The Jersey Evening Post, ever the faithful mouthpiece for the Jersey establishment, yesterday noted both the planned amendment to U.K. legislation that will impose new transparency requirements on the Island and my blog comments on the issue. Their lead comment was:

JERSEY is facing a constitutional crisis, as it looks increasingly likely that the UK will try to impose laws on the Island which threaten the future of the finance industry.

They added:

Chief Minister Ian Gorst has said that Jersey would resist any such interference in Island affairs.

And noted that:

Senator Gorst said, however, that the UK legislating for Jersey was ‘unconstitutional' and a public register of beneficial ownership could not be forced on the Island without Jersey's consent.

Whilst adding:

Senator Gorst said that he opposed the move, as Jersey already had sufficient arrangements in place for sharing information with the UK about individuals who owned companies here.

And then saying:

‘It would also be unconstitutional and impossible for the UK to impose such a measure on our island without our consent,' he said.

‘We are not represented in the UK Parliament, and it is an agreed constitutional position that the UK does not legislate for Jersey. We would expect this convention to be observed and would resist the registration of any Order in Council issued in breach of our constitutional arrangements.'

Senator Gorst is, of course, wrong. Let me quote from this (although other sources are available, all of which support the view I will be promoting):

This says:

UK legislation does not normally extend to the Crown Dependencies. In instances where it does extend, it may do so either by virtue of the Act itself or by Order in Council made with the their agreement under an enabling provision contained in the Act which provides for it to be extended to the Crown Dependencies . For an Act to extend otherwise than by an Order in Council is now very unusual. Departments must consult the Crow Dependencies at the earliest opportunity in the event that extension is under consideration.

It adds:

An enabling provision for an Order in Council, known as a ‘permissive extent clause' in a Bill could take the following form: “Her Majesty may by Order in Council provide for any of the provisions of this Act to extend, with or without modifications, to any of the Channel Islands or the Isle of Man”.

In other words, it is not normal for UK legislation to extend to the Crown Dependencies, but it is common enough for them to a normal provision for it to do so.

So can this be done without consent? The same note says:

The Crown is ultimately responsible for their good government, the UK for their defence and international relations of each Island — this was explained by Lord Bach in a parliamentary answer given on 3 May 2000 in these terms: “The Crown is ultimately responsible for the good government of the Crown Dependencies. This means that, in the circumstances of a grave breakdown or failure in the administration of justice or civil order, the residual prerogative power of the Crown could be used to intervene in the internal affairs of the Channel Islands and the Isle of Man“.

So there is not a shadow of a doubt that the UK can intervene if it wishes, albeit it has constrained when it might. But the note also says:

There has always been a close relationship between the Crown Dependencies and the United Kingdom. The constitutional relationship between the Islands and the UK is the outcome of historical processes, and accepted practice. The most recent statement of the relationship between the UK and the Islands is found in Part XI of Volume 1 of the Report of the Royal Commission on the Constitution, published in 1973 and known as the Kilbrandon Report. It acknowledged that there were areas of uncertainty in the existing relationship and that the relationship was complex. It did not try to draw up a fully authoritative statement.

In other words, there is no definitive answer as to when the power may be exercised, but there are most certainly some clues:

The UK Government is responsible for defence and international representation of the Crown Dependencies. In certain circumstances, the Crown Dependencies may be authorised to conclude their own international agreements by a process of entrustment. For example, all of the Crown Dependencies have autonomy in domestic matters including taxation and, having made commitments to the OECD on the exchange of tax information, they have consequently negotiated tax information exchange agreements (TIEAs) with an increasing number of other states. In order to facilitate the completion of TIEAs, which by virtue of their autonomy in tax matters they considered it inappropriate for the UK Government to sign on their behalf, the UK entrusted the Crown Dependencies to conclude the Agreements within the terms of Letters of Entrustment issued to their Governments under the signature of the appropriate UK Minister.

However, being responsible for the Crown Dependencies' international representation is not limited to simply entering international agreements; it should be read to include any international or external relations whether or not they result in some internationally binding agreement.

This is where we arrive at the nub of the argument. The UK is responsible for the external affairs of the Crown Dependencies. It has, when they have done what the UK expects of them (i.e. agreed to comply with international norms of tax practice), permitted them to act in their own names. But let's be clear, this was not hard: the form of these agreements was laid down in international standards set by the Organisation for Economic Cooperation and Development. But, the responsibility goes a lot further than such minor agreements and the primary authority very clearly rests with the UK.

