I watched a young person, formerly a member of UKIP, on Channel 4 last night as she explained she had let her membership lapse as the party was not all about immigration and it had forgotten what were, for her, the key issues of libertarianism and flat taxes.

Let's leave libertarianism aside as this comes in a variety of flavours, to some of which I can subscribe but which in the case of UKIP approximates to a licence to abuse and instead look at flat taxes. These have long been a subject of interest for me, partly because I find their appeal so very hard to understand. Quite a number of years ago I wrote a reasonably lengthy paper on the subject. I remember Vince Cable speaking at its launch. But the real essence of my difficulty is easily explained. All that a flat tax system really means is that there is one rate of tax charged on all income earned over an agreed personal allowance. In a progressive tax system there is more than one rate of tax charged. A simple example will explain the difference.

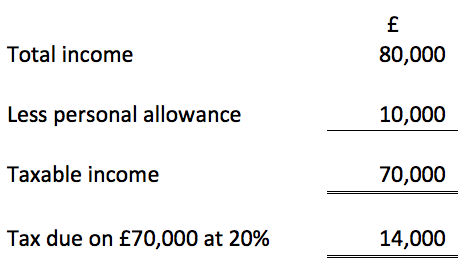

Suppose a person has income of £80,000 and there is a flat tax system in operation with all income over £10,000 being charged to tax at 20%. The tax calculation will look like this:

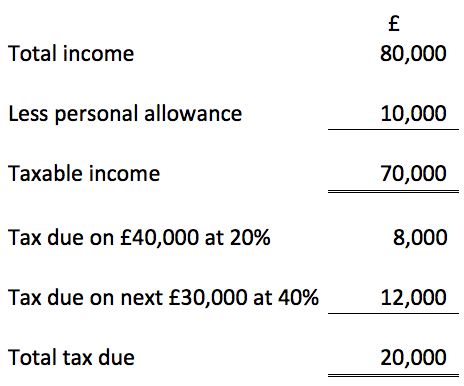

Now suppose the same person had the same income and enjoyed the same personal allowance but income above £50,000 is charged to tax at 40%, meaning that, in effect £10,000 is charged at 0%, £40,000 of income is charged at 20% and the rest at 40%. Then this person's tax calculation looks like this:

And that's the entire difference between flat and progressive taxes. Progressive taxation needs the addition of one more line, taking maybe 15 seconds of work, into a tax calculation, but raises significantly more tax from the well off as a result.

Of course, those supporting flat taxes say their system is much simpler. I suppose that's true if you really can't do maths.

If you can do maths then what that simplicity actually means is that the least well off pay relatively more of the overall tax bill whilst the amount of money available to government that might be used to provide the services they need is cut. And that is what flat taxation is really about. It's about making the rich richer whilst reducing the resources available to most in the country. That's a definition of tax injustice as far as I am concerned.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The flat tax advocates are those who like to point out that the UK’s tax code is one of the most lengthy and complicated in the world, as justification for their stance; the implication is that sneaky governments and bureacrats are getting tax via the back door.

Actually, isn’t it the case that our tax system has become so complex because we have such an active tax avoidance industry in this country? As an HMRC employee I’m well aware of the fact that legislation is constantly having to be amended and added to to close off the huge variety of avoidance schemes dreamed up, marketed and sold by (many in) the tax profession.

Any comment from the Taxpayers Alliance on this?

Your logic is right

It is abuse that has meant our tax code is so long

That, and the complexity big business adores

When I studied economics (in the same decade as you, Richard) a progressive tax system was one where the average rate of tax paid increased as income increased. A little simple maths will demonstrate that a flat tax system (as defined by you above) is progressive according to the definition I have given (as of course your multi-rate system is also progressive according to my definition).

But a progressive tax is much more progressive so you are resorting to pedantry

I wasn’t discussing how progressive a progressive tax system was; I was commenting on your definition of progressive. Either it is as I say, in which case your statement that a flat tax is not progressive is wrong and should be corrected, or you are changing the definition of progressive, in which case it helps to be clear that is what you are doing. I would have thought an organisation with ‘Research’ in its title would want clarity on these matters.

Technically having a personal allowance makes a flat tax progressive

But that ignores the fact that almost all taxes in the UK are regressive bar income tax and therefore abandoning a progressive income tax guarantees a regressive tax system overall

Nor does your pedantry in any way change my argument

“Of course, those supporting flat taxes say their system is much simpler. I suppose that’s true if you really can’t do maths.”

