The Boston Consulting Group (who are big enough to do the research) have published a new report on global wealth. It's something they have done for some time. And as they say:

A new report from The Boston Consulting Group explores, among others, the accretion of wealth among the world's wealthiest people. The reported, titled 'Global Wealth 2017: Transforming the Client Experience', is based on an analysis of global private and covers both current trend and future projections. Private wealth is measured for the affluent as between $250,000 and $1 million; for lower high net worth individuals (HNWI) between $1 million and $20 million; upper HNWI as between $20 million and $100 million; and ultra HNWI as anything over $100 million.

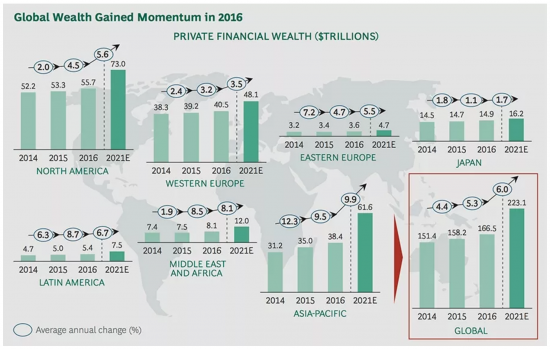

Globally, private wealth has continued its steady increase, up from $158.2 trillion in 2015 to $166.5 trillion last year — with growth averaging 5.3%, up from 4.4% between 2014 and 2015.

This is the trend:

Of this they say:

The firm is projecting strong growth in total wealth across the globe, at 6% CAGR between 2016 and 2021 — to hit $223.1 trillion. The US is expecting close to the average growth of 5.6%, with regional wealth topping $73 trillion, while the Asia-Pacific region may see 9.9% growth CAGR to hit $61.6 trillion by 2021.

In other words, they think wealth will grow vastly quicker than earnings possibly can. Or, to put it another way, inequality is going to rise, and rapidly. They're happy to trumpet it:

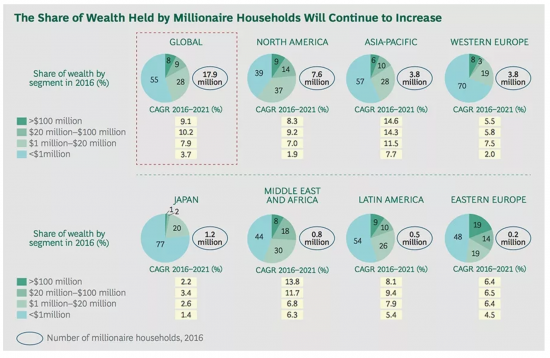

On this they say:

North America is largely set to grow from further wealth accretion for those that already hold it, at 73% of total gains to 2021, while in the Asia-Pacific, 65% of wealth addition stems from growth from new wealth creation. Europe has a relatively balanced profile, as does Latin America and the Middle East and Africa.

The research notes that those with money are likely to be making the lion's share of more money, in terms of CAGR between 2016 and 2021. The share of wealth by millionaire households will continue to increase, with the biggest share of that growth globally for households with $20 million - $100 million in wealth, at 10.2%, followed by >$100 million, at 9.1%. Households with <$1 million are likely to see the lowest growth of their wealth, at 3.7%.

In other words, not only will inequality increase, but the degree of inequality will increase with it.

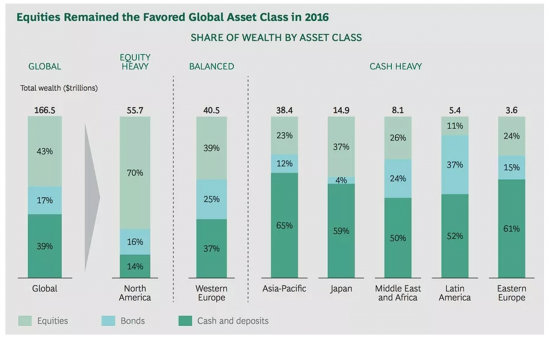

And what is this wealth held in? This is their estimate:

In other words, we're talking financial assets, but with cash surprisingly significant in large parts of the world. And remember that cash saved is dead money for economic purposes: it's money effectively withdrawn from the market that contributes nothing to investment, growth or innovation, let alone new employment. These people can't say their savings are doing something useful because we know they are not. All they're doing is slowing the world economy down. No wonder we remain in the doldrums, economically.

