I received the following comment on the blog when discussing wealth taxation. I thought it was worth considering it in more depth and so reproduce it in full here:

Richard

Can you tell me where I have gone wrong.

I am 63 and did have a free university education. I then spent 7 years in the employment of others and then all the years since I was a self employed chartered accountant until I retired aged 59.

I am married and my wife has never done paid work but has been a housewife, mum to our two kids and a volunteer at the local citizens advice bureau.

My children have been educated by the state and both have been to uni, one when the fees were £3000 pa and the other when they were £9000 pa.

Neither I nor my wife have received any state benefits other than child allowance for our two kids and during my working lifetime, I estimate I have paid some £1 million in tax, NI, etc

My wife and I have inherited assets from deceased parents of some £1 million and now have total net assets of about £5 million. These assets have been accumulated from savings. We have never invested in the stock market or the property market. We have simply kept our savings in bank and building society accounts earning interest.

I am appalled by the following :-

1. That unless we gift assets or buy farms, our estate will attract IHT of some £1.6 million. This is a horrible little tax that penalises the moderately sucess, whilst the truelly rich have their trusts, offshore accounts, farms and schemes and pay nothing. IHT brings in very little revenue. We should follow other countries including USA and charge it on assets above £5 million or abolish it.

2. Labours wealth tax. Why should I pay? My wife and I have gone without to accumulate these assets out of post tax income. And will your wealth tax seek to include future pensions entitlement or pensions currently being drawn, as if the wealth tax us to be fair it should include all forms of wealth including pensions wealth.

3. That my wife and I are termed rentiers, for the paltry interest our savings receive.

So having outlined the above, again I ask you, where have I gone wrong as I am obviously a nasty capitalist according to you and Labour?

In reply I would say this.

Dear Gareth,

Thanks for your comment. First, let me say you have done nothing wrong. I am not accusing you of being a nasty capitalist. And let me be clear, I do not comment for Labour, but I am not sure they're saying anything about you being nasty either. But I am suggesting that you have been considerably undertaxed.

You're an accountant, so let me work you through my logic. In saying so I hope you'll understand that I am having to make some big assumptions: you make reference to what was a working career of, I suspect, about 38 years and a total timescale of more than forty. Inflation has had an enormous impact over that period (being of broadly similar age, I know that). And of course tax rates and rules have changed a lot. What is more the information you give is a little generalised. But, using your data I think I can comment as I do below with any broad assumptions being unlikely to change the conclusions I reach.

First, as a good professional should, let me summarise the facts. You and your wife are worth £5 million. This sum, you say, is saved in cash. Of that £1 million was inherited. The rest you say you generated yourself. The figure appears to exclude pension wealth: you estimate the inheritance tax bill on this sum to be £1.6 million at the prevailing rate of 40%. That implies you think £4 million taxable, and this appears to take into account current likely exemptions available to you excluding any pension wealth, meaning you are likely to actually be worth rather more than you suggest. I return to this pension issue again, below. I note you do not refer to owing a house, but I presume you do; it would be rather surprising if you did not given your circumstances. I will make some guesses on that issue. Finally, you say you have paid about £1 million in tax and NI over your lifetime.

Now let me suggest some things that this implies. To have paid £1 million in tax implies a considerable income. A person earning around £100,000 will pay about 33% in tax and NI, overall. It's not absolute, of course, but HMRC agree. The ratio goes up to almost (but not quite) 40% at £150,000 of income. I'm using the lower figure; it favours you in what follows because what it means is that, give or take, your million of tax paid implies you earned at least £3 million of taxable income over your working life, ignoring pension contributions.

The rules have changed on those contributions over that period but I am guessing you paid in what you could because that's the typical accountant's mentality. This means roughly soaking 20% of your gross earnings, or on this basis some £750,000 of contribution, saving you maybe £300,000 in tax. If that sum invested grew (tax free) as it probably did you now have maybe another £1 million in pension wealth. I make the point because it shows how generous pension tax relief has been to those who could afford to contribute.

So, in summary, you made around £3,750,000 in total over a working life of 38 years, or around £100,000 a year on average. But we know the pound in 1975 was worth one sixth of what it is now; 40% in 1982 and 50% by about 1987. So very clearly during your self employed years you may have made £65,000 in the late 80s and maybe £130,000 or so towards the end. I say this just to make clear that this pretty much put you in the top one per cent of income earners thought the period. Maybe not quite, always, but near enough. The state granted privileges a chartered accountant enjoys certainly paid you well.

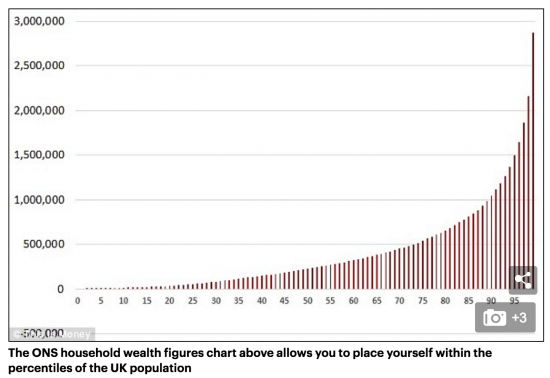

Let's get down to wealth though. First there are your parents to consider. You and your wife inherited a million from them. I am guessing roughly half each. And I am guessing you are not single children. This means that each estate was worth maybe £1.5 million to allow for inheritance tax of an earlier era. This means both sets of parents were in the upper echelons of wealth in the UK. This chart happens to come from the Mail, but is based on ONS data from a year or so ago. It will do.

I only make the point to show you did not come from under-privileged backgrounds. I am, of course, aware of social mobility. And increasing house prices. Don't get me wrong. But at the very least your parents did well if they were upwardly mobile.

