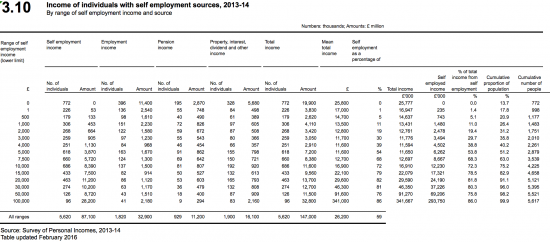

I drew attention to some new HMRC statistical data yesterday: now it is time to look at some more, just published, this time relating to the number of people with self employed earnings and what they report that they make. The base data, to which I have added the right hand five columns, is as follows (click the image to get enlarged versions):

The data reveals that just over 5.6 million suggests that they are self employed but that of these the vast majority who make no income as a result have significant other earnings, suggesting that these are hobby businesses at best, and that until self-employed earnings average £5,000 a year they do not, on average, make up more than 50% of the earner's income. This may come as no great surprise: it is very hard to live on £5,000 a year. But for the purpose of the analysis that follows I will ignore those earning less than £5,000 profit from self-employment as this is unlikely to be their main economic activity.

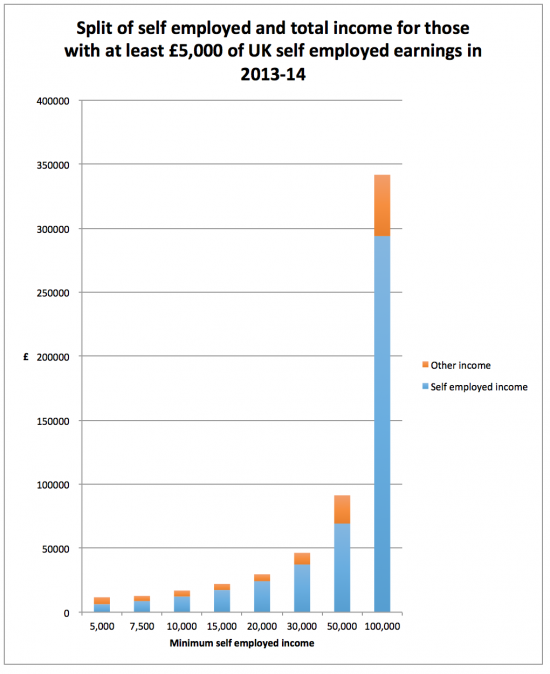

For those earning £5,000 and above the data is plotted as follows:

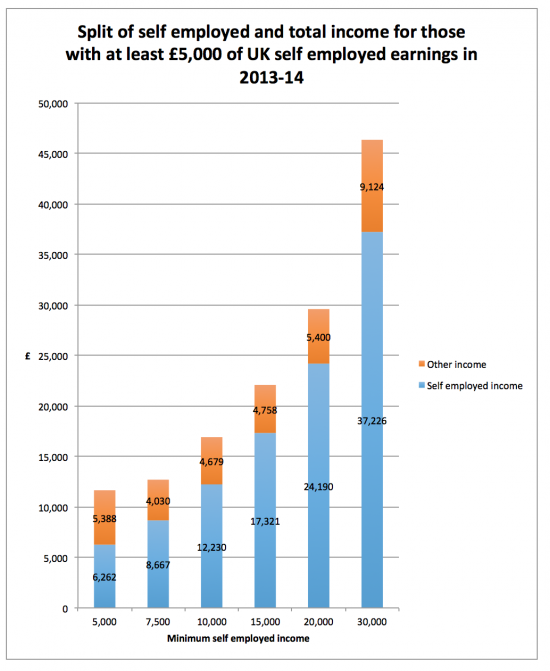

The impression given is, however, a little misleading. The top two bands of income represent just 6.6% of the sample. If they are eliminated the remaining 3,134,000 self employed people have income as follows:

Those in the bottom four income brackets represent 71% of the people likely to be full time self employed in the UK and all make less than average UK earnings, in total. On self employed earnings alone 85% of the full time self employed make less than median UK earnings.

Three conclusions follow. The first is that there may be systemic under-declaration of income here.

Second, alternatively, self employment is a poor economic option for many people.

Third, in that case its massive increase in recent years is a sign of economic desperation and not of an outbreak of entrepreneurial vigour.

And, for the record, there are 96,000 self employed people (about a quarter of them likely to be GPs) who are doing quite well.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It would be good to know how many of those have become ‘self-employed’ post sanctions regime which was the main way the Government gave the impression of falling unemployment figures. during 2013-2014 they were stopping the benefits of everyone and his brother on the least possible precedent. Despite being on Incapacity Benefit I remember being forced to go to utterly useless interviews where I was ‘encouraged’ to consider self-employment – despite suffering from M.E/depression and in the process of recovering from a breakdown -utterly ludicrous.

Last I heard they were encouraging people with cars to become self-employed couriers. Ignoring the problem with the cars insurance being invalid and them not having goods-in-transit insurance.

All of which are not cheap.

This is part of a general plan to have people running around, scuffling for bits of income.

I met and spoke to 3 people, well presented and intelligent, last year who said they were self-employed but earned below the minimum wage. One was the Green parliamentary candidate.

My Polish window cleaner now drives a Discovery 4, with a roof rack.

The guy who eco-cleans the bins has just taken receipt of a new Transit Custom.

I think 75% of car sales are on credit-with the TUC reporting that average household unsecured debt at about £11,000

A roof rack! Do you know when the credit company may take it into their receipt?

By its nature, it’s difficult to generalise about self-employment. Some do very well and others do OK (including some who turned to it out of necessity) and no doubt there is a lot of under-reporting. But for many, the income is both inadequate and insecure. This is not a new problem (it’s noted in the Beveridge report) but it has grown since the financial crash.

A particular problem is where a de facto employment relationship is made into de jure self-employment, so that the ‘employer’ can avoid various obligations from paying the minimum wage to making NI contributions. This not only reduces the ‘employee’s’ income but also deprives them of social protections. (Canvassing a few weeks ago, I met a ‘self-employed’ painter/decorator who had been working for a building contractor who now no longer needed him; he had yet to find other work but was not eligible for job seeker’s allowance.)

Add apps to this and we get ‘Uberisation’. The ‘gig economy’ (one-off tasks contracted over the internet) has similar issues. Often it offers desirable flexibility but rates can be very low for the work done and again minimum wage rules do not apply.

These forms of work are going to increase as new technology changes the capital-labour relationship and we need to re-think how we organise social insurance to meet these challenges. Universal basic income is one option.

Is there an opportunity for the lucky 96,000 earning £100k+ to pay a bit more National insurance? If they were employees, their businesses would be contributing 13% employers’ NI.

They could pay a lot more class 4 NIC, I agree

Presumably that top tier of self employed includes businesses such as accountancies, legal firms, or consultancies with a partnership structure under which people are technically self-employed? That would account for a lot of people with substantial incomes. Im certainly aware of plenty of ex-colleagues operating as self employed consultants and project managers and doing fairly well out of it. Very different to those driven to self-employment such as the delivery drivers referred to

All correct

Is there a mechanism to ensure that HMRC draw this data to the attention of DWP, specifically in the context of the deemed income provisions – effectively earning minimum wage for a normal working week -for the self employed under Universal Credit?

It is a staggering contrast in view, I agree

I know of a number of people, who were unemployed and advised by the Job Centres, to become unemployed. They barely make enough money to live on and are still dependent on benefits. They are just, no longer registered as unemployed or economically inactive!