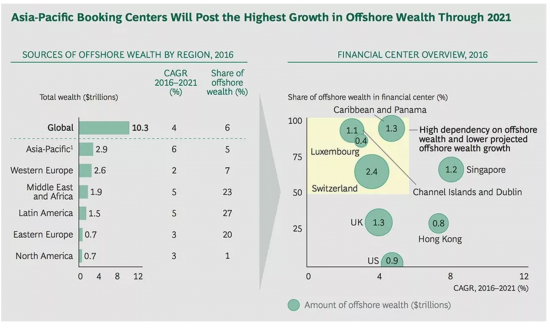

So where is this 'wealth'? This is the chart for that:

Surprise, surprise: offshore is growing. The measures being taken on this issue may well be deterring the small players who once abused these places but the wealthy carry on regardless.

Which is why I believe the need for a wealth tax is pressing and, if anything the most urgent tax justice priority now.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Taking out North America then ‘new wealth creation’ is a bigger factor than additional wealth accumulated by the already wealthy. This is a sign of mobility which most would regard as healthy. Creative destruction, wealth being captured by risk-takers, workers and consumers: these are things we like surely?

What policy recommendations would you have for North America, I wonder?

You think this degree of distortion is down to wealth creation and not rent seeking?

Would it be fair to say that a significant amount of this money might end up as rent seeking credit?

As well as taxation, this data tells me more than ever that new Government money as QE or other investment is now needed by ordinary working people.

A rolling back of privatisation might also help to stop QE/New Money from over-benefitting the already wealthy.

Cash is rent seeking

How can cash, which makes up a tiny portion of the money supply, and tends to attract low interest rates (and negative real rates) ever be rent seeking?

All interest is rent

What else us it?

By that definition all investment activity is rent seeking.

Are you saying that you would somehow stop this? By doing so you would make the banking and pension systems collapse overnight, let alone any private sector investment, the housing market etc.

Or are you saying you could only get a return from an investment if it was somehow approved or proscribed by government?

You seem to think saving and investment are the same thing

Go and do some basic reading

In fairness the comments of ‘Jerome’ absolutely invalidate the rather silly argument still sometimes put forward, e.g. by that idiot Christopher Booker, that the Clinton’s affordable mortgage scheme somehow contributed to the 2008 crash

I’m confused the dead money you talk about “And remember that cash saved is dead money for economic purposes: it’s money effectively withdrawn from the market that contributes nothing to” is this physical cash as in notes? I thought deposits would flow back into economic activity?

Deposits do not create loans

Loans create deposits

Banks literally never lend deposited money

All loans are made out of thin air

I’m sorry, but years working in Bank treasuries tell me you have got this totally wrong.

Banks have to have a certain amount of Tier 1 capital – and therefore a lot of deposits – before they can ever consider making loans.

Then, when a loan is made, the money the bank has loaned doesn’t simply appear from thin air. We have to go and borrow the excess (over our deposit base) from the money markets. Which means in practice other deposits, or from longer term savings.

Loans simply are not made of thin air. It might be a nice way for economists to explain things, certainly in model terms it helps with velocity of money calculations etc, but in the real world a bank simply cannot “loan money out of thin air”. At the end of every day our balance sheets need to be whole – so that money we loaned gets borrowed from somewhere else. As an accountant I would hope you understand the basics of balance sheet accounting and management.

Go and read what the Bank if England said in its first quarterly bulletin of 2014

And the double entry proves it

You need not one penny if another person’s money to go Dr Loan, Dr Current account

And that is all ( and I mean all) there is to it

To add:

Banks are in the business of maturity transformation. We borrow short to lend long. We do NOT create money out of thin air, as has widely and innaccurately been claimed.

Stop lying

That is what you do

Even the Babk of England now say so

Game over

The bullshit you’re promoting is now seen for what it is. You don’t like it because it leaves you limited purpose

That BoE Q1 bulleting you refer to says that bank deposits come first, and that bank deposits increase when banks make loans. Deposits first, loans second. You will also notice that they specifically say that Bank’s ability to create new money is NOT without limit. This is the very basis of the fractional reserve banking system.

