I have long argued that tax abuse results in messed up markets where abnormal behaviour has to take place to compensate for the absurdity of tax driven policy. Yesterday provided a perfect example. According to the FT:

Apple, the most valuable company in the world, completed the second largest bond sale of the year on Tuesday to fund its share buyback programme, as international debt markets began to reopen after a challenging start to the year.

The smartphone maker sold $12bn worth of debt across nine tranches, with maturities spanning between two and 30 years, according to several people familiar with the matter.

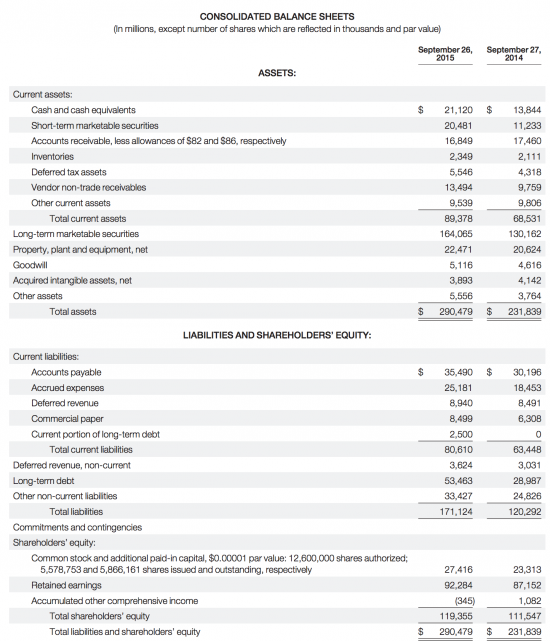

Let's put this in context. This is the Apple balance sheet at September last year:

The company has net worth in UK terms of about $119bn, although we know the stock is worth a lot more. But, $12bn is significant: 10% of the company's apparent net worth is to be spent buying back a much smaller proportion of stock. You can argue that's a pretty bizarre policy in the first instance but that's not the key point here.

That key point is that Apple is sitting on liquid assets (cash, short term and long term marketable securities) of more than $200bn and yet it is borrowing to buy back its own shares. Why? Because some of those assets are believed to be locked in tax havens and tax of up to 35% might be payable if they were brought into the US. Only $26 billion is provided for this reason in the accounts.

To the extent that tax is not provided these funds are not available to the shareholders. And if 35% was paid on them the net worth of the company might (I stress, might as opacity in the accounting does not make it possible to be sure and I am looking worst case) fall significantly, immediately giving rise to question as to the real viability of such large stock buy-backs.

Tax abuse using tax havens (and I think it fair to call that abuse, whilst making it clear it is entirely legal) does then appear to seriously distort what Apple both says of itself and how it has to behave as a consequence. If that's not tax havens screwing up markets I am not sure what is.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

For those of us without an accounting background, could you please explain how the company has a net worth, in UK terms, of USD$119 Bln ? Do you mean in US terms ?

UK terms means on a UK balance sheet the balance would be at $119bn, not total asset figure

Years ago, as a bond fund manager, I was firmly told not to sell on expensive holding, because it would screw up the annual EPS. Accounting illusion rather than tax abuse, but they both screw up markets.

In either case, the question is whether we want markets to work. I do – do you?

If possible, yes

“the question is whether we want markets to work.”

Theoretically there has to be a first time. But no one with more than one brain cell to rub together will be holding their breath.

Markets as defined by micro economists have never worked

And can’t

It is not humanly possible to deliver their model

That’s not tax havens screwing up markets, that’s the US tax system screwing up markets.

As ever, I beg to differ

Tax havens make this possible

But keep excusing abuse if you wish Andrew

This would be possible so long as there is a jurisdiction in the world with a tax rate less than the US rate – which is notoriously high.

Tax havens make the impact larger, but they do not create the issue.

So the issue is the willingness of companies to abuse the rule of law

And the capture of some states to make that easier to achieve

http://www.financialsecrecyindex.com/PDF/SecrecyWorld.PDF

Thanks for your clarification on the accounting point.

