I welcomed HMRC's adoption of country-by-country reporting yesterday, and am very unlikely to change my mind on that issue.

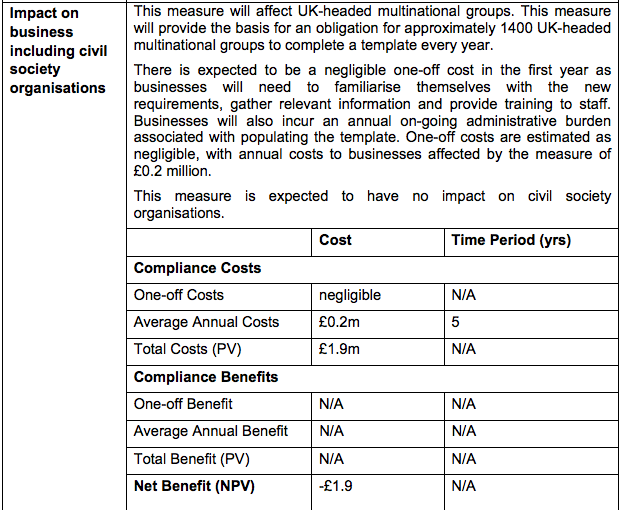

However, Joe Stead of Christian Aid did draw my attention to two issues in its announcement worth sharing more widely. The first is its impact assessment on the costs it thinks business will incur in complying with country-by-country reporting, which is as follows:

HMRC obviously believes what I have always said, which is that business already has all the data needed for country-by-country reporting and the additional costs will, as a result, be negligible.

That said, I think that their suggestion that country-by-country reporting will have negligible impact on NGOs is technically right in the sense that none will have to report it to HMRC, but totally wrong given that this issue will remain the focus of a great deal of their attention.

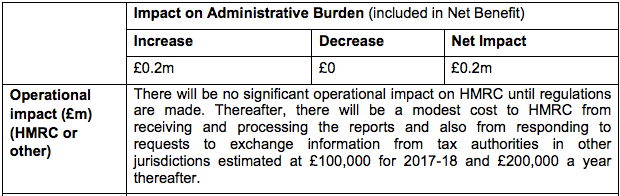

This though is not the most important part of the announcement. That most important part is implicit in this statement on HMRC costs:

The key issue here relates to responding to information exchange requests. Why should these arise, after all, with regard to country-by-country reporting? Surely the implication of country-by-country reporting should be that this data should be supplied to all countries impacted by the activities of the multinational corporation making the report so that each has an opportunity to appraise whether or not that group, as a whole, is profit shifting into or out of its country? That has been the demand made by NGOs at the OECD (I know: I helped make them) and in fairness that has been supported by the likes of Will Morris from the CBI at the OECD as well. If happened there would be no need for information exchange.

But the Big 4 accountants and their clients have argued that this data is far too sensitive to be given to all tax authorities and have instead suggested that it should only go to parent company tax authorities with other countries having the chance to access the data if they have double tax agreements with that parent company location. The implication of this cost assessment from HMRC is that this is what they expect to happen.

In that case it is quite clearly the case that the OECD will be failing to deliver country-by-country reporting for developing countries, who were always intended to be one of its main beneficiaries, since many of them do not have double tax agreements with countries like the UK and so will not be able to access this crucial data and so collect the tax owing to them.

If true this is absurd and a straightforward insult to the integrity and expectations of the countries that will be impacted. I am meeting Pascal St-Amans, the head of tax at the OECD, in Copenhagen tomorrow. He may be the recipient of some forthright opinion from me on this issue if he confirms that this is now the expectation.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard

I think that those figures for implementation cost are likely to be extremely underestimated, so if NGOs are within the ambit then they may have some funding issues around reporting. It’s not a question of whether the affected groups have the information somewhere – I would expect that they do. But if that information is not in the right format and needs either to be collected differently or extracted out of other accounting records then that is going to need IT spend. There is no way that a multi-national business is going to get that done for £1.9m over five years. That probably wouldn’t cover the project planning costs. Unless NGOs can do it with spreadsheets and sticky tape then I just don’t believe those cost estimates.

Fred

If companies do not have this data then they are not maintaining proper books and records required by law

Shall we stop talking nonsense?

Richard

If you read what I wrote, I didn’t say that they didn’t have the information. I said that they probably would BUT that setting up the process for putting that into a CBCR format could be expensive as there won’t yet be a process to do that.

I help multi-nationals on accounting IT for a living. I have a fair idea how much these projects cost in real life and I’ve seen some of the estimates for CBCR reporting. I wasn’t writing nonsense. Just an opinion, expressed civilly.

Fred

Fred

Then someone is exploiting someone else, I suggest

Is that it? Just a snarky comment? Not going to produce some counter-evidence. Of course we (try to) make a profit on our work. Have to tender for everything though and it’s cut-throat so not that big a margin anymore.

Interested in your estimate on how much it should cost to implement for a multi-national with operations in, say, twenty jurisdictions.

Fred

I have made my point

It should be minimal cost but consolidating some pretty basic data that has to be known by jurisdiction already really should not cost much

But I hear you saying I’m wrong

So we disagree

It’s gap owned to me before

I’m used to finding out I am right too

These would be one-off costs, nonetheless, and their benefits to society would be far higher than their costs to the firms.

Yes, paying taxes and complying with the law reduces profits.