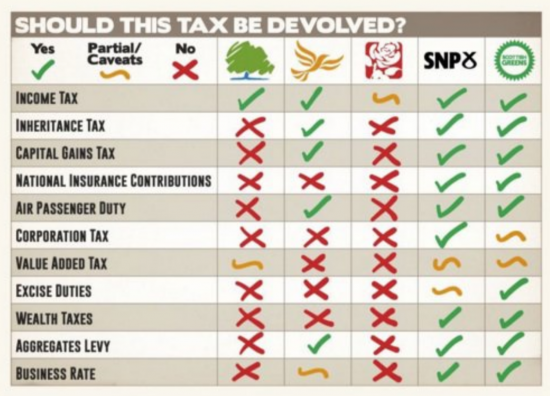

I am not sure of the origin of this table, which was posted on my Twitter timeline yesterday in response to my blog on devolved Scottish taxation, but it has the feeling of being completely credible:

I spoke on Wednesday to SNP MPs about the importance of an independent currency, which is the condition for full fiscal autonomy in any debate on the future of Sottish taxation. This thinking was based on my White Paper on Scottish Taxation produced for Common Weal.

What I also stressed is that is vital that at present Scotland has sufficient devolved powers to manage the economy within the country as things now stand since, increasingly, this is the task expected of the Scottish government. But, to put it bluntly, it's being given tools little better than those offered to a local council to achieve the task and that is absurd.

As I have explained repeatedly on this blog and elsewhere, government spending is not funded by tax. It is effectively funded by government creating new money in the form of promises to pay (which is why a promise is printed on bank notes), which promise is cancelled either by the government accepting back the cash it created in payment of tax or by the issue of debt to the market (which simply defers the promise from the present to the future because right now the government has decided to not tax enough to fulfil the promise by demanding tax payment). What this means then is that tax is not, as such, an instrument for funding, but is the balancing mechanism in the system of fiscal management of an economy where government spending is balanced by tax paid, changes in the level of borrowing and changes in the level of money creation (or QE, as things stand at present). Only with this whole range of powers being available to it can a government hope to manage the economy.

The trouble is that Scotland is not being given any significant borrowing powers over borrowing. Nor is it being given any powers over money creation, or QE, at all. And it is only being given very marginal powers over tax. This is because some very minor taxes apart, just part of income tax is really being devolved (ignore the VAT rules: they are just a ruse to undermine the Barnett formula). And as I noted yesterday, even those powers that are devolved are booby trapped.

The result is that any Scottish government will fail to deliver an economuc policy for the country at present. It is not possible for it to do otherwise. This is not an SNP or nationalist issue. I take seriously the intentions of other Scottish political parties to take power in Holyrood, alone or in coalition. And they too are doomed to fail, except that in their case they seem committed to the cause that dooms them to failure because they don't even want the range of taxing powers that might help them achieve their goals to be available to them.

I cannot stress sufficiently how important this is. The UK already faces an existential crisis as a result of Brexit. It might face another if devolution, which has supposedly been embraced by all major parties, fails to deliver. One existential crisis is enough for any state to handle at a time. The failure of devolution could create untold stresses at the same time. And that worries me, profoundly.

Those who thought they'd grant devolution to ensure Scotland (and in turn Wales and even the mayoralties) failed might have thought, in the student union political way that far too much UK politics is conducted, that this was a 'fun' thing to do, but the consequences for millions of people whose well being is deliberately intended to be left behind as a result whilst the vestigial wealth of the south east of England continues to accumulate are deeply significant. And eventually that consequence is also unacceptable.

Quite how this will pan out is uncertain. But if those with any degree of concern for Scotland, Wales and the English regions want to better understand how to deliver for the people who live there then they need to better understand that devolving powers over tax, borrowing and money creation has to be part of the equation or the demand that devolved governments produce stimulus by shifting funds within spending budgets whilst watching their tax revenues being undermined by design will result in economic, political and social backlash that will be deeply uncomfortable.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Your post more than adequately sums up many of my fears for an independent Scotland.

I wish that the nationalists wanted to see an ‘interdependent’ Scotland instead because interdependence is how human beings actually work and thrive.

You are Scotland’s best friend at the moment in my view – although I’m sure that there are those who will not see you that way.

BTW – I’m Englishman whose roots are Scottish.

And as far as I know I am not Scottish at all

I’d have to apply for asylum

On the basis of demographic statistics applied in the historical context it would be very surprising if you did not have any Scottish ancestors at some stage. Possibly, at the end of the 18th Century, probable by the beginning of the 17th. Away from the figures to history there were substantial interchanges of people between the various parts of the Atlantic Isles over the centuries. But I am sorry to say a kilt would not suit you.