The fact that the US tax system allows the offshoring of profits for tax purposes would seem to be a flaw in the US tax system, not anything else. Surely the most pragmatic solution to this flaw would be for the US to change their legislation to tax corporates on a global basis, rather than claim that everyone else should adjust their legislation to reflect your desired outcome ?

We can seek to do that via the OECD

But this is not a US fault: the abuse is from captured tax havens effectively run for corporate gain

It seems Andrew Jackson’s argument here is implying that tax havens exist because some legal entities have decided that taxes in some States are, in their opinion and clearly that of Andrew (and we all know what Harry Callaghan says about opinions), too high.

It would seem the simple notion that if you profit/benefit from the infrastructure you need to achieve that end you should pay your wack, which I Janet and Johned for Andrew and Pardeep’s benefit last week, represents too much of a thought crime to accept.

It would be interesting to know what level of tax contribution these freeloaders people like Andrew and Pardeep believe are hard done by would not consider too high, taking into account the level of direct and indirect real taxpayer subsidies which get thrown their way? Given the record and evidence of behaviour to date 0% would probably be too high a ceiling.

If someone wishes to subsidise such freeloaders, who already have more wealth and resources than you can shake a stick at, that’s their problem. However, there being no differentiation here, the sane and sensible rest of us have to chip in as well whether we like it or not.

And the bonus is we get the lacking in gorm, who think this is a spiffing idea and cannot bow and scrape low enough, rubbing our noses in it by constantly pontificating about how hard done by these poor little corporations and their executives with their multi million pound bonuses are.

To paraphrase John Vernon, as the character Fletcher in Josey Wales, ‘Don’t piss down my back and tell me it’s raining.’

Hi Dave,

You seem to be completely misunderstanding US taxation. Which is fair enough: it’s rather complicated.

You’re also completely misrepresenting my views. Which is fair enough: I’m only a name on a screen to you, which makes me a convenient place to project your ideas of how someone who disagrees with you must be.

Let me see if I can clarify both these in one go.

The way tax works for a US multinational is that it gets taxed on the profits is makes in every jurisdiction it operates in. In some cases that’s quite a low rate, in others it’s higher. This is pretty much the same across the world: UK multinationals get taxed that way. Then it gets taxed again on those same profits when it brings them to the US; this less usual these days, especially for a country with a high corporate tax rate like the US.

So when a US multinational makes a profit it pays local tax on that profit, and then has a choice: it can leave the profits where they were earnt, or it can bring them to the US and pay more tax.

The big question then is why it should pay that US tax on (say) UK income. Your argument that “if you profit/benefit from the infrastructure you need to achieve that end you should pay your wack” makes no sense, as they have already paid their whack in the UK, where the profits were earnt, and the US has provided no infrastructure to help them earn those UK profits.

Incidentally, this is the problem with “Janet & John” explanations: they are lovely and simple, but they only apply to lovely simple situations and break down horribly in complex ones – and the taxation of multinational corporations is not simple.

By analogy: I am perfectly happy to pay income tax in the UK on my UK income. However, I would be a little bit fed up if Spain were to say that I would have to pay Spanish income tax on it too, just because I had moved it to a Santander bank account, and so the money is now in a Spanish company. In fact I would almost certainly decide not to use Santander, purely to avoid that Spanish income tax charge. Would you then be complaining that by avoiding Spanish income tax I wasn’t paying my whack?

Now the fact that tax havens exist makes the US corporate tax problem worse, as I said, because it means you might be paying little or no tax on the profits. But the problem existed for UK profits back when we had a 30% corporate tax rate, so it can’t have been created by tax havens; and tax havens would exist (and be a problem) even if the US didn’t have this rule; so I rather suspect that the two are unrelated.

I’m not saying that tax havens are a good thing; all I am saying is that this issue is a product of a US tax system, not of the existence of tax havens.