Then look at your own wealth. It's actually not on the chart because it is so exceptional. I make the point simply because you seem unaware of the fact, which I find odd.

But then let's get to some harder facts. First, I am bemused as to how you accumulated £4 million (I have excluded the inherited £1 million) out of your gross earnings of £3.75 million that left £2 million after tax and pension contributions. They are sums that do not sit comfortably together.

Now of course you bought a house: just the family home, you imply. In my lifetime property in London has increased in price maybe fifteen fold, based on my first flat. Perhaps you have ridden that wave with a move or two on the way. What I am having to wager is a significant part of your wealth is in your house. I am having to put it as high as £2.5 million, at least. But I bet you didn't actually part with more than £500,000 over the years to pay for that. Of course I am guessing, but this still means you actually lived on nothing at all (£3million net earnings after pensions, less £1 million tax and £500,000 mortgage payments and you would claim on this basis to still have £1.5 million left in the bank). At most it seems you lived off the interest on your savings. This seems unlikely, but we'd all like to know the secret Gareth.

Alternatively, you earned a great deal more than you suggest, and your ability to tot up your tax paid is a little on the shoddy side for an accountant.

But let's talk tax. You say inheritance tax. You say this penalises moderate success. Really? Is being well into the top 1% of wealth 'moderate' success?

And as an accountant you've always known about inheritance tax. So the existence of it did not actually disincentivise you, did it? Whatever you say on this is obviously wrong, isn't it?

And could it be that you want it only to be charged on estates over £5 million because that happens to be just what you have? There is no self interest in this, is there?

Incidentally, how would you then make it stick as you say it does not work for people richer than you? I am curious; please tell?

And then let's talk wealth tax, even if, as far as I know, Labour isn't. You say you have accumulated all your wealth out of post tax income. But actually you inherited £1 million, maybe £2 million is tax free capital gain on a house and your pension of maybe £1 million was from pre-tax income. So at least two thirds of your wealth has never been taxed. So your claim is not true, is it? And how the rest came out of post tax income defeats me, for reasons I have noted. However looked at, the wealth tax I propose, plus the capital gains tax charges on death on houses and other assets, are actually new, single taxes, aren't they?

And I think you'd agree they're fair. At least I hope you will. Because (I will exclude the inheritance but include the pension) you have apparently accumulated £5 million of wealth and lived on (and I am assuming that cost you at least £1 million, which would still have meant you saved an extraordinary half of your net income) or enjoyed total income and gains of £6 million in your life but have paid just £1 million in tax. That's pretty staggering, don't you think? It's an effective tax rate of 14% or thereabouts. Of course this excludes indirect taxes, but on your frugal lifestyle these would have been low. I would expect 30% or more. Add in the £1.6 billion you resent and the charge will still be just 37% (£2.6 billion on £7 billion in all). Note you still don't even get to a 40% tax rate that society think those earnings a bit over £40,000 a year should pay on their marginal earnings, and rather more if they're a student.

But apparently you resent that. Instead you want your children to inherit maybe £2.5 million each (I am assuming you can live off your pension based on past performance), instantly catapulting them well into the top 1% whatever they have done in their own lives.

So, some questions Gareth. First, why do you say this tax is a disincentive when it so obviously is not?

And why do you claim it is on earned and taxed income when so much of it very obviously is not?

What is more, why say your success is only modest when you're not at the top, but on any realistic assessment, not that far from it?

Come to that, why claim the rich don't pay and moan about the tax instead of seeking to reform it so that they do?

And then, why do you think your children should enjoy such a massive advantage in life when so many others have none? Do you really think only inheriting £1.6 million would leave them so poorly off that they have no hope of a good life? If so, why?

Come to that, why don't you want to make a fair contribution to the society from which you have done so well? What makes you think you don't need to do so?

Finally, why not do something more constructive with your savings?

I am sure others will have other questions. But those will do for now. And if you want to correct anything, please feel free to do so. I am not publishing your details, ever.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Crikey, accurate and heavy artillery.

63? It may not be long before one or both begin to need a great deal more medical attention. Should they be blessed with a long life this could mean a lot of it. The percentage of the old needing certain forms of treatment is remarkably high.

As a working scientist I should be as financially successful as Gareth. I’m sure I don’t have to detail academic salaries and short term postdoc salaries to you Richard.

Even if I discover something patentable (I’m a basic science researcher) I will not enter the 1%. The Research Council who funded the research would take a large cut as would my employer, university or research institute. The guy who discovered dna fingerprinting got a holiday home out of it.

I’m sure Chartered Accountants are necessary functionaries in a modern economy but I’m not convinced they contribute more than us scientists. Oh well, I shall just have to hope my publishing record will keep me warm in retirement. In extremis I could always burn the issue of Nature my name appears in. It is de rigeur to buy the issue of Nature or Science if you get a paper in as such events come rarely, if at all.

I agree with you wholeheartedly

I cannot justify a chartered accountant earning more than an average GP

It’s an affect of supply and demand. Everyone would like to save lives and make a useful contribution to society but nobody with a fragment of humanity wants to be a Chartered Accountant.

I am your host

I am a chartered accountant

I do not think it has to conflict with my humanity

Well, good for you for bothering, Richard.

I would have just laughed at this rich man’s pathetic bleating, and got on with enjoying my day.

(Which clearly you have been!)

I assure you I have a good do planned

Yet again a fantastic and detailed response Richard. Some should not ask the question if they are unprepared for the truth. I look forward to the response from this gentleman who thinks he has been treated unfairly. If you happen to have further correspondence with him, ask him to help me with my finances. As a single parent in sure, given time I too will be in the top 10%

Re: ‘ . . But we know the pound in 1975 was worth one sixth of what it is now; 40% in 1982 and 50% by about 1987 . . ’

Should be ‘six times’, ‘2 1/2 times’ and ‘twice’.

