The Adam Smith Institute published a blog last night that was headed:

The blog feels as if it is the work of Tim Worstall, whose obsession with my work does not suggest objectivity on his part, as others have noted.

The blog concludes that having read my discussion on Oxfam's tax arrangements:

We really must thank Richard Murphy. Because we've now got a strict measure of what tax avoidance is, one we can all agree upon. If HMRC looks at it and says that's fine then that is fine. It is not avoidance.

And so thanks to Richard Murphy. There's pretty much no tax avoidance going on, only some criminal amount of tax evasion and the vast majority of the economy is entirely tax compliant. And, of course, if we cannot believe the noted tax campaigner, inventor of country by country reporting and the Professor of Practice in International Political Economy at City University on such a point then who can we believe?

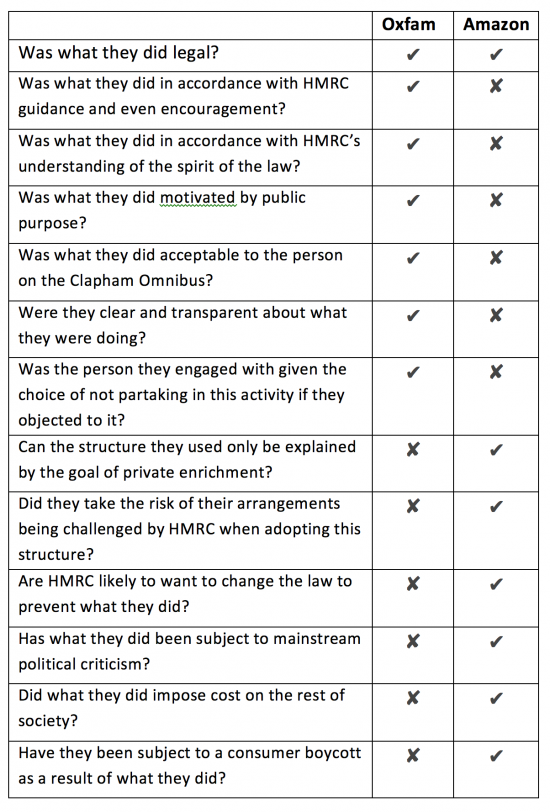

Well, you certainly can believe me. But let's be clear as to why. Let me do the comparison of Oxfam and Amazon, which is a test the ASI used. It looks like this:

So we agree on one thing: what Amazon did was legal.

Thereafter we agree on nothing, and I think I present the truth fairly and accurately. There is no common ground between Oxfam and Amazon (et al) at all. Oxfam worked within the framework of public policy: Amazon worked against it, and the evidence that both statements are true is compelling.

So, yes, the ASI do owe me an apology. They could start with apologising for wholly misrepresenting the truth on this issue, for a start.

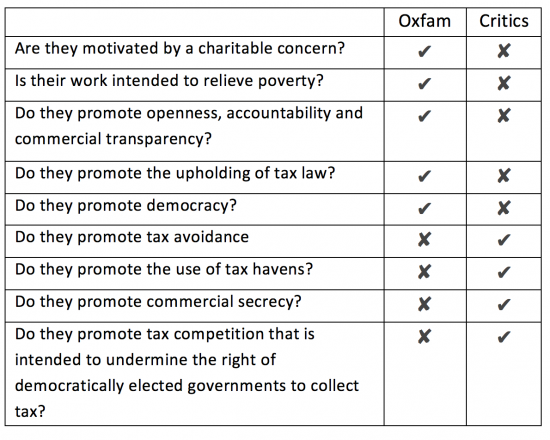

And why might they offer such misrepresentation? Another table might explain:

I rest my case.

I am well aware that there are those, no doubt Worstall acolytes, who say that my support for Oxfam will come back to haunt me. I don't think so. The case I have made is clear, unambiguous and has the advantage of being accurate, honest and right.

Tax avoidance is about the intention of complying with the letter and spirit of the law which Oxfam have very clearly done with quite explicit HMRC approval of the arrangements they use.

