I've already noted concern about the devolution of tax powers to Scotland this morning: now we have the detail on what has been written on Scottish income tax devolution by the Smith Commission, which is this:

And this is what the report says on the crucial issue of income tax.

Income Tax will remain a shared tax and both the UK and Scottish Parliaments will share control of Income Tax. MPs representing constituencies across the whole of the UK will continue to decide the UK's Budget, including Income Tax.

Within this framework, the Scottish Parliament will have the power to set the rates of Income Tax and the thresholds at which these are paid for the non-savings and non-dividend income of Scottish taxpayers (as defined by the Scotland Acts).

As part of this, there will be no restrictions on the thresholds or rates the Scottish Parliament can set. All other aspects of Income Tax will remain reserved to the UK Parliament, including the imposition of the annual charge to Income Tax, the personal allowance, the taxation of savings and dividend income, the ability to introduce and amend tax reliefs and the definition of income.

The Scottish Government will receive all Income Tax paid by Scottish taxpayers on their non-savings and non-dividend income with a corresponding adjustment in the block grant received from the UK Government, in line with the funding principles set out in paragraph 95.

Given that Income Tax will still apply on a UK-wide basis, albeit with different rates and thresholds in Scotland, it will continue to be collected and administered by HMRC. In line with the approach taken for the Scottish rate of Income Tax, the Scottish Government will reimburse the UK Government for additional costs arising as a result of the implementation and administration of the Income Tax powers described above.

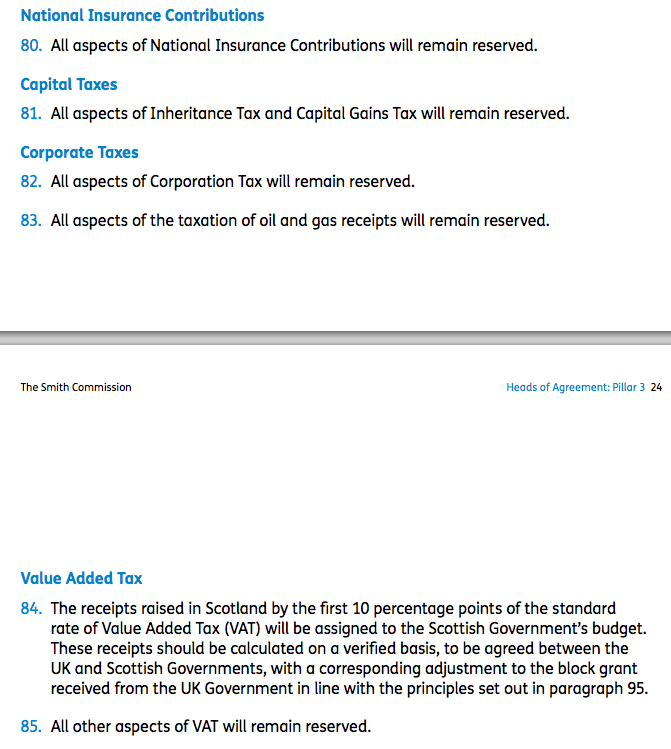

We also know the following, lifted straight from the Commission report:

So, income tax apart and maybe £2.5 billion (my best estimate) of VAT receipts all tax remains under UK control. Let's then consider this issue in its broader context, concentrating on income tax.

First, note that a power granted by Westminster is to be paid for by Scotland: there is no price tag attached. I hope someone has discussed the charging mechanism because this is a transfer pricing issue of the first order that could become very messy indeed.

Second, there is no control over key aspects of income tax - and most especially tax on savings income and dividends which may be key to any goal Scotland might have to redistribute income and wealth. Without control of capital gains tax and inheritance tax the political control of the Scottish parliament on the crucial issue of inequality is extremely limited by this.

Third, thankfully, there will be no race to the bottom on corporation tax.

Fourth, the Scots get no control of oil revenue. So much for devo-max.

Fifth, effectively the devolved power is only to set rates. Tax cannot be sued by the Scottish government to encourage investment, encourage or discourage any activity it thinks desirable or undesirable, and no changes in rules relating to any aspect of what is taxable can be discussed. To call this control of tax is in that case an insult: it's like being given a bicycle without the pedals, chain or brake and being told you're in full control when you have actually got no power to literally power the economy as a result, or drive its direction or brake what you think inappropriate.

And despite NIC being a tax in all but name that has significant economic impact, and heavy impact on the low paid, Scotland is denied any chance to control that either.

So what have we got here? We have rates devolved and little more. This is political spin without real consequence: it is little more than a minor re-writing of the Barnett formula, as the VAT note concedes. And yet at the same time there is macro-economic loss of control of the currency at a UK level and a borrowing formula with Scotland that is at present hard to fathom as to consequence.