You clearly don’t seem to understand the business of banking. My guess is that you have little or no experience in how and what they do.

Almost all banking involves maturity transformation. This includes the money creation/destruction aspect of fractional reserve banking. Any term loan is a maturity transformation for example.

You also don’t seem to understand basic balance sheet accounting. Double entry book-keeping is simply not sufficient for banking. With DE you assets and liabilities might match up, but in the real world they don’t because of their specific maturities.

When a bank lends money out, for say a mortgage, it might now have an asset on it’s books (the loan) as well as the cash liability, but that loan might be a 20 year loan, and that liability is immediate. Therefore the Bank has to go out and borrow that cash. Now in theory you could go and borrow the same amount for 20 years (and thus match the maturities of your asset and liability), but in practice this is not what happens – it’s simply not feasible. What almost always happens is the bank goes out into the money markets and borrows whatever cash it needs.

The way you see it, banks wouldn’t ever need to do this. By inference, we simply wouldn’t have had the financial crisis of 2008 as the money markets drying up wouldn’t have led to banks running out of SHORT TERM liquidity – because under your version of the system they simply don’t need to make their balance sheets whole.

Northern Rock simply wouldn’t have happened if the bank didn’t need to access the money markets – which it could no longer do.

We don’t have fractional reserves banking

And the BoE quite specifically says deposits are created by loans and not the other way round

And of course there is a limit to debt creation – it is the capacity to repay

And perhaps you should understand the difference between loans and liquidity

The UK most definitely has a fractional reserve banking system. It is quite frankly terrifying that someone calling himself a professor of economics doesn’t seem to know that.

The BoE are quite clear in their description. They say deposits come first, in the form of reserves and currency. New loans then can increase the deposit base.

The limit to debt creation has nothing to do with the ability to repay – how would you measure that to begin with? It has everything to do with the limits on credit creation set through the fractional banking system. Specifically regulatory limits and the effect of the base BoE interest rate. If we didn’t have a fractional reserve banking system why would banks need Tier 1 capital or have to follow Basel 3 etc?

I do very much understand the difference between loans and liquidity. You don’t seem to. In your opinion, a bank can simply lend out term money, but has no requirement to bridge the gap between that loan and it’s liquidity, because you are looking at it in the over-simplistic double entry book-keeping fashion. In the real world double entry is simply not used because it doesn’t take into account liquidity.

Of course, I should probably bow to your greater knowledge of banking and go into work on Monday and tell my Treasury team they are no longer needed, nor are the balance sheet management team, ALCO team, and we don’t need to worry about IAS39/IFRS9 so can get rid of the teams of accountants we have working full time on these things. All we really need is an accountant who can do double entry book-keeping.

I am not sure how to answer someone who is quite emphatically wrong

You offer a classic text book and as the BoE says, all those books are wrong. So are you.

Jerome is of course quite correct and to argue otherwise is quite frankle casuistic sophistry. The example you give of debiting a loan account and crediting a customer account does not create a loan or any form of creditor relationship because there has been no cash flow. It simply creates two account balances that can be offset. In order to make the loan into a true credit relationship the funds have to be disbursed, and in order to make that disbursement the bank has to either supply surplus equity funds, or more likely fun itself in the money markets. Although it might be anathema to an accountant, the timing of the ledger entry you mention is largely irrelevant falling in as part of the process of credit sanction, funding and loan disbursement.

You too need to watch this https://youtu.be/CvRAqR2pAgw

The BoE say you are emphatically wrong on all counts

All banking is debits and credits. Your belief that there is something tangible to the process is not just archaic, it’s dangerously wrong

BoE quite clearly states that deposits come first, then loans create more deposits.

It really isn’t that difficult. If it is as you say, why would any bank require Tier 1 capital – as mandated by Basel 3 and regulated in the UK by the BoE? They could simply lend money without limit, and with no capital base to draw on. They’d never go bankrupt!

That said, I’m not really sure I should pay any attention to someone, such as yourself, who believes that the UK DOESN’T have a fractional reserve banking system. let alone all the other howlers you’ve made.