True

All of it

“my fears for an independent Scotland” – The Scottish Independence Project is much more than just “the economy, stupid” and has been articulated by, among others, blogs such as WeeGingerDog (Paul Kavanagh), ScotgoesPop (James Kelly), IndyRef2 (Peter A Bell & others), Derek Bateman, Grousebeater(aka ??), Bellacaledonia, Common Space……etc etc.

Of course the economy is important and many of the above and others too, such as Business for Scotland, have explained how Scotland is a rich country, has subsidised the UK for decades and will be a strong and vibrant country after independence.

It will also be an outward-looking country, seeking partnerships, “interdependent”, if you like – that’s what the EU was about (among other things) – and will want to remain well connected to Europe and our friends to the south.

There are so many things wrong with the UK and Westminster, frequently described on these pages and recently on ProgressivePulse, that Independence can only be an improvement.

I accept that the issue is far, far more than the economy

But i think the economy matters too

‘G Hewitt’

Look – the Scottish people need to know that the finance of their new independent state – as proposed and to be realised – is built on sound foundations. Finance is the mechanics of most things I’m afraid – especially ideas. The finance has to stack up. There is no getting around it and it has to be right first time.

I don’t really care about all the stuff the other pro-independence blog writers write about. Because if independence does get messed up they’ll have less nicer things to talk about. An outward looking country needs to be a well funded one and relatively well off don’t you think? Yes? I think so.

The consequences if the after the fact finance system does not work or if it has weaknesses – are too appalling to consider. Expect to see vultures circling – mostly English ones with big grins on their faces as they snap up Scottish assets at fire sale prices. Oh and your ‘friends in Europe will be there too no doubt to ‘help’.

You are right about Westminster – no arguments there – but the Scots will have to deal with them (it) before anything changes.

Considering the inherent racism and superiority complex in British society towards the Welsh, Irish and the Scots I’d say check everything on any parting deal. And I mean everything. And if it isn’t right, don’t do it.

Remember that setting people up to fail is what this Government (Tories) are good at.

I’m probably missing something, so please bear with me. I’m picking up this stuff about macro economics as I go along.

It seems to me that having control over spending, (as you say, money creation) borrowing and tax can only be completely, er, complete if the devolved “state” ( for want of a better word) has its own independent currency. If a devolved government spent money into its local economy recklessly and neglected to tax or borrow enough of it back, wouldn’t that undermine the currency nationwide unless there are exchange rate shifts at the orders?

What aren’t I seeing?

You’re seeing it right

Neglectful governments with their own currency can wreck their economy

Do you think in democracy that neglectful governments last for long?

And would you ban cars because neglectful drivers can wreck lives?

The idea that devolving powers is the magic wand to keep the UK together fails to acknowledge a home truth, unless policies dream up by whoever are thought through, we see the same mistakes being made day in day out, regardless of who is in control.

Whether a decision is made in Westminster or Holyrood, if policy isn’t even reviewed to highlight any problems, it all ends in tears.

The issues that you raise are often a source of ongoing friction in federated nations such as the USA, Canada and Australia. For better and worse, state and provincial governments have some, very limited, fiscal autonomy but none issue their own currency. That is a national (federal) prerogative.

The rights of states and provinces is constitutionally defined. The devolution of powers in the UK is not so well defined. One thing that I think we can say with certainty though is that Scotland would not (could not) have monetary sovereignty or, by extension, complete fiscal autonomy without independence.

Hypothetically, if a situation occurred where they did not have official independence but somehow acquired monetary and fiscal autonomy – they would be effectively independent anyway. So, unless I’m missing something what you are effectively arguing for, Richard, is Scottish independence. Which is OK. I have no argument with that if that’s what the Scots want and vote for. What I can’t imagine is any of the unionist parties remotely wanting to agree with that. They wouldn’t be ‘unionist’ if they did.

Therefore, at the risk of contradiction, I would suggest that full fiscal autonomy is and must be an SNP / nationalist issue. Once again, that’s OK. The independence argument is now a vital part of the democratic debate in Scotland. Let this be part of it.

Looking at it from a nationalist perspective, the argument for fiscal autonomy works well for the SNP and it makes things simpler for them. By contrast it leaves the unionist parties with some thing of an enormous dilemma. If the unionists reject full fiscal autonomy and the current arrangement is as deeply dysfunctional as as you suggest, then the unionist parties will need to devise an alternative – one that improves on the current arrangement but still falls short of fiscal autonomy.