……………..

Thanks for this excellent demolition job on the delusions of the well to do/comfortable class. No-one, however rich, will ever accept that they are rich. This partly because all the people they know socially are at the same level of wealth so that this is the norm. We may know intellectually that others are poor but we don’t feel their poverty.

It seems to me that calculations like this always underestimate the effect of house price super-inflation in the sought after bits of London and the Southeast. I live in Twickenham in a flat bought 44 years ago (in part with inherited wealth) for c. 1.5 % of its current value i.e. it has doubled 6 times, i.e. every 7.5 years, implying average inflation = 10 % p.a. .

If Gareth, born in 1954, bought his first house aged 25 in 1979 he missed the first 6 rapid years of that inflation but he’s had the rest, untaxed. This asset only exists because it guaranteed by a strong state, which is expensive and must be paid for. This should be, in part, by a direct property tax, which is most conveniently levied at death when the property, nilly willy, changes hands.

If it’s not to be taxed at death, when should it be taxed, Gareth? You do know you can’t take it with you?

I admire your patience and forensic detailed analysis. But, I guess that what good CAs do. I cannot possibly comment on the numbers. I’d just say that Gareth’s letter identifies one of the fundamental differences between a conservative capitalist approach to society and that of a socialist (in the broadest sense). Conservatives give themselves and their families primacy over the rest of the community. Socialists understand that any individual can only thrive thanks to the efforts of others and State provision of physical & societal infrastructure at all levels. I’ll leave it with that overly simplistic explanation. Not got time to write an up-to-date version of ‘Das Kapital’.

Then there’s the question as to whose money is it anyhow?

In answer to his final question: Gareth is clearly a Capitalist and sounds a bit on the Neo-con spectrum. ‘Nasty’ is far too subjective and hopefully too pejorative. Based on the contents and tone of his letter – and your structured, informed response – I’d conclude he is ignorant as to how a modern sovereign state does and should function. But, with an accounting background and the fact that he reads your blog, there is hope that he will be curious to get a clearer understanding of where he stands in society and why fair taxation is necessary for the greater good. Then he will be better informed to pass on the knowledge to his children.

Not sure whether the assets are property or financial investments but let me comment on money. Remember that the purpose of money is to flow so the accumulation of money is not virtuous. In fact, it is completely pointless, if as it should society provides appropriate insurance against risk.

I agree with Richard’s point that anyone with £5million should do something useful with it, give it to people who want to start a business, or endow a university Chair (so someone like Peter can invent things). If the best you can think of is to leave it to your children then society should put it to better use.

Use it or loose it.

I agree….

In this case the typo (?) `loose` is aposite.

Set the money free!

What if his kids would like to start business instead of giving it to strangers? Also with the whole gifting legislation it would be somewhat risky. After all if he was to pass away they would have to cough up. If there was an exemption for lending for a start up that would be one thing but there is not. Besides the real issue with the gifting legislation is not that so much the 7 year rule but the gifts out income exemption which to my understanding is immiedetly exempt with no cap whatsoever so some people who have incomes of £10 million (ie double his wealth amount) could easily demonstrate it did not effect standard of living giving £2 mil and after a measley 3 years zilch would be payable yet if it came from capital your talking the tapering only starting to apply.

I would not mind if he invested in a start up

But the shares would be his

And so would the gain be

I would abolish the exemption for gifts out of income above a fixed monetary value if I had not abolished the tax first of all

I read this blog having just read George Monbiot’s excellent article on Nancy McLean’s new book, ‘Democracy in Chains: etc’ which charts the history of James McGill Buchanan, the founder of public choice theory (which I handily studied at uni as part of a political economy course)in which, as Monbiot notes, Buchanan argued that:

‘…a society could not be considered free unless every citizen has the right to veto its decisions. What he meant by this was that no one should be taxed against their will. But the rich were being exploited by people who use their votes to demand money that others have earned, through involuntary taxes to support public spending and welfare. Allowing workers to form trade unions and imposing graduated income taxes were forms of “differential or discriminatory legislation” against the owners of capital.’

And that: ‘Any clash between “freedom” (allowing the rich to do as they wish) and democracy should be resolved in favour of freedom…“despotism may be the only organisational alternative to the political structure that we observe.”.’

To help his theories along, McLean’s book details how Buchanan ‘…in collaboration with business tycoons and the institutes they founded, developed a hidden programme for suppressing democracy on behalf of the very rich. A programme, which, as Monbiot notes, and those of us who follow US politics and the actions of Republicans in the US and the Tory party in the UK, is now reshaping politics – and thus all policy making – in both countries.

https://www.theguardian.com/commentisfree/2017/jul/19/despot-disguise-democracy-james-mcgill-buchanan-totalitarian-capitalism

I suspect Gareth would be a strong supporter of Buchanan.

Thanks Ivan: I had not read Monbiot

Now I think I need the book

I have just searched the book.

To say that the George Mason crowed don’t like it is to be generous

What is amusing is they don’t argue with the the thesis but as, is always their way, nit-pick with extreme pedantry the arguments she makes based on their own intimate knowledge of their own lore. Maybe they do not realise quite how strongly they reinforce the impression of the existence of an extreme cult

Ivan

yes I have seen the Monbiot piece. Very interesting and I must get the book. It’s appalling how the once great country of the US has been reduced to a neoliberal hell hole for a large fraction of its population. It has been obvious that this has been going on ever since Regan came to power in 1981, but McLean’s book sheds major light on how this has been achieved. It is also obvious that the right wing of the Tory party seeks to emulate the US, which is why I think Brexit is so dangerous; with all its faults the EU protects us against right wing libertarianism. At least there is some small hope after the GE result.

