As the Guardian has reported this morning, the House of Lords has voted by a large majority to indicate that it would wish the UK to stay in a customs union with the European Union.

This issue is of enormous tax significance. The cost, complexity and risk of fraud if the UK leaves the customs union is very high. Richard Allen, who has long campaigned on this issue and who pretty much singlehandedly brought Channel Islands VAT abuse to an end, has written a briefing on this issue. With his permission I share it here:

BREXIT AND CROSS BORDER MAIL ORDER

Current Situation

Mail order between Countries within the EU.

At present UK consumers can purchase goods from any EU Member State and there are no customs procedures or charges levied when goods enter the UK. That is because within the Single Market and Customs Union of the EU there are no customs borders and therefore goods move freely between Member States. Within the VAT area of the EU, VAT is charged by the seller at the rate prevalent in their country so, for example, a mail order item sold to a consumer in Germany from the UK is sold at the cost-plus UK VAT at 20%. If the buyer in another EU Member State is VAT registered, then VAT is charged at 0% due to the fact it is not possible to claim back UK VAT in another EU Member State. In such circumstances the buyer must provide a valid VAT number and it is the sellers duty to ensure that the number is valid (the seller is liable for the VAT if the VAT number is invalid).

Mail Order between an EU Country and a non-EU Country

When a UK seller sells goods to a non-EU Country then no VAT is chargeable by the seller in the UK. However, the buyer may have to pay import taxes on receipt of the package. When a non- EU seller sells goods to an EU buyer then one of the following will apply:

For Low Value Goods

Goods below a set value threshold (set at between 10 and 22 Euros by individual member states) will be exempt from paying Import VAT when they arrive in the EU (alcohol, tobacco products, perfume or toilet waters are excluded from the exemption). This exemption is called Low Value Consignment Relief (LVCR). A similar exemption applies to customs tariffs. The LVCR exemption is mandatory under EU law but Member States can remove it from Mail Order goods and they are under an obligation to prevent the exemption being abused for VAT avoidance purposes. It was removed by the UK in 2012 from Channel Islands Mail Order goods after the Channel Islands abused the exemption. The Islands propagated a fulfilment industry that allowed retailers to avoid VAT on UK mail order supplies (the Channel Islands are outside the EU so until 2012 companies routed goods via the Channel Islands to obtain the exemption thereby avoiding VAT on sales up to the then threshold of £18).

Higher Value Goods

Imported goods with a value above the current UK LVCR threshold of £15 are subject to import VAT and items valued over £139 will also attract customs duty. The VAT and duty is collected by the Royal Mail in the case of post or by a courier company if the items have been sent that way.

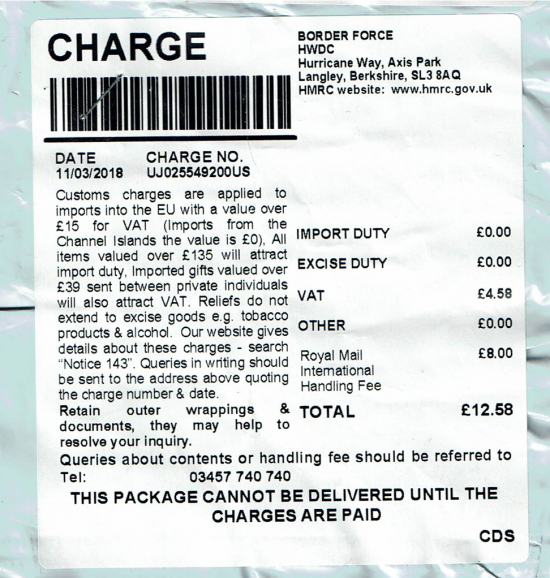

The following is an example of a charge made on a packet entering the UK from the USA. It includes VAT and an £8 handling fee. Note the Channel Islands exemption is highlighted (this exemption was the direct result of a campaign by Retailers Against VAT Abuse Schemes [RAVAS])

The above item was valued at £22.90 and attracted an extra 20% of VAT (£4.58) however the handling fee was £8 making the total charge of £12.58 or 55% of the value of the item which overall equates to an excessive charge. These charges are not applied to every packet since it would not be realistic for the UK to inspect and charge every packet, so they are applied randomly.

The Situation Post Brexit

If the UK remains in the VAT area, then the UK will remain under the existing rules. Those rules are due to change significantly just after the UK leaves the EU in 2021. This is because since 2012 the EU has been working on a solution to the ongoing abuse of VAT in relation to mail order (online retail).

