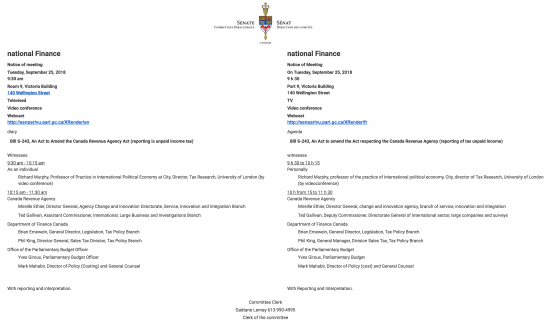

I have evidence in the Canadian parliament (by video link) this afternoon:

This is what I had to say on the proposed Canadian tax gap measure:

Thank you for asking me to give evidence today.

I have reviewed the proposed legislation that you are discussing that will amend section 88 of the Canada Revenue Agency Act.

I have noted the definition of the tax gap that the draft legislation proposes. That definition is welcome, but is also problematic:

- Firstly, it would appear to be limited to tax assessed under your Income Tax Act but there are, of course, other taxes and a narrow focus may be inappropriate.

- Second, I think it fair to say that whilst the definition used does seek to identify a tax evaded on undeclared income plus the amount of bad debt suffered on income assessed, but not collected, by the Canada Revenue Agency it does not appear to address issues of tax avoidance, and is ambiguous on the issue of profit shifting out of Canada, and so may be incomplete.

- In addition, and thirdly, I would suggest that any tax gap gap estimate that now fails to consider the amount of tax not collected as a result of official policy, reflecting the cost of all allowances, reliefs, reduced rates, and other exemptions that might have been granted by governments over time, fails to take into consideration the potential cost that these reliefs impose on taxpayers, which may need to be subject to continuous reappraisal if the tax gap is to clearly reflect the potential tax recovery available to any government at a point in time.

- For these reasons I would suggest that you need to expand your definition of the tax gap to include other taxes, tax avoidance and full assessment of the tax cost of revenues apparently willingly forgone so that this is understood by all who make decisions on tax policy issues. My concern is that you have information that can inform your decision making: at present I am not sure you will get that.

I have also noted the basis on which it is suggested that tax gap data will be estimated. This is technically described as a ‘bottom-up' approach.

- In a bottom-up approach to tax gap estimation the errors that a tax authority identifies in returns submitted to it are aggregated and extrapolated in an attempt to determine the likely error rate in the taxpaying population as a whole. I stress, this is a useful exercise: it helps you appraise the likely yield that you could raise if you were to allocate more resources to your tax authority to undertake more audits of taxpayer activity. So I would not suggest that you abandon this exercise.

- However, I do not think that a bottom-up approach is a sufficient basis for estimating tax gaps. The problem with using tax returns as the basis for the tax gap is that this approach is not enough to get a proper estimate precisely because so many tax evaders do not submit returns at all, whilst legal but unacceptable tax avoidance is also not identified in bottom-up approaches. This problem cannot be overcome by some sampling and what is, politely, guesswork. Instead the model used by the European Commission to measure the VAT tax gap across the EU is what is required. This is a top down measure that bases the estimated tax lost on GDP data, including that on the size of the shadow economy, to produce a more reliable estimate of total tax foregone. Reconciling the two approaches then provides an estimate of what is really lost to the shadow economy and abusive behaviour. As a result an estimate of what might be, at least theoretically, recoverable by enhancing resources addressed to identifying that shadow economy is then available. Without this I think that any measure of the tax gap is, necessarily incomplete.

Summary

- In summary, I welcome the proposal you are discussing and hope you will adopt it, but also hope that you will go much further because beating Canadian tax abuse requires that you do so.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

All the best with this – again, very well written.

Good to see you in demand.

I have a question prompted by thinking about the tax gap. I know people who have evaded and avoided taxes, I suspect many of us do. I have heard excuses: the govt would just waste the money (this one is v popular in the US), it would be spent on X or Y which the refusenik objects to (war, weapons, foreign aid, food for the poor etc.).

It seems to me that some of the argument for and against paying, for some is

1. If everyone paid what they should, taxes would be lower;

2. They wouldn’t because govts can’t help themselves and will spend whatever they get.

What I haven’t ever seen is any account to taxpayers of the opportunity cost of the tax gap, either in terms of how much more they paid or benefits foregone.

I have not done it barring the 2012 exercise I did for the S&D Group in Europe which I linked to the cost of healthcare

I might

Including in the tax gap revenue forgone as a result of reduced rates and the availability of reliefs and exemptions is absurd. These rates allowances and exemptions are legislated for in exactly the same manner as the headline rate for a particular tax. Otherwise, in calculating the tax gap for the uk, for example, you may as well include any personal income tax that would have been included had income within the basic rate band been taxed at 40% rather than 20%.

I would treat tax at 40% as additional yield i.e. a negative gap

And of course it is not absurd: the trax gap is measured to understand the tax system. In that case rthe whole purpose is to provide decision iusefulk information. Understanding the cost of allowances and releifs is decidedly decision useful information.

Why not drop the ridiculous dogma and do some thinking?

I think you have just outlined a pincer movement.

We have two massive problems of understanding to bridge.

Firstly is that politicians fail to grasp the revelation of MMT research into the mechanisms by which money is created and circulates in an economy…

And secondly when (or if they do ‘get’ it) they are inclined to ignore the implication that it will never work effectively without a thorough understanding how the tax system is pivotal in creating a sustainable economy beyond the very short term.

…got my brackets in the wrong place there.

Should read….when (or if) they do ‘get ‘it…..

Hi Richard,

Thank you for all your efforts, many many of us are very grateful to you.

Very good piece and your point, ‘the amount of tax not collected as a result of official policy.’ is a belter. The amount of tax lost through Government policy would be very interesting to record.

best wishes..

I am working on it…