That could be quite difficult if not impossible for them. If they can’t manage that then they might have to argue that the current state of devolution is quite satisfactory. That could be even more difficult.

FFA all sounds well and good until you understand a basic truth, Scotland having to pay for all the taxes it collects.

FFA will only work if the Scottish Government, puts in place an infrastructure and bureaucracy to collect the taxes, HMRC isn’t some sort of outsource agency who the SG slip a few quid if feeling in a generous mood.

Well I did note that independence was implied by the presence of full fiscal autonomy and, yes, that would require that the HMRC be replaced in its role by a new Scottish authority. There’s nothing too remarkable in that suggestion.

Spot on Marco.

What about, what were once Crown Colonies, i.e. Cayman Islands and Bermuda who do have their own currencies?

They are dollar pegged

That is not really having their own currencies

And they need that to function as tax havens

Scotland would not

I always thought that the promise on banknotes referred to being able to be paid in gold on presentation of a banknote at the counter. Has something changed?

Yes

There has been no relationship with any underlying asset for more than 40 years

The promise is to accept the note in payment

FIAT currency inverts the model.

Of course government can issue unlimited bit of paper.

I suppose the question is, why accept them as any more legitimate than Bitcoin, sea shells or stones of Yap?

Is it because the government is more trustworthy than any other invented measure of bean counting?

if not, whose beans are better? Yuan, Dollar, Yen, Euro?

What gives CREDIBILITY to any bean-token?

Forget money for a moment. I have five bushels of grain. I need only three. You have a surplus of salt and other things.

We can trade and make beautiful bread together.

Try paying your tax in sea shells or Yap stones. If either are accepted please let me know; I shall move to the coast.

Since the budget deficit = everybody’s ” sterling savings to the penny. ( At home and abroad)

Nobody seems to understand this is the crucial point when you analyse the Scottish Budget deficit and why the GERS is just a work of fiction. What happens to sterling savings is the most crucial point of all when you analyse it within the Scottish context.

The difference is that the bank account the Scottish government uses will bounce cheques when they reach their overdraft limit. Payment authorisation would be refused without HM Treasury permission. Just like any other local county council area in the UK.

Nicola thinks she’s running something other than a glorified county council.

She isn’t.

The UK does the tax collection across the UK. Scotland is nothing more than a glorified county council. If you did the accounts for North Yorks County Council you would find it too has a ‘deficit’ that is filled by the block grant and whatever ‘borrowing’ HM Treasury permits.

Here’s the gory details: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/479717/statement_of_funding_2015_print.pdf

So the leakage out of the arbitrary line of the Scottish border within the Sterling currency zone is to anywhere else in the world (including the rest of the UK) – and the rest of the UK saves a lot of Sterling. That leakage, plus any net savings within Scotland, is what causes the Scottish government sector deficit.

Ultimately in the same way that Greece needs to tax German savers, Scotland needs to tax UK savers. To have the power to do that you need UK savers saving in Scotland’s currency which the Scottish government can control and if need be tax. Otherwise Scotland will run out of money as it all drains to the rest of the UK.

Spending only comes back if you have your own currency. If you use somebody else’s then it leaks into a different banking system. Greece spending ends up under the control of the Bundesbank. Similarly Scottish spending ends up under the control of the Bank of England, which is owned and directed by the UK government. As long as that arrangement stays in place, Scotland is owned and directed by the UK government – like any other county council.

That is the key issue with fixed exchange rates. You end up with control of the money under some other entity which you have to follow the directions of.

So the key point of all in this debate which is never mentioned at all is the Scottish budget deficit is not just made up of Scottish people who save sterling but made up of people who save sterling all over the world and in the rest of the UK.

Which makes the actual figure of the Scottish budget deficit a work of fiction that is no use to the Scottish government at all.

I’m willing to bet that Kevin Hague does not even know that the budget deficit = the non government sector home and abroad savings to the penny.

That’s how you destroy his arguement. Kevin Hague is a budget deficit hawk who will always want to cut the deficit because he does not understand it and what it is actually made up of. Just ask him if we can start with his pension first and why is he so hell bent on destroying everybody’s savings.

I’ll go even further and say Kevin Hague will look at

a) What’s spent in Scotland

b) What’s collected in Scotland

See the difference in the same way as a household or his business. He won’t have the first clue about who we owe the difference to and why.

And that’s how you tear down his arguement piece by piece.

You have to break down the savings and who holds what that makes up the budget deficit,

‘Twill be another Darrien scheme m’lord…