I am of a similar age to Gareth

I have already been accused of being anti-intellectual by a right wing professor for retweeting Monbiot

I am of a similar age to Gareth and have benefited greatly from house price inflation since my first house in 1981. I am nowhere near as wealthy but fully understand that much of my success has been due to serendipity. Of course I have worked hard but despite Boris Johnson describing the British people as slothful; my experience is that they are no less hard working than the Germans. It’s the lack of self awareness I find troubling.

Accusations from right wingers need to be worn as badges of honour.

I think the rot initiated with The Powell Memo in the early 70s under Nixon and grown with other institutions like The Heritage Foundation, the American Enterprise Institute, and the libertarian Cato Institute, Its the monster we are fighting today.

I think the fact that:

a) he has inherited £1m

b) been fortunate to have a job that pays well enough to be the sole breadwinner for the family

c) a job which pays well enough money to save £5m in assets over that time alone

d) retired at the age of 59

makes him much better off than a lot of families in this country, is a little lost on him. I don’t like to be prejudice towards people who obviously have earned a lot of money, but they don’t make it easy for themselves.

Apart from all your very well-made points Richard, the guy has received plenty of state services in return for his £1m.

The only one he acknowledges is child benefit: currently about £1750/year for 2 kids x 16 years = £28,000.

But the state also paid for their schooling: circa £5,500/year/child x 2 x 13 years = £143,000.

And most of the first child’s university costs: £20,000 say.

Average NHS spending for a 4-person family is circa £8,000/year – let’s count the children only until they turn 21 years and start earning, and the two adults throughout their adult life, assuming they live to 80. He may not have spent as much in younger years, but the costs will probably be accelerating soon as most of health spending is in the later years of life. Total = £320,000.

The state has provided him with domestic and foreign security services in whose absence I suspect an accountant would not keep his £5m of wealth for long. Approximate share of Home Office, Defence and “public order and safety” budgets: £1300/year throughout an 80-year life for 2 people: £208,000.

Depending on whether he was contracted out and/or receives SERPS, state pension is hard to calculate, but at minimum it should be £6,000/year for each partner. Depending on his wife’s age this could start between 60 and 66, but let’s say they both receive it for 15 years. £6,000 x 2 x 15 = £180,000.

No doubt he has used the public roads and the odd train (£500/person/year), local authority bin collections, libraries, etc (let’s estimate £100 for the parts not covered by council tax – I’ll exclude social care and public housing as no doubt he would tell us that has nothing to do with him), the fruits of subsidised scientific research (£100), the great British countryside protected by the government’s environmental agencies (£250); and as an accountant he will recognise the value of accounting and administrative services to collect and distribute the tax, pensions etc so I’m sure he won’t mind paying his £100 share of all those overheads. That’s £1050 x 2 x 80 = £168,000.

I won’t count the services he’s received from private sector employees whose income was subsidised by tax credits, the implicit insurance policy he’s been given by the social safety net, the benefits of visa-free travel to, and duty-free imports from, Europe – and the many other more intangible gains from being a member of a stable, prosperous society.

I could have counted his own free university education instead of his first child’s, which would nudge the figures up a bit. I could have allocated a bit more of the security costs to him since as a business owner, he receives extra benefit from a secure stable society beyond just those accruing as a citizen. But let’s give him a break at this point.

All the above are calculated based on current budgets, so they may differ if spending levels were different in earlier years. In some categories this reduces the figures, in others it increases them.

Gareth’s total bill for state services over his lifetime: £1,067,000.

So according to his own calculations, he hasn’t even covered his OWN COSTS from the state, let alone contributed anything in return for the good fortune of being one of the richest people in the country.

£1m of tax might sound like a lot, but over a lifetime an average couple on national average income (one working for 40 years, the other 30) is likely to pay circa £600,000 (in income tax and NI only – not counting any VAT, council tax, corporation tax). This guy has barely paid more than an ordinary working couple, despite the astronomical assets he’s accumulated over his life.

Not to mention the slightly sneaky “tax, NI, etc” in his email – does this mean he HAS included VAT, corporation tax, employer’s NI, council tax, business rates and everything else? In which case, he has most likely managed to pay LESS tax than the average worker and it would hardly be surprising if angry voters were sympathetic to the idea of simply confiscating his ill-gotten gains.

Thanks for the calculations

@ Leigh

Your calculations remind me of the Book – Good times Bad times by John Hill – well worth a read

Most of the gain in value of his home, and those from whom he and his wife have inherited, would also have come from the provision of public goods and services in its location. The fabric of these homes would have required maintenance and renewal but not so the land element. Most of that unearned income (imputed rent) would have accrued since the abolition of the Domestic Rating System after which the comfortably off received a nice big tax cut.

When people say they are successful business people and have not received state benefits, I do try and remind them of the educational services that have provided them with workers, the health services that have kept those staff in work, the administration of the rule of law that protects their intellectual property, and so on.

Conversation seems to dry up after this …..

I doubt someone (a chartered accountant, of all people) with £5m of assets would never have invested in the stock or property markets. I can’t believe he would just have put it all in the bank.

Yes I found that part of his story somewhat implausible which made me wonder if ‘ Gareth ‘ was a real person, or whether this was a hypothetical situation . Notwithstanding that possibility it seems to me that his story is that of someone who is faced with an existential dilemma which is am I part of a whole, or an atom out there on my own in a hostile universe. If he felt comfortable in the latter case he would not have written his comment , but evidently he doesn’t feel comfortable, but at the same time still needs to cling on to his worldview . I have some sympathy with him . I am somewhat older than him, have made money, lost money , came from very modest circumstances blah, blah, blah. The world is a scary, uncertain place right now even for the comfortably off if you haven’t begun to think in terms of another kind of reality than the one we have now.

Remember when Northern Rock went under? There were people who had multiple £million savings accounts with them at the time. There’s definitely a sizable group of people who keep their spare capital in ordinary bank accounts, regardless of losses to inflation etc.

