As many will know the Treasury has proposed that a companies track record with regard to tax should be considered when assessing suitability for the ward of a public sector contracts in future. In the budget it said:

In fact, some guidance was issued on 14 February on this subject, and more has appeared since the budget, which dramatically watered down the 14 February proposal.

But which ever way looked at, to include tax considerations in the procurement process was a novel development in UK law and it occurred to me that it could be in conflict with EU competition law so I made Freedom of Information requests of both the Treasury and Cabinet Office, the two offices responsible, to see what legal advice they had taken on this proposal to ensure it was legal.

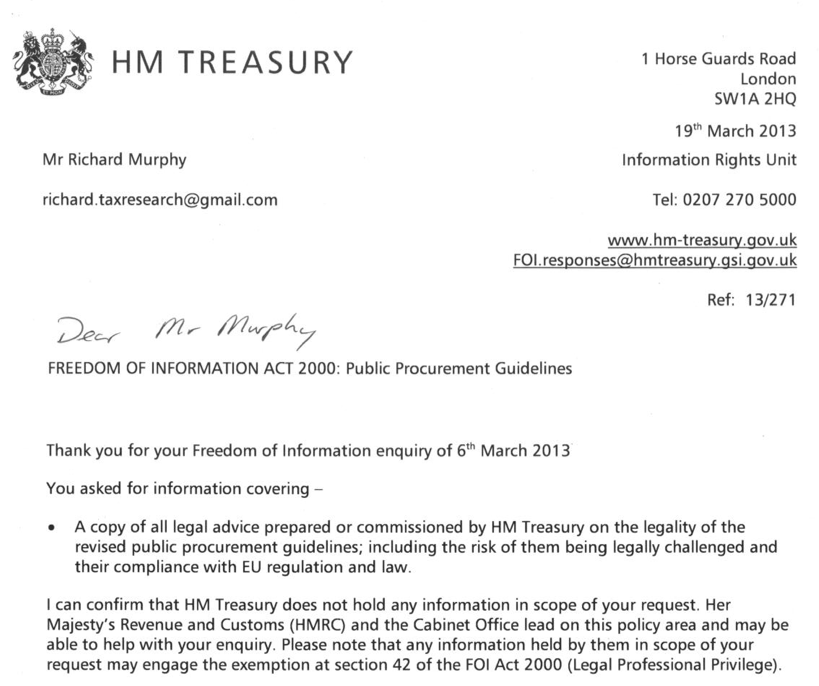

I was surprised to hear from the Treasury that they had left this entirely to the Cabinet Office. Their response said:

Today the Cabinet Office sent their FoI response which said:

So it would appear that this policy was put in place without any consideration of its legality having taken place.

Which is quite worrying.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Perhaps if it proves to be illegal they’ll retrospectively make it legal a la Iain Duncan-Smith’s dangerous precedent. They really don’t care about the ‘rule of law’, this mob, they just care about the ‘rule’ bit. This has, perforce, been obvious to the disabled community for some time. I’m pleased to see the rest of you are beginning to catch on.

Presumably they’re not expecting any challenges from affected suppliers. Now, why might that be?

You should ask HMRC. That said, this should be the kind of information they withhold on privilege/public policy grounds .

Why?

This is policy, not about a taxapyer

This was only ever ‘guidance’, Richard, as such it would have been widely ignored and what you have done is discovered what the reason would be for following that course of action.

I’ll wager that it was never, ever, intended to work. It was a PR stunt to go with the Cameron/Osborne rhetoric. Knowing that, the Treasury/Cabinet Office/HMRC (or whoever was the lead) would not therefore have bothered to put work into getting a legal judgement.

I fear that is true

In the usual Conspiracy vs Sod’s law debate I’m afraid that it is probably once more

Sod’s law. I fear for the competence of Government at every level. It’s no good demonising the Coalition (again), it’s been a continuing trend for many years.

It’s more to do with Parliament being full of career politicians with no other skills and the decline in professionalism, organization, and resources of the Civil Service.