The Abuse of the Existing EU Arrangements and the introduction of New EU legislation

When VAT is payable on imports into the EU it is entirely dependent on the declaration of the value of the goods. Unfortunately, this is subject to widespread abuse and values are often underdeclared. A study by Ernst and Young showed that only 35% of packages entering the EU had the correct amount of VAT declared and collected. Billions in VAT is lost because sellers outside the EU put a false value on the package to pay less VAT or more commonly to obtain the LVCR exemption and avoid paying any VAT at all. For example, an item worth £100 if correctly declared would attract VAT at 20% (£20) when imported into the UK but it avoids VAT entirely if it is declared at a value of £12. With small high value goods such as electronics it is very difficult to spot this kind of misdeclaration. Furthermore, widespread abuse of the LVCR exemption like that perpetrated by The Channel Islands results in UK goods being sent out of the EU deliberately so that they can be sold back into the UK by mail order free of VAT because of the LVCR exemption. For this abuse to operate items are always sent individually so if a customer orders 3 items with a value of £10 each, they are sent in individual packages so that the value of each is declared below the UK LVCR threshold of £15 thus depriving the revenue of the VAT that would otherwise be payable on the total value of £30. Because VAT must be checked by customs authorities at the border and is based on declarations made by the sender the process is labour intensive and highly inefficient. Customs authorities (except in totalitarian regimes such as Saudi Arabia and China) are unable to check every package and thus only spot check. As a result, some packages get charges whilst others do not. Customs authorities simply could not check every package because it would cause huge delays and, in any event, where declarations of value are involved there will always be fraud.

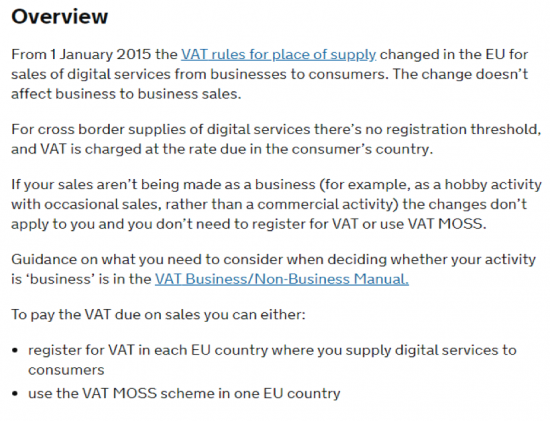

Because of these problems and the huge growth in online mail order, the EU has decided to abandon the current system of VAT collection on mail order goods. From 2021 LVCR will be scrapped and VAT will no longer be collected at the border based on value declarations on packages. Instead new legislation will be introduced that makes it mandatory for all sellers operating in the EU (even those based outside the EU) to either register for VAT in every Member State where they sell goods or sign up to the VAT Mini- One Stop Shop (or VATMOSS). They will then have to charge VAT at the rate prevailing where their customer is based and pay that VAT to the Member State or via VATMOSS. The EU will also be making online market places like Amazon an eBay liable for the VAT if they do not enforce this system. VAT collection on physical goods will thus become a paper exercise with no customs checks at the border. This will also eliminate Chinese fraudsters selling goods without charging VAT on Amazon as they will have to have a VAT number and charge VAT as part of their selling price and this will be enforced by the marketplaces who will be liable if they fail to do so. This system already operates for digital services (computer software, music downloads etc) and has been implemented by HMRC. The following is from HMRCs website:

So essentially from 2021 VATMOSS will also apply to physical goods and not just digital services.

The Impact on Mail Order of the UK Leaving the EU

If the UK leaves the VAT area, then all goods sent from the EU to the UK will be treated as imports from outside the EU. LVCR, import VAT and import duty will be applicable to all packages entering the UK. HMRC will have to process all packages in the same way that they currently process packages arriving from the USA. This will result in import VAT charges and a handling fee.

Why Make any Charges at all?

If the UK is outside of the VAT area of the EU, then EU based mail order retailers will not be charging VAT on goods sent to UK customers. That is because under EU rules no VAT is charged on a sale to a ‘third country' (a country outside of the EU). It is therefore essential that HMRC charges import VAT. If they do not, then EU goods will be considerably cheaper because there is no VAT included in the price and thus UK traders will be severely disadvantaged, and competition will be distorted in favour of EU retailers.