If their pension was invested in the stock market, it even makes a certain amount of sense to keep /some/ capital in short term cash. Probably not £5million of it though.

Richard said –

“…why do you think your children should enjoy such a massive advantage in life when so many others have none? Do you really think only inheriting £1.6 million would leave them so poorly off that they have no hope of a good life?”

And this is really the point, isn’t it? Gareth has clearly worked very hard in a field which is well rewarded and good on him for that. I can’t and won’t be angry or outraged at somebody enjoying success by their own efforts.

Gareth has also been very lucky to have inherited such valuable assets from deceased family. £1M is not and NEVER WILL BE a modest amount, regardless of what people think a house might fetch on the open market these days. To put it into context, it would take an Admin Assistant working for HMRC in London 50 years to earn that amount before tax. So, £1M = pretty far from modest. Also I can’t give credit for Gareth’s asset value arising from inflated property prices.

So, Gareth worked hard for some of his money and came into the rest by accident of birth or by perversions of the property market. This too is fine – we all need a bit of luck to get by.

But let’s look at the London based HMRC Admin Assistant again. No less hard working, no less dedicated, no more or less entitled to a bit of good fortune than Gareth. Probably going to retire on a £10K a year pension, living in state funded accommodation cos they’ve never been able to get a foothold on the property ladder and when they die, the only thing they’ll be leaving their kids will be the sage advice “For God’s Sake, son… be a Chartered Accountant!”.

All of our kids deserve a chance. As Gareth has shown, if you stick at it and work hard, and (admittedly) have the fair wind of fortune behind you, you can carve out a pretty good life for yourself. You don’t need to make your kids massively wealthy – if you’ve done your job as a parent right, they can take care of themselves… and you’ll be promoting social equality. For those not of a naturally socialist viewpoint, it’s equally fair to say that by leaving your kids nothing, you’re promoting healthy competition… may the best (wo)man win!

The argument for leaving your kids vast fortunes simply doesn’t stack up.

The argument isn’t with leaving your kids money, its an argument about at what point does the amount left becomes ‘more than enough’ and some of it gets redistributed. All of our kids deserve a chance, as you said, but if wealth remains concentrated with the people who have it and pass it down through the generations it means other children who are not fortunate to be born into a wealthy family might not get that chance to be a chartered accountant.

I feel your views are very blinkered to what you have and making sure you keep it at all costs. This is a view, in m opinion, which has caused a lot of problems in our society.

Sorry, the last paragraph should read ‘I feel those views are very blinkered to what the have and making sure the keep it at all costs. This is a view, in m opinion, which has caused a lot of problems in our society.’

– I think this is a wind up, just saying. I feel its wrong. any accountant know where to put the money that isnt needed

– Schools were probably private, just saying.

I think it was genuine or I would not have bothered

Not so! He says his kids were state educated.

Let’s give him the benefit of the doubt and credit where credit may be due: he has worked hard, earned well and made a very comfortable nest for himself and his family.

I can see why he wouldn’t want that nest to be diminished in any way. To him it would seem unfair to be taxed more because he thinks he hasn’t received any state benefits (or very few).

But this is codswallop of the smelliest variety.

He has received many more state benefits than child allowance: a free uni education, plus midwives, doctors and nurses to help his wife deliver their children, schools and teachers to educate his children, and presumably he has driven on the roads and used the electricity generated by once-nationalised powerstations?

These are benefits delivered by the state.

They are the foundations on which his wealth – and any citizens’ wealth – is and was built on.

He did not create his wealth entirely off his own back. Wealth creation requires collaboration, reciprocation and the existence of state-funded foundations.

That’s where he has “gone wrong”.

He has disproportionately attributed the creation of his entire wealth to his own efforts (and inheritance) without realising that his wealth couldn’t have been created without help from the state and other people, namely previous employers and his customers when he was self-employed.

That aside, to complain about paltry interest rates – which they may be – when he has a million or more in the bank also seems to be a tad miserly and lacking in appreciation for the fact that he has an enormous amount of wealth compared to someone living on the minimum wage and not had the good fortune to have inherited a million from their parents.

Isn’t this the time – the age of austerity – to be thankful for small, or in his case million-pound, mercies?

This is not to suggest that taxing him more is automatically justified, but it certainly makes it almost impossible to empathise with him and to think life has handed him a bum deal.

He seems to know the cost of everything and the value of nothing, but then again, he is an accountant.

Apart from your third and last paragraph, this is right.

I often hear people say ‘I’ve worked hard for my money’ when defending their wealth. Well no one can work more than 24 hours a day, and for my money no one works harder than the single parent (either sex) trying to hold down 2 or 3 part-time jobs while bringing up a family and maybe caring for an aging parent too!

May I suggest Gareth uses his accounting skills to do some voluntary work for the CAB or something similar. Not only could he be of enormous benefit to those so much less fortunate than himself, but it would give him invaluable insight into the horrendous problems that so many people have to cope with. Who knows, it may also serve to dent his inflated sense of entitlement?

I like that.

Yes, I do too.

I am a volunteer advisor at Citizens Advice and I can assure you the last type of characteristics we need in our volunteers, or paid staff, are those that Gareth displayed. His ‘there is no such thing as society’ and ‘I didn’t gain all I have for it to be taken for the benefit of others’ (I extrapolate from his tone) is 180° from the empathy CA volunteers need to be able to work successfully with our clients. His is a closed mind which might only be opened if and when really bad luck came his way and his well off milieu rejected him.

Bad luck, or lack of luck, characterises many of our clients (but by no means all) experiences.

Ability to think laterally and holistically is also useful for volunteers. Gareth does not display those either.

So in short, a fail.