The BoE clearly states the exact opposite

If you watch this video, in case reading would lead to another error, you’ll see the BoE say it is loans that create deposits, quite explicitly https://youtu.be/CvRAqR2pAgw

And the video makes absolutely clear there is no money multiplier and so there is no fractional reserve banking system

They quite emphatically disagree with everything you say

That said, I think in 2014 the BoE got the impact of QE wrong – as we now know

Jerome this might help:

From BOE (pdf download):

https://www.google.co.uk/url?sa=t&source=web&rct=j&url=http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf&ved=0ahUKEwiSwNSNy47VAhXKK8AKHdqlA7cQFggdMAA&usg=AFQjCNEC40I_RsLixV-7vqDH8EnIWMnFzw

“In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often

misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.

The reality of how money is created today differs from the description found in some economics textbooks:

– Rather than banks receiving deposits when households save and then lending them out, bank lending creates

deposits.

– In normal times, the central bank does not fix the amount of money in circulation, nor is central bank money

‘multiplied up’ into more loans and deposits.

Although commercial banks create money through lending, they cannot do so freely without limit. Banks are limited in

how much they can lend if they are to remain profitable in a competitive banking system. Prudential regulation also acts

as a constraint on banks’ activities in order to maintain the resilience of the financial system. And the households and

companies who receive the money created by new lending may take actions that affect the stock of money – they could quickly ‘destroy’ money by using it to repay their existing debt, for instance.”

Also from BOE (pdf download):

https://www.google.co.uk/url?sa=t&source=web&rct=j&url=http://www.bankofengland.co.uk/research/Documents/workingpapers/2015/wp529.pdf&ved=0ahUKEwiSwNSNy47VAhXKK8AKHdqlA7cQFggrMAE&usg=AFQjCNE1OUDeW7Pz-GLlW8l8dCMCAAUMWA

Working Paper No. 529

Banks are not intermediaries of loanable funds – and why this matters

Zoltan Jakab(1) and Michael Kumhof(2)

“Abstract

In the intermediation of loanable funds model of banking, banks accept deposits of pre-existing real resources from savers and then lend them to borrowers. In the real world, banks provide financing through money creation. That is they create deposits of new money through lending, and in doing so are mainly constrained by profitability and solvency considerations.”

Finally – an explanation from professor of economics Bill Mitchell corroborating Richard’s opinion on this: (link)

https://www.google.co.uk/url?sa=t&source=web&rct=j&url=http://bilbo.economicoutlook.net/blog/%3Fp%3D31063&ved=0ahUKEwiSwNSNy47VAhXKK8AKHdqlA7cQFggzMAI&usg=AFQjCNFC_wuD1FV43bARzBmPD0szmq6DLA

Adam

Many thanks

You went for the word and I went for the video, with the same intent

Richard

Beyond the point that Richard made it should also be noted that “economic activity” and actual production are not one and the same.

Rent-seeking is an economic activity. With the difference being that rent-seeking does not produce. It captures and re-distributes existing wealth.

Forgot to note – that last comment was in reply to Tony B (at top of thread).

Marco, Its pretty obvious there is an intellectual battle ground.

What’s a good book to understand terms and definitions. My comment was partly about the difference (definitions) between ‘cash’ and ‘deposits’. I have only read two books on Economics ‘The Courageous State’ and ‘The Economics of the 1%’, all other reading is bits of books, newspapers and web based. What about ‘Economics: The User’s Guide’ by Ha-Joon Chang?

On money Ann Pettifor is worth a read

And try Steve Keen

But the book we need has yet to be written

As possible reading for those struggling with understanding what Steve Keen has called the “myth” of fractional reserve banking; may I suggest for example Federal Reserve economist Seth Carpenter and academic economist Selva Demiralp,”Money, Reserves, and the Transmission of Monetary Policy: Does the Money Multiplier Exist?” (Federal Reserve Board, Washington D.C.,Finance and Economics Discussion Series, May 2010).

I shall not attempt a detailed analysis of their argument, and will shortly cut to the Conclusions, but first in their Abstract here is a quotation on their methodology, which – in my view cricitally – focuses on the empirical evidence over the theoretical: “We explore the institutional structure of the transmission mechanism beginning with open market operations through to money and loans. We then undertake empirical analysis of the relationship among reserve balances, money, and bank lending. We use aggregate as well as bank-level data in a VAR framework and document that the mechanism does not work through the standard multiplier model or the bank lending channel. In particular, if the level of reserve balances is expected to have an impact on the economy, it seems unlikely that a standard multiplier story will explain the effect.” (unpaginated).

