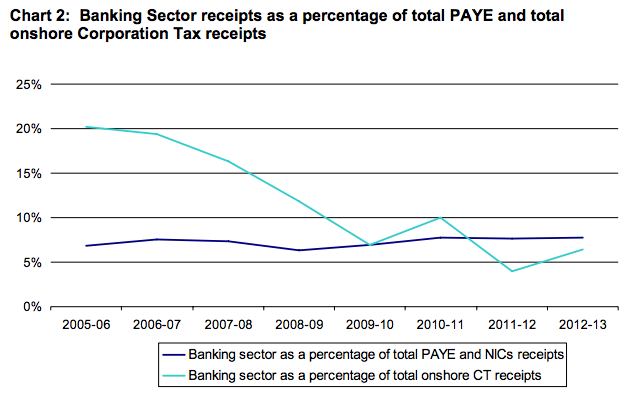

There was a reason, perhaps, for putting up with the banking sector when it added to the value of UK tax receipts. But it doesn't any more, as the following chart just issued by HMRC shows:

Corporation tax receipts from banking have tumbled and the recovery in 2012-143 is modest and almost certainly related to lower loss provisions.

PAYE meantime has been fairly static in real times, but also a complete red herring in this debate. Banks do not pay PAYE. Their staff do. That's even true of employer's NIC which all economists agree is actually paid by staff through reduced wages.

So to attribute this PAYE to banks is absurd: it assumes that these employees would have nothing else they could do if the banks did not employ them. Of course, if bankers really are socially useless (and some top end ones maybe are) that could be true but most bank employees do actually have highly transferable skills and work in relatively ordinary jobs doing a useless job in the service economy that could easily use their skills elsewhere. So the PAYE they pay is not the banks' liability, it is theirs.

And that means all the banks really pay is corporation tax and the bank levy. And the corporation tax contribution has become pitiful for an industry that has imposed so much harm on the UK economy and which remains, when all is said and done, the only thing the government thinks this country can do.

If ever there was evidence of the need for an economic rethink as to what the UK economy should be about, this is it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

presumably the banks have accumulated a lot of tax losses over the last few years which are now being used up (obviously the losses dont shield the bank levy). Are you suggesting that tax losses shouldnt be offset against profits (assuming they are now making profits !?!?)

interesting that the PAYE is static since 2005 – which rather suggests that there hasnt been any increase (or decrease) in bonuses etc

The losses have to some extent been used – hence increase in tax last year, I suspect

Here’s the joke

Taxpayer ripped of by banks thru mis-selling, fixed labor rates, inflating the housing market and general economy by irresponsible lending

Banks and economy crash putting many people out of their business and their houses ruining their lives

Taxpayer bails out the banks

Banks now sued for millions / billions ref misselling etc, losses accumulate, who is paying this back to the taxpayer …..the taxpayer!!!

Banks buy back the taxpayers share once they are back in profit!

WAKEN UP PEOPLE, SMELL THE COFFEE, BUY GOLD, DO NOT PUT YOUR MONEY IN THE BANKS!

Perhaps a bank levy that reflects the amount of money they have drained out of our communities via housing bubbles would redress the imbalance?

Presumably an “economic rethink” that has banks serving the economy rather than being the economy? Where the service sector actually serves the real economy rather than itself? And one that believes that our people have the ideas, creativity and ingenuity to create jobs rather than being hell-bent on attracting business to our shores from abroad.

PAYE just means their still paying the same amount of wages to their employees – So they either haven’t cut back on numbers, have increased numbers but paying less per head or employ less but paying more per head – If you see what I mean.

What does surprise me about that graph is that CT paid was already falling prior to the financial crisis, when (if memory serves correcly) profits were large and increasing. What does that suggest? Ah so maybe it shouldn’t surprise me then 😉

Companies can carry back losses to a certain extent; also bear in mind that roughly half the tax a company pays in one year relates to the profit of the previous year. So whilst the trend shown in the graph is certainly real, there is a complex relationship between any individual data point and the years it refers to.