We, Citizens Advice, would however treat Gareth and any issues he presented as a client, with respect and empathy, in spite of his clear inability to display those values to others who make up the society which has given him such good fortune.

On re-reading richard’s post I see that Gareth’s wife has worked for Citizens Advice. Either she never told him about the awful experiences of many of her clients (unlikely) or he is completey incapable of viewing the world outside his privileged bubble and totally devoid of empathy. You are absolutely right Windsorlass, this man would be useless. It’s a fair bet that much of his work as an accountant has involved helping clients avoid tax. Contemptible!

Well sais Chris W. ‘Nail on the head’ springs to mind

The same point was trotted out (by some) with regard to Messrs Evans and Vine at the BBC…’Well they’ve worked hard for it’. And as the man who called in to Vine pointed out, people who go (went…) down coal mines work hard. Accountants (with all due respect to our host whose energy and commitment are evident) might work long – billable -hours but it’s not the same as digging, or indeed surgery.

Gareth lost the plot, spurred on doubtless by that Tory ad-man nonsense about ‘hard working taxpayers keeping more of the money they earn’…

Mr Murphy you do great work that really adds value to the crucial political and economic debates of our time. Thank you. As to Gareth I do find it hard to understand the begrudging nature he exhibits. I have calculated that had Labour won the recent election my household would have lost around £5000 in after tax income. But we would have gained from better schools, better health care, better prospects for all and overall for £5k. Our daughter would have grown in a happier country. My God I want my nurses and doctors to be really well paid ! I just don’t understand the low, low tax brigade. What a scary nation they want to live in.

I don’t find Gareth’s story very plausible. In particular, I’m finding it hard to believe that a chartered accountant would not have any exposure to stock markets. It would be crazy for someone with £5m of assets to have it all in cash or in one main property. I wonder if the £5m includes his pension (which perhaps was invested in the stock market but transferred into cash as he approached retirement?).

Why is a 63 year old reluctant to transfer assets to his children, he presumably does not need £5m of assets to live on? I’d expect someone in his position to be buying properties for his children (or at the very least giving them substantial deposits); this would be an obvious way to reduce his IHT bill (assuming he lives for a further 7 years).

I am a chartered accountant

I have no exposure to the stock exchange

I do to gilts

I have some cash

But the stock market is overvalued and i’m nit going near it

You are right about the stock exchange being overvalued especially with brexit mishaps. But is not the bank of england via low interest basically forcing people to go into riskier assets to produce a return? Hense why a reasonable saving interest rate of 2-3% to deflate the bubbles such as property/shares?

What is wrong with low interest rates?

Wouldn’t credit controls denying funds for speculation be more use?

You may not realise that many chartered accountants will have worked at top levels or have contact with public quoted companies. They will know that many are run by crooks and psychopaths who are there to feather their own nests rather than those of their shareholders. So it’s no surprise to me that Gareth doesn’t invest in shares and keeps his cash in banks. Presumably quite a few of them

if he has any sense. I worked at the Inland Revenue and in large accounting firms and share those attitudes from personal experience. I don’t have any problem with IHT being levied on my estate which I regard as modest but which I am self aware enough to realise makes me much more fortunate than most.

One thing the ONS report on wealth levels of the UK population does not include which skews the figures probably, is those UK nationals that leave the country. Also as I have said before and as Gareth alluded to many countries have no estate tax at all and ours is 4th highest in the world. Some would say it would promote some to be idle and not be in the labour market, to that one could argue that would make way for someone as to take the job instead of someone who may not need it due to a fortunate bequest. Plus unless you literally have a rate of 100% even if the very rich billionaires paid it at even 70% their heirs would still not have to raise a finger, so really when people mean it would promote idleness they really mean for more comparatively ordinary wealthy people compared to the super rich. Also I read some report that stated IHT avoidance costs £12 billion per year year yet the tax brings in only £5. You can see the long list of celebs past that their heirs never paid it. Just a few months ago Roger Moore died and wanted to be buried in Monaco so I doubt any penny will be paid to cite one example. I read Nick Cleggs father has a big mansion in Switzerland. So it really seems to be a tax designed to have a go at the more modestly wealthy and the super rich can avoid which created more inequalty?

I would say in the spirit of equalty how about changing the the system where its based on estate size anything above is taxed to the exempted amount is which each beneficially can receive? Because currently it penalizes that spread wealth around more than leaving to less. Which incidentally a lot of countries to with their ‘forced heirship rules’ . Also just because the owners of said wealth are wealthy does not mean their kids/nieces and nephews are, so one could say yes some wont have the luck of having well of parents/grand parents etc, but if those are fortune are taxed highly now they will need state support as well. So within reason it could be argued that if the modestly well of were left alone more state resources could then be spent on the non affluent.

And as I said before doing the CGT charge (without IHT?) would be worse in someways, as you could have some lucky /Lottery/Premium bond big prize earnings that would never have been subject to income tax and so would not be subject to anything on death either Or those due to missfortune entitled to a big insurance pay out. Which the family home while technically not subject to tax the owners would have paid lots of income tax while paying off the mortgage.

There is almost no evidence at all that people will move to avoid tax

There has been quite a lot of research on the issue

Put simply, there are a lot more important things sin life for most people – Gareth included, I suspect

“Richard Murphy

There is almost no evidence at all that people will move to avoid tax

There has been quite a lot of research on the issue”

I thought most of the actual research that had been done looked only at US interstate movement? Hardly a reliable measure. No doubt you will provide a link to prove me wrong.

Meantime, Jenson Button, Lewis Hamilton, Stelios (the EasyJet fellow) Richard Branson, the Barclay twins, Sir Phillip Green and the 4,500 who renounced US citizenship in 2016 suggest otherwise.