So the best way to answer the question as to whether or not this is an issue pertaining to international relations is to refer to the facts.

The first, and obvious, fact is that the financial services industry in the Crown Dependencies does not exist to service a local market. It is almost entirely an export trade.

Second, secrecy is a key component in this. It is widely recognised that I defined the now commonly used term 'secrecy jurisdiction' that is now frequently used to define these places when the term tax haven is not considered appropriate. I define secrecy jurisdictions as places that intentionally create regulation for the primary benefit and use of those not resident in their geographical domain with that regulation being designed to undermine the legislation or regulation of another jurisdiction and with the secrecy jurisdictions also creating a deliberate, legally backed veil of secrecy that ensures that those from outside the jurisdiction making use of its regulation cannot be identified to be doing so. This is a description of the Crown Dependencies.

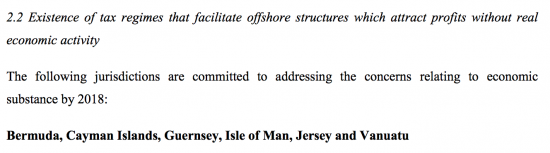

Third, it has to be decided if this is causing international concern. As I have previously noted, in December 2017 the European Union placed the Crown Dependencies on its tax haven grey list, saying:

So, there is an undoubted issue of compliance with international relations that is of concern for these Islands at present. And this impacts the UK. The threat from the EU is to sanction non-compliant locations. If the UK leaves the EU and it could change the law in these locations but does not then it too could be sanctioned by the EU because it would then be the government permitting the non-compliant behaviour. I think that this risk is real.