Andrew

Almost all the supposed facts on tax you state here are blatantly and absurdly wrong

I hope you have a better knowledge of tax than this or I worry for your clients

I also hope you don’t patromise them the way you seek to do Dave

So, for the record, the problem is Google has set up structures to make sure it is not taxed here

And it is ensuring it is not taxed in the US

So your claims are profoundly incorrect

And it is also not true that US companies are now taxed on profits remitted from overseas. This is blatantly untrue

As for the Spanish reference, were you smoking something?

If you contrinute here you could at least have the decency to tell the truth and advise correctly

The problm is not the US tax system: it is Google’s abuse of it and many other tax systems

Only a fool would deny that

Surmise waht you will

Richard

This discussion about the US tax laws has reminded me about one thing that puzzled me during the Google PAC meeting, in that they continually referred to the number of US employees they had and the fact the algorithms/code were developed in the US.

But what has that got to do with UK tax? If their argument was that instead of paying the tax on the value of the US employees effort in developing and maintaining the software (which presumably is one of the thing they are using transfer pricing to extract from their UK profits) – that would suggest that they should be paying tax on the value of this in the US. But do they, or do they just divert this now completely untaxed profit to Bermuda and leave it there?

In which case there is no duplication of taxation if they move the cash back to the US, they would just be paying the tax they should have paid anyway according to their own argument.

I’m probably on the wrong track due to not being an accountant and not having all the facts – but it all smells very fishy to me!

Everything about their argument that they should pay tax in the US as that is where the value is created falls apart when you realise they located the asset in Bermuda

FOA Andrew Jackson

Thank you for your piece on how US taxation works for multinationals.

Three words for you – Double Taxation Relief.

Discuss.

Geearkay – Double Tax Relief? What about it?

If you want the explanation (greatly simplified): Say a US company taxed at 35% has a UK subsidiary taxed at 20%, which makes 100 of profit in the UK. UK tax is 20, leaving 80 to be used in the business.

If however the UK subsidiary were to repatriate that profit to the US, it would be liable to an additional 15 of US tax – calculated as 35% of 100, less the 20 already paid for which the US company gets double tax relief. That leaves only 65 to use in the business.

The double tax relief mitigates the problem of high US rates, but does not eliminate it. The US company still has that choice: bring the cash on-shore and lose some of it, or leave it off-shore keep the lot. The question is, why should it do the former?

You made no mention of that before

That was the problem

The issue is then, tax avoiding in the UK is useless barring the availability of tax havens

As I said

And as you denied

“The issue is then, tax avoiding in the UK is useless barring the availability of tax havens”

Hold on, in your original post the issue was that tax issues – and specifically, US tax issues – screw up markets. THAT is what I was talking about.

Now suddenly the issue is tax havens and how they relate to UK tax avoidance. How did you suddenly get from one to the other? As I said earlier, the Apple US tax issue would still exist if there were no tax havens, and no UK tax avoidance, so the issue seems to be completely irrelevant.

And how does me failing to talk about an issue that is completely off-topic for your post constitute a denial that there is a problem with it? You could just as well say that I am clearly against vaccinating babies against meningitis, as I didn’t mention that either! 🙂

Finally, to try to bring the two issues together, you are clearly wrong anyway: tax avoidance in the UK would work perfectly well for a US multinational, even without tax havens. If the UK subsidiary were to avoid tax on profits which were *not* repatriated, then the group would be saving that tax. But that wasn’t what we were talking about, so I’m not sure why you have brought up a new subject only to get it wrong straight away 🙂

The original post was about Rac havens

Start

Middle

And end

You really do have issues you need to address

Just bear with us a moment as there is an urgent requirement to open all the windows to deal with the overwhelming odour of bovine effluence which seems to have entered the room.

Last time I looked Santander were paying the appropriate property taxes etc etc on the 1000 plus branches and other property it has in the UK in which it conducts it’s business. It certainly deducts the appropriate tax from interest it pays on my account. For all I know it may or may not be siphoning off some proportion of what it makes from its use of the UK infrastructure of communications, transport, utilities, security etc without which it would not be able to make a dime.

However, the point is that Santander are paying at the very least a proportion of their wack for use of that infrastructure in which it makes its UK profits, if not all of it. Quite what paying tax in Spain has got to do with the price of pilchards in this scenario is anyones guess. Perhaps that bit of the narrative in the post is part of some long lost Monty Python sketch which got inserted by some fiendish new computer virus? Who knows? Its certainly a challange to imagine a scenario in which either one or both an individual or corporate entity dependent upon the infrastructure in one State to make any money on its operations within that State would pay tax to another state, the infrastructure of which played no part in generating the surplus from the operation in the geographical space and jurisdiction of the first state.

Having said that, it would certainly be interesting to try and imagine that. Next time my mate Ben (not this real name as I don’t want to get him into trouble) nips off to Mexico I’ll have to ask him to bring me back some special baccy to see if it’s possible?

We seem to be in a situation here not too dissimilar in some respects from the well known scenario in which some chancer tries to proposition a young lady by asking if she would accompany him for a £1m. When after a short pause an affirmitive answer is forthcoming the same question is fired back but this time he offers only £50. When the response comes back along the lines of “what kind of girl do you think I am” the chancer replies that this has already been established and they are now just haggling over the price.

Similarly,the argument seems to be being put forward that what is being asked for here, that global corporations should pay appropriste levels of tax in the geographical jurisdictions in which they make their profits, because like everyone else who operates within that jurisdiction and makes a living in that space they to are dependent upon the infrastructure within that space without which no one would prosper, is somehow not legitimate in principle.

In which case the question has to be asked, why it is that many of these companies have agreed to pay at least some tax on their operations in the UK with HMRC? I’ve checked on the register of charities and can find no record so far of any of these companies being registered charities with the charity commission. To all intents and purposes they are as they say on the tin, for profit entities whose reason for being is to maximise profit.

Yet at least a proportion of them, like the young lady in the above scenario, have accepted the principle which is being argued and the only remaining issue is the price, ie the level of tax which ensures that ordinary hardworking PAYE and SME taxpayers are not subsidising freeloaders, given they are already seeing a larger proportion of their relative income taken as tax, compared with the proportion paid by these entities, which is subsidising these entities in direct and indirect ways.

It would seem reasonable therefore to point out that even the companies themselves do not agree with the principle of the argument being put forward here. As the author of this blog observes, someone certainly does have some issues.

Which implies that there is:

– Under regulation bordering on the criminally negligent.

– Insufficent anti trust legislation.

– Regulatory capture by minority special interests.

– Malfeasance on th part of those entities carrying out such practices.

– Breakdown of the rule of law.

If anything has been missed feel free to pile in.

The US tax system is a democratically agreed method of funding the US state.

Multinationals have decided un-democratically they don’t want to pay for the US state any more than they believe they should. As they do for all other nation states with higher taxes than they want to pay.

I doubt the US public will put up with this for much longer, because much as their noble attempts at democracy have been corrupted by the power of money, you really don’t want to p**s off the poor people of a country with over 300 million guns in the hands of the general population.

Other countries will have to rely on the ballot box and boycotts, while they dig out their old pitchforks from the garage.

The US corporate tax and income tax rates on the highest earners have fallen dramatically from post war levels through to when Reagan decided to slash the burden on the rich and go on a military spending spree never before seen in human history – funded by massive US government debt paid for increasingly by the majority of average Americans(with interest payments on govt loans going to the rich instead of them having to pay taxes – to pay for the defense of their economic system and privileges against the supposed threat of communism).

It’s odd how the rich want all these investments and protections, but just don’t want to have to pay for them and squeal like the little fat piggies they are every time it is suggested they should contribute at least their fair share.

So instead, if they won’t pay their fair share let’s reduce the size of our military spending, reduce all corporate tax allowance, reduce the levels of patent protection given to corporations, reduce the incentives to all polluting industries, etc etc etc…..

They can’t have it both ways anymore, even though they still think they can!

I realise the blog PC police will be on my back for using the F word here, but what the hell, be fair Keith.

They don’t actually have to take the trouble to squeal themselves when they have so many forelock tuggers more than willing to come onto blogs like this one, bowing and scraping in their cringeworthy way, to do it for them on their behalf free of charge.

Even worse, Apple’s profits are mainly based on state funded innovations, GPS, touch screen etc, see

http://marianamazzucato.com/the-entrepreneurial-state/

Of course you could say that the state was not clever enough to build in the right intellectual property but society prospers much faster from the creative commons approach where all knowledge is free. In this model businesses can only succeed because they are good on many levels not just at exploiting the rules.

I have bought Apple products in the past but will not do so again.

The trouble is Android etc are really little better in tax terms

Although I have switchd to an Android phone and do not regret it

Android is a source code made freely available. Android isn’t even used exclusively by one manufacturer. It’s used by all members of the OHC. Even Apple have developed an Android App. As such it’s hard to see that Android could be blamed for tax avoidance. It’s a bit like blaming a typewrite for the contents of a letter.

Oh come on: it is a Google sales mechanism

But to say that ‘Android’ are little better in tax terms is just plain wrong. It’s an operating system. It’s distributed free. Dozens of phone manufactures use it, hundreds of App designers use it. It’s like saying Linux is used for tax avoidance.

It’s just an inaccuracy that suggests you don’t understand how this particular market works. I try to help by improving your knowledge and just get a facetious ‘oh come on’ response which suggests you’re not even interested in learning.

That’s not really the approach I expect from some one who teaches.

Oh come on is exactly the right response

iOS is not neutral

Nor is Windows

Get real

Android is not Linux

I know one thing for sure – when a for profit company gives away something for “free”, you can be absolutely certain it is entirely for the purpose of generating income by some other means.

Google (as with many software providers) is the master of giving things away to consumers/user of their products and services for “free” – but seem to have a remarkable ability to generate huge revenues regardless.

Android is just another “free” marketing and sales generation tool.

I would suggest there is a serious requirement for some research into the recent row involving Facebook, net neutrality in India, and neo colonialism, when considering the issue of loss leaders by certain corporate entities.

For some perspective – the harmful effects of that $200B just sitting there doing nothing are enormous.

One problem we as a species are going to have to solve is the energy crisis. Many would argue the best way of doing this is by cracking the problem of creating a viable fusion reactor.

The ITER project, the most expensive reactor project on the planet, looks like it’s budget will cross the $15B mark soon. We need a whole bunch of fusion research projects, not necessarily the size of ITER (probably much smaller).

Apple has $200B which it isn’t doing anything with. Just the 35% tax they might be liable for would pay for 4 more projects the size of ITER, and then some.

As I understand it, the US claims to tax US corporations on their worldwide income (like the US taxes US citizens on their worldwide income, whether or not they are US resident). However, it does not tax a corporation’s overseas earnings until they are remitted to the US, when they are taxed with credit for tax paid overseas. I believe this is intended to allow US corporations to reinvest overseas without paying US tax, on the basis that more money will come back to the US eventually. The problem is that the money does not seem to come back to the US, so the deferral became in effect permanent. Added to which the US’s controlled foreign corporation rules don’t seem to apply effectively (you could say that the UK’s new CFC rules are also toothless).

As Andrew Jackson says, recognising the income in a low tax jurisdiction amplifies the effect – BEPS will make that more difficult – but the same principle applies if a US corporation has a direct subsidiary in the UK or Ireland or anywhere else.

But as you say, it is somewhat perverse that a cash-rich entity like Apple feels the need to borrow to fund a return of cash to shareholders rather than using its own cash resources, simply because it doesn’t want to pay US tax. No doubt it will also be claiming a deduction in the US for its cost of finance.

Is it very naïve to presume that a company sitting on a large cash pile merely looks at the best place to invest, and decides that it’s own stock provides the best yield?

Perhaps there is no compulsion to invest elsewhere if one’s methods of accumulating beans are without peer? Could all change tomorrow, of course. But I doubt it.

I have to say I think this is very much driven by the US tax rules and US society.

As the two Andrew’s say, the US rules work to only tax income remitted by corporations back to the US and their CFC rules are notoriously lax, which ,means there is a lot of opportunity to avoid paying tax on income earned outside the US. Add to that that their transfer pricing rules are similarly rules based and so enable you to ‘choose’ which rules you want to apply and you have a situation where not only can you choose to keep income offshore but you can choose how much.

It seems to me that this is highly driven by the fact the US is very rules driven. And the tighter you try to make the rules of course, the more slips through — Think of a kid squeezing their play dough — a lot comes out through their fingers, you canlt just compress it.

Add to that the fact US people very much think along the lines that if the rules allow you do something then you are free to do that something – their view seems to be that it’s not up to them to write the rues — that is for the legislators — and if the legislators give you freedom to do something that, in this space, allow you to pay less tax then you are free to do that or exploit that.

This is the problem with a rules orientated system and society — Contrast that with Europe (maybe excluding the UK which is a bit of a hybrid) where typically there is more of a focus on principles.

And this is a problem for BEPS too in my opinion. The EU may well be buying into BEPS and adopting the principles, but in the US they seem to be saying their ‘rules’ are OK and so they’ll carry on as is which means the ‘abuse’ as you see it – but as the US guy would say “applying the rules” — will continue even if BEPS is adopted in the EU and the UK — Clearly there will be less scope to shift profits in and out of the EU but the scope to shift profits between the US and tax havens will remain. Well that’s how I see it anyway.

“And it is also not true that US companies are now taxed on profits remitted from overseas. This is blatantly untrue”

Richard, US companies owe taxes at the full U.S. corporate tax rate of 35% on profits they earn around the world. They get tax credits for payments to foreign governments and don’t have to pay the residual U.S. tax until they bring the money home.

That is blatantly true. You can check it out if you like. It’s in the US tax code’s transfer pricing regulations, Subpart F, and Section 956.

If US companies were not taxed on profits remitted from overseas, why are US companies stashing cash outside the US and why is there all the fuss about them avoiding tax by doing so?

Sorry: that should have said UK not US

Typo on my part

Apologies

That explains your rather bizarre assertion 🙂

However, I didn’t say UK companies are taxed on profits remitted from overseas, I said a US company gets taxed in the territories where they make profits, and so does a UK company.

When I then went on to say that a US company gets taxed on remitted profits I said nothing about UK companies – because of course they are not.

If you are going to read “and so do UK companies” from one sentence as applying to the next one as well, then all I can say is that you have an interesting way applying the rules of English grammar 🙂

Andrew

You just misrepresented everything that happens

I did make a typo

But you cannot excuse the mess you created for yourself on that basis

I’m sorry, but your misrepresentations are very tedious as I have to point them out

Richard

Andrew J

You’re being unfair on Richard. He has so much reading to do I expect he often reads what he would like to be there rather than what is there which when responded to script including typos can often lead to situations where what Richard writes turns out later to mean something completely different to first impressions.

Such are the pitfalls of prodigious blogging.

Richard read what was there

But he did make a mistake in typing US for UK

“the harmful effects of that $200B just sitting there doing nothing are enormous” – it would be odd to keep $200bn in a bank account doing nothing, and it seems that is not what Apple does.

From note 2 to the 10-K (on page 49 to 450 of the document linked by Richard) it seems that about $3.5bn is held in cash or cash equivalents, about $16bn in mortgage-backed securities, another $20bn invested in other debt securities and about $35bn is invested in T-bills, and then a whopping £116bn invested in “corporate securities” which I assume are also third party debt instruments. But then it seems to have only $3bn of interest and dividend income (page 54).

That is a sizeable investment portfolio for an IT company – about a third of its $550bn market capitalisation.

My comment on this article a few days ago may have got lost in your spam bucket, but I was interested to see that the US are taking multinationals through the courts and whether this brings to light new information which provides HMRC with more ammunition to go after Amazon for UK taxes.

http://www.theguardian.com/technology/2016/feb/18/revealed-project-goldcrest-amazon-avoid-huge-sums-tax