Of course, you’ve flattened (and simplified) the tax calculation by removing the complexity of more rates, NI, allowances, benefits, tax credits, frequency rate changes, band changes and so on. How many people do you think could do their own PAYE every month?

I related the issue solely to flat taxes

That is what the post was about

You won’t hear from the TA on this, because they live in a neo-liberal nirvana as far removed from reality as you can get.

“And that’s the entire difference between flat and progressive taxes. Progressive taxation needs the addition of one more line, taking maybe 15 seconds of work, into a tax calculation, but raises significantly more tax from the well off as a result.”

That’s it?….No discussion that the additional line leads to distortion as people replace the higher income with capital gains, undertake avoidance or simply reduce earnings?

Are you really saying additional tax codes automatically raise the money asked for and have no effect on the economy or individual actions?

Those are all relevant issues

Bit have nothing to do with flat tax per se

If the introduction of the flat tax was accompanied by a withdrawal of the significant reliefs and allowances tha the better off enjoy, the the outcome might be different.

If Mr £80000 is paying £40000 in pension contributions and maybe making an EIS investment, he may not be paying £20000 tax under the progressive system but something not unadjacent to zero. Not mention the zero tax on his ISA accounts.

A flat tax might collect the £14000.

I am not saying that a flat tax is a good thing. I am not a believer, but it depends on so many other variables. In fact, we may not really have a progressive system. It may be actually regressive.

I know we need to reform what we have

Byt flat tax is no replacement

“A flat tax might collect the £14000”

Do you really believe your Mr 80000 will suddenly ditch his tax avoiding ruses just because HMRC ditches the higher tax bands (which were of no relevence to him anyway, as he didn’t pay tax at those bands)? That he’ll suddenly volunteer up £14000 in tax because the taxman seems more reasonable?

You hear the government throw up the same flawed logic RE the top rate of tax and Cooperation tax; that if we reduce these rates big companies and wealthy individuals will give-up dodging tax altogether (as many currently do) and volunteer up some extra tax. Like aggressive tax avoidance is just them trying to make a point, throwing a strop at what they think is an unfair rate, and that if we were only to ask for a bit less they might throw us a few extra crumbs. Nonsense!

If people/companies/whatever can get away with paying nothing back to society they will do. Your Mr £80000 will still be paying the basic rate and Amazon et al will still pay sod all.

Evidence from the real world is that any positive tax rate induces avoidance in some

Indeed, in the US, negative rates are common in some states for corporations

“whilst the amount of money available to government that might be used to provide the services they need is cut”

Come on Richard, let’s drop the “UK government needs monetary funding” line. That is perpetuating a dangerous anti-progressive myth in a dynamic currency system like ours.

However the powers that be try to dress it up, a government using a monetary system like we have in the UK can always deploy whatever real resources are available within its currency area whenever it can muster the political will to do so. And it can set the tax rate, or rates, at a point that stops that overloading the production system.

The key question is whether those who receive more money than perhaps they should due to a deficient capitalist distribution system should be allowed to build up financial savings in excess of investment.

In other words are they allowed to ‘voluntarily’ tax themselves by excess saving – and maintain control over that portion of money they have put aside – or is it better to ‘compulsory’ tax them and destroy the money completely.

So I would argue that progressive taxation is a distribution issue rather than a ‘total amount of tax’ issue. Far too many commentators mix up the two.

The whole flat tax debate is tied up with the marginal productivity nonsense – the idea that everybody magically gets what they deserve via the majesty of capitalism. In that world view flat tax makes sense because they really honestly believe that those earning a million are 100 times better than those earning £10K on min wage.

Anybody who has spent a nano-second in the real world knows damn well this isn’t true. Capitalism by default over distributes to those with the power and under-distributes to the dispossessed

Capitalism is short-sighted, and progressive taxation attempts to correct the vision. And frankly, with the disturbing level of income inequality we have, what it really needs is a much stronger prescription.

Neil

I buy a log of MMT but MMT does not say tax has no role and tackling inequality is a wholly valid role for tax even in MMT theory

I am not sure where the inconsistency is – bar some of the rhetoric that is aimed at a world where MMT is unknown

Richard

Whilst I would not disagree with the gist of your premise it all depends which sum of tax is actually collected – the £14k or the £20K and how much it costs to collect. And that depends on the culture of taxpayers and of the efficiency of the tax collecting agency. What I would have been more impressed by would have been a critique of those states that do apply flat rate income taxes,don’t one or two of the Baltic states do so for example?