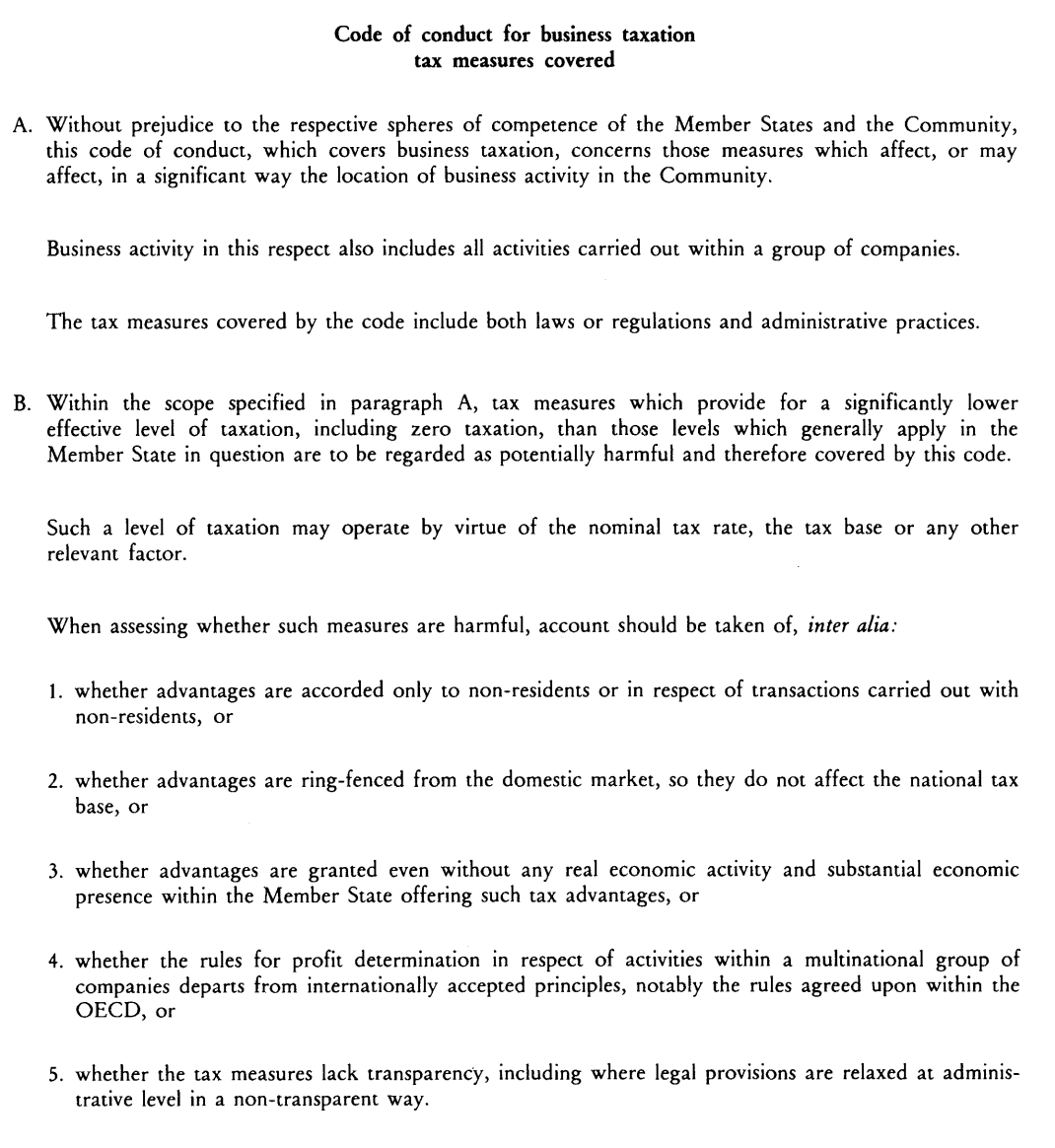

So does the UK have a right to intervene because Jersey is undertaking acts with international consequences that suggest that a 'grave breakdown or failure in the administration of justice' is taking place? I would say that is the case, beyond a shadow of doubt. And if evidence is needed I would refer to the EU Code of Conduct on Business Taxation from 1997 which says non-compliant behaviour can be defined like this:

It is pretty clear that the EU is now saying that abuse is happening as defined at stages 3, 4 and 5 of part B, at least. That is a failure of the administration of justice in that case.

Has Senator Gorst got a leg to stand on in that case? I would suggest not. He might be much more sensible to start drawing up the necessary rules.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I pretty well agree with this analysis.

My only major concern is that to impose these regulations on the crown dependencies slaps of bullying by a big brother who has far slacker regulations in place. I really do believe that the UK and for that matter Holland, Switzerland, Luxemburg, Monaco, Andorra etc also need equivalent regulations in place.

We are far ahead of the CDs and OTs on this right now

None of us are good enough

Ed note:

This comment was bogus

It was not made by Sam Mezec

The content has been deleted

Let’s hope

Not only is Senator Gorst wrong, he is also being downright disrespectful to both the Crown, the Jersey electorate and other Senatorial candidates like you. To the Crown he offends by choosing to disregard the constitutional role of the appointed Crown officers as representatives of the Sovereign on her island. They as much as he speak for “Jersey” when it comes to relations with the UK and on constitutional matters. To the electorate and you he offends because he ignores the democratic reality that he is up for re-election in just over two weeks time and may well not be a Senator, let alone Chief Minister, by the end of May. I suppose you can understand that sort of confidence from him but it’s disappointing that the JEP regurgitated his Gorst-centric assertions without pointing that out or offering a platform to a balancing voice or opinion.

Well said

Richard . The comment about Reform Party are not made by Sam Mezec and do not reflect Reform’s or Sam Mezec’s view. You have fall on a dirty trick. Someone is using Sam Mezec’s name ..It will be interesting to know the e-mail address associated with this comment..I assure 100% this is not a genuine Sam Mezec’s contribution

OK, if you say so

I do not disclose email addresses

Typical.

We’ve heard the argument of returning Jersey to what it used to be before but no thought about the financial repercussions that go with it.

End up like Sark under Reform Jersey.

It is reported that Sam did not write that comment

“Departments must consult the Crow Dependencies ….”

I always suspected there would be role for me one day 🙂

! 🙂

The comment attributed to Sam Mezec is fake news. Reform Jersey have made absolutely no comment on the matter, its just an attempt to discredit Jersey’s only progressive centre left party , who are trying to address the appalling levels of inequality on the island.

If you say so

I cannot comment

Re Sam Mezec comment – I too suspected straight away, well after 3 seconds reflection, that it was fake news.

I am writing to Sam this minute for confirmation

re DW above:

After an exchange of more detailed emails with Sam Mezec, I summarised:

“So not you.

Someone is impersonating you. Correct?

Daniel​”

Sam replied at 29 April 2018 at 01:08:

“Correct”

Understandably I suppose this will now wait until after the election.

