in Jersey.

It seems as though you have a fundamental misunderstanding of the nature of Jersey’s companies (and the far greater number of non-Jersey companies administered there although many (ie BVI) will convert to Jersey companies. Such a fundamental misunderstanding will naturally cause you to reach inaccurate conclusions. If the minuscule percentage of offshore “trading” companies leave Jersey then the loss will be immaterial and will be offset many times over by companies from elsewhere redomiciling to Jersey.

As I said, nobody in Jersey is panicking.

Ah, but you’re wrong

You see the Uk has to apply standards it has to comply with to the CDs and OTs as for foreign policy purposes you’re part of the EU due to agreements signed in 1973 and so you have to comply with the EU Code of Conduct on Business Taxation and other requirements. It’s not an option

And the UK will not be Brexiting in March 2019, let’s be candid: the transition is going to be long….

And for the record – investment income is taxable – and the EU is not going to accept stateless entities, I promise you

I can assure you – the errors are all yours

But Jersey made the same mistake of not believing me last time and had to play catch up for years

I suggest you go and read that Code again and note all the references to non-standard admin. I can assure you stateless companies will be caught

R

Richard

Oh dear. Your poor knowledge of constitutional law seems to be letting you down once again. I’m happy to let you carry on believing what you believe.

As for Brexit, it is happening. Get used to it.

You don’t seem to understand territorial taxation. It is actually quite simple. Personal investment companies are not “stateless”. They are Jersey companies and taxable in Jersey but they will not be liable to Jersey tax because their profits will be from a non-Jersey source. The source of their profits will be passive income and gains, not trading income and gains, arising in countries which do not and will not tax income and gains arising to non-residents, other than withholding tax on dividends in some cases. There are many such countries.

I understand all those issues, but am well used to being assured by those in Jersey I really understand nothing

I suggest we see how things pan out

I convincingly won last time

And I think I will this time

But note, I have not denied the possibility of territorial taxation

I have denied the possibility of no tax residence

Well, here’s looking forward to a bumper harvest of Jersey Royals in Spring 2019 then, as they find some honest employment!

Richard

Jersey government thinks it has far more important matters to attend to.

Headlines on gov.je site concern a seagull being relocated!

https://www.gov.je/News/2017/Pages/SeagullRelocation.aspx