The point is that it is the stinking rich who leave when tax rates rise. And then we don’t just lose the extra 10% or 20% you would like to squeeze out of them it’s all the tax they might have paid as well. How much of Lewis Hamilton’s estimate $46m in 2017 will be taxed in the UK? Nil. Zero. Nothing. How many average tax payers will that take to fill in that missing money?

In the 1970s of course it wasn’t a trickle it was a flood, when tax rates on earned income peaked at 83%. The richest 1% in the UK now pay MORE as a % of total income tax than they did in those days.

You can carry on denying that there is evidence all around you that high taxes chase the rich away if you like but it’s just so obvious to anyone looking around in the real world.

The general chant from the left on this is “they won’t move” and then when they do, it’s “good riddance”. Which seems a strange way to collect tax.

I am not saying no one moves

A few examples do not prove the case

And yes, the research is US bssed, because that is the only reliable base for it. Elsewhere the phenomenon is too small to observe

Well the long list of british non doms over the decades suggest otherwise. Such as Mick Jagger/Richard Branson/ Bernie (the founder of F1) Roger Moore, Sean connery whom a relative in scotland did an interview a few years ago clearly saying sean does not talk about his previous support scotish indipendance for tax purposes). Or Richard Burton, Elizabeth Taylor, Anthony Hopkins (he is an american citizen). Or Johnny Depp whom owns a island in the Caribbean somewhere so its very likely he is a non dom to. So all I can see is labour crying about a tax cut cut that is for more ordinary wealthy but with no words of action on going after the super rich who just pack up their bags and leave. To illustrate this point I failed to find a single politian let alone Jeremy Corbyn who brought up the issue of the duke of westminsters passing last year

My remedy for low interest rates would be the government provide infrastructure bonds which give a return for the government and depositor call it a investment for a social purpose..

You are clearly confusing non resident with non dom

And as I say, if that’s it we really need not worry

Most of them were also long ago

I wonder if you’ll ever hear from Gareth again?

He has commented here before

I did email him the link to the blog

I hope he replies

If this chap is genuine then his attitudes bears all the hallmarks of the ‘culture of contentment’ Kenneth Galbraith talked of. It is a sort of benign ignorance allied with a certain self justification. I would love to know how much he has been paid and what positions he has held. I wonder if he has used offshore.

I think that you have dealt with his questions fairly and in detail.

He says he was a practicing chartered accountant most of his career

Yes – noted – but in what capacity, what area of the economy, what client base etc., is what I was getting at really?

As we have seen on this blog, the wealthy are willing to pay those in the accountancy trade well for maintaining secrecy and even turning a blind eye.

But what still amazes me about people like Gareth is the fact they think that their success (which I do not begrudge Gareth at all) is totally of their own making. I do think that the acquisition of money changes people and throws out their perception of real life.

I may have already recounted the tale of a senior member of my family who is always telling us to be careful with our money and not spend much when in fact in reality her own wealth was given to her on a plate! She is careful with her regular retired income so as not to dip into her substantial reserves. My family does not have those reserves as we are trying to build them up – we save as much as we can in the meantime whilst trying to meet daily or monthly expenses and keep debt to a minimum. But the senior does not get it. She has no dependents now but herself. And the money just sits there and no doubt we may even get some of it when she passes.

When people acquire money, they seem to forget about when they did not have it. The ownership of it seemingly elevates them above humanity. Which is a shame.

It’s the oft repeated mantra of the rich and successful that they owe their position to their exceptionalism – studied hard, worked hard etc, the self-made people who worship their creator. But many of these great men (and they are still mostly men) didn’t start off in the gutter but were born into families who were already successful or wealthy or at least reasonably comfortable, to a greater or lesser extent, families that provided encouragement, families that read books, that valued education and so on and so on, but crucially (because lots of other families also value these things) they were families that had the time, the inclination and wherewithall (cash?) to imbue their offspring with these sorts of values.

Now, does that mean they’re entitled to all the material rewards? Because much of their success is down to good luck and to having chosen the right sort of parents.

Since a youth I have always been of the opinion that pay differentials should be far lower than they commonly are, whatever your job, street cleaner or prime minister (or boss of an advertising agency). The Ecology BS gets it right where the CEO’s remuneration is 4.4 that of the lowest paid and top pay is capped at 5 times that of the lowest full time worker.

As regards wealth, and I too have benefitted from some inherited assets, I think there should be limits to that as well and to tax-free gains from main residences, after improvements and inflation, from which I have also had (modest) gains.

Perhaps we could be encouraged to leave more to charity when we shuffle off?

“That unless we gift assets or buy farms, our estate will attract IHT of some £1.6 million.”

Well, to me this proves the difference between an accountant and a tax adviser.

There are many ways to avoid paying that IHT that don’t involve farms or gifts.

Could you put this chap in touch with me?

Thanks

CR

Gareth doesn’t mention how his parents helped him get where he is now, except for the £1m inheritance. Perhaps he thinks they just did what (just about) any parents would do. Yes, most parents do their best for their children. But what they are able to do varies greatly.

A cartoon which is thought-provoking on this topic: http://thewireless.co.nz/articles/the-pencilsword-on-a-plate . It’s easy to overlook the different lives people live when they start from different places in the same society. (Never mind the accidents of which country and era we’re born into.)

Exercising a little bit of imagination about the circumstances other people live in is a good place to start from when holding opinions on questions of political economy.

Well, granting that most wealthy people have indeed worked hard, what about the people who have worked equally hard but haven’t accumulated the same wealth?

I think I worked pretty hard but, having chosen to work in a public library the wealth I accumulated is pretty sparse. I am fortunate enough to live in co-op housing at decent rates that I can afford but that’s just luck. And without that luck I’d be hard pressed to get by.