When the ASI can offer me similar HMRC suggestion that an entity should adopt the structure used by Amazon and others then they may have a case. They cannot, I know, and for good reason. Those arrangements are intended to exploit the law contrary to the will of parliament. They are legal, but that is not contested when it comes to avoidance. It is the intention to take tax risk to reduce a tax bill contrary to public purpose that matters when identifying tax avoidance and, as I have shown, using this appropriate criteria Oxfam have no case to answer: they have acted wholly within the spirit of the law and the likes of Amazon very clearly did not.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Worstall and Teather are clearly birds of a feather! Coinhabiting the same cesspit of immoral slime no doubt as the rest of the asi and iea numbskulls.

You’re a poet and don’t know it;o)

Just call me the bard, or a tub of best lard

For at rhyming slang, I was top of my gang

But when it came to a poet, I was too meek and mild

For I gave up on lyrics, when I was a child.

(a failed thespian)

these worshippers of Adam Smith do like to gloss over some of his more pertinent observations,

“All for ourselves and nothing for other people seems, in every age of the world, to have been the vile maxim of the masters of mankind.”

would it be fair to say that Adam Smith has been hijacked by these ideologues?

Yes

He would be furious

I suggest that you are misguided on many counts in trying to reformulate what is tax avoidance, but then that is your prerogative.

However, with regard to a number of your criteria I suggest you look closely at Article 5 of the UK/Luxembourg DTA which clearly defines the Amazon situation. Then for good measure have a good look at the OECD commentary to Article 5 and for even greater measure have a look at the Vienna Convention.

You will then see that what in fact took place was within the spirit of the law (whatever they may actually mean), in accordance with HMRC guidance, and there was little if no risk of HMRC successfully challenging the arrangement. Furthermore, it is the consequence of a bilateral agreement entered into by the UK and to which they are bound. The fact that the treaty hasn’t been amended at any stage must surely indicate that the government is perfectly comfortable with Amazon’s arrangement and the tax consequences.

Justin

You really are dissembling

I do know article 5, inside out

And as you well know it was written for another era when no one could have imagined the abuse it has facilitated

You ignore that

I’d call that a deliberate act of misrepresentation

Pretty much what most avoiders do

Now stop wasting my time with your pathetic excuses for abuse

Richard

With respect you are talking rubbish.

That fact that you may think it is outdated does not mean the law automatically adjusts.

Another nonsense is the fact that the DTA was amended by a 2009 protocol. If it was such a problem then it as you suggest, Article 5 could have been amended, or 2010, 2011 or any year after that. Nothing to stop the UK adjusting the terms of the DTA.

And furthermore, the courts have purposive interpretation to strike down abusive arrangements – how come HMRC never tried that approach?

So I suggest it is you who is misrepresenting.

This issue has been rehearsed from the OECD onwards

I have no more time ro waste with trolls on it

The quintessential Tim Worstall tactic can be seen in a joust he had with Simon Wren-Lewis over food banks. While Wren-Lewis is worth reading in his entirety, Worstall is not so it’s probably easiest to skip to here – https://mainlymacro.blogspot.ie/2014/12/small-states-economics-and-food-banks.html?showComment=1418289507617#c608215023611163931 – where Wren-Lewis catches Worstall out pivoting from claiming that the demand for food banks “is at least in part (I would argue almost entirely but I will not take as being serious anyone who says that this is not true at least in part) because the supply has increased massively” to “It’s possible that the expansion of food banks has been driven by an increase in demand, yes. But that ain’t the way to bet: an increase in supply is”, a contention that Wren-Lewis demonstrates to be entirely bogus. As another Simon further down pithily noted: Shameless.

Quite right

But then shame is a word Worstall would not understand

Surely Worst-of-all knows that Say’s Law has been soundly trounced.

There is no evidence that the news has reached him as yet

The Adam Smith Institute is just another member of the Atlas Network, founded by neoliberalism’s godfather, Antony Fisher. Fisher helped (funded?) Pirie et al to set up the ASI. Teather is listed as an ASI “fellow”, whatever that means.

So in that respect, it’s no surprise the ASI should come to the defence of their fellow travellers at the IEA. Indeed sometimes it seems as though these Atlas think-tanks are all slightly different emanations of the same organisation – you could call them sock puppets.

At least the ASI had the sense to abandon the pretence of being a charity back in 1991. When will the IEA do this?

