Last week the UK took another step towards Brexit. I am still not convinced it will happen in anything like the form being discussed: Ireland remains the challenge to be addressed that no one is seemingly big enough to talk about. But let's presume for a moment that we really do leave. The consequences for business are substantial. As the web site VATlive notes:

At present, by act of law, the UK will leave the EU VAT system on 29 March 2019. The [VAT] implications for UK businesses include:

- Importers will face a UK 20% import VAT bill and cash flow recovery admin on all their goods coming into the UK

- The imposition of a potential £720 million in VAT compliance costs on up to 27,000 small businesses to continue to sell online after the loss of the EU distance selling threshold relief.

- UK sellers of digital services (streaming media, apps and e-books) losing their right to the EU MOSS single VAT registration and filing facility

- UK exporters of goods to the EU having to appoint special tax representatives for tax reporting in 19 of the 27 EU states

These are not inconsequential: they are massive.

The most important by far is on cash flow: VAT on imports will have to be paid upfront or the later payment will have to be guaranteed - which comes at a heavy price from a bank. The cash flow impact is significant.

Whilst the admin burden for all importers and exporters will be substantial because leaving the EU will not mean that EU VAT rules will cease to apply to those selling into EU markets.

The combined impact of these measures will be threefold.

First, some businesses will not be able to afford the upfront VAT payments. They may cease to trade.

Second, many businesses will give up exporting: it will simply not be worth the bother. UK trade will shrink as a result.

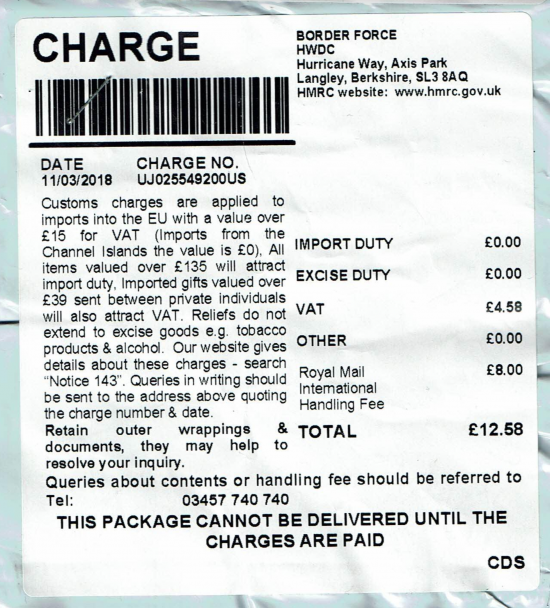

Third, there will be whole new fraud opportunities. These charges will become much more prevalent:

We will all have to get used to paying VAT on imports. But there's a tale in there. Note that there is no monetary limit on imports from the Channel Islands. That is because of VAT abuse from those places. The chance that new abuse will arise with a new border is very high. The smugglers, and their near legal friends, will be back in business again. That is a cost we can well do without, but Brexit will, I am quite sure, be bringing it our way.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The Isle of Man already has a VAT system with the UK which is already problematical but can you explain how such arrangements might evolve bearing in mind the many boundaries that could exist in future?

Its beyond my brain.

But if VAT free aircraft can be smuggled I am sure that much smaller items will be whizzing between the many British territories and foreign places on a grand scale. If only as electronic transactions.

I remember the days before 1993 when VAT had to be paid in Cash,Yes Cash at Dover.You Imagine nowadays walking around with five or six grand in your pocket.So this means there must be import forms,C10,C12,T2L Certificate Of oringin and transport documentation.They need the details to work out the VAT. Or asking a question to those who may know.Will an invoice be ample?

The documentation requirements are likely to be horrible – and we have no way of getting the systems in place now

Which is why HMRC are in the team at the EU today who are negotiating alignment with the single market (call it membership for shorthand). It’s the only option we have

C10,C12s,T2Ls?

How old are you? 🙂

Nowadays it’s the SIngle Aministative Document which is a C88, we haven’t used C10s since the very early 90s.

The SAD is the legal document that the computerised system is based on, there has to be that document, what it does though is set the boxes (data fields) that need need to completed so for instance box 33 is the HS code, box 44 all the additional info statements e.g. licences, IPR authorisation numbers. You will never now see a completed C88 (it’s 8 page document) all you will see is the computer generated page you would need if someone prints one off, not usual we would do that. Some community transit movements needs an EAD Which is just generated from the data entered.

At a basic level if we just go WTO then pretty much will just need a commercial invoice for general cargo, but all sorts of cases else would need much more such as veterinary certs, rather depends on what you are shipping,

If in the case of an FTA and this seems the most likely outcome we will be using the EUR 1 preferential certificate as that system is already in place, no need to reinvent the wheel but it will add costs/time delays applying for them.

Sorry post is a bit techincal but the question was as well.