Carpenter and Demiralp’s concluding analysis is as follows:

“Simple textbook treatments of the money multiplier give the quantity of bank reserves a causal role in determining the quantity of money and bank lending and thus the transmission mechanism of monetary policy. This role results from the assumptions that reserve requirements generate a direct and tight linkage between money and reserves and that the central bank controls the money supply by adjusting the quantity of reserves through open market operations” (p.27)

Carpenter and Demiralp’s go on to draw the following conclusions from their research: “First, when money is measured as M2, only a small portion of it is reservable and thus only a small portion is linked to the level of reserve balances the Fed provides through open market operations. Second, except for a brief period in the early 1980s, the Fed has traditionally aimed to control the federal funds rate rather than the quantity of reserves. Third, reserve balances are not identical to required reserves, and the federal funds rate is the interest rate in the market for all reserve balances, not just required reserves. Reserve balances are supplied elastically at the target funds rate. Finally, reservable liabilities fund only a small fraction of bank lending and the evidence suggests that they are not the marginal source of funding, either. All of these points are a reflection of the institutional structure of the U.S. banking system and suggest that the textbook role of money is not operative.

While the institutional facts alone provide compelling support for our view, we also demonstrate empirically that the relationships implied by the money multiplier do not exist in the data for the most liquid and well-capitalized banks. Changes in reserves are unrelated to changes in lending, and open market operations do not have a direct impact on lending. The textbook treatment of money in the transmission mechanism can be rejected” (p.27-8).

Thanks

And new source for me, I think (he says, going off to check Zotero where I tend to log these things)

It also shows that Thomas Piketty’s observations in Capital in The 21st Century are as relevant as ever.

Quite simply if returns to capital exceed GDP growth then it is only a matter of time till the oligarchs own the whole world. Ancient Egypt’s God Kings would be jealous.

The disparity between GDP growth and returns to capital, indicates the degree of rent-seeking . In fact, the disparity between wealth accumulation and GDP growth is a better measure.

Then you factor in the flaws in GDP measurement (eg. the parts that effectively include finance sector growth)and these days you’ll find that its virtually all rent-seeking especially so in the Western World.

Capitalism is fundamentally unstable without a high level of redistribution via taxation. Inequality rises inexorably until we hit an economic or political crisis. Previously, we needed war to reset the imbalances. May be it can be achieved politically. The demos will not stand for further increases in wealth inequality. Change is coming!

I agree

I agree with Charles that we might well have reached the limit of the tolerance of wealth inequality and the trigger for this will probably be the limit of the ability of private debt to be pushed any further which has created that ‘tolerance’ of inequality.

War has reset the balances, that’s true ( although, in Ireland’s case, the complete gutting of thee economy with mass emigration did it). But there is another factor which is Marx’s Law of the Tendency of the Rate of Profit to Fall. professor Andrew Kliman has anallised this in a book called ‘The Failure of Capitalist Production.

‘When measured as the net value added of US corporations (what AK calls ‘property income’) minus employee compensation against the historic cost of the fixed capital stock of corporations, the US rate of profit shows a persistent fall from 1947 to 2009. And it does so, using historic costs, whether profits are measured as pretax, adjusted for inflation, or adjusted for labour values.'(/thenextrecession.wordpress.com/2011/12/08/andrew-kliman-and-the-failure-of-capitalist-production/)

The maths is tricky but its an interesting thesis.

Thanks, I will have a read of that.

Since the late ’60s the US has been practising an extreme form of rent-extracting shareholder capitalism. It survives on natural resources, defence spending and imported talent. Although there are pockets of real innovation, it could do so much better. Apart from a few elite universities, the education system is terrible, as is healthcare and infrastructure. But it does have some great people. I hope they win the battle one day.

Walter Scheidel’s book “The Great Leveller…” suggests that throughout history inequality diminishes only through violence or catastrophe such as environmental disasters or plagues etc. I think he may be right and nothing much will change. After all, the rich control the politicians and through them the military.

That thesis made for interesting discussion with my sons tonight

It certainly does not have to be this way. In the US for the top 10% most of the decline in income share did indeed happen in the year after Pearl Harbour, see e.g. graph in

http://www.zerohedge.com/news/2013-09-11/us-income-gap-soars-widest-roaring-20s

but more interesting is that it did not increase again for a whole generation between 1942 and 1980. If you have the right policy mix there is no reason why inequality has to rise!

