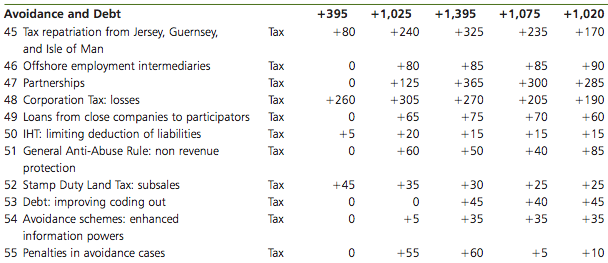

The schedule on the implications of tax avoidance and evasion measures in the budget are interesting.

First, excuse my cynicism for thinking they jut happen to exceed £1 billion a year: we will, of course, never know.

Second, note the official estimate of losses to the Crown Dependencies. I suspect these are low.

Third, the scale of partnership abuse - where LLPs in particular (and lawyers even more particularly) make people who are really employees partners to save NIC is bigger than I ever imagined (sorry for missing that one - although see yesterday's post on the much bigger problem in companies).

Fourth, oddly the Revenue show little faith in the GAAR and are still producing specific tax avoidance rules to target corporate tax abuses. If we had a general ant-avoidance principle neither this of the LLP rules would be needed: despite my current (ambargoed) work on the general anti-abuse rule I remain quite convinced of this, as seemingly are HMRC.

Note also how limited the general anti-abuse rule is going to be in impact terms, supprting all I have said about its far too limited scope in the face of the tax abuse problem.

And note that penalties in tax cases are meant to collapse. I have no idea why.

But when the tax gap is £95 billion this is a lame effort, and it's important to say so.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

And look what was hidden yesterday http://www.accountancyage.com/aa/news/2256056/frc-disagrees-with-competition-commission-audit-report

Sounds like a case for some rotation of the Big 4 out of the FRC.

How dare anyone criticise the great big “closed shop” operated by the Big 4! 😉

Move along sir, there’s nothing here for you to see.

Contrast this with the reception afforded to Bob Crow when he defends the LU workers rights!

Was there anything on “demonstrating tax compliance” for government suppliers?

IT Outsourcing companies based in Indian STPI/SEZ “tax holiday” zones got a boost a few weeks ago when:

“The Central Board of Direct Taxes has clarified a number of issues relating to tax holiday claims by taxpayers who have registered under the STPI (software technology parks of India), SEZ (special economic zone) and EOU (export-oriented unit) schemes. It clarifies that profits derived from computer software developed abroad at a client’s location (onsite) and onsite deployment of technical manpower shall be eligible for tax holiday benefits, provided there exists an intimate nexus/ connection between the onsite development and the eligible unit, subject to the condition that such activity is pursuant to a contract between the customer and the eligible unit;”

http://www.thehindubusinessline.com/industry-and-economy/taxation-and-accounts/bank-account-attachment-quashed/article4469407.ece?textsize=small&test=2

The Indian tax department had previously been claiming that their profits from “bodyshopping”/deployment of technical manpower to client sites in other countries were outside the special tax treatment.

The CBDT decision means the profits that outsourcing companies generate by sending Indian staff to work on projects in the UK will still get the “tax holiday”. So companies like TCS (which has won the NEST and DBS contracts with the government), and transfer in most of their UK staff from India, will still have an incentive to transfer the profits back to the Indian STPI/SEZ that provided the staff.

Linda Kaucher brought this up at the Compass House of Commons event last week. The Labour Party unfortunately have nothing to say about this. She has been banging on about this for years but no one seems to be listening – just treat it as a bit of racism.

Jim Flaherty’s comments are quite interesting.

http://ca.reuters.com/article/businessNews/idCABRE92L18120130324

“But Flaherty said he expected the additional revenue to be much higher because the tax collection agency is only able to make a partial estimate of how much is currently slipping through the cracks.

“There are some loopholes that the Canada Revenue Agency cannot estimate the results to be, so for those ones we put nothing in the budget,” he said.”

If I’ve understood the above comments correctly, then it appears that the Canada Revenue Agency are at least admitting they can’t quantify, Canada’s “tax gap”. Would I be right in thinking HMRC are not quite so candid?

Absolutely right