Is there something morally repugnant about me or the other lower middle class earners? Or did they just have bad luck, chose the wrong occupation (one like Library workers that society had decided isn’t worth as much as chartered accountants), or, like me, couldn’t afford a higher education? And I didn’t get to retire at 59, either. So if it’s largely a matter of luck why shouldn’t the people at the top contribute some money back to society as payment for their luck?

I know the government isn’t funded by taxes, but why would someone who inherited a million from their parents mind giving a little back?

This made me break out in spontaneous applause and some whooping and cheering too.

My favourite sentence is this:

“Come to that, why don’t you want to make a fair contribution to the society from which you have done so well? What makes you think you don’t need to do so?”

And that is, indeed, the 64 thousand dollar question, or whatever that translates to these days.

The source data for the wealth chart above is ‘Distribution of total household wealth by percentile points, total financial wealth (net), total property wealth (net), total physical wealth and total private pension wealth: Great Britain, July 2012 to June 2014 (User requested data: #007203)’ which is at:

https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/adhocs/007203distributionoftotalhouseholdwealthbypercentilepointstotalfinancialwealthnettotalpropertywealthnettotalphysicalwealthandtotalprivatepensionwealthgreatbritainjuly2012tojune2014

Thanks

I agree with your points Richard. I was confronted with this questioning from a friend recently and I went along a completely different track by trying to use their own beliefs against them. I.e.

“You believe in running a balanced budget however during your 50 years the government has spent vastly more than it has taxed. You have benefited from under taxation and over spending and are part of a society that has spent too much and paid too little tax. So even although you have paid the tax you have been asked to you haven’t been taxed enough during your working life for your country to pay its way.

To make it easier for you to pay your way we will let you pay your share when you least need it, i.e. when you are dead.”

My friend seemed to think this was reasonable enough, though not enough to not vote Conservative…

As an aside do you know if there is research on the optimum level of IHT and how to stop people avoiding it.

Oh and thanks for the book recommendation on your blog “Rethinking the Economics of Land and Housing”. It’s a very good book – free flowing with more than enough detail to make it very informative. I might have to read your book next!

Ken

I know of no optimum level of IHT

In fact, in The Joy of Tax I suggest getting rid of it

But I have a replacement or two, of course….

Best

Richard

“Neither I nor my wife have received any state benefits other than child allowance for our two kids and during my working lifetime, I estimate I have paid some £1 million in tax, NI, etc”

That’s the crucial line. He sets it up, as so many do, as a case of individually paid in cash, individually paid out cash – which is to miss the whole point of universal provision.

I wonder, for example, if he would only count the monetary value of vaccines that he and his family have received.

“To die rich, is to die disgraced” Andrew Carnegie

Also, “Dark Money” by Jane Mayer is a very good read, if you want to understand what has been going on in USA GOP politics.

Richard, there are some “billions” in your blog which ought to be “millions”, I think.

Sorry

I know it sounds daft, but I usually work in billions

Hello Richard

Thanks for your comments.

There are some errors in my original comments and your reply and these include:-

1. £1.2 million is property, being my wife’s deceased parents house inherited at £200000 now worth £320000 and our house in which we have lived for 30 years, cost £120000 plus £30000 improvements, now worth £800000,

2. Pension wealth of some £150000 is included and comprises the remains of our equitable life contributions now in draw down.

3. My wife still has stocks ans shares inherited from her father of some £120000. I have invested in stocks myself and property but always sold at a loss or break even.

4. The £1million tax paid is an estimate. I intend going through my old tax records next winter to establish the exact figure.

I am grateful to the comments from your contributors.

You and they may be interested to know the following:-

1. I realise that I have been very fortunate.

2. If you knew me, you woukd know that I am not an egotist.

3. I know I have been lucky.

4. Life throws you some lucky breaks. Mine include having the sense to become self employed rather than rely on the promises of employers for partnerships, etc, my start of self employment coincided with chartered accountants being allowed to advertise for business for the first time, buying my office freehold, I am lucky enough to still be married to the girl I met at 11, I was good at maximising the profits of my business and computerisation enabled me to reduce staff costs, we have good state schools to which our children went and both mine and my wife’s parents bought us up to be sensible with money and instilled the savings habit in us.

5. I am lucky enough to know when “enough is enough”. I have Alzheimer’s in my family (my dad and his two sisters all died in their early 70’s), so when the chance came to sell my business when I was 59 I took it. I haven’t missed it for a second. I don’t begrudge the additional wealth I could have creared from continuing my business and I happy to have been able to pass this wealth creating opportunity to the buyer f my business.

6. I stick to my belief that IHT is a horrible little tax that yields minimal revenue, although with our stupid property market it will increasingly capture more estates and then generate more revenue. It should start at levels above £5million or some such figure.

7. I thank you for the offer of financial advice re IHT but I believe this would comprise insurance products and stocks and other risky assets for which I have no tolerance. 35 years in business, including dealing with many financial advisers has not installed confidence in me

8. I accept that I have underestimated the benefits I and my family have had from the state for which I apologise.

I look forward to reading any of your further comments and observations and may infact be tempted to make some of my own.

But you have not explained how you could have saved so much Gareth from earnings that I have estimated and you have not challenged

Nor have you answered the vast majority of the questions raised

But thanks for coming back, even if I am none the wiser

Hearing that Gareth sold his business could explain a lot – if he got £2-3 million for this and claimed Entrepreneurs Relief he would have paid just 10% capital gains tax on the balance. This is a legitimate way to use the tax system of course; though even as someone who’s benefited from it, I think it’s unnecessarily generous to business owners.

Even if all the questions aren’t answered yet I am impressed by Gareth’s bravery in venturing back into the lions’ den of this comments thread!

I would be astonished if an accounting practice sold for that much

Correction

House is worth £880000

Thanks for the correction Gareth

But that makes the rest of your claim even more incredible

Might you elucidate how you saved so much and paid so little tax?

And maybe answer the questions I, and others, raised?