The graph really needs a line showing bank profits – this would I believe show about a 40% drop in statutory profits in 2012 reflecting PPI and other fines; also, bizarrely, the recovery in banks’ own bonds in 2012 resulted under IAS in the banks booking a loss (i.e. the fair value of their liabilities increased). This reverses the “profit” the same banks would have made in previous years as their poor performance cause their own bonds to fall in value (and therefore resulting in a profit under IAS). Madness, but only fair that since the banks were taxed on the illusory profit in 2008 (or whenever) they got a tax loss when the position reversed a few years later.

I expect all these various effects are close to being fully played out, and bank profitability will return to trend next year. We shall see!

I have to say interpretation is guess work

We agree on that!

Erm, don’t economists agree that workers bear the burden of corporation tax too?

http://stumblingandmumbling.typepad.com/stumbling_and_mumbling/2010/04/corporate-tax-incidence-some-evidence.html

The Oxford Centre for Business Taxation studies on which that is based are so fundamentally flawed the claim is as valid as the oft held belief that the moon is made of cheese

Is it the German study – which I’ve just sped read in about 15 minutes?

Well all I can say is you can make statistics prove almost anything! So CT rates went up and wages went down over a period of time in the sample of German companies they used. So what? There were surely many other factors involved in the rise and fall of wages.

I once recall a statistic book I read pointing out that over a period of time the number of TV aerials increased as did lung cancer – So one could conclude TV aerials caused lung cancer – Clearly rubbish – But illustrated the fact that without any obvious causal link any two trends could be said to be linked.

Now to be fair to the German study there is a potential causal link between wages and CT, but there are so many other things causing movements in CT rates and movements in wages rates, it seems very difficult to me to say the link is clearly established.

The potential causal link to my mind is that if a company is focussed solely on post tax profits, then if taxes go up they will want to reduce other costs. So potentially wages is one of the costs they may want to reduce. They may raise sales prices which means cost of living goes up so effective wages go down of course. So yes there is a possible causal link. But so many other factors are involved, and many companies look at operating profit or above so other than at a very high level (i.e. the board) management often doesn’t focus on post tax profits so it isn’t a driver in their business decisions, and hence not on wages decisions. Causal link dismissed (ish).

You are right – this is a perfect case of correlation not proving causation

But it is worse than that

First, CT rates only go up when government is short of income – when there is recession in other words. Wages fall in recession. There is a third party factor

More importantly, if the link was real, then it would work both ways i.e. corporation tax cuts would give rise to pay increases. UK CT has fallen from 28% to 20% in a very few years (announcements are, curiously, what matters to economists since everything is about discounting the future) and real wages have fallen about 5%

The Oxford Centre for Business Taxation study is propaganda, not good social science

It is trite that the economic cost of tax has to be borne by consumers/suppliers, workers or shareholders. The interesting and difficult question is whether the cost falls in particular cases. It does, however, seem that in the case of banking, the cost of recent tax measures have been borne mostly by shareholders – see e.g. the very expensive bank bonus tax – this greatly increased UK banks’ tax liability but remuneration did not reduce – rather, bank profits were eroded.

True

“More importantly, if the link was real, then it would work both ways i.e. corporation tax cuts would give rise to pay increases. UK CT has fallen from 28% to 20% in a very few years (announcements are, curiously, what matters to economists since everything is about discounting the future) and real wages have fallen about 5%”

Yes, if the theory is correct then it should go both ways. But looking at what’s happened in such a short timescale, and with a great many other issues in the economy, doesn’t really debunk much.

Companies (like people) are also having to deal with rising energy costs, and a devalued currency, in a world of falling or static sales. We know that private sector employment levels have managed to stay fairly stable during the last few years.. if the falling CT rate has contributed to companies deciding to keep staff employed during a difficult period then that’s a return to labour.

