The tax gap debate in the UK was pretty much first sparked by my February 2008 paper for the TUC entitled The Missing Billions. Old Treasury papers reveal that. HMRC began publishing tax gap data in direct response, the first in March 2010. I have been arguing HMRC have got their methodology wrong and have massively understated the tax gap pretty much ever since.

Yesterday the Public Accounts Committee addressed the issue, partly using questions I'd suggested here yesterday morning. And the conclusion, according to the Guardian was:

Britain's official tax gap of £35bn is only the "tip of the iceberg" and is being exacerbated by tax officials' failures to use the law to clamp down on internet giants such as Google and Amazon, according to the high-profile chair of a committee of MPs.

Margaret Hodge cast doubts over HM Revenue & Customs' estimate of just how much taxation is lost through avoidance, evasion and non-payment as the public accounts committee questioned Britain's leading tax officials.

The officials admitted that they do not include money earned in Britain by Google, Amazon and Starbucks — all accused of tax avoidance, but who reiterate that they abide by the law — in their tax gap estimate.

Hodge said: "It does not include a lot of what ordinary punters in the street think you should be collecting, particularly in regard to the large corporations. The tax gap is really the tip of the iceberg in the gap between the money that you collect and the money if everyone paid their fair share."

I think the time has come for HMRC to stop pretending that their tax gap measure is either a useful measure or a useful management tool. It is neither. It does not indicate areas of concern requiring action; it's methodology is dubious at best, and by dramatically understating the scale of the tax gap problem it does not act as a good indicator of the resources HMRC needs to address this issue. The result is that it is not fit for purpose. Margaret Hodge came to that conclusion and I am sure her report will do so too.

Now it's time for a useful measure to be introduced. The question is whether HMRC will have the nerve to admit they got this wrong. After all, if parliament does not think their measure useful then it quite clearly is not: no better indication of it not being useful could be found. Under the current Board I doubt that it will make any changes though, but I look forward to being proved wrong.

Update:

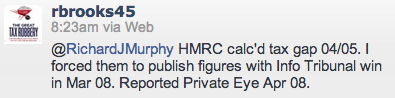

Richard Brooks has posted this on Twitter:

Fair point. I'm always happy to share credit with Richard. We were both on the case in different ways.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

First, define your tax gap. HMRC is a creature of statue; it can only play by the rules as written. Asking them to guess what the tax gap might be if the law was different would be no more than that; a guess. We can debate the implications for overall economic activity if the tax system changed, and hence the ultimate impact on the tax take, but to quote something I read on Twitter the other day, “Of course you can extrapolate. It doesn’t mean you’re right.”

Respectfully – there is no avoidance in tax law so HMRC do not follow it now on that logic

Your argument does not make sense

If there is avoidance they’re not defining it properly

I thought that you had said that HMRC only looked at the Tax Gap because of your work but Richard B says it had done it in 04/5?

One was done earlier

The regular pattern started as a reaction to my work as far as I can see

It’s an honest claim based on documentary evidence of Treasury notes just after the Missing Billions was published that refer to it

You say the Tax Gap is not fit for purpose. Of course, but the underlying problem is that HM Revenue & Customs and the Treasury are not fit for purpose. Billions of £s are spent in R&D for various commercial purposes but Tax policy formulation and implementation is done on the cheap and by amateurs, and even when experts are used (often from the Big 4 Accountancy firms where all knowledge is said to reside) it is given with vested interest. The whole edifice is rotten.

So, a woman with no background, grounding or understanding of the tax system has pronounced….

I hardly think using Margaret Hodge as a supporter qualifies you to claim that you have won any argument. Quite clearly she thinks tax ‘avoidance’ and what the ‘average punter’ thinks HMRC should be collecting should be included in a calculation of the ‘tax gap’ which is patently absurd.

In PAC hearings she didn’t even seem to grasp the difference between turnover and profit and remains conveniently vague when discussing the tax affairs of her own family company Stemcor (which, I’m sure, only uses ‘nice’ tax planning not the ‘nasty’ tax planning everyone else uses). Mike Truman’s awarding of ‘Tax Prat of the Year’ to Hodge was well deserved.

You might think that

It proves just how out of touch you are

And why people do not trust those who profess that view