Because of the misdeclaration issues outlined above it will not only be impossible for HMRC to effectively charge VAT on every package but it will also be impossible to check every single package due to the vast numbers of packages involved. Even if they could all be checked it would create huge delays. Furthermore, HMRC must treat all postal operators equally and, for example, they do not check every package coming in from the USA. Consumers will suffer delays and the extra cost of handling charges which are additional to the VAT.

Low Value Consignment Relief

Unless it is abolished by the UK Government LVCR will apply to all EU goods entering the UK after Brexit. Because of their proximity to the UK the Channel Islands became a centre for LVCR abuse. The proximity of Europe and the application of LVCR will result in an even worse situation not least because there is a legitimate reason for having a supply hub in France because it is a logistically convenient location - unlike the Channel Islands which made no sense as a logistical hub other than for the abuse of LVCR. A business such Amazon could locate its warehouses at the end of the Channel Tunnel and sell UK sourced goods from there free of VAT into the UK, if LVCR was available post Brexit. Additionally, the problems with misdeclaration and LVCR will no doubt intensify with greater volumes of goods being undervalued to obtain the exemption. It is inevitable therefore that there will be a major market distortion that harms UK business if LVCR is applied to goods coming from Europe into the UK.

The Government's Position

The Taxation (Cross Border) Trade Bill Impact assessment acknowledges these issues in paragraph 40:

It is good that the Government recognises the issues. Currently many UK consumers are unaware when buying online that they are buying goods from another EU Member State. Amazon will regularly supply stock to UK consumers from a non-UK, EU location. Many UK consumers have never ordered an item from outside the EU and therefore have never encountered an import VAT charge. Politically it will be highly damaging for the Government if consumers suddenly find they must pay excessive import charges. The Governments has not yet however, offered any solutions to these problems and no mention is made of the EUs changes to VAT on mail order due in 2021 in the Treasury's Impact Assessment. Neither was any mention of it made by senior officials from HMRC in the Public Accounts Committee hearing examining Online VAT Fraud on the 13th of September 2017. Similarly, it was not mentioned in any subsequent reports or submissions by HMRC to the PAC.

Because of the Chinese VAT abuse on Amazon (another issue yet to be fully addressed) HMRC are carrying out a consultation on ‘split payments' which suggests that Amazon and eBay could collect VAT directly by splitting the customer's payment between the cost of the goods and the VAT due to HMRC. The problem with this is that the EU (specifically France) looked at split payments several years ago and concluded that they were unworkable as they were too complicated and involved changes to banking regulations that could never be applied globally. Currently — for obvious reasons - only the sender of a payment can authorise two payments to different payees i.e Amazon and HMRC. To allow Amazon or anyone else to split a single payment would involve changes in the law globally which will not happen. In any event not all packages entering the UK from Europe will result from sales on Amazon or eBay thus implementing a split payment system will not resolve the main issue of collecting VAT on all sales to prevent market distortion and abuse.

The UK has very little time to sort out a complex problem. If it is not addressed there will be potential chaos and an industrial level of abuse that will dwarf that which took place in the Channel Islands. That issue took seven years of campaigning by RAVAS to resolve a period during which every major UK retailer was forced offshore to remain competitive. Famously HMV stated publicly that they had no option but to move their mail order offshore to Guernsey noting to the BBC in 2005 "We resisted that for as long as we could but we realised that if we were to try to compete on the same level playing field then we would have to try to get the benefit and that advantage as well “ .

Although the Channel Island abuse of LVCR ended in 2012, Gibraltar now hosts an LVCR industry where printer ink suppliers who were previously based in Jersey are now abusing LVCR to avoid VAT on mail order sales into the UK.

The Solution

The easiest solution is for the UK to remain in the VAT area. Failing that the UK should duplicate the new EU VATMOSS system on physical goods entering the UK. Given that the UK has already implemented VATMOSS on digital services and assuming VATMOSS will be retained post-Brexit, then the UK is already halfway there. It is imperative however that there is a smooth transition and that there is not a period of chaos because as proven by the Channel Islands LVCR trade, even a relatively short period of industrial levels of abuse will destroy UK business and alter the retail landscape for years, if not decades.

Richard Allen

Retailers Against VAT Abuse Schemes (RAVAS)

If there are corrections to be made, please let me know.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: