The budget announced a might big crack down on big corporate tax avoidance in the UK. And quite a lot of other tax avoidance too, come to that. Don't get me wrong: I welcome such crack downs: I campaign for them after, so credit where credit is due: the government has made the right moves.

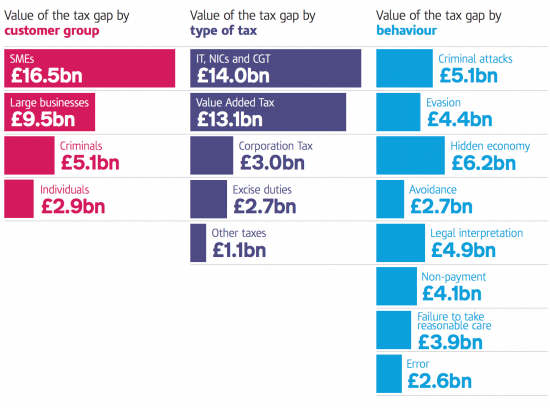

But, there's a little more to it than that. Let me explain. This comes from the HMRC 2015 publication on the size of the UK tax gap. The tax gap is the difference between the money HMRC should get in tax if the system worked as they expected and what they actually receive. They split the figure down by tax and by type of abuse as follows:

Note that for all companies - and 1.5 million or more submit tax returns - the total loss including to evasion was supposed to be £3 billion.

And total avoidance was just £2.7 billion.

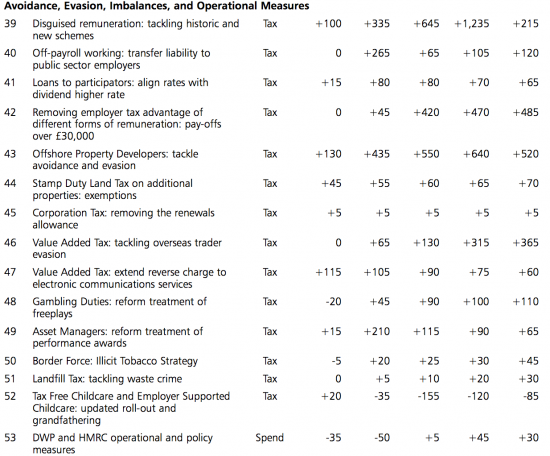

Now note that according to the budget it is planned that £12 billion be raised from tackling avoidance and evasion (page 57 here). So I looked at what makes this up. It is as follows:

Now there's a problem with that lot: they only add up to about £9.4 billion in my estimate.

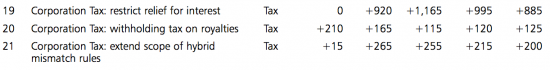

So where's the rest? Try this table too - almost all of which were described as measures to tackle avoidance by big business by the Chancellor:

They come to over £5.6 billion: we've now well overshot the £12 billion mark. As with everything else in this budget, someone can't add up, but what we know for sure is that all these figures are required to make the target totals.

Noe let's take a year - say 2018-19, as example, since by then the measures should be working.

Corporation tax avoidance measures in that year will raise at least £1,535 million from the second table and £550 from offshore from the top table. That's £2,085 million in all. Staggeringly, that's supposedly two thirds of all recent losses for this tax - and since all the items in question are exclusively for large companies that leaves all the rest evading and avoiding less than £1 billion between them for all known reasons. Let me suggest to you that this is nigh on implausible: for a start in 2018-19 the above measures also raise £65 million from tackling avoidance by using personal service companies and £645 million from tackling disguised remuneration. It's as if when these changes are made almost every company will be paying the right amount of tax in the UK, and let me assure you, they won't.

Put all this together in another way and it then also seems that the claim is made that something like £2.5 billion of tax avoidance is going to be stopped. But the current best estimate is there is only £2.7 billion a year. Something does not add up here either, and it is that, as I have always suggested, HMRC's estimate of avoidance are far too low.

In my last tax gap estimate I estimated UK tax avoidance at £19.1 billion a year. I did, of course, give my reasons. And whenever estimates such as those noted above come out they just show how embarrassing the estimates made by HMRC are. You can't, as they do, both claim avoidance is very small and then announce measures to tackle it that supposedly close down almost the entire tax avoidance activity of the UK overnight when there is not a person who thinks that will happen.

HMRC need to be honest about the tax gap. They aren't. And so they keep producing these absurd statistics which only make sense in the context of the data that I have produced - which also shows that the moves announced are good news but that there is still a long way to go. That is what they should be saying, and at the same time a small note of apology to me for the years in which they have said I am wrong when doing so has so obviously been propaganda and not fact would not go amiss.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I welcome the revisions but I deplore the fact that he is using the additional tax collected (assuming his projections are valid) to augment a failing austerity programme.

Well somebody was clearly telling porky pies, the question is who (or is it really both of them?)

This welcome new level of planned tax collection from a depleted and demoralised HMRC begs the question of just how achievable it is? And all this while they are being consolidated and relocated, quite amazing!

Richard do not know if you spotted it but the Govt. state there is £1.5 billion per year of VAT fraud on the internet (eBay and Amazon ..who else matters) but suggest they will only recover a small part of this over next few years. Why ? You would think it would be easy given we know who is facilitating it!

“Non-EU traders who sell goods (located in the UK at the time of sale) to UK consumers,

mainly via online marketplaces, are not always paying the correct VAT and duty to

HMRC. These goods are normally shipped to the UK prior to sale and stored in fulfilment

houses close to their final delivery point. This abuse has grown significantly and now

accounts for £1-1.5bn of the total VAT gap. These overseas traders are unfairly

undercutting all businesses trading in the UK, abusing the trust of UK consumers and

depriving the government of significant revenue “