Currently many UK small businesses on Amazon and eBay charge absurd prices to ship to Ireland or simply won’t do so. As result there are at least three separate redirection services offering reshipment from virtual addresses in NI (parcelmotel, parcelwizard and addresspal delivering to a locker at Tesco, one’s home, and post office respectively). The costs are typically €4 or so.

In future there may be parallel services providing EU to UK redirection. The EU is looking at harmonising parcel delivery costs as a way of boosting cross border trade by SMEs. However, the VAT situation will introduce friction after Brexit, even with existing arrangements in Ireland, and leave the UK at a disadvantage.

A massive disadvantage

And most especially for SMEs

I predict a big fulfilment industry in Calais supplying UK mail order customers VAT free . The Channel Islands LVCR trade was clearly abusive (why would you be in Jersey gives it is completely inconvenient as a logistical hub) but in France you could claim it was your EU hub. HMRC has a real issue looming with LVCR and Brexit and one that needs resolving now not 10 years after businesses start to complain.

I do not believe the Channel Islands – nor any source of EU VAT ‘loophole’ associated with the United Kingdom – will continue to exist post-Brexit.

You and I, and most of of us who read your work inline, are well aware that UK is facing a 2-Billion Euro claim for the recovery of import duties lost by Britain’s negligence in refusing to take action on a known long-running import fraud.

There is no goodwill on this from the EU and there will be no latitude for repetition of this failure – in import duties, VAT, or any other matter.

I wish you were right

I can’t see that happening…

What is ironic is that by 2021 the EU will have sorted out the distance selling issues but we will have left the EU! and unless we remain in the Single Market will have lost any benefit and will be faced with having to comply with it as a non EU seller into the EU.

Interesting to note Keir Starmer’s choice of words on Peston this weekend “To stop a hard border in Ireland we need a strong single market relationship”…is that politicians speak for staying in the Single Market ?

I hope so

Nothing else will work

Corbyn will probably sack him this Friday night.

As if.

Holland, France, Norway and a number of other EU countries allow import VAT to be dealt with through a VAT return rather than physical payment and refund. in other words, the same type of scheme applying to intra-EU imports. Clearly Norway is the most relevant example for post-Brexit UK.

HMRC has been asked by the Treasury to look at this approach, which actually used to be in place many years ago in the UK.

Your article presumes that the UK will not introduce a scheme that a lot of Europe does anyway in time for 2021. This is far from certain and will I suspect not be clear for some time.

We allow this now!

Norway can because it is in effect in the single market

So far we are ruling that out

I think that will change but right now what I have written is correct

No we do not allow IMPORT VAT to be reclaimed via a VAT return. You might be confused between this and a deferment account. Nothing to do with a single market re: Norway – imports means imports from anywhere, e.g an import from the USA to Norway.

There is a whole world outside of the EU!!

Sorry – but that is standard EU procedure on VAT returns

And the UK could do this – but it never did in the past

The EU won’t let us anywhere near VAT unless we accept the VAT rulings of the CJEU or the EFTA Court. The idea that we will have complete legal autonomy and still be part of the EU VAT system is a fantasy.

Agreed!

The Uk from the point of view of on-line shopping is somewhat more advanced than many other EU markets & I write as somebody that has bought on-line (e.g. e-bay) in france, Germany, Belgium and the Netherlands. Uk prices for branded items are usually much much cheaper. Indeed when wanting to buy around 1 tonne of parquet I convinced the Belgium supplier to reduce his price by around 25% – thet UK was around 30% cheaper – that is how competitive Uk suppliers were.

Taking one example of a well run on-line operation: I have yet to see any equivalent in any country to Axminster Tools (& they ship Europe wide) – which raises the question: how much do UK-based on-line traders ship to other member states? & if the VAT issue ain’t sorted – what sort of hit will they take? My guess is – a big one. but the pea-brains in Wezzie have yet to work that one out.

UK was the biggest internet market in the world until recently beaten by Germany. Without a doubt any VAT issues will cause major issues with UK based online retail not least because online has become riddled with VAT abuse and Brexit will just cause confusion. I can assure you from personal experience I have yet to meet anyone in “Wezzi” who has the slightest notion about how online retail works … last thing they bought online was a pair of slippers from an advert in the back of The Oldie

To quote you Richard

“Sorry — but that is standard EU procedure on VAT returns

And the UK could do this — but it never did in the past”.

Do you think I have just started to make this up? I have been a VAT advisor for 31 years and saw most of these changes in VAT live. I would not presume to tell someone who specialised in another tax their job if I was an interested amateur! You did not write a book called the Joy of VAT and an expert in this you are not.

To clarify, IMPORT VAT is chargeable and payable on imports of goods into the United Kingdom from outside the EU. You have to pay at import and claim the VAT later if you can. you may be able to defer the payment of the VAT until the 15th of the following month if you have a deferment account, but, aside from warehousing and a few other rare reliefs, you MUST pay the import VAT.

When goods come into the UK from other members of the EU, this is not called an import (since 1992). It is an ACQUISITION and, as you say, the VAT is not physically payable but included on the VAT return. But this ONLY applies to acquisitions, not imports.

