![]()

I was in discussion with a group of economist yesterday. Left of centre economist, but all the better for it.

We agreed there was a need for cuts now — but not cuts in government spending. There is no proven need for that at all.

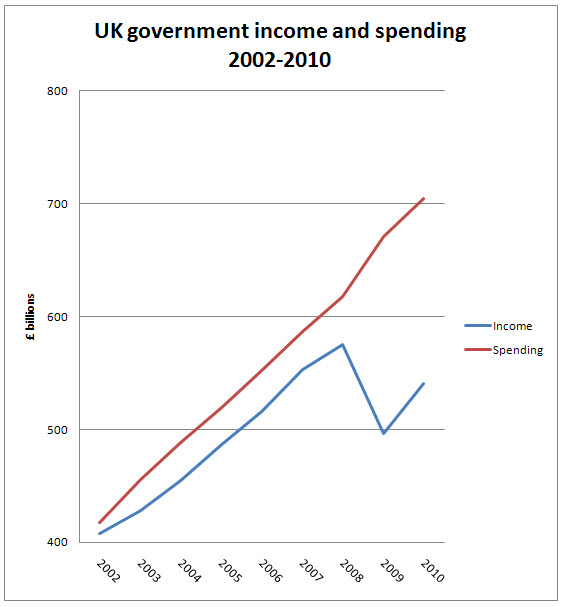

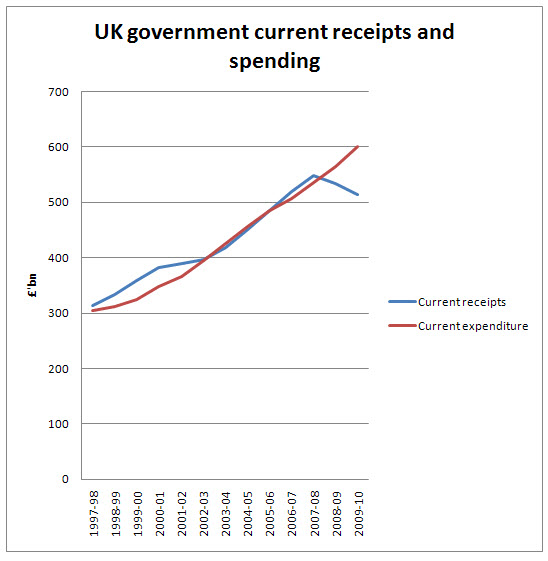

Don’t get us wrong. We know we have a financial crisis. But it’s this graph that tells the story:

The data is from budget statements for each of the years in question. and yes of course that shows expectation — but that’s important. Planned spending is based on planned income.

And do remember these figures are unadjusted for growth and inflation.

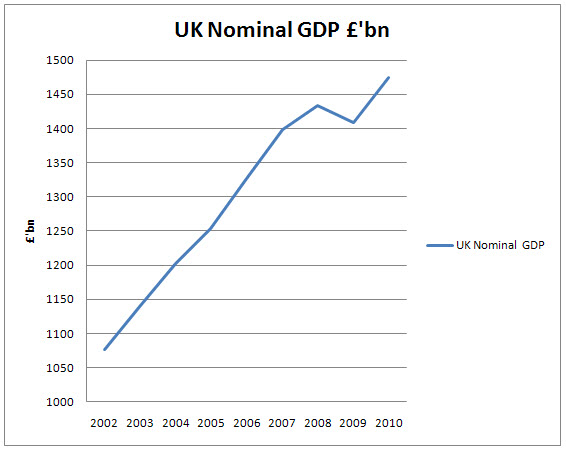

It’s very obvious that a deficit was run from 2002 to 2008. That was largely explained by net investment in new assets though, by the time lag between growth and government picking up the benefit of that growth in the economy. Don’t underestimate that growth. It looked like this:

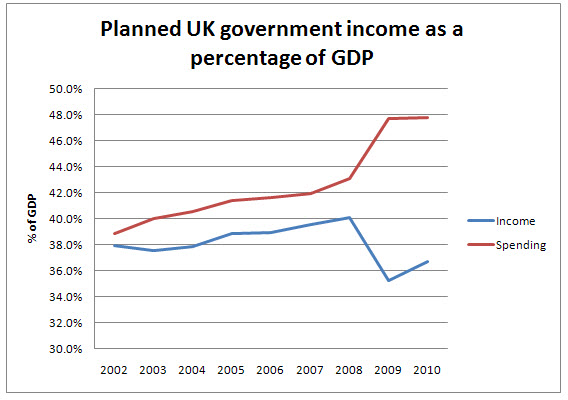

Planned income and spending as a percentage of GDP therefore looked like this, to eliminate this distortion:

So yes, there was a small and upward forecast in spending from 2002 onwards — as there was also in revenue to match, with as noted investment being broadly covered by borrowing. It was the collapse in GDP and tax revenues that utterly changed things. That’s where the faultlines have arisen in the graphs shown. None of what has happened has anything at all to do with government spending. That’s been under control, and the only reason that it has risen in proportion to GDP is because GDP collapsed.