I have to profess, without reading and re-reading the articles and other articles a few more times it is a bit confusing to understand exactly the arguments……

However, as far as I can tell, the IEA argument hinges on the fact that Oxfam is using an artificial structure to utilise a tax relief and suggesting that this constitutes tax avoidance.

But as far as I am aware using artificial structures in this way doesn’t constitute tax avoidance eg. my salary sacrifice scheme.

The difference is that with Amazon etc they are not seeking to utilise a tax relief deliberately intended for purpose, but simply seeking to avoid tax altogether, which isn’t the same thing. Utilising transfer pricing arrangements, loading companies with debt etc are not the same thing as tax reliefs etc.

You’ve pretty much got it

How is encouraging ordinary donors to enter into sham agency arrangements acceptable to the man in the Clapham Omnibus, assuming he understands the implications? Not blaming Oxfam for this – HMRC is now on record as saying that sham arrangements are sometimes OK. A disappointing precedent is set.

Why is HMRC’s wish to change the law a relevant consideration? They are unelected, their opinion is no more relevant than anyone else’s. Their job is to administer the law, as it is. They are the hired help, nothing more.

Why are consumer boycotts and the opinion of ‘mainstream’ people relevant? People have a right to protest, but their opinions are not conclusive of anything. We don’t have rule by the mob.

Your list demonstrates conclusively that the existence or not of tax avoidance is in the eye of the beholder – we can all make up our own lists.

You still deliberately miss the point

I did not make up the list

It is government policy I was noting

And you ignore that with your fatuous comments about ‘the mob’

It is government policy that civil servants’ opinion on what the law should be is a relevant consideration in how the public behaves?

I must know 20 Heads of Legal in local authorities. This principle appears to have evaded all of them.

Or does this principle apply solely in the area of HMRC and tax?

Consumer boycotts by a small section of the community (and that’s all that happened for Starbucks, Google, Amazon – there was no mass reaction) are exactly that – mob behaviour. People are free to boycott, and our elected representatives can react by changing the law, or by ignoring it. But until our elected representatives react, the boycott is an irrelevant consideration. It prejudges that the boycotters were in the right. Who says so?

I don’t know whose list you have used but it has been made up by somebody and is effectively saying ‘tax avoidance is anything that I don’t like’.

No wonder it is such a mess.

Adrian

You very clearly have no idea how any law can work

It is always, inevitably, about interpretation. That interpretation must be done by someone and since legislators are not responsible for implementation, it is the implementer i.e. the person at the coalface, who will always have to be engaged in that process. To deny this is absurd. It is an obvious, and I would have thought agreed, statement of fact that legislation, or any written statement, is an incomplete statement of the intent of the writer.

Now of course we expect the implementer to use their best efforts to discern the will of the writer: that is the way in which the process works in the UK civil service, and in so many other areas, if we are to uphold the rule of law, offer consistency, and secure acquiescence. But to pretend that interpretation isn’t a part of this role is to be, at my very kindest to you, stupid; and with respect those 20 heads of legal services in local authorities will also be laughing behind the hands at your comment, because if this was not the case they would not be seeking opinion on what the law meant on so many occasions.

So, very politely, I will treat your commenters the waffling of a fool, which is I think the status that it deserves.

Richard

Yes, lawyers of all stripes (whether acting for private and public sector clients) are expected to interpret legislation. Their task is to ‘best guess’ how a court would interpret it. That’s all that ultimately matters.

You appear to suggest (in your list above) that HMRC’s interpretation carries weight in determining whether there is tax avoidance simply because it is the HMRC doing the interpreting. If you can find some authority to support this suggestion (that the intepretation of the public body in itself carries weight), I will have learned something, and I will gladly share it with colleagues for whom this will also be news (and will save us headaches in our litigious activity).

If anything (and I am having to look to other areas of law to find any parallel), courts are suspicious of ‘interpretation’ by the state. The fact we have ‘innocent until proven guilty’ in the criminal field is some testament to the fact the public body’s interpretation of things is sometimes unreliable.

In any case, you’re still avoiding the issue I have raised about engaging in fake arrangements in which Oxfam have apparently been engaged, albeit with HMRC encouragement.

You really are a time waster

In 99.99% of all cases – those that are uncontested – of course the opinion of HMRC is what matters

They also win 80% of cases

Now stop trolling

And making false accusations