Any UK pushed legislation would have to be approved by the States of Jersey and that is not going to happen anytime soon Richard. With regard to the exchange above on Reform Jersey, I was reading on TLM’s Facebook page that Deputy Tadier supports ATTAC and the TJN earlier in the week with recorded news articles. Also Ann Southern supposedly is a firm supporter of the TJN so are Reform Jersey really all for the Finance Industry? I am skeptical about that.

I am really not sure what ou argument is

You are suggesting the UK can force legislation onto Jersey when they cannot as it would have to be approved by the States of Jersey.

That is simply not true

I have quoted my sources

And the evidence is here http://www.offshoreradiomuseum.co.uk/page971.html

You are, very simply, wrong

Still wrong on the vassal status of Jersey. As for the other point, the manifesto is informative regarding Reform Jersey’s stance on the finance industry. After researching it our spoof senator appears to be as misguided as the current Chief Minister. Perhaps that should read… misguides as much as the outgoing Chief Minister. Here are the relevant paragraphs. My comments are in parentheses.

“We will support the industry in all its efforts to continue to be at the top of the league when it comes to meeting our international obligations on transparency and cooperation, so we can offer a world class service.” [The current regime, as voiced by Gorst in the JEP, does not support the need for transparency and isn’t particularly interested in meeting its obligations. What it will do is pay just enough lip service to protect what reputation Jersey still has for probity. It will also deliberately ignore or deny instances of misuse that are brought to its attention. Sound a little familiar? I believe some call it the “Jersey Way”].

“There will be challenges in the future as the nature of the finance industry changes, in particular as the banking sector shrinks and the funds sector increases. We will not bury our heads in the sand when change is on the horizon. [The implication is that Gorst, his ministers and supporters are disciples of King Cnut]. We will support those who promote the industry abroad and be ready to actively assist businesses in adapting to change. As technology and automation changes the nature of work in the finance industry, we will make a concerted effort to protect livelihoods.” [I expect they mean the local support staff rather than the high priced help imported from the City of London, who are well able to look after themselves here or back home].

“Last year, the European Union Code of Conduct Group on Business Taxation ruled that Jersey was a

co-operative jurisdiction, however there are changes that must be made in 2018 to ensure that this

is maintained. These changes relate to the so-called “substance test”, which involves making sure

that companies registered in the Island have a genuine presence here. It is essential that these

changes are made by the end of this year. We will ensure that there is no room for complacency and

that those in charge are held accountable to make sure that we meet our obligations.” [If this happens it will come as a big shock to the staff, particularly the senior staff, of the Jersey Financial Services Commission].

As I gave shown, Jersey has no clue how to address the fact that more than 80% of companies appear not to be compliant

You cannot take the word of either Mezec or Eduardo Humanas as both will lie to cover up any transgressions. For example both have claimed that Mezec was not the joint founder and current co-chair of the JPSC. I can prove both assertions are lies.

That said, I’ve seen quite a lot of Mezec’s comments over the years, and that doesn’t read quite like his style. I could be wrong.

Btw, I have a screenshot of the allegedly fake comment, sent to me by someone who follows this blog closely.

Richard, It interests me greatly to know why you were so easily able to believe that Mezec would write the post in question? Presumably you’ve had similar discussions in the past.

I have almost no knowledge at all of Sam Mezec

I hate to tell you this – but I am finite and most definitely do not know all the ins and outs are all the personalities of Jersey politics

So what you are trying to prove is a little baffling

Ed note:

This comment deleted as it was deeply offensive

Returning to the issue of your blog post, may I ask what date the JEP printed that article please? It seems to me it must have been some time ago, as the Jersey situation has changed. A senior official in a Trust company wrote this just a few days ago:

“Jersey has a register of beneficial owners which is held at the Registry. It is not public, but we have agreements in place to provide necessary information in cases such as investigations by authorities and police.

In fact we have always had a beneficial ownership register. Although perhaps dodgy with incorrect information due to changes in ownership.

But last year, we had to submit all beneficial ownership to the Registry for them to up-date and it is law now for the Registry to be kept up-dated at all times.”

I’m wondering why Ian Gorst would have argued against keeping a register after this was implemented.

The article was linked and was on the day before I posted from it

he was arguing against a public register which is what the Commons will be voting for

[…] MPs vote on an amendment to the Sanctions and Anti-Money Laundering Bill that would require the UK to impose a requirement on the UK’s Crown Dependencies and Overseas Territori… that they create registers of the beneficial ownership of companies if those places fail to do so […]