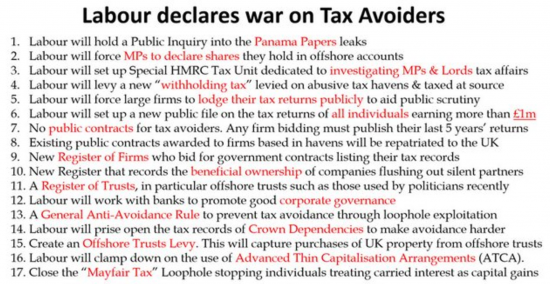

This picture is circulating on Twitter, summarising what it is claimed is Labour's anti-tax avoidance policy for the election:

I have to say I hope this is not it. The big problem is what is not there. Start with this list:

- Public country-by-country reporting

- Full accounts of all companies on public record

- A tope down reform of HMRC to end its capture by corporate interests

- Additional resources for HMRC

- An end to the HMRC office closure programme

- Investment in Companies House so that it can enforce company law which it does not do now

- A review of all tax reliefs and allowances and an assessment of their future

- A general anti-avoidance principle (we already have a rule)

- Alignment of tax rates to reduce the incentive to avoid

- Automatic information exchange from UJ banks to HM Revenue & Customs on which UK owned companies have bank accounts to make sure that corporation tax returns are demanded of them, and are submitted.

I'd list all of these as higher priority than anything on the list above. I could probably add several more before I got to many of them.

The reasons are obvious. Of course country-by-country reporting we can all see is more important that tax returns no one can use.

And having full accounts is the pre-condition for any supplier vetting process but right now we don't have access to them.

And without Companies House and HMRC being properly resourced none of the above work.

I'm not saying this list is wrong. I'm saying that if that is the list the serious stuff is missing. And I am very much hoping it isn't.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Its an unprecedented step in the right direction. An acknowledgement that we need to rebalance our economy in favour of the many not the few. Its to be welcomed with open arms.

That’s the way I see it too. Incomplete and imperfect it may be, but it least it seriously addresses the issue and seeks to offer remedies.

At last proper recognition after over 10 years of campaigning, the UK under a Labour government will implement the CCT!! Brown pretended he would when he succeeded Blair but neither of those 2 wanted to annoy the City. There have been so many names for this tax and we all know it is more than fair. Brown should have done so much more after the 2008 crash, he had all the cards but didn’t play them. I blame him for that, obviously not the crash. Labour are our only hope, these policies are in the right direction and if we all work together maybe we can save our country. You can helpfully put forward your ideas as you have the standing.