Also interesting is during this era the US enjoyed its highest ever average growth rate.

Lets hope and pray we don’t need the four horsemen to bring about justice and equality.

That’s why another financial crisis is as necessary as it is inevitable.

The trick is in not wasting the opportunity.

with respect to your last sentence: “the rich control the politicians and through them the military”.

I think it was Machiavelli who first said it (& Graham Greene paraphrased him in the Quiet American): there is no equlity between the armed and the unarmed – states for the most part have a monopoly on violence. Fortunately we have the possibility of (non-violent) change – it remains to be seen if the rich allow it.

Jerome

I guess you’re new here? If so, I’ll explain how things work on here – Richard Murphy is only interested in allowing comments from people who worship him and his beliefs.

Anyone that actually has a modicum of understanding of the real issues, as you clearly do, will be banned quite quickly, once it’s obvious that allowing you to post will only serve to reveal Murphy’s ignorance.

How none of his disciples can understand quite how wrong he can be, even on basic issues of economics, is scary.

Thank you for your ‘kind, comments

The point yout still miss is the simple one, and is that it is not just me who says Jerome is wrong; the BoE has specifically said his thinking is quite specifically incorrect.

But what do they know?

As for everything else, you appear to be intent on being gratuitously rude to a great many sensible people. You may think that socially appropriate. I think it as inept as Jerome’s comprehension of banking

“…the BoE has specifically said his thinking is quite specifically incorrect”

They can’t have been any more specific than that.

speak for yourself pal – I don’t agree with some of the stuff that Richard says & I certainly don’t “worship him and his beliefs” – I think for myself – that said – I also read – with great interest the BoE 2014 report & watched the “parliamentary debate” on the BoE report – oddly – the first in +/- 100 years on the subject of “where does money come from” – that in itself tells you that there is something sreiously wrong with the understanding of banking and gov’ finances – where it matters most – amongst the politicos who are supposed to run the show.

Here is a question for you & Jerome – if it’s all so hunky-dory (in terms of banks & their functioning) how come the 2007 crash? why Basel 3? & so on & so forth. Come on mate – I’m sure you have the answers all ready to hand. I’m interested to hear.

You won’t hear: I let people be rude once

Jerome is still here as he has not been rude

Mr Keane,

With all due respect; I do not do “worship”, and indeed you (can) provide no evidence that I do, save that I happen to have commented here. Your comment, as an illustration of your empirical methodology, I am afraid simply will not do. In a similar way, your comment is nothing more than an ‘argumentum ad hominem’ (a logical fallacy incidentally). There is no evidence in your comment; it is bereft of both interest and content, but it does require a short reply.

Both the Blog and the comments on this thread have generally provided sources, references, argument; and rely on evidence. They can be checked. The sources relied on include the Bank of England, Federal Reserve, and economists like Ann Pettifor, Richard Werner, Steve Keen, and in its essentials the argument goes back to Hyman Minsky. What do you offer, Mr Keane, above the slack, gratuitous, personal insult? The exploded theory of out-of-date textbooks, that demonstrably failed the empirical test; supported by the hubris of “Jerome”, without a surname. Now is that a tough call? Gardner, Demiralp, Pettifor, Minsky, Werner, Keen, BofE, et al ….. (oh, Murphy of course) and the empirical evidence – or “Jerome”? Tough call? I do not think so. I read his comment.

You (and he) can of course prove me wrong: respond to the actual arguments that have been made here. Demonstrate the flaws in Gardner and Demiralp’s specific case. Critique, line by line, the detailed argument of Richard Werner on ‘Money’. Everything I believe on this issue is contingent; if it fails the test of empirical experiment, I will change my mind.

Ironically, the reason I comment on this site is that, generally at least, it provides a platform for civilised debate; it rises above the cheap jibe; the empty posturing, the vulgar hectoring that damages so much social media. I hope you decide to rise to the challenge.

He will need to write to me first to ask to be unblocked

[…] It’s commonplace to say that the world has a debt problem. It doesn’t. It has a savings problem. Let me explain using the data from Boston Consulting group that I referred to here on Saturday. […]