Have you noticed the economic crisis they, Russia and Iceland have been in and in some cases remain in?

And why can’t we have a tax authority that can collect tax? The only thing absent is political will

Your example assumes a personal allowance that represents around 30% of the average salary. How about setting the personal allowance at 100% of the average salary, let’s say, at £30k. This would make for a flat tax that is far more progressive than the current tiered system.

Of course, this would result in a shortfall in tax revenues, which could be made up by a property tax. If this property tax were levied on ownership rather than occupancy, then this would also help the less well off as they have a greater tendency to be tenants rather than homeowners.

I happen to think an income tax more just

But I would emphatically have a property tax too

Part of the tax system should be about redistribution. It should also be about competition. In that capital should not be advantaged over labour or large over small companies or debt interest over equity. Capital accumulation can bring many benefits to individuals. It can also lead to undue influence and much much worse. Money is a society construct enforced by the state you made it from a society therefore pay up somewhere – otherwise its a racket.

Points well made

a flat tax system with an allowance clearly has increasing marginal tax rates:

0% between 0$ and the allowance

x% after the allowance

So increasing marginal tax at the allowance…

Considering the current UK tax system is is 32% – 42% – 47%, more or less, I don’t think it’s very different from the current system… If you include the employers NI it’s even flatter… Due to the allowance cancellation, the current system has no change in marginal tax rates above 150K, so I really fail to see the difference…

Given the constraint of raising the same revenue and assuming no dynamic effect, you can achieve any number to results… You could for example extend back the very top rate of tax down the income scale and return that money as a raise in the allowance… This would clearly benefit the working class at the expense of the middle class… Bands are not really needed to benefit low paid workers…

I think it’s the very high marginal rates for 50K income families with children (potentially more than 100%) and the allowance withdrawal (60% at 100K and getting worst as the allowance is being raised) which generate the most unattractive features of the current tax system. Benefit withdrawal are probably even worst, but I don’t know the subject very well…

I agree the bands are not inherently that complicated, it’s mostly the other features that are bad…

We need to redesign our tax system: I agree

You are assuming NIC applies to all income

It does not…..

I think you have to take account of the issues that make Flat Rate Tax attractive.

The Tax Code is just horrendously too long. We also don’t take notice of international experience enough, to see what works and what does not. Our Universities seem to see Tax research as somewhat beneath them. The whole Tax policy making regime is amateurish. Most MPs are so ignorant of practical tax because most of them have not had a real job in their lives. And yes HMRC is underfunded,de-skilled and with useless leadership. And lawyers have a vested interest in keeping taxation complicated.

No wonder Flat Rate is so appealing!

Flat rate is only appealing to those who want to gut government

That apart it has no appeal at all to anyone who looks into the issue

No, I am not saying it is appealing- it’s a reaction against the current system. And that reaction can’t be ignored.

OK

How do you suggest dealing with it – especially when the reaction is factually misplaced?

“You are assuming NIC applies to all income

It does not…..”

Indeed.

Campaigners for ‘tax justice’ such as yourself and left-wing radicals such as Ken livingston are well aware that dividends attract neither employer’s nor employees’ NIC.

I guess that’s why you used to pay yourself dividends from a company you controlled, as did Ken Livingston from a company he controlled.

“video meliora proboque deteriora sequor” Ovid – “I see and approve of the best way, but follow the worse”.

The total dividends paid from a company I controlled were less than the NI limit as I recall

Hard to avoid NI in that case

“Flat rate is only appealing to those who want to gut government

That apart it has no appeal at all to anyone who looks into the issue”

There are currently in excess of 50 countries or states with flat rate tax systems. Are you saying none of them looked into the issue? Or that they all want to ‘gut’themselves in terms of government?

That those countries have single, flat rate taxes at rates of between 2.5% and 46% shows that the issue is far more complex than you have suggested (and you yourself say the topic is about flat rate tax ‘per se’).

We currently have combined income tax/NIC rates that change as income increases:

0%

12%

32%

42%

62%

42%

47%

Not to mention situations where a income tax refund doesn’t result in NIC refunds and vice versa.

Some say a higher personal allowance and single flat rate tax would make things much easier to administer. The argument is then about where that personal allowance and single rate sits.

But you dismiss the whole idea out of hand because the only reason you can see for flat rate tax is to ‘gut government’. Sounds to me that you haven’t really looked at the issue.

And how many of the flat tax countries al;so have very high and complex NI rates?

And how many are tax havens?

Shall we move away from simplistic trivialising of the issue, which is what you offer?