Postponed accounting for import VAT was a feature of UK VAT law to 1984 (so go check your VAT history books) and HMRC has been asked to look at this again by the Treasury. As I said, a number of EU countries already do this and Norway does too. In case you don’t believe me, here are some other sources, at random (there are a lot more).

https://www.quorumtraining.co.uk/blog/vat-post-brexit-a-personal-view/

https://www.4eyesltd.co.uk/index.php/9-news/96-budget-2017-imports-and-brexit-postponed-accounting

http://www.gabelletax.com/blog/2017/11/22/postponed-accounting-import-vat/

If there is anything else you would like to take a punt at regarding VAT, please do ask and I will happily assist.

I trust you will be big enough to acknowledge that I am correct. As I said, been at this a long time.

With respect, splitting hairs between imports and acquisitions is just splitting hairs to make a point when you had at no point revealed you consider yourself an expert (a title I do not claim).

And actually your pedantry proved nothing: what I had written was correct in the current U.K. context. No one disoutes it could change. But so far it hasn’t and as such it seems you are agreeing with me despite your aggression.

If you want to engage I suggest a) lay your card# face up on the table b) try to add to the argument. It is a shame you did neither.

I’ll take that as an apology. If getting stuff right is pedantry, I am guilty as charged!

With respect, I did add to the argument and in a positive sense. I said that the UK had once had postponed accounting (which you denied) and could do again, and indeed the Treasury has tasked HMRC with looking at that. If it is implemented as a lot of EU countries have done it will be a great thing for UK importers and will make Brexit a lot more palatable for them. Lots of people are talking about this including the industry.

A man of your resources will be aware of this possibility and the Treasury letter to HMRC. But it does not fit your agenda does it so better to do another (yawn) ‘Brexit will leave us as paupers’ article.

Believe it or not I do not know everything

How could I?

And let’s be clear – I checked this post before publishing it and I found no reference to it on good VAT websites so with respect if it not well known

And I did not offer you an apology

Your patronising style does not incline me to do so

When we leave the EU we are not obliged to have VAT. We should be looking at a consumption (of non-renewable resources) tax which encompasses a carbon tax.

Over 150 countries do have a VAT

They have flaws

They do work

And we do need mechanisms to reclaim government spending from the economy

Carol Wilcox…we may not have VAT but all the people in Europe we trade with have VAT…which is the point of this post

And we will have VAT

I will guarantee it

It is not my favourite tax but a tax system without one would be like a golf bag without any drivers: possible to play with but crippled from the first tee

Wayne Neale Everything you say on import VAT is correct as I worked in import and export for many years. A deferment account is hardly ideal though. Nowhere near as convenient as the current way of dealing with movements of goods within the EU plus of course however keen the UK might be to make Brexit work forcing VAT deferment arrangements on wholesale customers of UK businesses within the EU will I suspect just result in them finding other more convenient suppliers. RAVAS has no view on Brexit. It is merely concerned with practicalities that affect businesses. To date the debate on this issue in the public arena has been sparse to say the least and the public who voted are I can pretty much say with confidence entirely oblivious to it. Ask the man in the street if he wants to pay handing charges and import VAT on mail order purchases from the EU and I can confidently predict what he will say.

Thanks Richard

Just to add to this debate, postponed accounting is not deferment, because under that you still have to pay the import VAT. It is entering the VAT in Boxes 1 and 4 of your return so that the net result is nil in most cases, so no VAT cashflow.

In terms of the EU, things are changing there as well and are looking to change fundamentally pretty much as the UK leaves any transitional period.

The EU has announced plans to create a single trading area and that means that exporters charge VAT when selling to other EU countries and the VAT is collected through a collection house mechanism and paid to the member state of consumption. This is the complete opposite of the current helpful system. A transitional approach involving trusted taxpayers being allowed to retain the current system for a while has been discussed, but, as a matter of principal the EU wishes to move to a system where exports are taxed as they believe it minimises tax leakage.

So, if the UK had of voted remain, it would have had to use this system.

The EU has also proposed lowering or even removing the Low Value Import limit – currently £15 in the UK, nil from Jersey. This will mean that all purchases from outside the EU will be taxed. this is going to be implemented as it does reduce tax leakage.

If you think about it, if a post-Brexit UK could allow importers (from anywhere) to pay import VAT through a VAT return (see Norway), it may make the UK a tremendous place as a European hub for European importers and distributors.

You mean fraudsters?

The EU have introduced these changes to stop fraud and market distortion. Uf what you suggest is intended to avoid VATthen its fraud . The Courts recognise VAT avoidance as fraud (see a case called Direct Cosmetics) In any event UK traders selling to EU customers mail order will be disadvantaged selling from a hub outside of the EU.

In any event you can be sure EU will be on top of it and wont allow UK to become a hub for sbuse. I worked with Commission on the removal of LVCR and they are intent on ending the abuse of that which was pioneered by The Channel Islands despite their hollow denials.

I agree