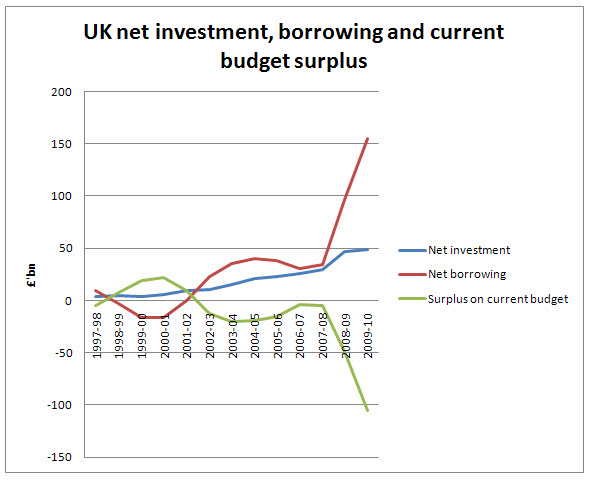

Let’s also be clear about borrowing and it’s cause. This graph shows budget outcomes (i.e. final data) for 1997/98 t0 2008/09 and estimate for 2009/10, all from Budget reports:

Borrowing appears to match current surpluses and deficits. But note 2006/07 and 2007/08 — where borrowing was almost entirely for investment — a pattern also true in largest part from 2001/02 onwards. Now I am well aware that PFI is not included — and that is an issue where I have no truck with what New Labour did — but this is not a government recklessly over spending in the environment of the period. The transformation in borrowing is again shown to be the consequence of the crash in income. Comparisons of the outturn data on current government income and spending (as opposed to expectation) also makes this very clear:

The conclusion is obvious: the crash was not caused by government spending. And it was not spending that was out of control.

The crash was caused by a collapse in government income.

In that case the means to overcome the current crisis is to restore income, not to cut spending.

And therefore the whole basis of the government's economic policy is wrong.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“Investment” is a euphemism for “spending”, right?

@Delphinium

Sure it is

But that’s true of business and government

What;s your beef?

You want to end investment?

Recession here we come in that case

@Richard Murphy

One thing that has often bemused me is that the Left have always said that economic growth is not important – or rather, that Western societies place too much reliance on it as a measure of success. Some even say that we should aim for lower growth as it is not sustainable. These may or may not be true.

However, now we have lower growth we see the Left demand higher growth!

The fact is that any growth lower than c. 2.5% pa will lead to a rise in unemployment. That is almost certain. So it is an amusing spectacle the left now arguing for growth they previously said was unsustainable.

And don’t give me the Green New Deal spiel – you would lose millions of jobs just by making energy more expensive (which is an inevitable outcome of the GND proposals).

Sorry, Richard, but I can’t agree.

A good Keynesian would have run a surplus during the boom, so that we would then be able to safely run a deficit during the inevitable bust. Brown didn’t – he ramped up spending, failed to raise taxes sufficiently, and relied upon pie-in-the-sky notions of an end to the economic cycle. To say spending was too high is not really the point – it’s simply that he ran a deficit when he shouldn’t have done.

Then when the inevitable downturn hit, Brown was right to keep spending going – anything else would have been catastrophic – but the fact we were already running a deficit made the situation unsustainable in the medium term.

The Coalition seem intent on running Keynesianism in reverse – cuts during a recession, followed no doubt by tax hand-outs once the economy recovers, plunging us into another unsustainable boom.

@Marc Daniels

Depends on defining when the boom was

Remember 2000 – 2003 was pretty downside

In which case the numbers show Brown was more Keynesian than you suggest – this seems to have gone from collective memory

But he could have been better no doubt – maybe he waited a year too long to correct

But that’s about all

I don’t believe we were technically in rescession in 2000-2003 and we were certainly booming 2004-2008 – Brown ran a deficit throughout.

@Marc Daniels

Or a recession, come to think of it

@Marc Daniels

Memories are short

The FTSE 100 tells why there was stimulus from 2001 to 2003 or 4

http://www.forecast-chart.com/images/historical/ftse-100-august.gif

That was turned off in 2006 / 07. Maybe not enough I agree

But the failure is not nearly as big as played by some

Marc Daniels and his Brown-baiting chums are forgetting the prescursor to the credit crunch – dot.com crash of the early 2000s (yet more “Market” hysteria) which led to recession in pretty much the rest of the world, but not here.

I remember Francis Maude (I think it was) bellowing about “Downturns made in Downing Street!” But the UK carried on growing because Labour had just extricated itself from its ludicrous, shortsighted and unnecessary pledge to match Ken Clarke’s spending plans.

Stimulus worked then.