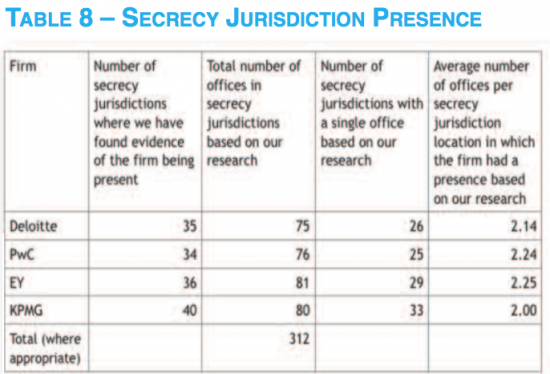

The only firms that are to be consistently found in all the world's major tax havens are the Big Four firms of accountants - PWC, Deloitte, EY and KPMG. Saila Stausholm and I have documented the fact:

As we show in that report the Big 4 are the single most common presence in all these places:

And as a result, if you want to start tackling tax haven abuse the Big 4 is where you have to start.

As Saila Stausholm and I suggest in that report, which is the first ever study of the issues it addresses:

-

The Big Four firms of accountants do not accurately report all the jurisdictions in which they work, although PwC comes close to doing so. We found that they operate in 186 jurisdictions overall, with an average of 3.41 offices per jurisdiction;

-

The Big Four have offices in 43 of the 53 secrecy jurisdictions identified in this report;

-

It is difficult to establish precisely how many offices each of the Big Four firms have but what is clear is that the size of their operations in a jurisdiction is not always proportional to its population or GDP. For example, the Big Four have more staff in Luxembourg in proportion to the size of the local population than in any other country; the Cayman Islands come second in this ranking and Bermuda third;

-

We have not been able to accurately locate all the staff employed by the Big Four. In the case of EY we were only able to identify where 83 per cent of their staff work;

-

A case study on the legal structure of KPMG could not identify the legal ownership of its offices in 55 jurisdictions;

-

Despite the Big Four having central management organisations, the firms all claim to be networks of independent entities that are said to be legally unrelated to each other.

We suggest tin that report that:

The structure adopted by the Big Four firms of accountants, which at one level suggests the existence of a globally integrated firm and at another suggests that they are actually made up of numerous separate legal entities that are not under common ownership but which are only bound by contractual arrangements to operate common standards under a common name, has been adopted because it:

- Reduces their regulatory cost and risk;

- Ring-fences their legal risk;

- Protects their clients from regulatory enquiries;

- Delivers opacity on the actual scale of their operations and the rewards flowing from them.

These advantages can be secured by these firms because the regulation of auditing and the supply of taxation services is devolved by the EU to member states even though, as this report shows, the supply of three services is dominated by what appear, for all practical purposes, to be multinational corporations.

As a result we suggest that:

In an era where transparency is seen as fundamental to accountability it is inappropriate for the world's leading auditors to be almost wholly opaque on their operations and to provide no effective reporting on their own activities when they play a fundamental role in the regulation of global capitalism.

To counter the risk that these structures impose on society we suggest that firms organised in this way:

-

Should be defined as being under common control, and so are single entities for group accounting purposes within the European Unio

-

Should be licenced as single entities for audit and taxation purposes throughout the European Union

-

Should be required in due course to separate entirely their audit and other professional services but until this is possible should be required to ring-fence the two from each other worldwide as a condition of being licenced to provide such services in the EU

-

Should, as a condition of those licenses, be required to prepare worldwide group consolidated financial statements which must be published on public record

-

Should ensure that those consolidated financial statements include full public country-by-country reporting.

It's time for action.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

“Should be required in due course to separate entirely their audit and other professional services”

Indeed. That lesson should have been learned from the Enron/Arthur Andersen debacle. I can’t imagine any genuine argument being made against separation.

The Big Four are not found in all of the 53 jurisdictions, are they. And in most cases, if they have an office in one of those places, they have just one office. The only way to have fewer than one office in a place is to have no office. Are you saying that they should not have an office in those 53 jurisdictions?

Tell me why they need an office in the BVI but not the Isle of Wght?

Well, they would have to answer for themselves, but I am sure their commercial decisions about where to open offices are led by client demand.

Regarding the Isle of Wight, perhaps they feel they can service clients there adequately from another office sufficiently nearby? How long does the ferry from Southampton or Portsmouth take? I doubt every place with a population of 150,000 people needs a big 4 office, or that there is a need for a Big 4 office within a travel time of say an hour.

Do you really think these firms are content to follow demand and do not generate it?

Do you think they have no influence on the ‘options’ available in tax havens?

If you do, wow! Naïveté has reached new limits

At least one Big 4 firm is considering separating from its audit practice if you read the times. I suspect it’s kpmg who wouldn’t have much to lose. What this would do to audit standards remains to be seen but having a low margin business standing alone dosent feel like it will increase quality

[…] I start with the Big Four – PWC, Deloitte, EY and KPMG – who make all this possible. They are most at fault in the world of […]

[…] http://www.taxresearch.org.uk/Blog/2017/11/05/the-biggest-names-in-tax-havens-are-pwc-deloitte-ey-an… […]