The Observer reports this morning that:

Labour will launch a detailed review of the multitude of tax breaks offered to Britain's businesses, as the party seeks to craft a distinctive Corbynite economic policy, according to shadow chief secretary to the Treasury Seema Malhotra.

In an interview with the Observer, Malhotra said business reliefs, which allow companies to reduce how much they owe the taxman, should be subject to the same scrutiny as any other area of public spending.

“The big test really is to see whether economic policy is helping or hindering businesses and families; so that's why we've started to look at the different types of incentives to invest business has,” she said. “A Labour-run Treasury would want to ensure that tax expenditures would be subject to the same rigorous analysis and review as other expenditure”.

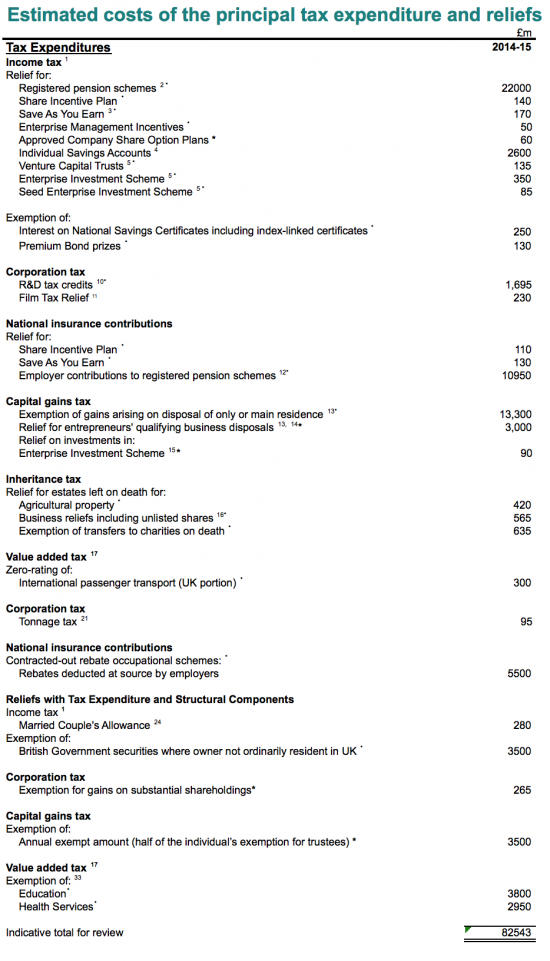

I warmly welcome this move. Tax spending is a concept that many on the right deny exists. What tax spending represents is the money given away by not being collected as tax when incentives, allowances and reliefs are added to the tax system. In total they cost more than £100 billion a year. The list of the main reliefs is here.

Very clearly some of the main reliefs, such as personal allowances for most people, are not going to be played with in any significant way. But there are many reliefs that could be reduced or even eliminated with ease. Take this list for starters:

Now please do not get me wrong: I am not suggesting all these reliefs should be abolished. Some could be. I have already identified Entrepreneur's Relief as ripe to be axed, and several other reliefs like it need to go in my opinion.

Many more of these reliefs could be modified. So, for example, some aspects of pension tax relief - which still costs far too much for the hopeless benefits provided by private funds in exchange - could be changed whilst the case for higher rate tax relief on gifts to charities disappeared years ago.

Looking at ISAs, capital gain tax allowances and domestic residence reliefs is more contentious but there is a trade off here. Bluntly, do we want old people on the streets, millions of families in poverty, a collapse in law and order, reduced security, hobbled defence forces, and the NHS inoperable because of the failure of care homes and declining education standards or are some sacred cows of the tax system to be questioned instead?

There are tough questions to ask and heart searching to do but if Labour is to be serious these are questions it has to address.

I do hope to submit evidence to any such review.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Bill Mitchell points out well, the inherent contradictions in Government Language and the ‘reality’ on the ground:

“While the Conservatives like to make out that they’re pursuing a hard-nosed austerity program, the fact remains that up until now, the fiscal stands has been supporting growth. That’s not to say that the cuts that have been made in spending programs (you might call these a sort of micro austerity) have not been extremely damaging to those in the breach.

The other theme that came out last week, which was reflected in the quote above about the upcoming Autumn statement, was that the rising net spending will necessitate even harsher austerity plans being implemented then were previously announced.

The UK Telegraph article (November 20, 2015) — Autumn Statement 2015: George Osborne dealt a blow by ‘terrible’ borrowing figures — was similarly hysterical, which is no surprise given the ownership of the newspaper.

This article quoted the same private sector economist that the Guardian had quoted but this time use the words “terrible” to emphasise the message.

The British Chancellor should take the combination of moderating growth rate, the government’s contribution to supporting that growth rate, and the declining company tax revenue as a warning that any attempt to cut the discretionary component of the deficit will in all likelihood push the British economy back towards recession.

With the goods-producing sector in decline, any austerity-type attacks on households, particularly those low-income families with high propensities to consume, will impact heavily on the services sector, which is currently driving the (moderate) growth.

There is actually in need in Britain at present for an increase in discretionary net public spending to ensure that growth continues and non-government sector confidence doesn’t collapse again as it did in 2010-11.”

This type of review should always have been part of a professional approach to tax policy. My concern about Labour raising it, is that the review will be heavily biased in favour of its own ideology. Nothing wrong in proposing one’s own views, but it puts the review on a partisan basis, and so more easily discredited.

Tax is political, good points can be made, but no one holds all the virtues in their opinions.

All tax is political