So what have we got? A half baked tax devolution with almost no chance it can deliver any tax reform to create increased well being and employment in Scotland but which gives the pro-English faction every chance to beat Scotland down. It is, as I said before, a worst outcome and one that the people of Scotland will rumble as being not in the least in their interests very quickly. This issue has not been resolved by a long way as yet.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Five political parties seem to have signed up for this (Cons, Lab, LD, Green, SNP) so presumably it stands a pretty good chance of being implemented.

I can understand how you can split up “Scottish taxpayers” from other UK taxpayers (s.75 of the Scotland Act – an individual resident in the UK for income tax purposes who has “the closest connection” with Scotland in that particular tax year), but what does “receipts raised in Scotland” mean? Something simple, like VAT collected by businesses with a Scotland business address? Or will the full panoply of the place of supply rules be applied – for example, a reverse charge for services supplied by rUK businesses to Scottish businesses, or vice versa?

This looks like a reorganisation of deck chairs: as the revenues allocated to Scotland from income tax and VAT collected in Scotland go up (and the other taxes, like the land transactions tax, air passenger duty, and aggregates levy) then the amount paid to Scotland by the UK central government will go down (or vice versa).

I think there is a nightmare on its way with Scottish residency

And the VAT is just a joke: will VAT returns of UK wide companies now have to be split? How?

Country-by-country reporting may be needed in the UK……

I’ve just read all three of your bogs on this issue, Richard, and I have to say that what strikes me is that this leaves the Scots free to tax labour, with a share of VAT thrown in, but not to tax capital and interest. Or, to put it another way, free to tax workers – the majority of whom are not well paid – while the rentier and the rich (and corporations) can still rely on government in London to keep their tax rates low and create mechanisms that allow them to pay even less should they want to do so.

In short, if any future Scots government wants to try to address inequality, improve services, stimulate economic growth, or do anything socially and economically progressive then the ordinary working man or woman is going to end up paying for it (robbing Peter to pay Paul). Given what we saw during the independence campaign and that’s happened subsequently, that seems to me to be unashamedly directed at undermining the SNP (as the party most likely to govern Scotland for the foreseeable future), and punishing – or at the least holding the threat of punishment through higher income tax – over any citizen who is or might consider being an SNP supporter. Talk about a stitch up!!!

Still, no doubt Gordon Brown and all those who stood solid with him as he embraced the Tories (and their lies) remain proud of their role in this new, 21st century version, of the enslavement of Scotland and the Scots.

I agree entirely – staggering stitch up

And Labour deeply culpable

Membership of pro independence parties has increased greatly since the referendum. The Scottish Labour Branch Office has lost its manageress and assistant manager, Brown and Darling aren’t standing at the next General Election. I hope the remaining Labour and Lib den MPs are routed at the next election along with the remaining tory.

You should adopt classic EU democracy – keep having referenda until you get the ‘right’ result.

Meanwhile, in England, many people are beginning to wish the vote had been Yes & we would no longer have to listen to all this whining because the SNP lost the vote.

I have heard no one whine in that way

Can someone explain how the VAT will work? I get the impression that Smith (a Chartered Accountant) thinks it is a sales tax. But taking half of the VAT on say Tesco’s sales isn’t going to give the right answer – it should be half of the sales vat less purchases VAT. I am pretty sure cross border companies do not account for input tax on a geographical basis – or are they going to have to?

I have no clue how this will work

And anyway it’s not real: it just changes Barnett allocation and so makes no overall difference at all

Like most of this, whoever negotiated clearly had little or no real understanding of tax, which is worrying

http://en.wikipedia.org/wiki/Robert_Smith,_Baron_Smith_of_Kelvin

You may well be right about some/all of those (on the Scots side it would seem) having no real understanding of tax, Richard, but I don’t for one moment believe that what we are seeing now – indeed what we have seen from the Tories since the ‘NO’ vote – isn’t well planned and orchestrated. If truth be known I’d say they’ve had a working group looking at post-referendum “opportunities” (i.e. re-engineering the union such that it can be spun as more devolution but is in fact the refining and restatement of mechanisms of power and control – ie. hegemony) since not long after Cameron agreed to the referendum. Of course, when it looked like the Yes campaign might triumph it obviously threw that plan into question – hence the blind panic in Tory circles. But once the vote was lost, the Tories had exactly the opportunity they wanted. The Tory aim could be distilled into one sentence: if we are going to have to tolerate a progressive government/state north of the border then we are going to make you, the Scots, pay for it – and in as many ways as we can.

As there’s also an upside to this aim when it comes to England (eg. excluding Scots MPs from voting on certain “English only” issues/policies, and thus likely circumscribing what Labour can do if they ever get into government again), this is a win-win situation for the Tories. There must have been trebles all round many times over at No10 and Tory HQ in the weeks following the No vote.

I don’t dispute there’s been a plan

I regret that they are so much better at doing such things than the left