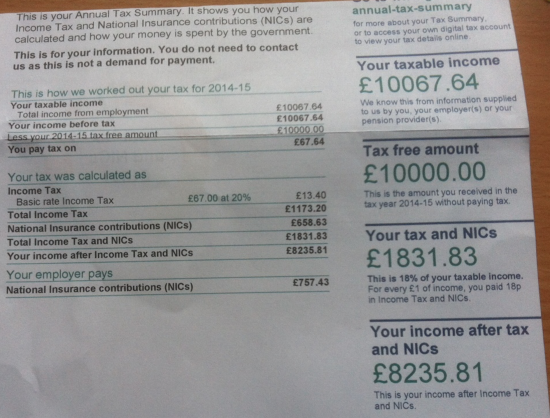

I have been commenting on HMRC's plans to make all tax services digital. I do not believe this will (and maybe even can) work. Let me offer an example as to why not. This is a personal tax statement sent to a person recently:

However it is looked at this statement is wrong. There is clear implication in it that the recipient really does owe £1,173.20 of tax on taxable income of £67.64.

There is no hint made that if they did pay £1,173.20 they are now owed a refund of £1,159.80.

And the NIC calculations are bizarre: the recipient of the statement was a not a company director and as such there is no way I can even get close to working out how the supposed liabilities could have arisen.

But instead of HMRC contacting this person to work out what is going on, or sorting it out for them, or sending them a cheque, they do instead send a statement confidently telling them they have paid £1,831.83 when the real liability was vastly lower than that.

So let me draw some inferences. The first is that I learned, long ago, that nothing could be 'digitised' unless it already worked well. If any form of computerisation is tried on a system that does not already work then even more confusion follows. A system that can send the above statement is not working well.

Second, this says existing systems have no checks and balances built into them: the simplest of algorithmic checks should have flagged the above statement up as looking as if it was wrong and suggested it should have been checked before being sent out.

Third, if such things happen now then there is no guarantee they won't in the future but the staff to put things right will have been reduced by then and the attitude will be 'the computer is right' because that is what top management will say as a mantra.

Last, what this implies is that HMRC have got all their priorities wrong. Nobody needs a digital tax service right now. They do want to stop tax cheating, but as I have explained, this process won't do that. But what they really want is HMRC to work. For once I agree with the Mail who said yesterday:

All most people want is a tax service that deals with the most rudimentary problems swiftly and picks up the phone within, say, five minutes when you call.

That should be the aim.

When that can be done there may be a chance to think digital.

Right now there's just a disaster in the making developing at HMRC. And we will all pay for it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Truly shambolic, shocking and for ordinary citizens, such tax letters are often very scary. This is why there also needs to be a culture change at the HMRC because most ordinary people want to pay their due taxes in the right way. Culture change is about people not systems, and we have few people left in so many key organisations- this is the real meaning of Tory austerity and cuts -more pressure on ordinary, fair-minded people and stress for them without any of their own doing.

Agreed

Do we know if it is the Big 4 firms who sold them this piece of computer kit and at what fee? Would be great if we could, as we all know how good they are at getting tax right.

Why is the employer’s national insurance liability of relevance or interest to the employee? Surely this adds to confusion.

Agreed in this context

Perhaps the intention (of the statement) is to sow fear amongst the population? Or, by making the statement incomprehensible, to create a business op’ for large accountancy companies – who then handle “problems” (for a fee) that were dealt with by HMRC (for free). Given the current political trajectory of withdrawing the state from most activities, I’d suggest the latter.

The phrase “Shows how your money is spent by the government.” is highly politically charged and really should not be included on a state document.

If it’s my money what is the government doing spending it?

Surely “Shows how the government spends its money.” would be more accurate?

Richard, I received one of these early last week, and my wife had one the previous week. In her case the “statement” understated her earnings by several thousand £s, and on mine it overstated by several hundred. This despite the claim on the statement that the figures are based on data provided by our employers (we are both PAYE and have no income apart from our main employment). Neither statement corresponds with the figures on our P60s.

So yes, utter claptrap. But of course, the purpose of this document is not an “Annual Tax Summary” is it. The purpose, as was fairly comprehensively established when they first emerged under the previous government, is actually illustrated by what’s shown on the other side of the statement: the pie chart, and specifically the big segment labelled “welfare”, just so we can all see how much of our tax (whether correctly stated or not) is being spent on those scroungers and shirkers – whether sick, disabled or unlucky enough to be out of work – that the government wants everyone to believe is what all that welfare (and thus your tax) is spent on.

Lies, damned lies and HMRC statements, I think

Richard,

I think you’re slightly missing the point, it’s not a tax calculation it’s an Annual Tax Summary, the figures on the front are largely irrelevant & illustrative only.

The main point of these is the pie chart on the reverse, approx 25% is yellow… Looking at the key, yellow = welfare, now if that doesn’t get the Daily mail reading public frothing at the mouth & screaming for more cuts to benefits I don’t know what will!

Have I really missed the point?

These figures aren’t plucked from thin air, surely?

A client of mine received one of these statements, but he had already received a proper tax calculation, plus a refund, so he was somewhat bemused by the tax summary. This is clearly a complete waste of time, the figures appear to come from the payroll data submitted by the employer, and don’t take into account any other income that may be filed under self assessment. It’s just a political stunt

But is some sign HMRC can’t join up data

Atul Shah asks if the “Big Four” would be responsible for this piece of computer fantasy.

Google is a wonderful tool (other search engines are available), and I found this:

http://www.theregister.co.uk/2015/08/05/hmrc_aspire_replacement_programme/

Aspire was the grandiose name attached to a consortium of IT providers and consultancies who won the 2004 bid for services to HMRC. Prior to that the original 10 year contract was held from 1994 by EDS (founder Ross Perot). I joined the EDS account providing services to HMRC in 2002, and one of the interesting features of that environment was that most of the 2000 people working for EDS on that account, were former members of HMRC tax department, who had been outsourced along with the support of all their computer systems. By the time I joined the account, the Revenue (as we fondly termed them then) had created a separate new shadow IT organisation, which mirrored every activity we performed. Approximately 2000 people marking each others homework.

EDS lost the account in 2004 after taking the rap for the Tax Credit fiasco, for which they were in my opinion only partly responsible. The contract was won by Cap Gemini, as the main participant in the Aspire consortium, which unsurprisingly is deemed a failure.

It is interesting that HMRC now seem to be setting up their own IT providers, albeit as a separate company. Has the great experiment in outsourcing to commercial providers failed? Can an in house provider do a better job?

Caveat: when those who specify the system are politically motivated, then failure is almost inevitable, regardless of who provides the system.

I agree with you: this is a disaster in the making

Thanks Helen for your detailed reply. Cap Gemini used to be part of EY before. It all sounds like a complete mess, and awful project management.

–“Third, if such things happen now then there is no guarantee they won’t in the future but the staff to put things right will have been reduced by then and the attitude will be ‘the computer is right’ because that is what top management will say as a mantra. – ?”

You mean like the Horizon event that led to so many sub-post office managers misery and ruin?