Also, the fall in the real wage level is largely to do with lower paid and part-time workers. An organisation which employs a lot of such people (e.g. retailers, outsourcing companies etc) would have a CT cost which is far smaller in relation to the labour cost than a typical company. Even if the CT reduction did pass through to labour (which I don’t suggest has happened), the effect would be barely observable.

I’m entirely happy to agree there is no link one way

But please don’t then argue there is the other way when the evidence is weaker if you want any shred of credibility to remain

Verth – The incidence of corporation tax is a very difficult question. There is a lot more work done on it than the Oxford Centre studies That Richard refers to. It is very hard to draw firm conclusions as all times in all jurisdictions or even for all sorts of CT measure (eg the actual effect of capital allowances or interest deductions) and there there is a lot of work going back over many years – including the German study you refer to – that shows at least some of the incidence of corporation taxes falling on labour. Google on Kotlikoff & Summers or Atkinson & Stiglitz and you’ll find a lot of the relevant material.

And it’s a very important question for policy making. Because if you have a tax like corporation tax that is believed by many people to fall on the rich (ie the shareholders) but which actually falls to some extent on the less affluent (ie me)or vice versa then you can get things very badly wrong.

My House of Lords submission earlier this year reviewed some of the broader evidence – and it is, as you say, inconclusive

BUT in the short term the evidence seems to be it falls on capital

And actually since there is no long term – only on this issue continual short terms – that is compelling to me

I have no doubt the incidence is on capital – not least because capital behaves as if it is

I agree that in the shorter term it sticks with capital. But, of course there is a longer term! (that was a joke right? – or do you believe that Achilles never catches up with the tortoise?). At the very least you’d have a two-period economy with one short-term period where the tax sticks to capital and one long-term period and in the second period there would be time for the burden to adjust (to some degree)away from capital.

Found the submission. Interesting thanks. I see this at point 4 in the introduction:

“The incidence of corporation tax is almost certainly on capital in the short and medium, term and in the long term cannot be appraised. The evidence that the incidence is on labour at this point in time is weak”

I’d only disagree to a small extent and I’d change it a little to “…long term cannot be appraised as confidently. However, the evidence that some incidence is on labour at this point in time is quite strong.”

Nice to see that you believe in the long-term really!

No – actually I don’t

In the modern economy there is no ceterus peribus

All things are not equal: there is always another short term impact before the long term impact can be appraised on micro matters like this

So we are not in full agreement – sorry

Way to technical for me – It’s been 30 years since I did any differential calculus to that level.

The underlying econimics being the driver of changes in both tax rates and falls/rises in wages makes much more sense – The same thought was going through my mind as I drove to the gym last night 🙂

As you point out falling tax rates can be driven by government wanting to stimulate growth in difficult economic conditions, and those same economic conditions mean wages go down – Which I think is the UK scenario in a nutshell.

Verth – There is a problem with your analysis, which is that in the recession wages have fallen in real terms only, not in nominal terms. Here is a link to the ONS’s report from Feb “Changes in real earnings in the UK and London, 2002 to 2012”: http://www.ons.gov.uk/ons/dcp171766_299377.pdf . Have a look at Figure 1 on page 3 which shows median hourly earnings (excluding overtime) of all employees from 2002 to 2012. Post 2008 hourly rates have been flatish or have risen. They have not fallen. This is not unusual in a recession, nominal wages tend to be resistant to reduction. Any effect that CT rates have on wages would take place year-on-year in nominal terms and in that period you have CT rate going down and nominal wages rising. For the record, that does not prove that labour benefits from a reduction in CT rate but it invalidates your analysis.

Oh well. I still see it as being teh econmic ocnditions that are driving changes in wages and economic conditions that drive governements to make changes to tax rates, rather than there beinga direct link between wages rates and tax rates.

But then it is clear from the links you provided that tehre is a lot of technical academic work going on looking at how tax incidence drives prices and wages – It’s just not clear to me (due to lack of technical ability) what those analyses conclude and how they relate to the real world since there are so many more variables in the real world than a relatively simple mathematical model, which is based on 2 or 3 variables, shows.

Precisely!!!